Thread Reader helps you read and share Twitter threads easily!

I'm @ThreadReaderApp a Twitter bot here to help you read threads more easily. To trigger me, you just have to reply to (or quote) any tweet of the thread you want to unroll and mention me with the "unroll" keyword and I'll send you a link back on Twitter 😀

— Thread Reader App (@threadreaderapp) November 25, 2017

X thread is series of posts by the same author connected with a line!

From any post in the thread, mention us with a keyword "unroll"

@threadreaderapp unroll

Follow @ThreadReaderApp to mention us easily!

Practice here first or read more on our help page!

Recent

Mar 10

Read 6 tweets

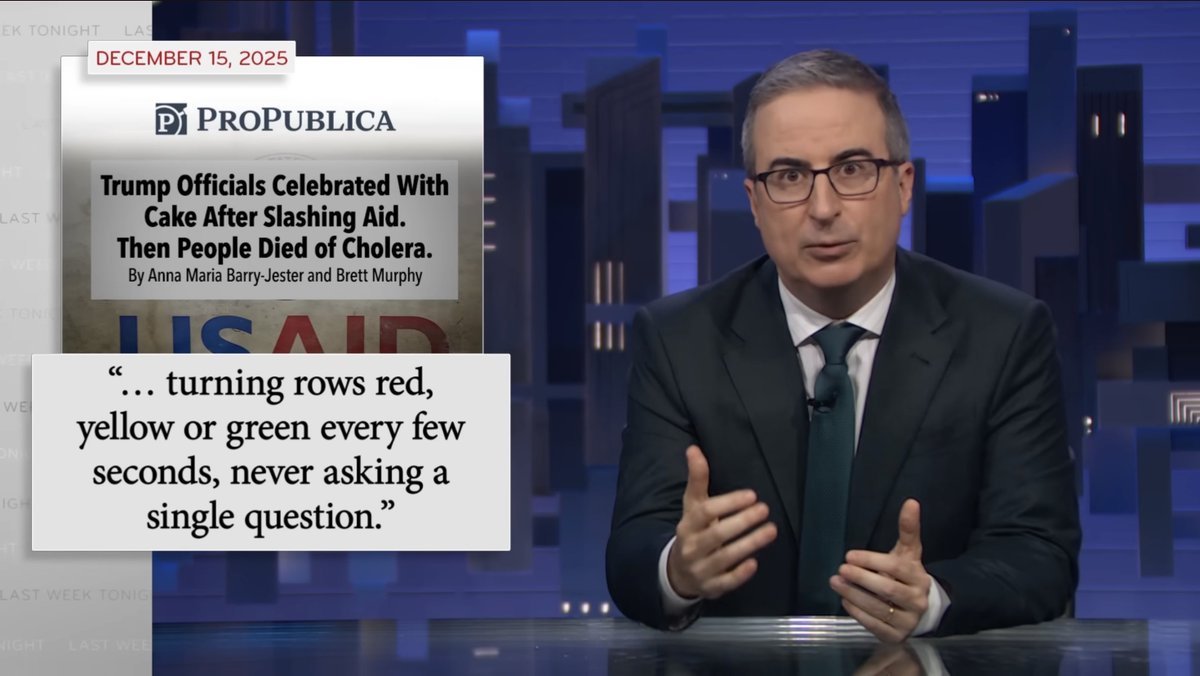

1/ On yesterday’s @lastweektonight about USAID, John Oliver cited several of our investigations.

First up was our reporting about how DOGE operatives had arbitrarily cut aid programs, in some cases by literally clicking through a spreadsheet: propub.li/4bbPEXl

First up was our reporting about how DOGE operatives had arbitrarily cut aid programs, in some cases by literally clicking through a spreadsheet: propub.li/4bbPEXl

2/ Oliver later referred to our reporting about former USAID lead Peter Marocco.

Officials told us they saw Marocco’s gutting of the agency as a campaign of retribution against those who opposed his foreign policy agenda in the first Trump administration: propub.li/3N8HZBm

Officials told us they saw Marocco’s gutting of the agency as a campaign of retribution against those who opposed his foreign policy agenda in the first Trump administration: propub.li/3N8HZBm

3/ Finally, Oliver brought up our reporting on how cuts to aid caused an American-made hunger crisis.

At one refugee camp, mothers had to choose which of their kids to feed & pregnant women were so desperate for calories that some resorted to eating mud: propub.li/40iWl59

At one refugee camp, mothers had to choose which of their kids to feed & pregnant women were so desperate for calories that some resorted to eating mud: propub.li/40iWl59

Mar 9

Read 10 tweets

1/ Analysis based on these facts: 15 days ago Putin faced multiple existential threats of CB default, economic collapse, & threat of command mutiny/coup.

