Some tokens might go to $0.

Others might break all-time highs in the next cycle.

How can you know which one is which?

Here's a framework for evaluating possible bear market winners & losers:

Others might break all-time highs in the next cycle.

How can you know which one is which?

Here's a framework for evaluating possible bear market winners & losers:

Today I'll be covering:

• My framework for evaluating tokens

• Projects I'm looking at

• Buying best practices

Here's your Edge 🗡️

• My framework for evaluating tokens

• Projects I'm looking at

• Buying best practices

Here's your Edge 🗡️

It's time for a portfolio cleanse.

(If you haven't done one already)

Even though some of your tokens are down, they can go down even further because of the macro environment.

Use this framework to figure out if your tokens are worth keeping or dumping.

(If you haven't done one already)

Even though some of your tokens are down, they can go down even further because of the macro environment.

Use this framework to figure out if your tokens are worth keeping or dumping.

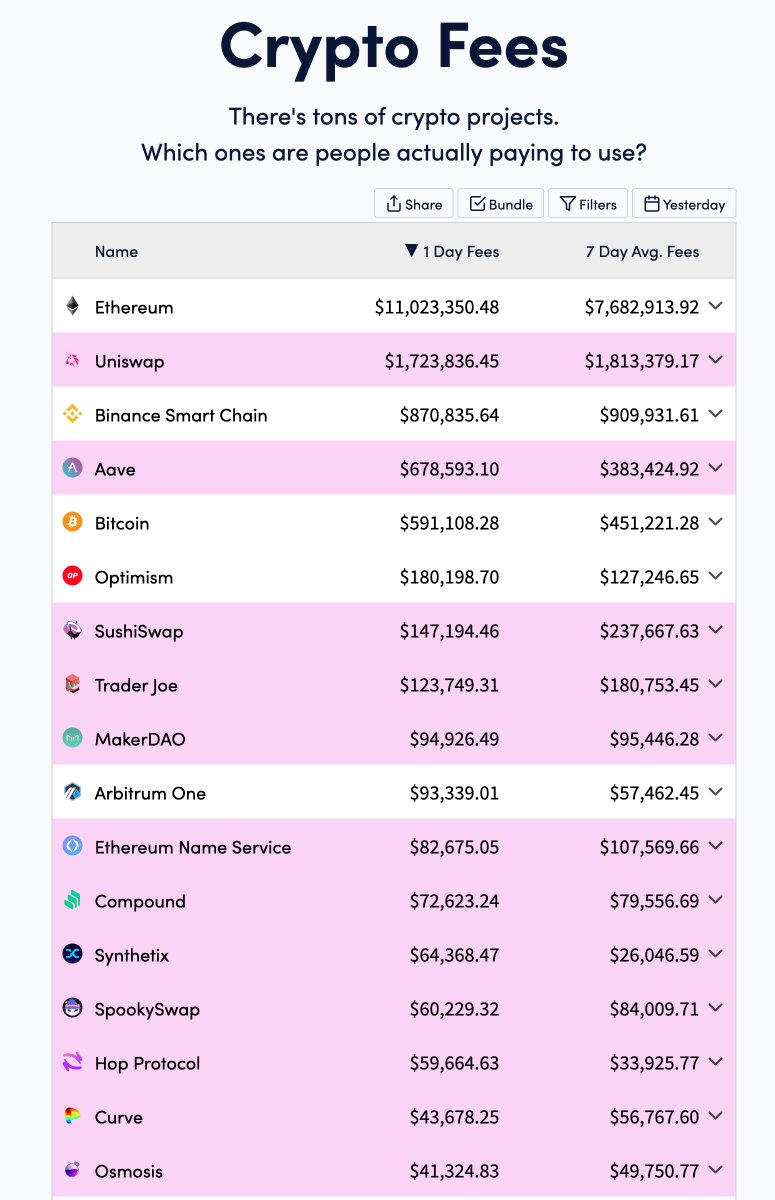

/1 Are They Generating Revenue?

Protocols are businesses.

Most give out inflationary tokens as a way to incentivize and bootstrap growth.

The demand for inflationary tokens slows down in a bear market.

When the hype's gone, only the fundamentals remain.

Protocols are businesses.

Most give out inflationary tokens as a way to incentivize and bootstrap growth.

The demand for inflationary tokens slows down in a bear market.

When the hype's gone, only the fundamentals remain.

