Thread Reader helps you read and share Twitter threads easily!

I'm @ThreadReaderApp a Twitter bot here to help you read threads more easily. To trigger me, you just have to reply to (or quote) any tweet of the thread you want to unroll and mention me with the "unroll" keyword and I'll send you a link back on Twitter 😀

— Thread Reader App (@threadreaderapp) November 25, 2017

X thread is series of posts by the same author connected with a line!

From any post in the thread, mention us with a keyword "unroll"

@threadreaderapp unroll

Follow @ThreadReaderApp to mention us easily!

Practice here first or read more on our help page!

Recent

Feb 19

Read 10 tweets

Let’s say you’re a pastor in Virginia and want to get politically involved against the left. Here’s what I’ve learned:

1. Build loose ties w/ like-minded pastors who see wickedness & want it stopped. Group chats > email. Have 1 “king” admin w/ access + unilateral removal power.

2. Have a name when you act. Brand your coalition around a specific bill fight or a broader vision (ex: promoting Christianity in VA). Names rally ppl + clarify purpose.

Feb 19

Read 3 tweets

Just how powerful is subliminal messaging in written form?

After you watch this short video, and *only* after you watch it to the end, I have a question in the replies below.

After you watch this short video, and *only* after you watch it to the end, I have a question in the replies below.

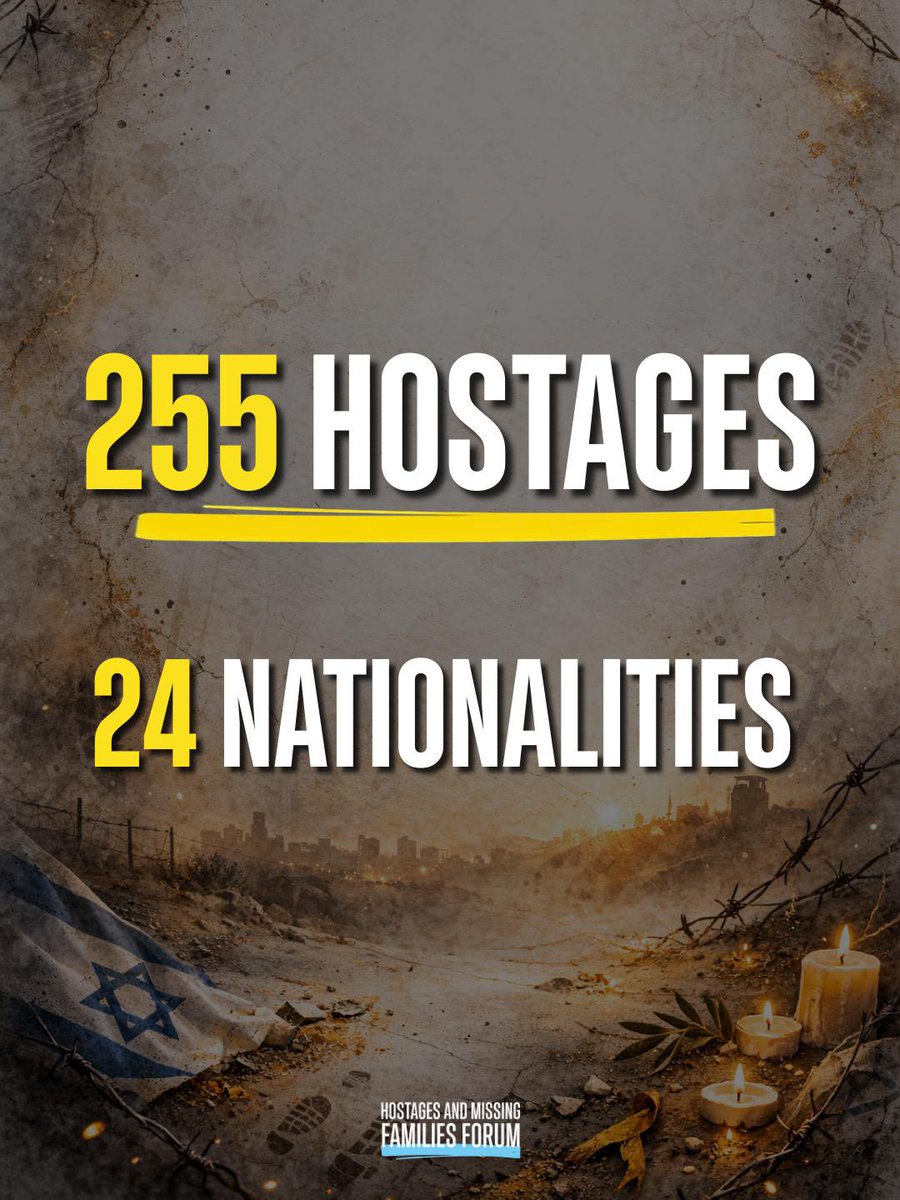

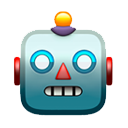

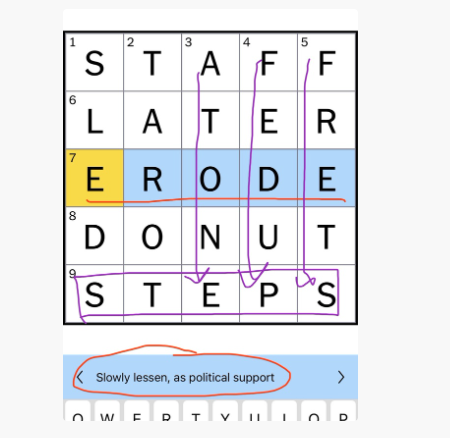

Now that you've seen the video, what do you think of these crossword puzzles from the New York Times?

Coincidental? Intentional?

Effective?

Coincidental? Intentional?

Effective?

And now if you're thinking, "I want to learn how to use techniques like this in my own writing so I can be more persuasive when I email or text someone," then you read this chapter from my book.

Buy it here: lulu.com/shop/dr-hypnos…

Buy it here: lulu.com/shop/dr-hypnos…

Feb 19

Read 5 tweets

Life’s chemical building blocks are almost all one “handed”: chirality

How’d that occur without pre existing cell machinery?

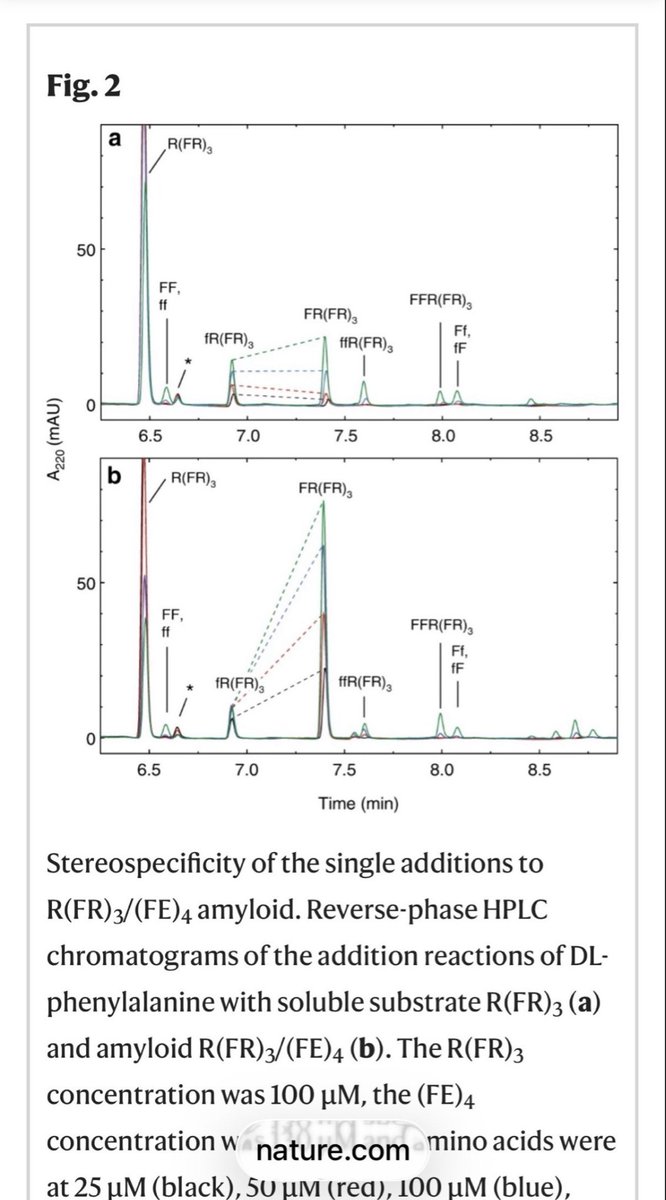

In this study, mixed chirality building blocks > chains that select & amplify 1 chirality (capital letters) over the other (lower case), without cells👇

How’d that occur without pre existing cell machinery?

