How to get URL link on X (Twitter) App

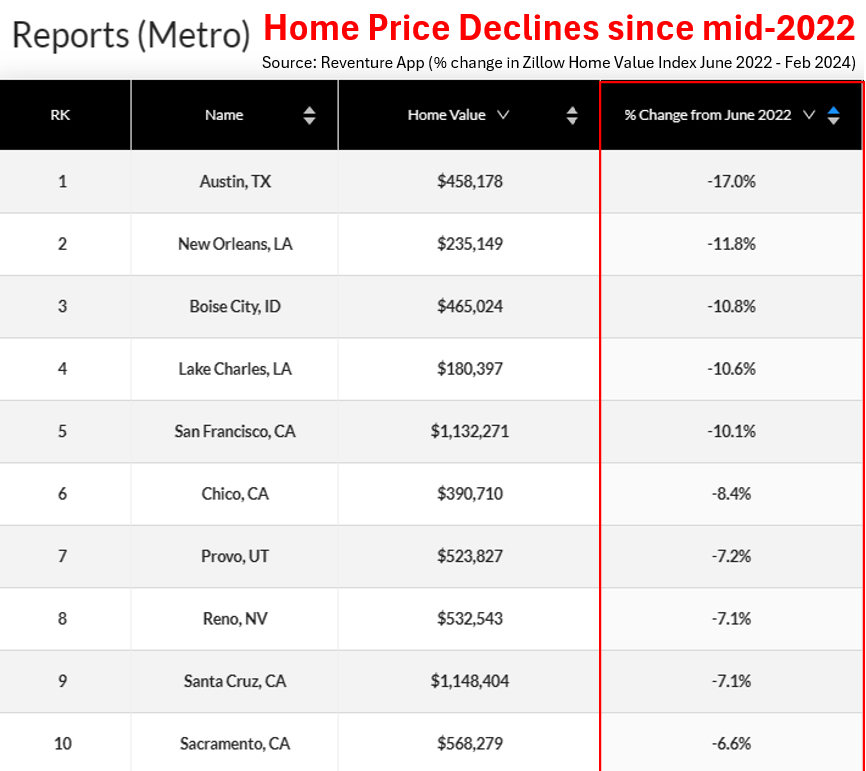

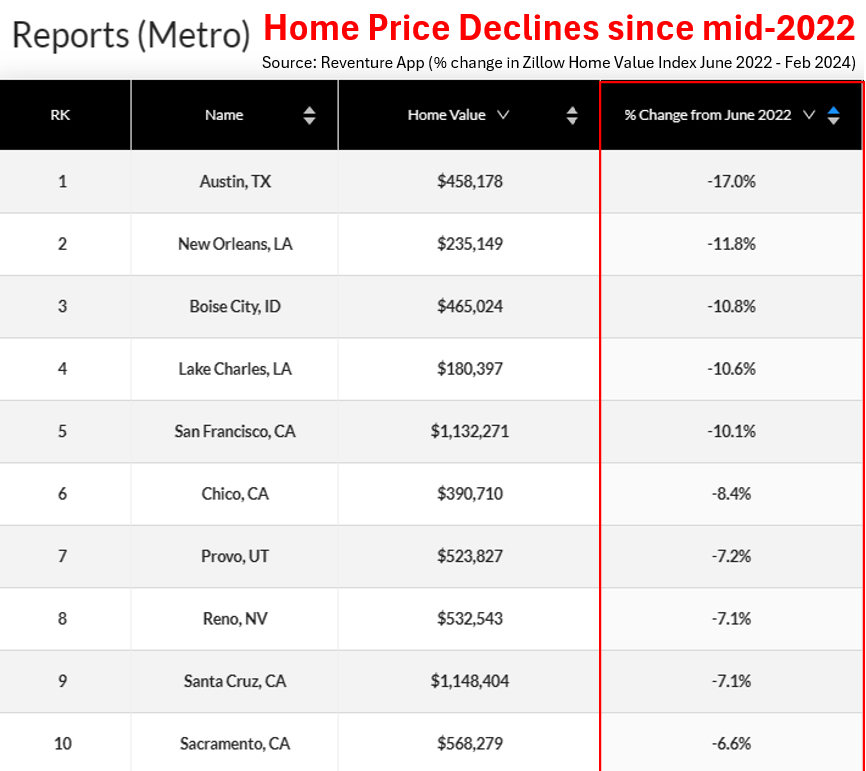

1) Austin's housing market is a cautionary tale about what can happen in "boomtowns".