Here are some ways protocols generate fees:

• Interest fees

• Bridging fees

• Swapping fees

• Liquidation fees

• GameFi mechanics

Ask, "how does this token make money?"

You can find revenue information at @tokenterminal and @CryptoFeesInfo

• Interest fees

• Bridging fees

• Swapping fees

• Liquidation fees

• GameFi mechanics

Ask, "how does this token make money?"

You can find revenue information at @tokenterminal and @CryptoFeesInfo

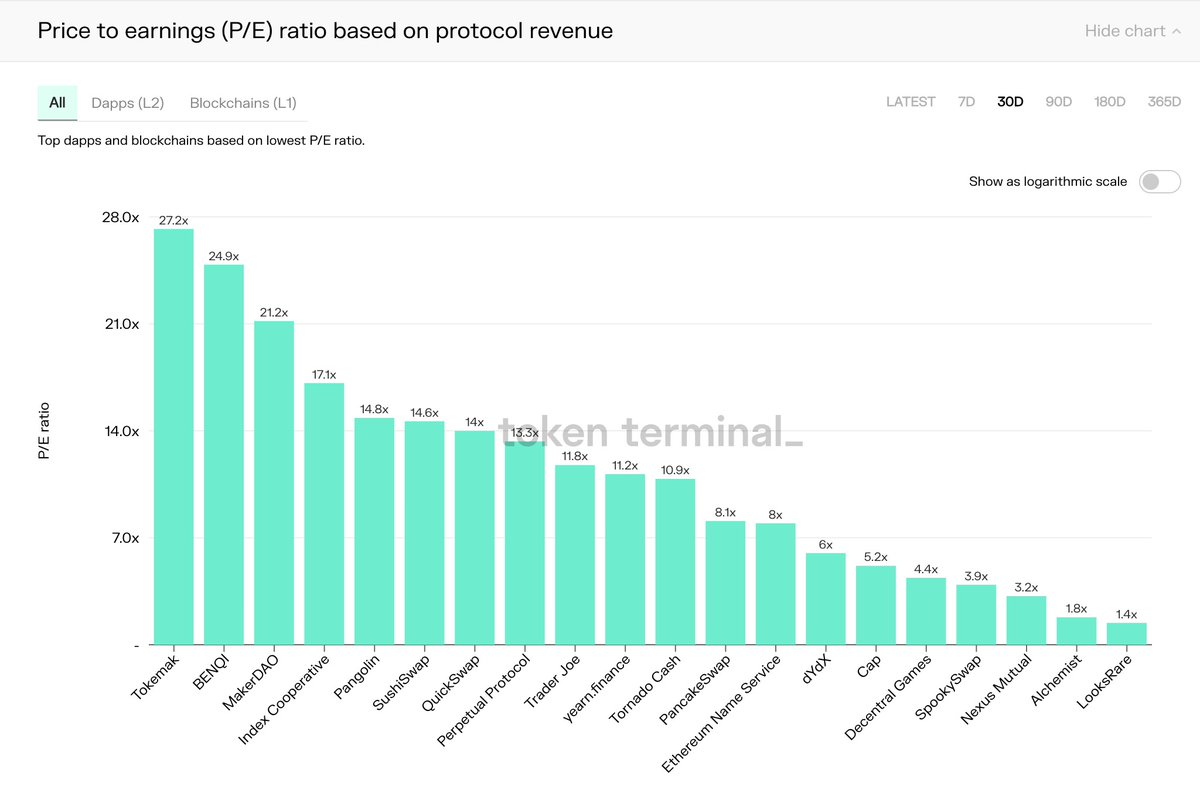

@tokenterminal @CryptoFeesInfo Judging the Value

One metric used TradFi is the P/E ratio (Price to Earnings Ratio).

The lower then the more "value" it has.

Warning: It isn't the most accurate value in Crypto because most protocols are in the "start-up" phase.

It's still a valuable tool to have.

One metric used TradFi is the P/E ratio (Price to Earnings Ratio).

The lower then the more "value" it has.

Warning: It isn't the most accurate value in Crypto because most protocols are in the "start-up" phase.

It's still a valuable tool to have.