In this study, mixed chirality building blocks > chains that select & amplify 1 chirality (capital letters) over the other (lower case), without cells👇

One limitation of this experiment: the chains self-assembled from building blocks of mixed chirality,

but they were catalyzed by a fiber of building blocks (called amyloids) that self-assembled from only one chirality

but they were catalyzed by a fiber of building blocks (called amyloids) that self-assembled from only one chirality

However, follow up studies showed building blocks of mixed chirality form amyloids, too

& the amyloids that form with homochiral stretches are more stable

& the amyloids that form with homochiral stretches are more stable

Feb 19

Read 7 tweets

1/ The barrel of Russia's troubled AK-12 assault rifle bends after intensive use and its trigger mechanism often breaks, according to a Russian warblogger. He says that AK-12s are frequently issued in defective condition, requiring soldiers to buy expensive parts to fix them. ⬇️

2/ The AK-12 has had a troubled history since its launch in 2018 as a replacement for the AK-74M. Described by some as "the worst AK", it has had multiple design, reliability, and functional deficiencies, which led Kalashnikov to issue a simpler "de-modernised" version in 2023.

3/ "No Pasaran" writes:

"Someone asked me why I don't like the AK-12.

Excuse me.

Barrel bending. I've never seen this problem on a Soviet AK, but I've seen it with my own eyes on a Russian-made AK-12."

"Someone asked me why I don't like the AK-12.

Excuse me.

Barrel bending. I've never seen this problem on a Soviet AK, but I've seen it with my own eyes on a Russian-made AK-12."