2/ US intel assessment based on these facts likely would have raised the possibility of a rapid disintegration of

3/ Putin’s control and raised a specter of Russia’s nuclear, biological & chemical stockpiles being disbursed during the collapse much

Mar 9

Read 7 tweets

A common misconception:

Money in your 401k and IRA's are locked away until you retire

Let me show you FIVE powerful strategies to access dollars in your retirement account any any age at all:

(bookmark this post for later)

Money in your 401k and IRA's are locked away until you retire

Let me show you FIVE powerful strategies to access dollars in your retirement account any any age at all:

(bookmark this post for later)

1 - Borrow up to $50K from your 401k (or $100K if married)

You can borrow money from your 401k for any reason, at any time at all

Even though you have to pay a market interest rate, the interest goes right back into your 401k account!

Very powerful esp. with a Solo 401k

You can borrow money from your 401k for any reason, at any time at all

Even though you have to pay a market interest rate, the interest goes right back into your 401k account!

Very powerful esp. with a Solo 401k

2 - Roth IRA Contributions

Did you know you can take out dollars you have contributed to your Roth IRA at any time at all?

There's no penalties or taxes due at all

You cannot withdraw earnings, but no taxes will be due until all contributions are withdrawn first

Did you know you can take out dollars you have contributed to your Roth IRA at any time at all?

There's no penalties or taxes due at all

You cannot withdraw earnings, but no taxes will be due until all contributions are withdrawn first

Mar 9

Read 6 tweets

This is a great example of confession through projection. I am totally flabbergasted.

There are 58 Muslim countries and one tiny Jewish one and it is the size of New Jersey.

1)

There are 58 Muslim countries and one tiny Jewish one and it is the size of New Jersey.

1)

Tucker does not believe that the indigenous Jews of Eretz Yisrael should be able to live in peace in their homeland. He obviously does not believe in G-d, the power of prayer, or the Bible. But Tucker Carlson did claim to be attacked by a demon in his bed...

2)

2)

who left scratch marks on him. Anyone who has read the Torah knows witchcraft is strictly forbidden within Judaism.

See.

1. Book of Exodus 22:18:

“You shall not allow a sorceress to live.”

3)

See.

1. Book of Exodus 22:18:

“You shall not allow a sorceress to live.”

3)

Mar 9

Read 6 tweets

Mar 9

Read 15 tweets

PhillyFashWatch Exposed

Paul Minton of Philadelphia, Pennsylvania, and Scotlyn Schmitt have been uncovered as operating the Antifa doxxing account PhillyFashWatch on X and its associated website.

Paul Minton of Philadelphia, Pennsylvania, and Scotlyn Schmitt have been uncovered as operating the Antifa doxxing account PhillyFashWatch on X and its associated website.

Very interestingly, they've collaborated with other Antifa doxxing pages such as ByWayofPlymouth a Boston based antifa account.

Under promise of anonymity, we received information from a source claiming to be “Antifa”, but complaining about the involvement of both Paul Minton and Scotlyn Schmitt in Antifascist circles.

Mar 9

Read 17 tweets

MY VIEW ON THE IRAN WAR

Most people seem to think nothing important is happening. They are still posting about baseball and influencers, and don't understand why I would drop everything to argue against this war. In this thread I'll share my view for my readers.

Most people seem to think nothing important is happening. They are still posting about baseball and influencers, and don't understand why I would drop everything to argue against this war. In this thread I'll share my view for my readers.

First of all, this war was started by the US and Israel without justification. National interest aside, it is morally wrong to go starting wars without justification. The stain of this unnecessary violence will haunt America for years to come.

The war rhetoric coming out of the Department of Defense is highly disturbing, and in some cases nakedly evil.

Renaming the DoD the Department of War is a red flag in itself. Promoting real violence with video game clips is psychotic. I could go on, but I won't....

Renaming the DoD the Department of War is a red flag in itself. Promoting real violence with video game clips is psychotic. I could go on, but I won't....

Mar 9

Read 25 tweets

After 10 days of war between Iran 🇮🇷 and the USA/Israel 🇺🇸🇮🇱, the economical situation is worsening

Here is a new MAP UPDATE with the military situation, the economical situation, some analysis and some prospects :

🧵THREAD🧵1/25 ⬇️

Here is a new MAP UPDATE with the military situation, the economical situation, some analysis and some prospects :

🧵THREAD🧵1/25 ⬇️

The war has been going on for now more than 10 days and the repercussion are felt worldwide.

Iran held despite constant strikes which obliterated its navy and airforce and still continues to launch important drone and missile strikes across the region.

Iran held despite constant strikes which obliterated its navy and airforce and still continues to launch important drone and missile strikes across the region.