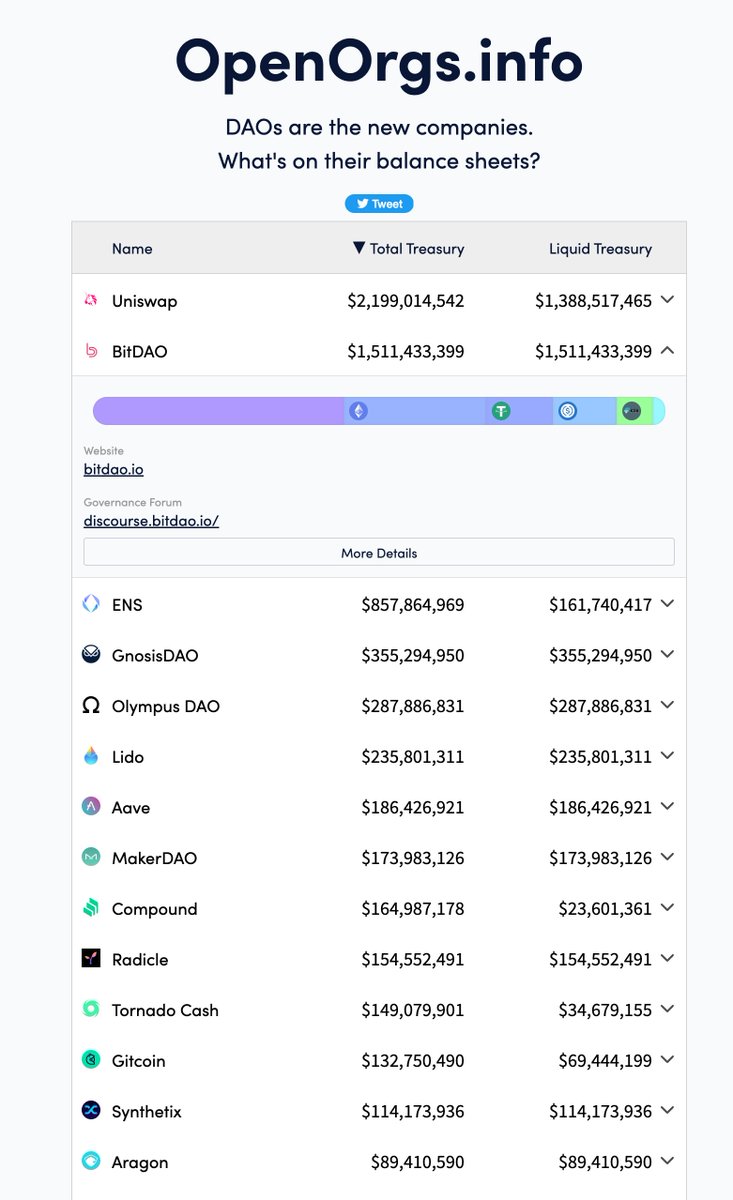

@tokenterminal @CryptoFeesInfo /2 What's in the Protocol's Treasury?

It costs $ to run a protocol: software, salaries, development, marketing, & other costs.

(1) How much money is in their treasury?

(2) What are their expenses?

(3) How much runway do they have?

Cash is oxygen for a business.

It costs $ to run a protocol: software, salaries, development, marketing, & other costs.

(1) How much money is in their treasury?

(2) What are their expenses?

(3) How much runway do they have?

Cash is oxygen for a business.

@tokenterminal @CryptoFeesInfo Treasury Composition

It's risky if the treasury is 100% comprised of the native token.

What if the token crashes?

I like seeing diversified treasuries are good, along with some sort of treasury management strategy.

It's risky if the treasury is 100% comprised of the native token.

What if the token crashes?

I like seeing diversified treasuries are good, along with some sort of treasury management strategy.

@tokenterminal @CryptoFeesInfo /3 Locked Up Funds

Bear markets create sell pressure.

With DeFi 2.0, some protocols started incentivizing users to lock their tokens up for years such as Curve and LQDR.

Locked funds lower selling pressure, showing user confidence in the protocol's long-term future.

Bear markets create sell pressure.

With DeFi 2.0, some protocols started incentivizing users to lock their tokens up for years such as Curve and LQDR.

Locked funds lower selling pressure, showing user confidence in the protocol's long-term future.

@tokenterminal @CryptoFeesInfo /4 Utility and Use Case

It's easy to rationalize the use case of any token when we're in a bull market.

You're high on hope and dopamine.

• Now's the time to ask why does this token exist?

• What does it do better than its competitors?

• What problem does it solve?

It's easy to rationalize the use case of any token when we're in a bull market.

You're high on hope and dopamine.

• Now's the time to ask why does this token exist?

• What does it do better than its competitors?

• What problem does it solve?