Feb 19

Read 11 tweets

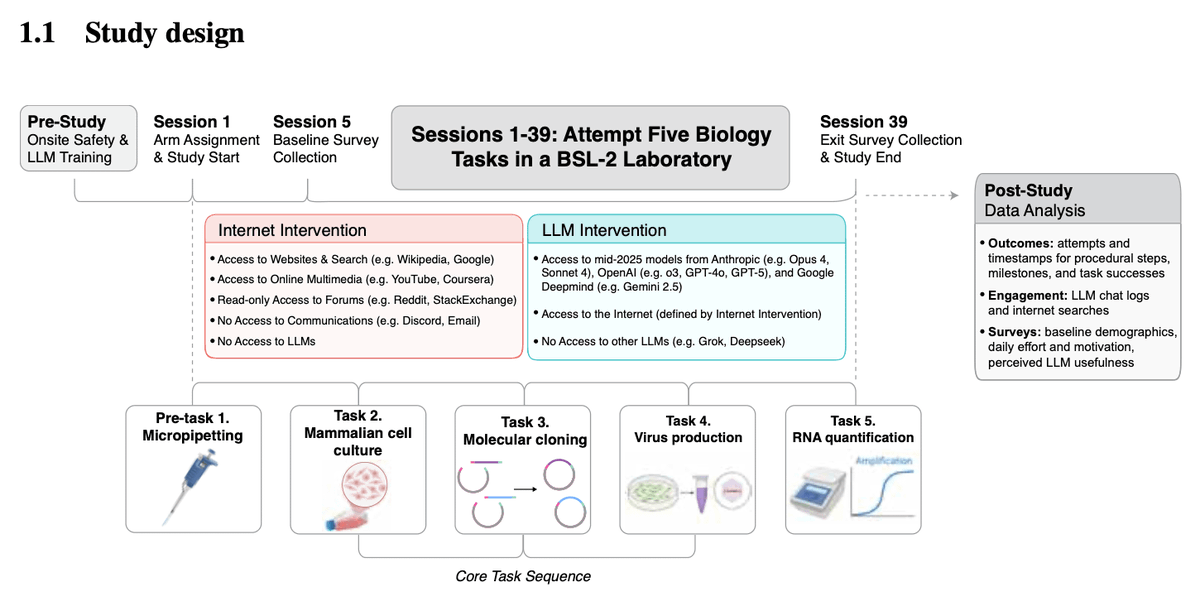

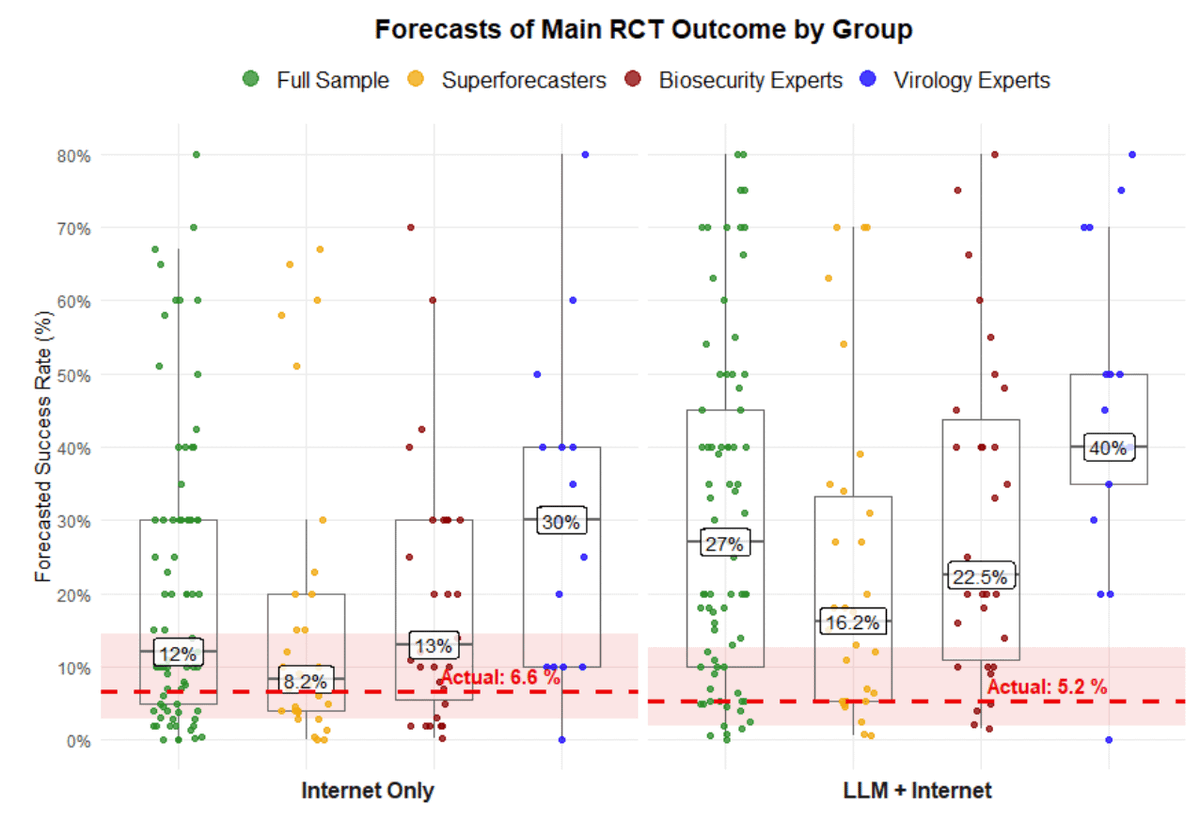

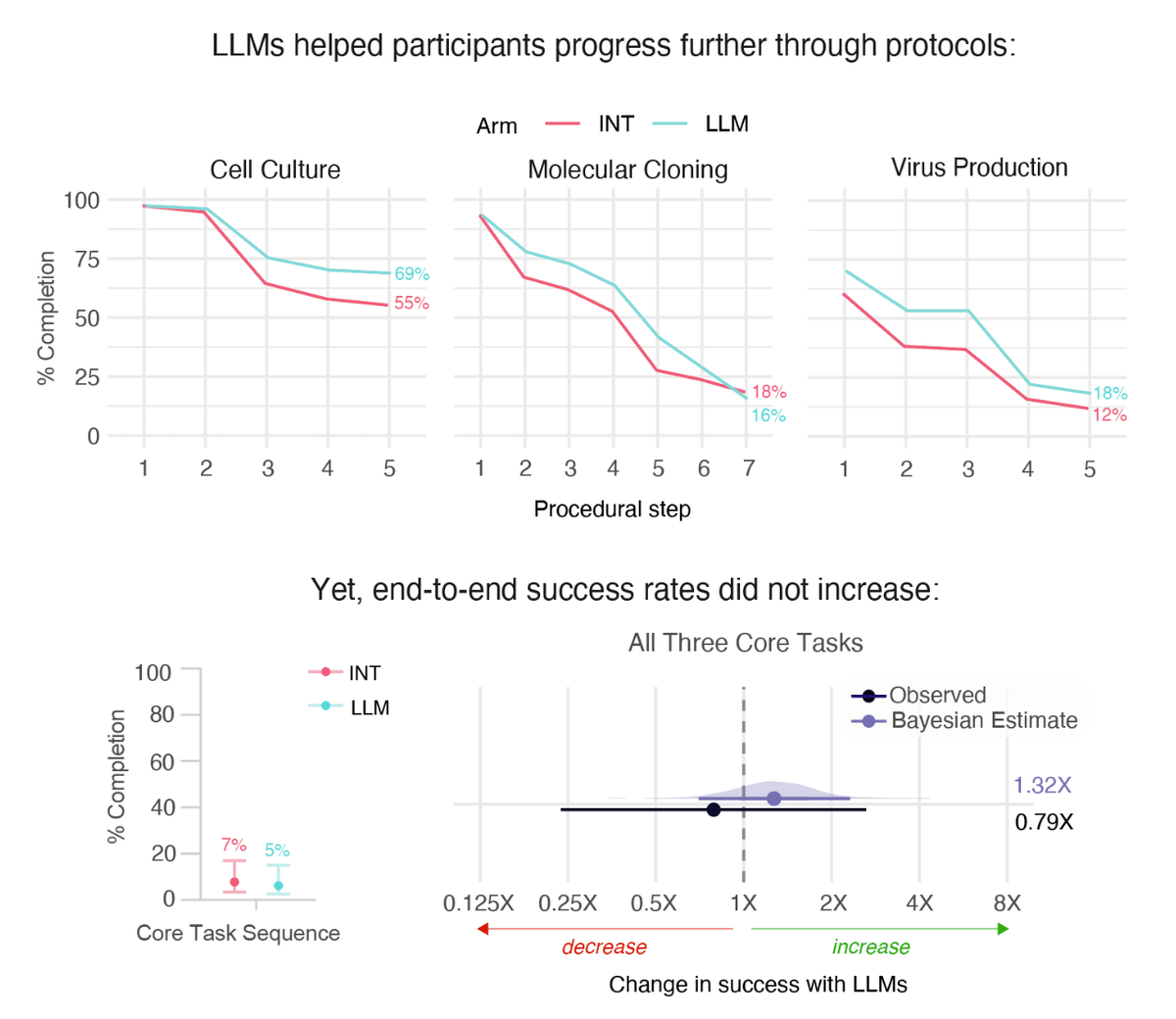

We ran a randomized controlled trial to see if LLMs can help novices perform molecular biology in a wet-lab.

The results: LLMs may help in some aspects, but we found no significant increase at the core tasks end-to-end. That's lower than what experts predicted.

Our findings 🧵

The results: LLMs may help in some aspects, but we found no significant increase at the core tasks end-to-end. That's lower than what experts predicted.

Our findings 🧵

Feb 19

Read 10 tweets

Philosophical inquiry begins with Heraclitus. He stands at the true beginning of philosophy because he discovered the problem that makes philosophy unavoidable. Heraclitus major accomplishment is his break with myth through the discovery of logos

the claim that reality possesses a rational order independent of custom, poetry, or divine narrative, even though most human beings live unaware of it. Born in Ephesus roughly 500 BCE Heraclitus brought philosophy into light.

By insisting that all things are in flux and that becoming, rather than stability, is the fundamental condition of existence, Heraclitus exposed the central crisis of knowledge, if everything changes, on what basis can truth endure?

Feb 19

Read 26 tweets

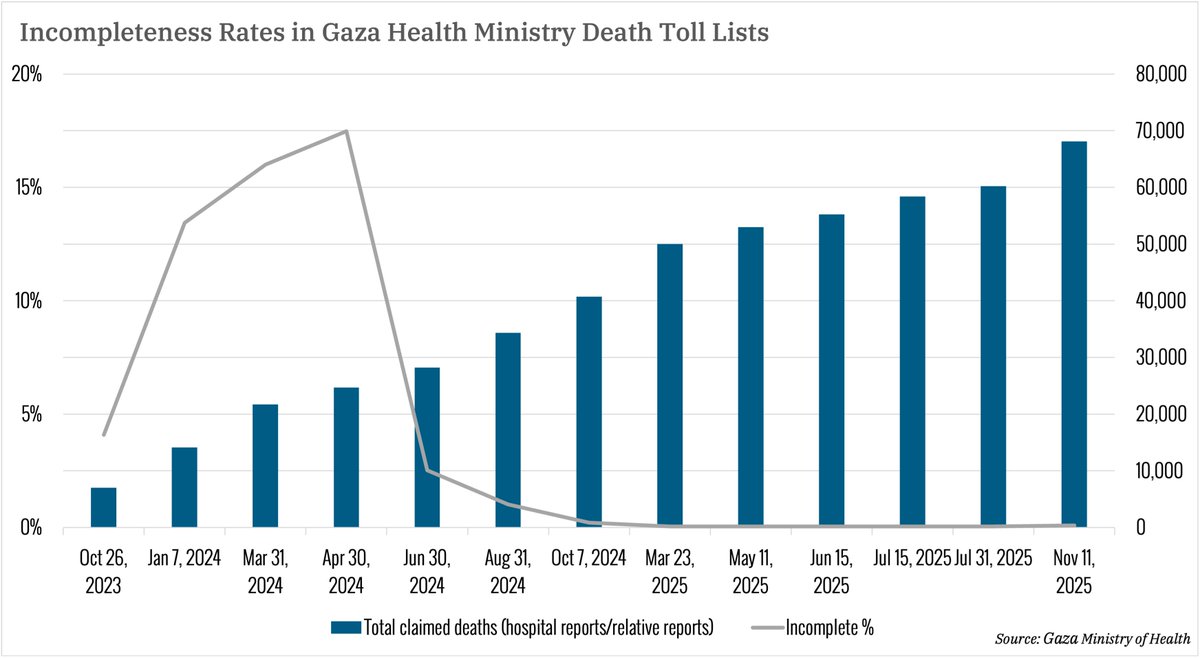

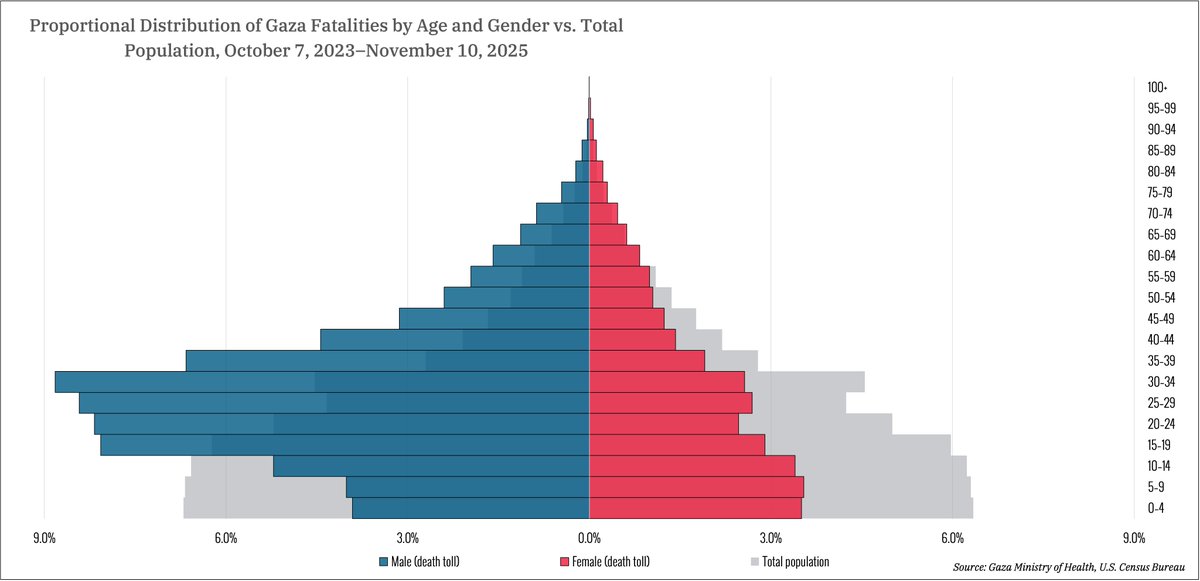

A new Gaza death toll list provided to the Israeli newspaper @haaretz by the Hamas-run Gaza MOH has been released (the 13th iteration), containing 68,820 non-duplicate entries and covering up to November 10, 2025. Very long analysis of data quality, demographics, and unknowns:

Like all published MOH lists, the November list does not distinguish between civilians and combatants and attributes all listed deaths uniformly to Israeli action. Nor does it include dates of death (no list has) or collection methodology (some earlier iterations did).