1) Austin's housing market is a cautionary tale about what can happen in "boomtowns".

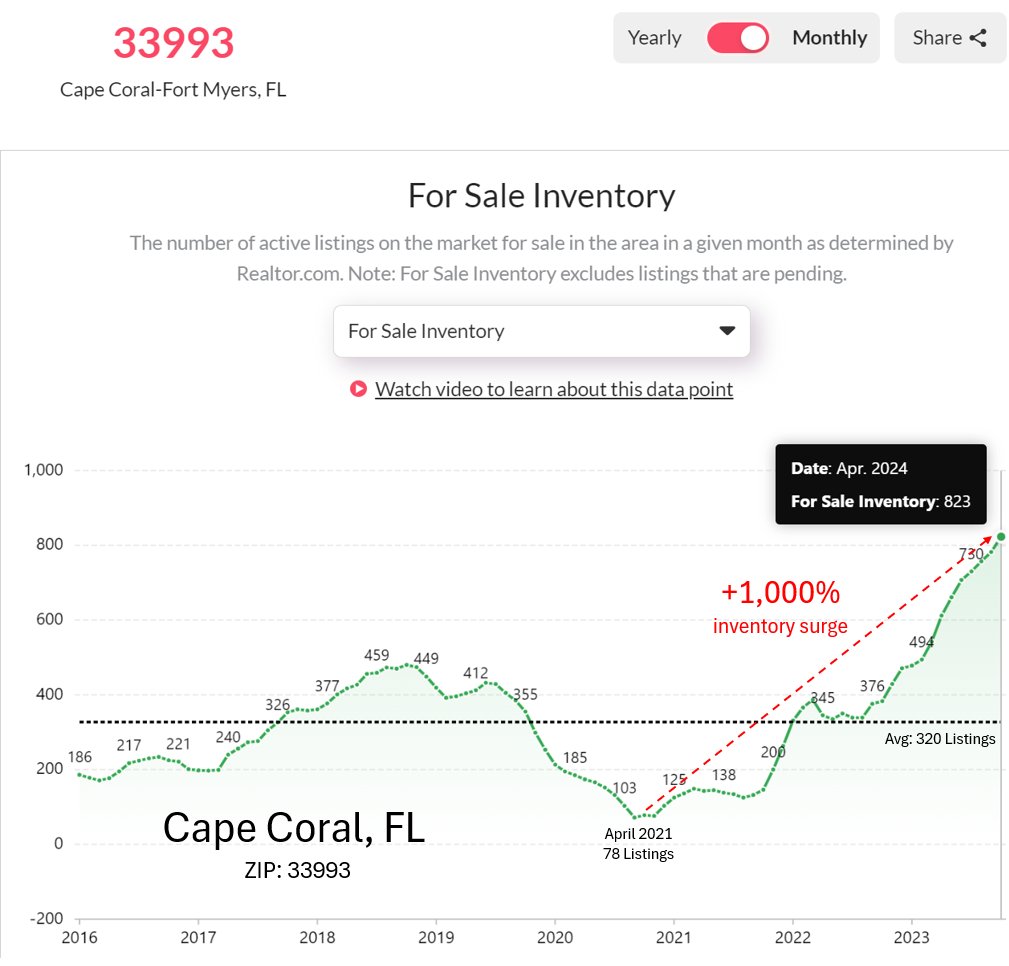

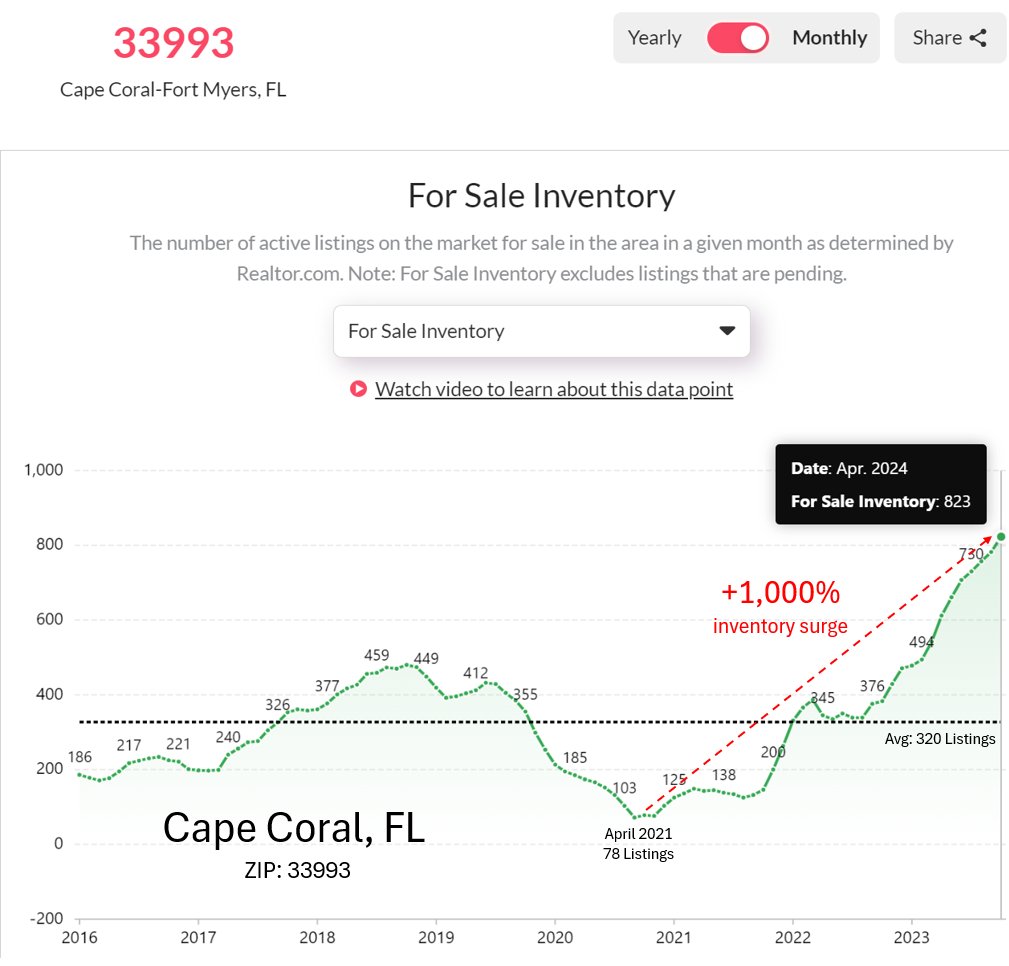

1) Interestingly - home prices haven't declined by much yet in Cape Coral. Only dropping by a couple % points from peak, despite this inventory surge.

1) Interestingly - home prices haven't declined by much yet in Cape Coral. Only dropping by a couple % points from peak, despite this inventory surge.

1) Builder sentiment is declining because of subdued buyer demand conditions to go along with rising inventory levels.

1) Builder sentiment is declining because of subdued buyer demand conditions to go along with rising inventory levels.

