A Currency Crisis?

When the long-term charts all start pointing to a single event risk, I pay attention.

When those charts are at the KEY level, I focus.

And when they break, it is time for action...

Something really BIG is going on...

When the long-term charts all start pointing to a single event risk, I pay attention.

When those charts are at the KEY level, I focus.

And when they break, it is time for action...

Something really BIG is going on...

We are at the most important juncture in FX markets in my entire 30 year career. The dollar appears at risk of an uncontrolled rise.

Let me show you...

Let me show you...

The Fed Broad Trade Weighted Dollar Index is incredibly close to breaking the ENORMOUS cup and handle pattern at 130. Barely a half a percent away...

And this translates into the largest chart pattern in the history of FX - The ADXY Head and Shoulders Top. A pattern so big, I cant quite get my head around the outcome...a fall of 20% or more across ALL Asian major currencies...AND we are RIGHT on the CLIFF OF DEATH

We are also at the KEY juncture on the JP Morgan Emerging Markets Currency Index... new lows await, any day now...

And one currency, after another, is approaching, and then falling off, the CLIFF of DEATH... The Aussie broke a while ago and has been tumbling ever since...

The Korean Wan...Yikes! This is one of the most crucial levels in its history...These big wedge patterns tend to resolve in EXPLOSIVE moves to new all time highs (for the dollar vs KRW). Mind bending...

The Canadian Dollar looks like it is about to break the wedge for a RAPID move. The CAD is going to very quickly get a LOT weaker.

And the big disturbance in the Matrix is the CNY, which conceivably could go to new all time lows (highs on chart) versus the dollar. It's not my forecast but that chart suggests a higher probability than anyone suggests, even if the odds are still low. It is broken....

And this currency crisis of dollar strength is causing an enormous deflationary wave globally. The CRB is literally the second worst chart in the world, after the EU banks. And we are right on the fucking CLIFF OF DEATH. Right there. Today.

I think oil breaks lower, today.

I think oil breaks lower, today.

Gold is rightly doing its job, sniffing out a BIG problem and is exploding higher, outperforming even the super strong dollar as gold begins to price in an end game of an eventual MASSIVE readjustment of the dollar (in 12 months? 18 months?) #GOLD $GLD

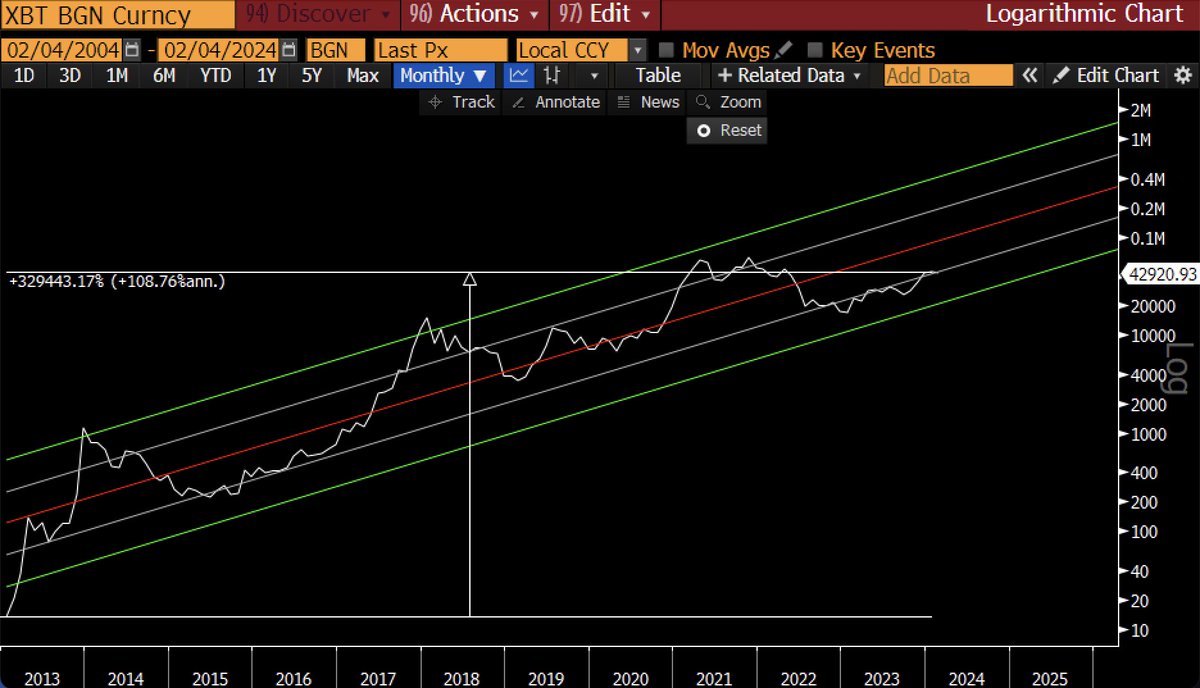

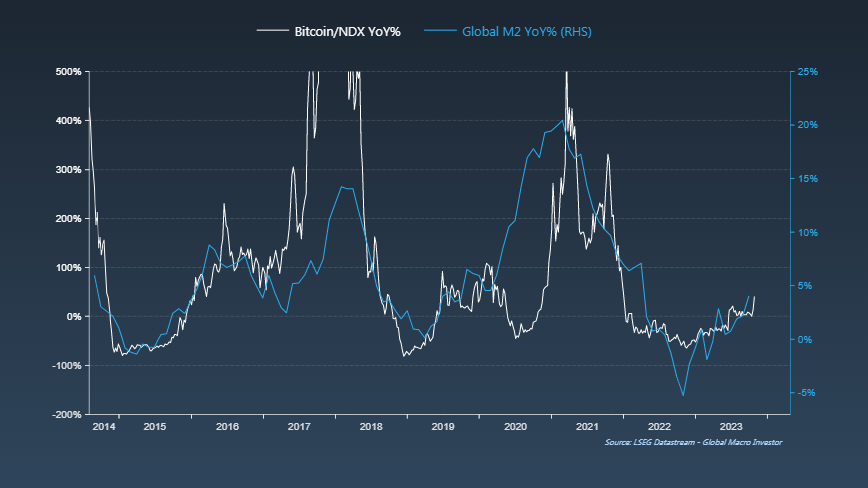

And $BTC #Bitcoin is doing its job of suggesting an alternative system is gaining in probability (it trades like call option on a new system, in my mind). The price moves are so ENORMOUS (and thus the increase in probabilities are so FAST) that you have to use log charts...

And the 10 Yr US bond suggests that bond yields are going to zero, as the deflationary wave spreads like wildfire...

And that would be the end game for the pension system and a HUGE loss of wealth for Baby Boomer Retirees and the start of the Doom Loop of BBB downgrades and a potential freezing of the corporate credit markets...

You get the picture.

Sadly, we are at one of the BIGGEST junctures for markets in history. You may disagree with my assessment of the odds. It doesn't matter. But you simply CANNOT ignore the risk.

Bonds. Dollars. Bitcoin and Gold.

Thanks for paying attention.

Sadly, we are at one of the BIGGEST junctures for markets in history. You may disagree with my assessment of the odds. It doesn't matter. But you simply CANNOT ignore the risk.

Bonds. Dollars. Bitcoin and Gold.

Thanks for paying attention.

• • •

Missing some Tweet in this thread? You can try to

force a refresh