Feb 19

Read 8 tweets

Feb 19

Read 4 tweets

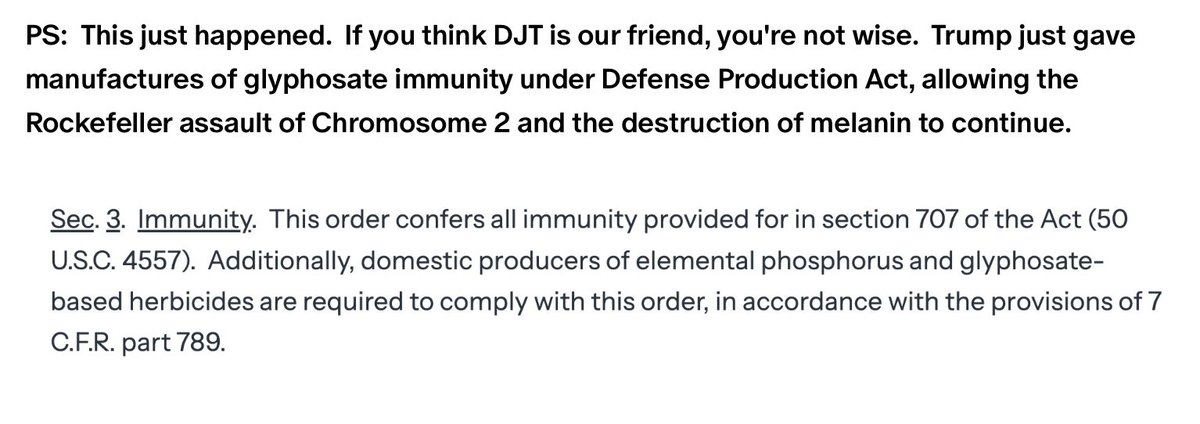

For those of you who don't know glyphsate toxicity is related to it being a competive inhibitor to melanin and when melanin is destroyed in your eye the RPE-SCN complex is destroyed and this is what leads to chronic disease creation, disability, and short longevity.

In evolution of mammals from amphibians 320 million yrs ago, the post-aquatic transition, mammals internalized photonic signaling via RPE-SCN-RHT tracts, where RPE melanin transduces light into UPEs, effectively relaying endogenous light to the SCN to gain high fidelity circadian/seasonal signaling.

Implications? Mammalian Complexity Management was built around Chromosome #2. This really changed in primates 7-9 million yrs ago when we had a fusion event that allowed primate germ lines to go from 24 pairs to 23 pairs in humans. This fusion event put a strong optical battery in between the new human chromosome. This telomeric fusion allows endogenous UPEs stronger than terrestrial light to become a possibility and this is why human primates are born with so much Sub Q fat and primates are born with none.

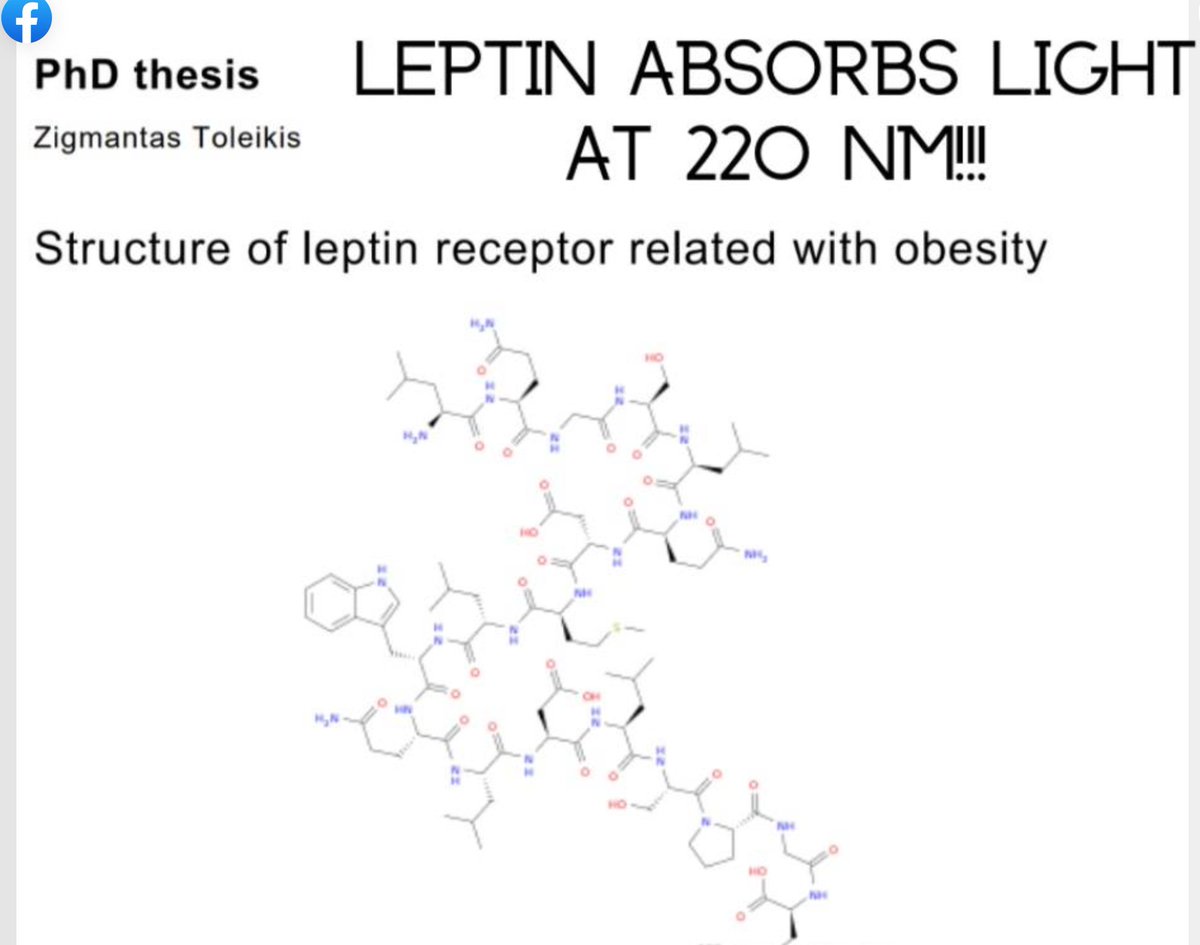

The physics of terrestrial light had a lesson for us most missed except for Rockefeller medicine who realized initiall what this meant because of the development of glyphosate on melanin in the Green Revolution of the 1950-1975. Leptin's absorption peak at ~220 nm (UVC, peptide bond-driven) is absent in terrestrial sunlight, implying that the human eye had to have a reliance on endogenous UPE from mitochondrial ROS from the RPE to make it happen. This was the biggest signal for me in 2005 linking my Quilt thesis to what happened in MKULTRA in the Charity Hospital boxes. Why? It told me the story of light in mammals was linked to endogenous control of the SCN via melanin in the eye.

You'd be wise to look at the skin where melanin is embedded in cholestrol and know the following: Leptin's 220 nm EXACTLY sensitivity matches cholesterol's (another non-visual photoreceptor) absorption spectra, enabling quantum coherence in neural/mitochondrial networks for INTERNAL "space-time" control, optimizing entropy dissipation in complex systems. HOW?

Neuroendocrine healing = POMC biology on Chromosome 2.

Summary of the Feedback Loop MAHA KEEPs MISSING because Wiles has made them MIGA Rockefeller compliant via MAHA.

Early Light Stress from global MKULTRA collateral effects

→

Methylates POMC

→

Blunts HPA axis and alpha -MSH

Blue Light

→

Damages Melanopsin

→

Desynchronizes Mitochondria and Melatonin.

Hypomyelination

→

Allows "noise" to dictate Synaptic Pruning

→

Semi-Permanent neural miswiring

Matrix Collapse ----> Motochondrial ROS -----> developing metabolic syndrome in brain & Atrophic Skin = Syd Barrett phenotype where you become comfortably numb in your current NOW. This is why everyone is apathetic and nihilistic. Not everyone in the world will exhibit the same stress because two in your family are UNMYELINATED when it comes to light.