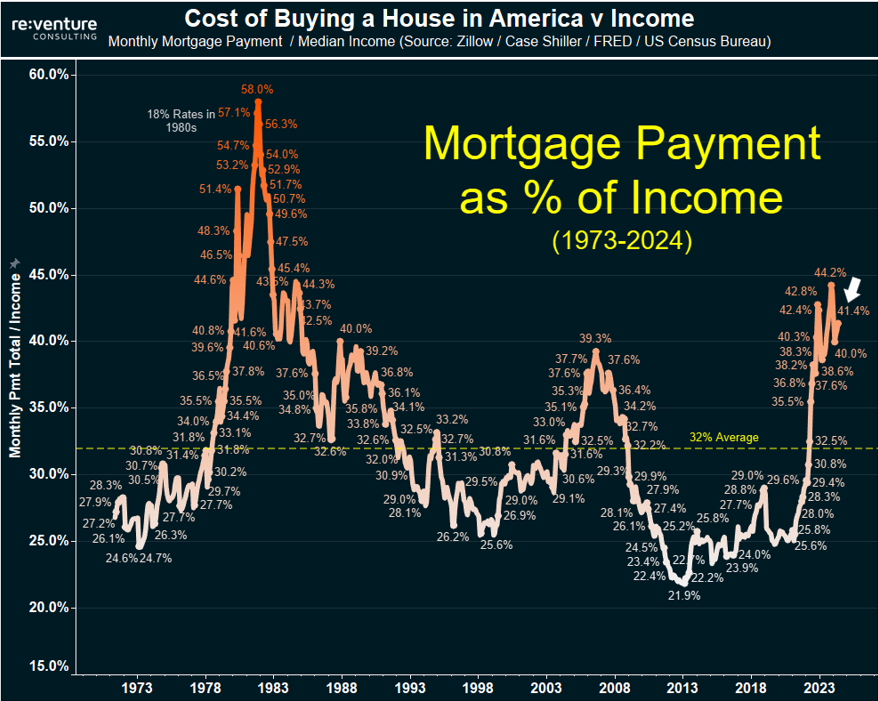

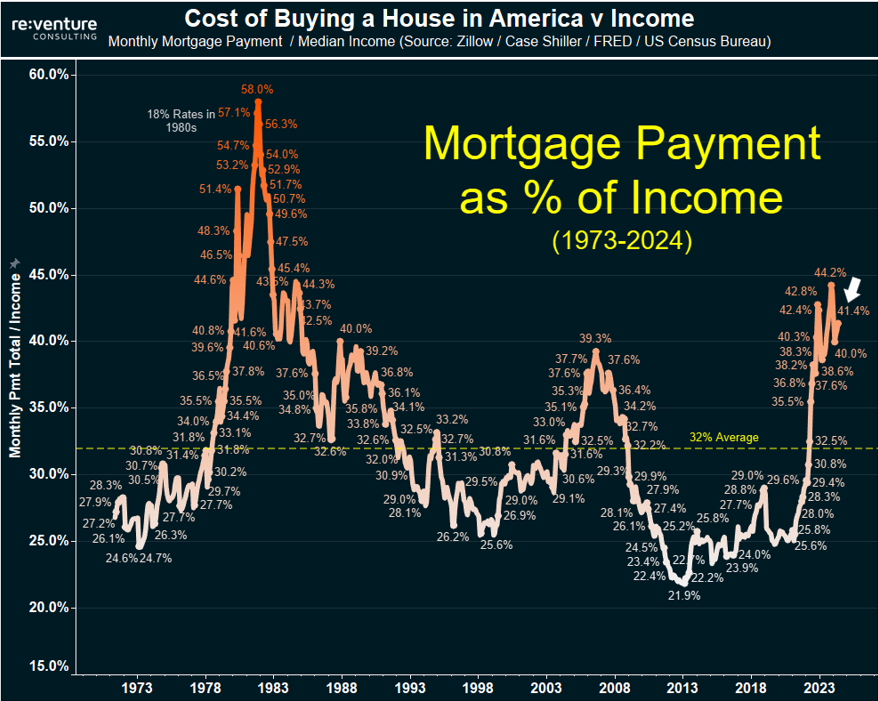

1) Here's the math in the graph above, for those who are curious:

1) Here's the math in the graph above, for those who are curious:

1) What's interesting is that this inventory surge in Nashville is happening amidst a wave of positive press about how many people are moving to the city.

1) What's interesting is that this inventory surge in Nashville is happening amidst a wave of positive press about how many people are moving to the city.

1) What's alarming about this inventory rise in Orlando is how fast it's occurring.

1) What's alarming about this inventory rise in Orlando is how fast it's occurring.