@tokenterminal @CryptoFeesInfo /5 Their Roadmap

The Roadmap is a strategic plan for the future.

• Check the developer activity via GITHUB.

• Is the team actively communicating?

• Are they hitting their milestones?

My spider senses tinger whenever a protocol stops updating its roadmap.

The Roadmap is a strategic plan for the future.

• Check the developer activity via GITHUB.

• Is the team actively communicating?

• Are they hitting their milestones?

My spider senses tinger whenever a protocol stops updating its roadmap.

@tokenterminal @CryptoFeesInfo /6 Succeed Breeds Copycats

Some categories become a Winner Takes All system.

You want to bet on protocols that can potentially become market leaders.

Once they're successful, how will they STAY at the top?

(Everything's open source in Web 3, compared to Web 2)

Some categories become a Winner Takes All system.

You want to bet on protocols that can potentially become market leaders.

Once they're successful, how will they STAY at the top?

(Everything's open source in Web 3, compared to Web 2)

@tokenterminal @CryptoFeesInfo Look For Moats

Moats are competitive advantages that are hard for competitors to replicate.

Anyone can fork Sushiswap and create their own DEX.

So if a project is going to become the #1 choice, what's going to KEEP them at the top?

Moats are competitive advantages that are hard for competitors to replicate.

Anyone can fork Sushiswap and create their own DEX.

So if a project is going to become the #1 choice, what's going to KEEP them at the top?

@tokenterminal @CryptoFeesInfo It's harder to establish moats in Web 3.0 because everything's open source.

Some Crypto moats:

• Liquidity

• Community

• Brand value

• Partnerships

• Switching costs

• Network effects

What's this protocol doing better than everyone else?

Some Crypto moats:

• Liquidity

• Community

• Brand value

• Partnerships

• Switching costs

• Network effects

What's this protocol doing better than everyone else?

@tokenterminal @CryptoFeesInfo /7 The Team & its Funding

Bear markets are challenging mentally.

I saw so many teams abandon their projects in 2018.

It's tempting for an anon team to disappear with their millions, chill on a beach in Bali, and come back with a new project during the next bull cycle.

Bear markets are challenging mentally.

I saw so many teams abandon their projects in 2018.

It's tempting for an anon team to disappear with their millions, chill on a beach in Bali, and come back with a new project during the next bull cycle.

@tokenterminal @CryptoFeesInfo Some Pluses:

• Is the team doxxed?

• Prominent Investors. It's rare to see projects get abandoned if they're backed by prominent VCs.

• Active Communication.

Remember, these aren't guaranteed.

Everything in crypto is a probability bet, and you're weighing the odds.

• Is the team doxxed?

• Prominent Investors. It's rare to see projects get abandoned if they're backed by prominent VCs.

• Active Communication.

Remember, these aren't guaranteed.

Everything in crypto is a probability bet, and you're weighing the odds.

@tokenterminal @CryptoFeesInfo Other Thoughts

• The macro-environment sucks. We can drop further until the Fed reverses course.

Be cautious.

• Be careful of sunk cost bias.

You're down 70%, it might be worth salvaging the last 30% instead of seeing it go down further.

• The macro-environment sucks. We can drop further until the Fed reverses course.

Be cautious.

• Be careful of sunk cost bias.

You're down 70%, it might be worth salvaging the last 30% instead of seeing it go down further.

@tokenterminal @CryptoFeesInfo I'm "risk-off" at the moment.

I'm at the poker table.

I'm itching for action - I'm waiting for the right hands.

Think about the previous crash.

Even though we were in a bear market, there were new projects and gems like Chainlink that skyrocketed.

I'm at the poker table.

I'm itching for action - I'm waiting for the right hands.

Think about the previous crash.

Even though we were in a bear market, there were new projects and gems like Chainlink that skyrocketed.

@tokenterminal @CryptoFeesInfo So my strategy:

• Buying BTC / ETH every month.

• Farming stable coins as my "dry powder."

Keep my eyes out for new narratives and the Fed's decisions.

• Bargain hunt. Some tokens are at a discount now and will break their ATHs again in the next cycle.

• Buying BTC / ETH every month.

• Farming stable coins as my "dry powder."

Keep my eyes out for new narratives and the Fed's decisions.

• Bargain hunt. Some tokens are at a discount now and will break their ATHs again in the next cycle.

@tokenterminal @CryptoFeesInfo I want to share some tokens I'm looking at buying.

Not financial advice.

Not shilling my bags.