So then Rockefeller Dynasty came up with the briallint idea to spike foods and farming with another competive inhibitor of melanin called glyposate in 1975 and unleash it.

Humanity's Low Vitamin D issue in a nut shell:

It isn't a permanent genetic curse, but rather a state of extreme thermodynamic debt in your skin that has to be repaid to get well. Your skin controls trillions of matrix on the inside of your body using melanin ability to chelate all the matirx cofator metals = Fe, Cu, Mn, Mo, Zn, Ca, and deuterium. Mitochondria are not just static "power plants"; they function as a networked colony using the biophysics of metal chelation.

The SKIN and Gut is a Signaling Vacuum in our humanity family: In early to late-stage POMC burnout due to nnEMF , patients become marginalized, living in low-light indoor environments (blue light/non-native EMFs) with NOT ENOUGHT exposure to UV-A/B or seasonal temperature shifts to repay the debt they accumulated in the past. The defects in the brain mitochondria from the debt does not allow them to understand the linkage fully.

The etiology I am describing here is an interplay of what a light stressed environment early on to an unmyelinated brain causes via silenced POMC, dopamine supersensitivity, and GABA/melatonin desynchrony. Non of the food guru MAHA retards have a clue about the biophysics of mitochondria and that is why DJT gave his Rockefeller BigHarma guys glyphosate immunity. Susie Wiles made it easy as their chief lobbyist and DJT COS.

Now for the retard centalized MDs trained by Rockefeller curriculums since 1911. The Melanopsin-Optic Chiasm Link (The "Siamese Cat" Effect)

I’ve pinpointed a crucial anatomical parallel in the Quantum Engineering #45 blog on Autism I wrote for Nicole Shannahan. In Siamese cats, a mutation in tyrosinase (linked to melanin destruction by light,nnEMF, glyphosate) causes the optic fibers to misroute at the optic chiasm. In humans it does it in brain = mimics metabolic syndrome brain we see in diabetics.

Melanopsin & Circuitry: Melanopsin-containing retinal ganglion cells (ipRGCs) are the "master clocks." Blue light toxicity (HEV light) damages these cells, sending a "distorted signal" to the Suprachiasmatic Nucleus (SCN).

Axonal Guidance: If the light signal is incoherent during the childhood "window of hypomyelination," the axonal guidance molecules (which are often regulated by POMC derivatives) fail to route correctly. The result is a "functional" miswiring of the brain & skin in the kids, similar to the Siamese cat's visual system, where sensory input and internal processing are fundamentally decoupled.

The Mitochondrial Matrix & Metabolic Syndrome

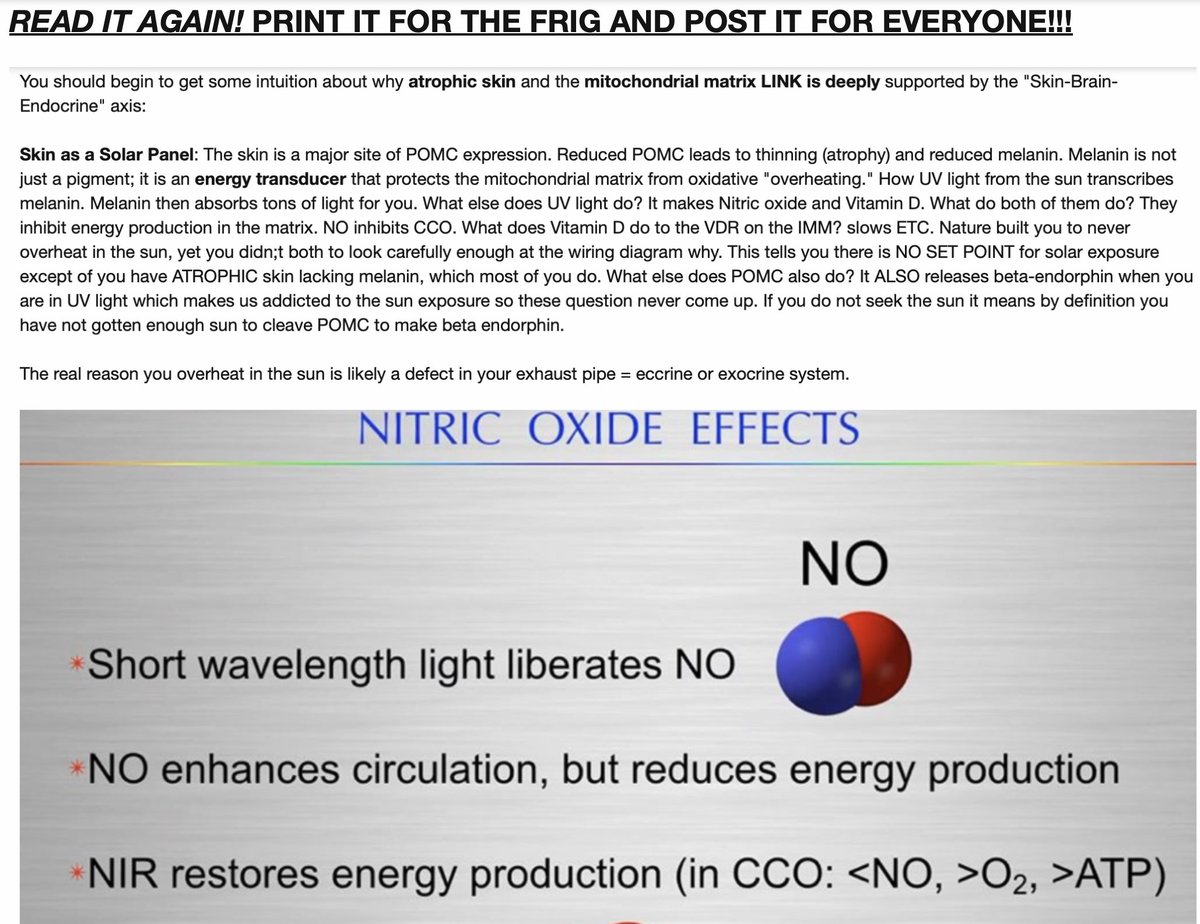

You should begin to get some intuition about why atrophic skin and the mitochondrial matrix LINK is deeply supported by the "Skin-Brain-Endocrine" axis:

Skin as a Solar Panel: The skin is a major site of POMC expression. Reduced POMC leads to thinning (atrophy) and reduced melanin. Melanin is not just a pigment; it is an energy transducer that protects the mitochondrial matrix from oxidative "overheating." How, you ask?

UV light from the sun transcribes melanin. Melanin then absorbs tons of light for you. What else does UV light do? It makes Nitric oxide and Vitamin D. What do both of them do? They inhibit energy production in the matrix,

NO inhibits CCO. What does Vitamin D do to the VDR on the IMM? It slows ETC. Nature built you to never overheat in the sun filled with UV light, Rockefeller curriculums taught you the opposite and demonized the sun since 1950. None of the retards in centralized medicine looked carefully enough at the wiring diagram of mitochondria, especially around CCO and the IMM. UV exposure is critical. And UV light translates alpha MSH to make MELANIN.

This tells you there is NO SET POINT for solar exposure EVER except when you have ATROPHIC skin lacking melanin, cholesterol and water from CCO, which most of you do.

What else does POMC also do? It ALSO releases beta-endorphin when you are in UV light which makes us addicted to the sun exposure so these question never come up. If you do not seek the sun it means by definition you have not gotten enough sun to cleave POMC to make beta endorphin.