Mar 9

Read 19 tweets

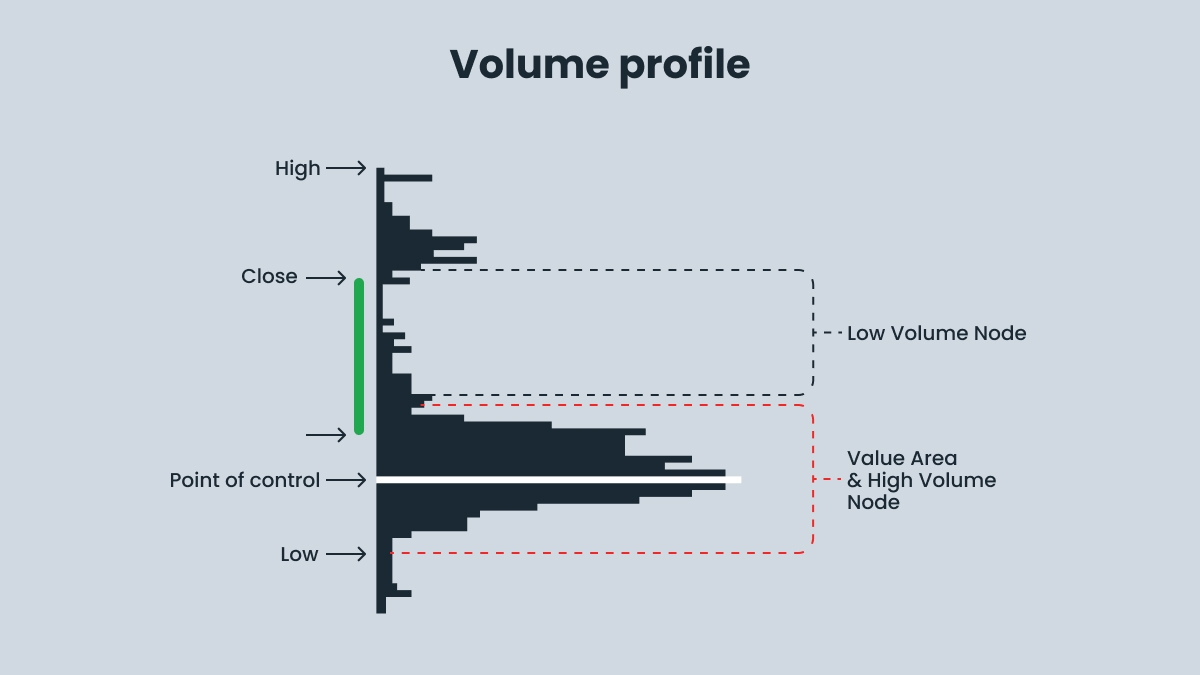

This is the VOLUME PROFILE and it can give you precise SNIPER level entries for your trades.

Most traders don't know about this simple & powerful tool.

But after going through this thread 🧵, you will know how to add it to your trading arsenal.👇

Most traders don't know about this simple & powerful tool.

But after going through this thread 🧵, you will know how to add it to your trading arsenal.👇

Comment "EBOOK" to receive my 36-page strategy e-book with a complete A-Z guide on how to use the Volume Profile.

Make sure you are following, so I can DM you!

Make sure you are following, so I can DM you!

Majority of unprofitable traders are holding THEMSELVES back

They keep looking for the most complicated strategy and avoid what actually works - simplicity.

That’s why this 100% mechanical strategy erases all the discretion!

Here’s how to use this simple and highly profitable strategy:

They keep looking for the most complicated strategy and avoid what actually works - simplicity.

That’s why this 100% mechanical strategy erases all the discretion!

Here’s how to use this simple and highly profitable strategy:

Mar 9

Read 4 tweets

1/ Bitcoin for Corporations is $STRC. In Las Vegas, Prevalon Energy, @Anchorage Digital & @ORANJEBTC announced they hold $STRC on their balance sheets🧵

2/ Ben Hunnewell, CFO of Prevalon Energy shared "STRC will change the world." The rails are already in place in TradFi - adopting $STRC isn't difficult. Prevalon currently holds an 8-figure $STRC position as a treasury asset, parking capital in $STRC until it's ready to deploy.

3/ Manuel Andreani, Head of Prime Sales at @Anchorage Digital described how adopting $STRC allows them to continually improve alongside their clients. He shared that as a corporate treasury company themselves, they don't just build the infrastructure of the digital economy - "We use it ourselves."

Mar 9

Read 16 tweets

🧵Will get lost in geo-political turmoil & its domestic impacts, but the Govt's cohesion plan is imo well pithced & quite bold avoiding usual 'kumbaya' and placing more emphasis on responsibilities/ expectations necessary for a cohesive society than is normal in this type of work