The first collateral integration from a US-based bank in the DeFi ecosystem is getting closer.

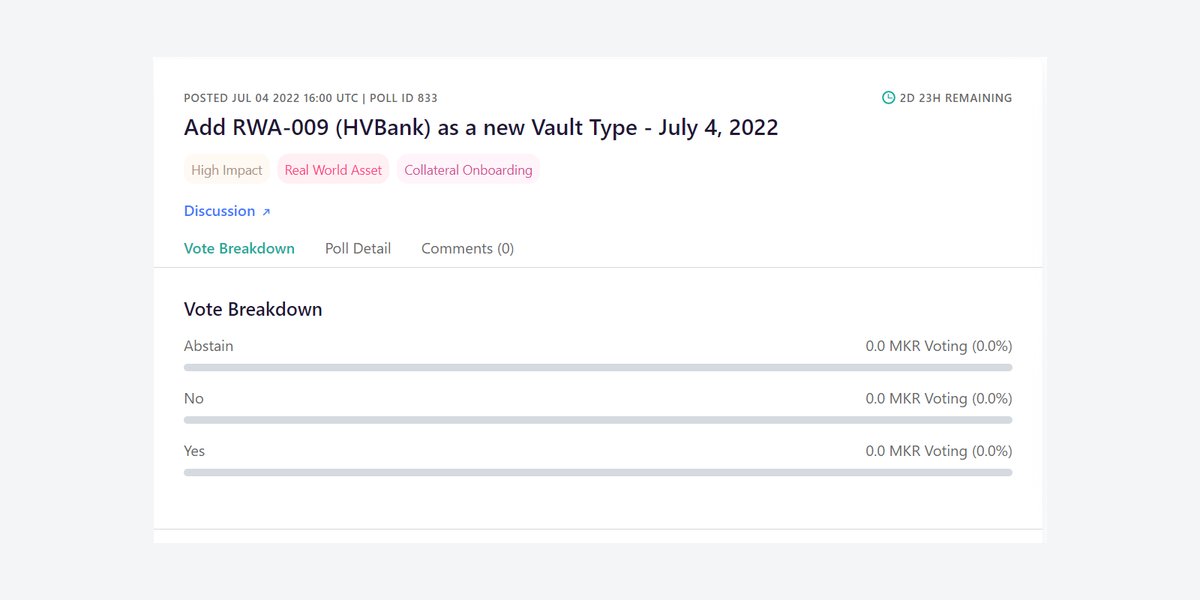

The Maker Governance votes to add RWA-009, a 100 million DAI debt ceiling participation facility proposed by the Huntingdon Valley Bank, as a new collateral type in the Maker Protocol

The Maker Governance votes to add RWA-009, a 100 million DAI debt ceiling participation facility proposed by the Huntingdon Valley Bank, as a new collateral type in the Maker Protocol

Huntingdon Valley Bank, a Pennsylvania Chartered Bank founded in 1871, is seeking a 100 million DAI debt ceiling participation facility to support the growth of existing businesses and to grow new businesses.

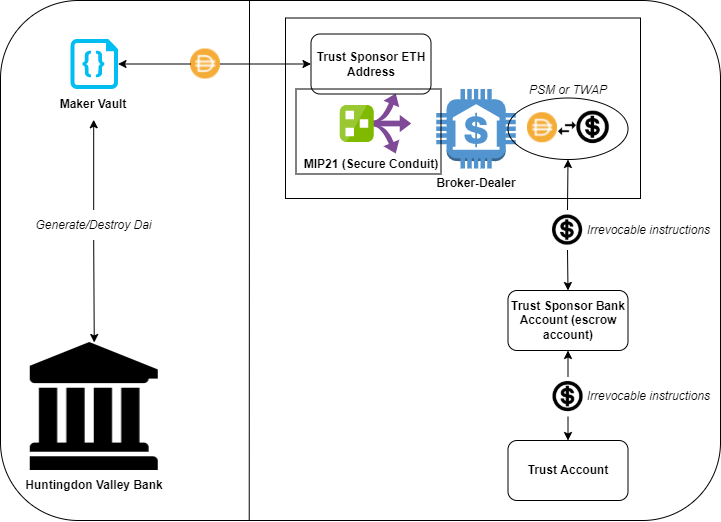

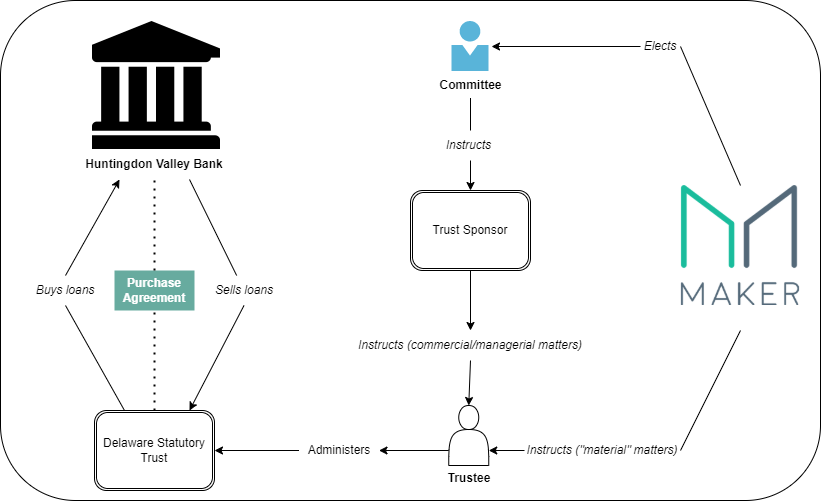

This application proposed a legal structure wherein Huntingdon Valley Bank enters into a Master Purchase Agreement with a trust for the benefit of MakerDAO.

For further reading, we recommend the following threads:

👇

For further reading, we recommend the following threads:

👇

Signal Request Recap (Original Proposal)

https://twitter.com/MakerDAO/status/1507420596119945248?s=20&t=uQybhHwzv3xZR8Dk-L-HNQ

Risk Assessment Recap:

https://twitter.com/MakerDAO/status/1537462748254294029?s=20&t=osPAtgr_jVg5_VUoFxR4cg

• • •

Missing some Tweet in this thread? You can try to

force a refresh