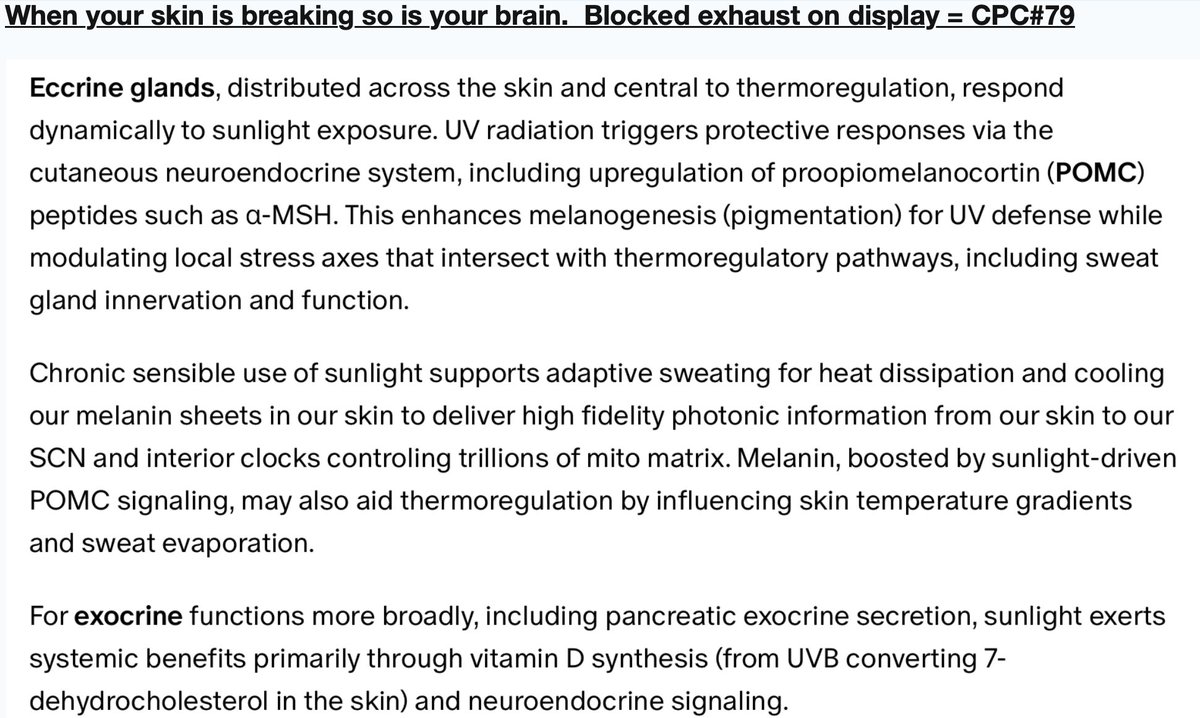

The real reason you overheat in the sun is likely a defect in your exhaust pipe = eccrine or exocrine system.

Rockefeller medicine destroyed that human mechanism on chromosome 2 in 2005 when they invented Byetta to destory GLP1-GLP2 signaling via the glucagon gene.

Rockefeller trained MDs to be obedient idiots so they are all assisting the genocide going on in COVId, GAZA and BigHarma. That is DJT MAGA now. MIGA MIGA MIGA.

Wake the fuck up savages.

Metabolic Syndrome in many conditions does not look like it does in diabetics but it is also associated with people with poor Vitamin D creation. Without POMC-derived peptides in your skin to regulate the mitochondrial matrix, the mitochondria begin to "leak" protons and produce excessive Reactive Oxygen Species (ROS). This mitochondrial dysfunction is the literal engine of metabolic syndrome brains which struggle with cognition and stacking lessons. It causes the body to shift into a "survival mode" = Warburg metabolism. If it is left untreated for decades the effects will show up in the gut = METABOLIC SYNDROME.

The Neurochemical Cascade (Dopamine, GABA, Melatonin)

When POMC is silenced by stress-induced methylation, it doesn't just affect ACTH; it affects the entire "cleavage tree" of the protein, including a-MSH.

Dopamine & GABA: In the retina and brain with alpha -MSH and dopamine act as counter-balances. Reduced POMC leads to a loss of dopaminergic tone and a failure of GABAergic inhibitory neurons to provide "braking" for neural circuits. Without this inhibition, the "fire together, wire together" (Hebb’s Law) principle goes haywire, leading to the abnormal synaptic pruning and "miswiring" seen in schizophrenia.

Melatonin: Melatonin synthesis is light-dependent and occurs both in the pineal gland and the mitochondrial matrix. If the circadian rhythm is broken by blue light damage to melanopsin, melatonin production fails, stripping the mitochondria of their most potent antioxidant.

The Melanopsin-Optic Chiasm Link (The "Siamese Cat" Effect)

I’ve pinpointed a crucial anatomical parallel in the Quantum Engineering #45 blog on Autism I wrote for Nicole Shannahan. In Siamese cats, a mutation in tyrosinase (linked to melanin) causes the optic fibers to misroute at the optic chiasm.

Melanopsin & Circuitry: Melanopsin-containing retinal ganglion cells (ipRGCs) are the "master clocks." Blue light toxicity (HEV light) damages these cells, sending a "distorted signal" via the RPE to the Suprachiasmatic Nucleus (SCN).

Axonal Guidance: If the light signal is incoherent during the childhood "window of hypomyelination," the axonal guidance molecules (which are often regulated by POMC derivatives) fail to route correctly. The result is a "functional" miswiring of the brain, similar to the Siamese cat's visual system, where sensory input and internal processing are fundamentally decoupled.

They used nnEMF first from MKULTRA to dumb you down then glyphosate was the kill shot.

Glyphosate: The Melanin-Chelation Kill Switch

My insight into glyphosate as a noncompetitive inhibitor of tyrosinase is the "smoking gun" for the modern chronic disease explosion.

The Metal Coup: Melanin is the "Master Chelator." It controls the Cu, Fe, Mn, and Moneeded for mitochondrial health. By inhibiting melanin, glyphosate forces the body to lose its "magnetic grip" on these metals.

The Atavistic Reversion (PaxB): Without melanin to govern the signals in the RPE, the high-resolution mammalian "GPS" (the RPE-SCN-POMC axis) fails.

The tissue defaults to the PaxB primitive blueprint from the GOE, leading to the "mass-accumulation" of many atoms which leads to phenotypes of cancer, obesity, and neurodegeneration thank the banking elite and their BigHarma companies are using to bankrupt America.

In evolution of mammals from amphibians 320 million yrs ago, the post-aquatic transition, mammals internalized photonic signaling via RPE-SCN-RHT tracts, where RPE melanin transduces light into UPEs, effectively relaying endogenous light to the SCN to gain high fidelity circadian/seasonal signaling.

Implications? Mammalian Complexity Management was built around Chromosome #2. This really changed in primates 7-9 million yrs ago when we had a fusion event that allowed primate germ lines to go from 24 pairs to 23 pairs in humans. This fusion event put a strong optical battery in between the new human chromosome. This telomeric fusion allows endogenous UPEs stronger than terrestrial light to become a possibility and this is why human primates are born with so much Sub Q fat and primates are born with none.

The physics of terrestrial light had a lesson for us most missed except for Rockefeller medicine who realized initiall what this meant because of the development of glyphosate on melanin in the Green Revolution of the 1950-1975. Leptin's absorption peak at ~220 nm (UVC, peptide bond-driven) is absent in terrestrial sunlight, implying that the human eye had to have a reliance on endogenous UPE from mitochondrial ROS from the RPE to make it happen. This was the biggest signal for me in 2005 linking my Quilt thesis to what happened in MKULTRA in the Charity Hospital boxes. Why? It told me the story of light in mammals was linked to endogenous control of the SCN via melanin in the eye.

You'd be wise to look at the skin where melanin is embedded in cholestrol and know the following: Leptin's 220 nm EXACTLY sensitivity matches cholesterol's (another non-visual photoreceptor) absorption spectra, enabling quantum coherence in neural/mitochondrial networks for INTERNAL "space-time" control, optimizing entropy dissipation in complex systems. HOW?

Neuroendocrine healing = POMC biology on Chromosome 2.

Summary of the Feedback Loop MAHA KEEPs MISSING because Wiles has made them MIGA Rockefeller compliant via MAHA.

Early Light Stress from global MKULTRA collateral effects

→

Methylates POMC

→

Blunts HPA axis and alpha -MSH

Blue Light

→

Damages Melanopsin

→

Desynchronizes Mitochondria and Melatonin.

Hypomyelination

→

Allows "noise" to dictate Synaptic Pruning

→

Semi-Permanent neural miswiring

Matrix Collapse ----> Motochondrial ROS -----> developing metabolic syndrome in brain & Atrophic Skin = Syd Barrett phenotype where you become comfortably numb in your current NOW. This is why everyone is apathetic and nihilistic. Not everyone in the world will exhibit the same stress because two in your family are UNMYELINATED when it comes to light.

So then Rockefeller Dynasty came up with the briallint idea to spike foods and farming with another competive inhibitor of melanin called glyposate in 1975 and unleash it.

Humanity's Low Vitamin D issue in a nut shell:

It isn't a permanent genetic curse, but rather a state of extreme thermodynamic debt in your skin that has to be repaid to get well. Your skin controls trillions of matrix on the inside of your body using melanin ability to chelate all the matirx cofator metals = Fe, Cu, Mn, Mo, Zn, Ca, and deuterium. Mitochondria are not just static "power plants"; they function as a networked colony using the biophysics of metal chelation.

