Stock Advisor| Financial Planner |CFA charter holder|| Content Creator

For enquiries email at adityashah291@gmail.com

26 subscribed

26 subscribed

26 subscribed

26 subscribed

How to get URL link on X (Twitter) App

26 subscribed

26 subscribed

Health insurance is a very personal Experience

Health insurance is a very personal Experience

Loan growth:-

Loan growth:-

Loan+Deposit growth:-

Loan+Deposit growth:-

Advances+Deposit growth:-

Advances+Deposit growth:-

What is a Mutual fund fact sheet?

What is a Mutual fund fact sheet?

What Is Asset Allocation?

What Is Asset Allocation?

A mutual fund is a pool of money managed by a professional Fund Manager.

A mutual fund is a pool of money managed by a professional Fund Manager.

How big is India's Infra push?

How big is India's Infra push?

What had happened?

What had happened?

Buying a house:-

Buying a house:-

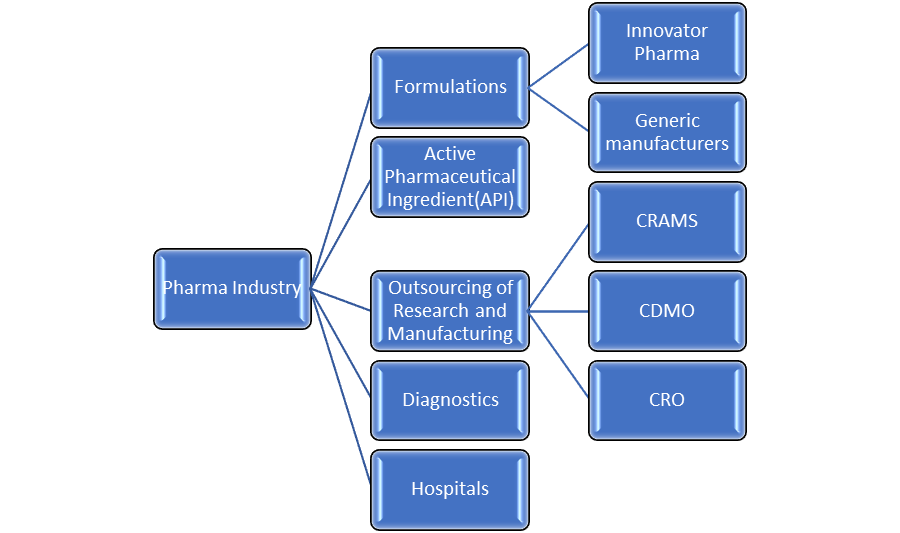

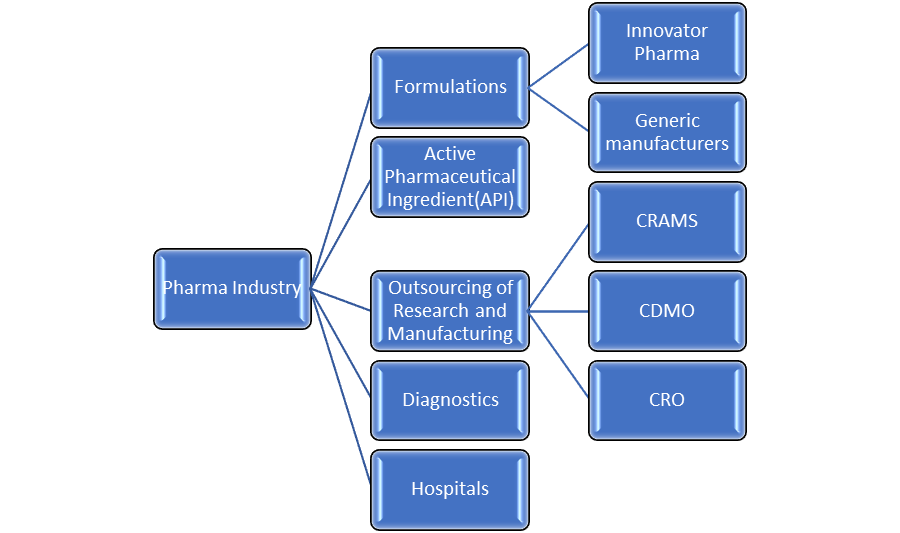

What is CRAMS/CDMO?

What is CRAMS/CDMO?

What is Hindu Undivided Family(HUF)?

What is Hindu Undivided Family(HUF)?

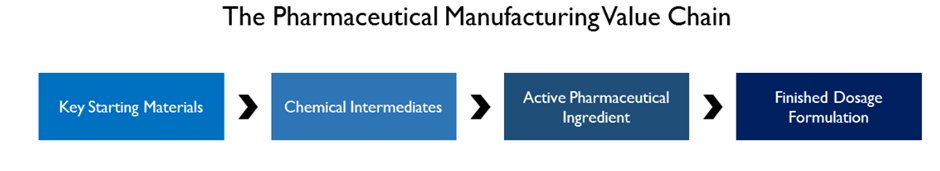

So how does the pharma sector operate?

So how does the pharma sector operate?

What are InvITs?

What are InvITs?

What is a health insurance policy?

What is a health insurance policy?

What does ACE do?

What does ACE do?

Brands under Zudio:-

Brands under Zudio:-

Active or Passive?

Active or Passive?

What are specialty chemicals?

What are specialty chemicals?

First things first:-

First things first:-

What is a payment Bank?

What is a payment Bank?