I hate theoretical content that doesn't show any examples.

Not financial advice.

Not shilling my bags.

I hate theoretical content that doesn't show any examples.

@tokenterminal @CryptoFeesInfo Frax (FXS)

• Market leader.

• Good moats. Stablecoins are challenging to crack.

• Should pick up market share that $UST opened up.

• Oversold due to algostable coin fears. It's 90% collateralized.

• Held its peg well in May.

• Market leader.

• Good moats. Stablecoins are challenging to crack.

• Should pick up market share that $UST opened up.

• Oversold due to algostable coin fears. It's 90% collateralized.

• Held its peg well in May.

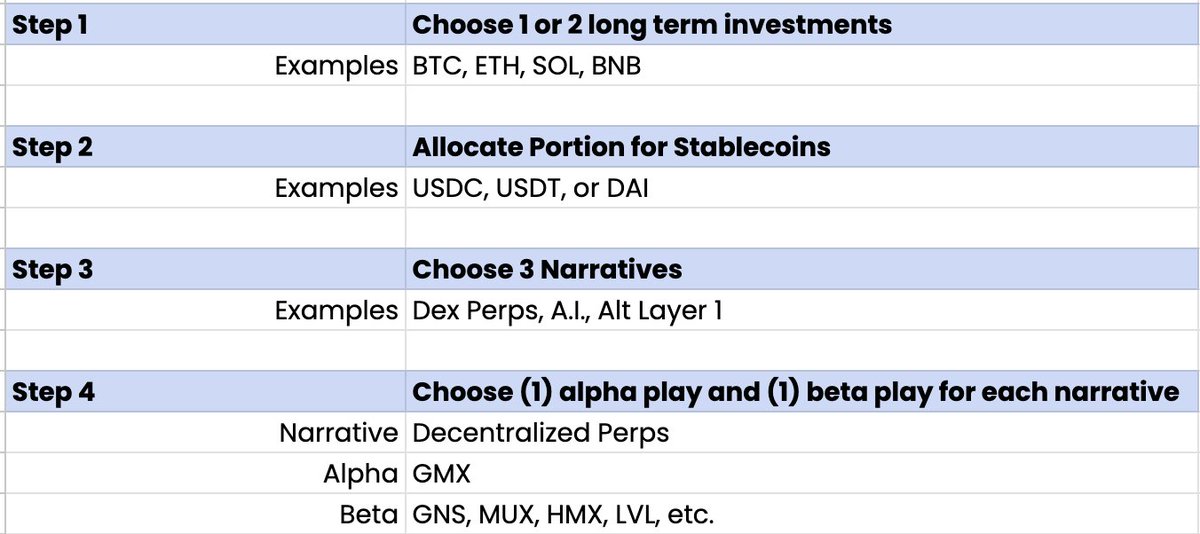

@tokenterminal @CryptoFeesInfo Decentralized Perpetual Exchanges

• Growing sector

• Generating massive revenue already

I'll watch the other people gamble while I own part of the casino.

Quite a competitive space with DYDX, GMX, Perpetual Protocol, Synthetix

• Growing sector

• Generating massive revenue already

I'll watch the other people gamble while I own part of the casino.

Quite a competitive space with DYDX, GMX, Perpetual Protocol, Synthetix

@tokenterminal @CryptoFeesInfo I'm not listing too many projects.

I'm not too big on bargain hunting on existing projects.

I prefer waiting for new narratives to form and investing in them early.

That's my personal investing style.

I'm not too big on bargain hunting on existing projects.

I prefer waiting for new narratives to form and investing in them early.

That's my personal investing style.