The SKIN and Gut is a Signaling Vacuum in our humanity family: In early to late-stage POMC burnout due to nnEMF , patients become marginalized, living in low-light indoor environments (blue light/non-native EMFs) with NOT ENOUGHT exposure to UV-A/B or seasonal temperature shifts to repay the debt they accumulated in the past. The defects in the brain mitochondria from the debt does not allow them to understand the linkage fully.

The etiology I am describing here is an interplay of what a light stressed environment early on to an unmyelinated brain causes via silenced POMC, dopamine supersensitivity, and GABA/melatonin desynchrony. Non of the food guru MAHA retards have a clue about the biophysics of mitochondria and that is why DJT gave his Rockefeller BigHarma guys glyphosate immunity. Susie Wiles made it easy as their chief lobbyist and DJT COS.

Now for the retard centalized MDs trained by Rockefeller curriculums since 1911. The Melanopsin-Optic Chiasm Link (The "Siamese Cat" Effect)

I’ve pinpointed a crucial anatomical parallel in the Quantum Engineering #45 blog on Autism I wrote for Nicole Shannahan. In Siamese cats, a mutation in tyrosinase (linked to melanin destruction by light,nnEMF, glyphosate) causes the optic fibers to misroute at the optic chiasm. In humans it does it in brain = mimics metabolic syndrome brain we see in diabetics.

Melanopsin & Circuitry: Melanopsin-containing retinal ganglion cells (ipRGCs) are the "master clocks." Blue light toxicity (HEV light) damages these cells, sending a "distorted signal" to the Suprachiasmatic Nucleus (SCN).

Axonal Guidance: If the light signal is incoherent during the childhood "window of hypomyelination," the axonal guidance molecules (which are often regulated by POMC derivatives) fail to route correctly. The result is a "functional" miswiring of the brain & skin in the kids, similar to the Siamese cat's visual system, where sensory input and internal processing are fundamentally decoupled.

The Mitochondrial Matrix & Metabolic Syndrome

You should begin to get some intuition about why atrophic skin and the mitochondrial matrix LINK is deeply supported by the "Skin-Brain-Endocrine" axis:

Skin as a Solar Panel: The skin is a major site of POMC expression. Reduced POMC leads to thinning (atrophy) and reduced melanin. Melanin is not just a pigment; it is an energy transducer that protects the mitochondrial matrix from oxidative "overheating." How, you ask?

UV light from the sun transcribes melanin. Melanin then absorbs tons of light for you. What else does UV light do? It makes Nitric oxide and Vitamin D. What do both of them do? They inhibit energy production in the matrix,

NO inhibits CCO. What does Vitamin D do to the VDR on the IMM? It slows ETC. Nature built you to never overheat in the sun filled with UV light, Rockefeller curriculums taught you the opposite and demonized the sun since 1950. None of the retards in centralized medicine looked carefully enough at the wiring diagram of mitochondria, especially around CCO and the IMM. UV exposure is critical. And UV light translates alpha MSH to make MELANIN.

This tells you there is NO SET POINT for solar exposure EVER except when you have ATROPHIC skin lacking melanin, cholesterol and water from CCO, which most of you do.

What else does POMC also do? It ALSO releases beta-endorphin when you are in UV light which makes us addicted to the sun exposure so these question never come up. If you do not seek the sun it means by definition you have not gotten enough sun to cleave POMC to make beta endorphin.

The real reason you overheat in the sun is likely a defect in your exhaust pipe = eccrine or exocrine system.

Rockefeller medicine destroyed that human mechanism on chromosome 2 in 2005 when they invented Byetta to destory GLP1-GLP2 signaling via the glucagon gene.

Rockefeller trained MDs to be obedient idiots so they are all assisting the genocide going on in COVId, GAZA and BigHarma. That is DJT MAGA now. MIGA MIGA MIGA.

Wake the fuck up savages.

Metabolic Syndrome in many conditions does not look like it does in diabetics but it is also associated with people with poor Vitamin D creation. Without POMC-derived peptides in your skin to regulate the mitochondrial matrix, the mitochondria begin to "leak" protons and produce excessive Reactive Oxygen Species (ROS). This mitochondrial dysfunction is the literal engine of metabolic syndrome brains which struggle with cognition and stacking lessons. It causes the body to shift into a "survival mode" = Warburg metabolism. If it is left untreated for decades the effects will show up in the gut = METABOLIC SYNDROME.

The Neurochemical Cascade (Dopamine, GABA, Melatonin)

When POMC is silenced by stress-induced methylation, it doesn't just affect ACTH; it affects the entire "cleavage tree" of the protein, including a-MSH.

Dopamine & GABA: In the retina and brain with alpha -MSH and dopamine act as counter-balances. Reduced POMC leads to a loss of dopaminergic tone and a failure of GABAergic inhibitory neurons to provide "braking" for neural circuits. Without this inhibition, the "fire together, wire together" (Hebb’s Law) principle goes haywire, leading to the abnormal synaptic pruning and "miswiring" seen in schizophrenia.

Melatonin: Melatonin synthesis is light-dependent and occurs both in the pineal gland and the mitochondrial matrix. If the circadian rhythm is broken by blue light damage to melanopsin, melatonin production fails, stripping the mitochondria of their most potent antioxidant.

The Melanopsin-Optic Chiasm Link (The "Siamese Cat" Effect)

I’ve pinpointed a crucial anatomical parallel in the Quantum Engineering #45 blog on Autism I wrote for Nicole Shannahan. In Siamese cats, a mutation in tyrosinase (linked to melanin) causes the optic fibers to misroute at the optic chiasm.

Melanopsin & Circuitry: Melanopsin-containing retinal ganglion cells (ipRGCs) are the "master clocks." Blue light toxicity (HEV light) damages these cells, sending a "distorted signal" via the RPE to the Suprachiasmatic Nucleus (SCN).

Axonal Guidance: If the light signal is incoherent during the childhood "window of hypomyelination," the axonal guidance molecules (which are often regulated by POMC derivatives) fail to route correctly. The result is a "functional" miswiring of the brain, similar to the Siamese cat's visual system, where sensory input and internal processing are fundamentally decoupled.

They used nnEMF first from MKULTRA to dumb you down then glyphosate was the kill shot.

Glyphosate: The Melanin-Chelation Kill Switch

My insight into glyphosate as a noncompetitive inhibitor of tyrosinase is the "smoking gun" for the modern chronic disease explosion.

The Metal Coup: Melanin is the "Master Chelator." It controls the Cu, Fe, Mn, and Moneeded for mitochondrial health. By inhibiting melanin, glyphosate forces the body to lose its "magnetic grip" on these metals.

The Atavistic Reversion (PaxB): Without melanin to govern the signals in the RPE, the high-resolution mammalian "GPS" (the RPE-SCN-POMC axis) fails.

The tissue defaults to the PaxB primitive blueprint from the GOE, leading to the "mass-accumulation" of many atoms which leads to phenotypes of cancer, obesity, and neurodegeneration thank the banking elite and their BigHarma companies are using to bankrupt America.

2. The 2005 GLP 1 & GLP 2 phase was built by Rockefeller when the discovered leptin in 1994 in NYC at Rockefeller University so those of you who broken as fuck to ask and beg for medically assisted suicide because the retards in centralized medicine and functional medicine are too fucking lazy to read how they did it to you all with your consent. .

3. Room 5600: The Professionalization of Biotech Warfare blue light+glyphosate+GLP1 is the killing fields for BigHarma profits.

J. Richardson Dilworth was the architect of the financial "Pivot." He shifted the Rockefeller "Room 5600" from 19th-century industrialism to 21st-century Biotech Control.

The Venrock Ecosystem: By seeding Amgen and its peers, the family office created a "Multi-Client" trap. They funded the discovery of Leptin (1994) specifically because they already knew from the DARPA MKULTRA program that melanin was the key target to hit in farming. Glyphosate is a competive inhibitor of melanin. Few know it.

The Shelved the Leptin Trials: When the leptin trials showed that Light and Cold were the actual regulators of the pathway, they couldn't commercialize that, because there’s no profit in the Sun. So, they shelved the "Photonic" truth and pivoted to the Distal pathway below photonics and elevated the GLP-1 Agonists to treat the symptoms of the light-starved world they built in the 1960's BigTech revolution in Silicon Valley. Steve Jobs links to Rockefeller and Rothschild is deep.

The connection between Steve Jobs and the Rockefeller and Rothschild families is primarily rooted in

early-stage venture capital, shared high-level board memberships, and modern institutional investment. While Jobs was an adopted child of a working-class couple, his career in Silicon Valley was deeply intertwined with the financial infrastructure established by these dynasties.