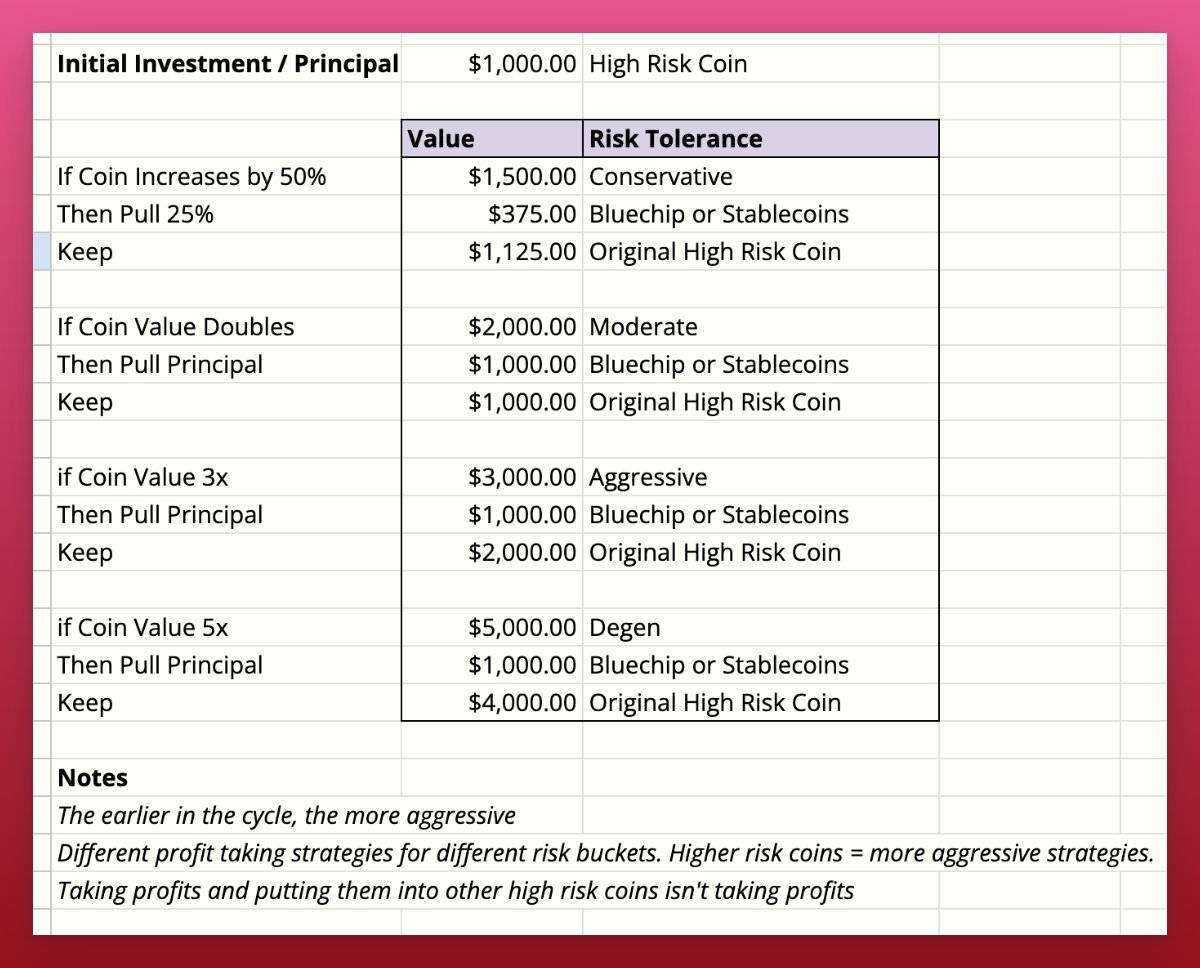

@tokenterminal @CryptoFeesInfo Buying Advice

• Dollar Cost Average (buy with fiat every month)

• Play it safer, and go heavy on BTC and ETH.

Consider buying in Ratios.

With $1,000 Try

• BTC ($400)

• ETH ($400)

• Any token you want ($200)

• Dollar Cost Average (buy with fiat every month)

• Play it safer, and go heavy on BTC and ETH.

Consider buying in Ratios.

With $1,000 Try

• BTC ($400)

• ETH ($400)

• Any token you want ($200)

@tokenterminal @CryptoFeesInfo That's it on evaluating protocols.

• What coins are you thinking about dropping

• Which ones will you be buying?

By the way, if you found this thread helpful, please consider sharing the 1st tweet linked below.

• What coins are you thinking about dropping

• Which ones will you be buying?

By the way, if you found this thread helpful, please consider sharing the 1st tweet linked below.

https://twitter.com/thedefiedge/status/1533061461169172481

@tokenterminal @CryptoFeesInfo Also, I write a free weekly newsletter at TheDeFiEdge.com.

Make sure you've subscribed for exclusive content.

↓

Make sure you've subscribed for exclusive content.

↓

@tokenterminal @CryptoFeesInfo There's a typo here that I can't correct.

It should read as

"I'm NOT itching for action - I'm waiting for the right hands."

It should read as

"I'm NOT itching for action - I'm waiting for the right hands."

• • •

Missing some Tweet in this thread? You can try to

force a refresh