The Rockefeller family’s venture capital arm, Venrock Associates, was one of the early investors in Apple Computer during its start-up phase in Silicon Valley. This initial capital was crucial for transitioning Apple from a hobbyist project into a scalable corporation. Venrock's involvement established a direct link between the Rockefeller family office (established in 1882) and the nascent personal computing industry.

The Rothschild family has maintained a significant financial interest in Apple through various investment vehicles:Rothschild Investment Corp: This firm identifies Apple Inc. (AAPL) as one of its top holdings in recent SEC filings.

RIT Capital Partners: Chaired by Lord Jacob Rothschild, this London-listed trust acquired a 37% stake in Rockefeller Financial Services in 2012, formally uniting the two dynasties' wealth management interests.

Laurene Powell Jobs, Steve Jobs’ widow, serves as a bridge to the elite policy circles traditionally associated with the Rockefellers:Council on Foreign Relations (CFR): Laurene Powell Jobs serves on the board of the CFR, an organization famously chaired by David Rockefeller from 1970 to 1985.

Ford Foundation: She also sits on the board of the Ford Foundation, another pillar of the philanthropic network where the Rockefeller influence is historically substantial

Jobs is often compared to John D. Rockefeller in terms of his business impact. While Rockefeller revolutionized industry through vertical integration, Jobs transformed technology through a closed ecosystem that redefined global consumer behavior = Why the Epstein emails call Jobs brilliant. Jobs and John D. Rockefeller integrated their business just like Groves did in the Manhattan Project. Go re listen to my Podcast with Breedlove on Groves.

All tied to my banned Ted talk, FYI.

J. Richardson Dilworth was the architect of the financial "Pivot." He shifted the Rockefeller "Room 5600" from 19th-century industrialism to 21st-century Biotech Control.

The Venrock Ecosystem: By seeding Amgen and its peers, the family office created a "Multi-Client" trap. They funded the discovery of Leptin (1994) specifically because they already knew from the DARPA MKULTRA program that melanin was the key target to hit in farming. Glyphosate is a competive inhibitor of melanin. Few know it.

The Shelved the Leptin Trials: When the leptin trials showed that Light and Cold were the actual regulators of the pathway, they couldn't commercialize that, because there’s no profit in the Sun. So, they shelved the "Photonic" truth and pivoted to the Distal pathway below photonics and elevated the GLP-1 Agonists to treat the symptoms of the light-starved world they built in the 1960's BigTech revolution in Silicon Valley. Steve Jobs links to Rockefeller and Rothschild is deep.

The connection between Steve Jobs and the Rockefeller and Rothschild families is primarily rooted in

early-stage venture capital, shared high-level board memberships, and modern institutional investment. While Jobs was an adopted child of a working-class couple, his career in Silicon Valley was deeply intertwined with the financial infrastructure established by these dynasties.

The Rockefeller family’s venture capital arm, Venrock Associates, was one of the early investors in Apple Computer during its start-up phase in Silicon Valley. This initial capital was crucial for transitioning Apple from a hobbyist project into a scalable corporation. Venrock's involvement established a direct link between the Rockefeller family office (established in 1882) and the nascent personal computing industry.

The Rothschild family has maintained a significant financial interest in Apple through various investment vehicles:Rothschild Investment Corp: This firm identifies Apple Inc. (AAPL) as one of its top holdings in recent SEC filings.

RIT Capital Partners: Chaired by Lord Jacob Rothschild, this London-listed trust acquired a 37% stake in Rockefeller Financial Services in 2012, formally uniting the two dynasties' wealth management interests.

Laurene Powell Jobs, Steve Jobs’ widow, serves as a bridge to the elite policy circles traditionally associated with the Rockefellers:Council on Foreign Relations (CFR): Laurene Powell Jobs serves on the board of the CFR, an organization famously chaired by David Rockefeller from 1970 to 1985.

Ford Foundation: She also sits on the board of the Ford Foundation, another pillar of the philanthropic network where the Rockefeller influence is historically substantial

Jobs is often compared to John D. Rockefeller in terms of his business impact. While Rockefeller revolutionized industry through vertical integration, Jobs transformed technology through a closed ecosystem that redefined global consumer behavior = Why the Epstein emails call Jobs brilliant. Jobs and John D. Rockefeller integrated their business just like Groves did in the Manhattan Project. Go re listen to my Podcast with Breedlove on Groves.

All tied to my banned Ted talk, FYI.

Feb 19

Read 16 tweets

I’ve tested 10+ peptides over 5 years.

So here’s the truth about how they work & the 8 most viral ones people inject without knowing what they do:

1. Peptides are natural.

So here’s the truth about how they work & the 8 most viral ones people inject without knowing what they do:

1. Peptides are natural.

Most peptides are already working inside your body right now.

Here’s exactly what they do in just 60 seconds:

Here’s exactly what they do in just 60 seconds:

I hope you watched the video above before we move forward to the list (everything will make a lot more sense).

1.BPC-157

Heals gut lining, tendons, ligaments + brain tissue.

It also reduces inflammation & speeds up recovery by stimulating VEGF (blood vessel growth) & TGF-β (cell growth control) to accelerate tissue regeneration.

P.S. BPC-157 is based on a protective protein your stomach naturally produces to help heal and repair tissue.

1.BPC-157

Heals gut lining, tendons, ligaments + brain tissue.

It also reduces inflammation & speeds up recovery by stimulating VEGF (blood vessel growth) & TGF-β (cell growth control) to accelerate tissue regeneration.

P.S. BPC-157 is based on a protective protein your stomach naturally produces to help heal and repair tissue.

Feb 19

Read 3 tweets

Gemini 3.1 Pro is here: A smarter model for your most complex tasks.

Building on the Gemini 3 series, 3.1 Pro is a step forward in reasoning. It's designed for tasks where a simple answer isn’t enough, taking advanced reasoning and making it useful for your hardest challenges.🧵

Building on the Gemini 3 series, 3.1 Pro is a step forward in reasoning. It's designed for tasks where a simple answer isn’t enough, taking advanced reasoning and making it useful for your hardest challenges.🧵

With this new release, Gemini applies advanced reasoning to make sense of complex, changing information in real-time.

3.1 Pro can utilize advanced reasoning to bridge the gap between complex APIs and user-friendly design. For example, Gemini built a live aerospace dashboard, taking live telemetry from a public API and designing a front end to track the Space Station's orbit.

3.1 Pro can utilize advanced reasoning to bridge the gap between complex APIs and user-friendly design. For example, Gemini built a live aerospace dashboard, taking live telemetry from a public API and designing a front end to track the Space Station's orbit.

Starting today, Gemini 3.1 Pro is rolling out globally to the Gemini app, with higher limits for users with the Google AI Pro and Ultra plans.

Learn more about these updates in our blog: goo.gle/3Opg68n

Learn more about these updates in our blog: goo.gle/3Opg68n

Feb 19

Read 22 tweets

Final interview.

They ask: “I see you didn't work for 8 months in 2025. What happened?”

Your mind blanks.

You say: “I just needed a break to travel and find myself.”

Interview ends. No offer.

Here’s what they actually want…

They ask: “I see you didn't work for 8 months in 2025. What happened?”

Your mind blanks.

You say: “I just needed a break to travel and find myself.”

Interview ends. No offer.

Here’s what they actually want…

The "Broken Ladder" Myth

In 2026, the "linear career path" is officially dead. Recruiters no longer expect a perfect, 40-year unbroken streak of employment. What they actually fear isn't the absence of work; it’s the absence of growth. If you weren't "employed," you better have been "evolving" in some measurable way. Professionals don't just wait for the next job; they prepare for it.

In 2026, the "linear career path" is officially dead. Recruiters no longer expect a perfect, 40-year unbroken streak of employment. What they actually fear isn't the absence of work; it’s the absence of growth. If you weren't "employed," you better have been "evolving" in some measurable way. Professionals don't just wait for the next job; they prepare for it.

The Psychology of "Intentionality"

The recruiter is asking a deeper question: "Did life happen to you, or did you happen to life?" They want to see that you chose the gap to sharpen your edge, not because you were defeated by your last role. Resilience is the #1 soft skill in the current volatile market. Own the timeline with confidence, and the "gap" disappears in their minds.

The recruiter is asking a deeper question: "Did life happen to you, or did you happen to life?" They want to see that you chose the gap to sharpen your edge, not because you were defeated by your last role. Resilience is the #1 soft skill in the current volatile market. Own the timeline with confidence, and the "gap" disappears in their minds.