1) Collapsing mortgage demand is a huge problem for the Housing Market.

1) Collapsing mortgage demand is a huge problem for the Housing Market.

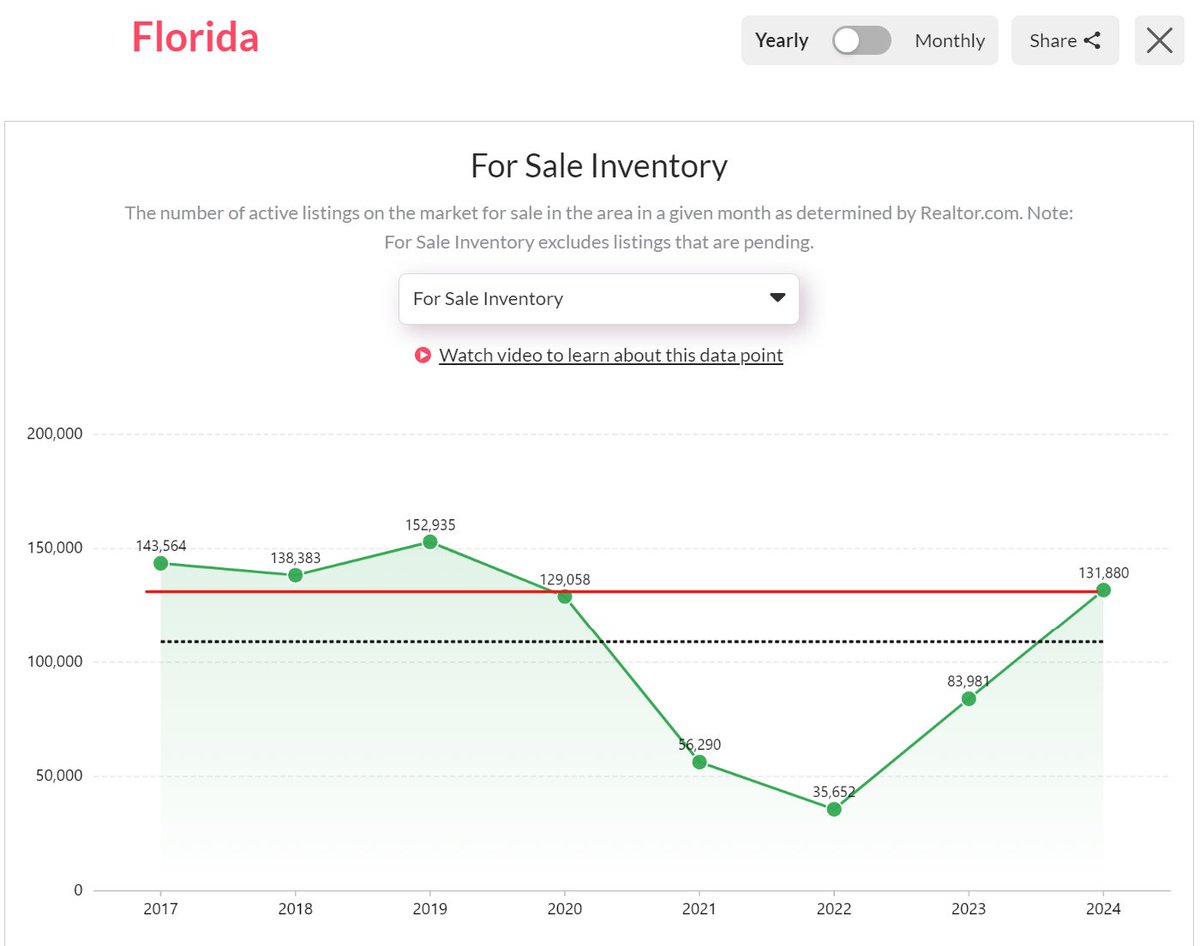

1) In the case of both Florida and Texas, homes for sale are now back at or above pre-pandemic norms.

1) In the case of both Florida and Texas, homes for sale are now back at or above pre-pandemic norms.

1) Shocking data.

1) Shocking data.

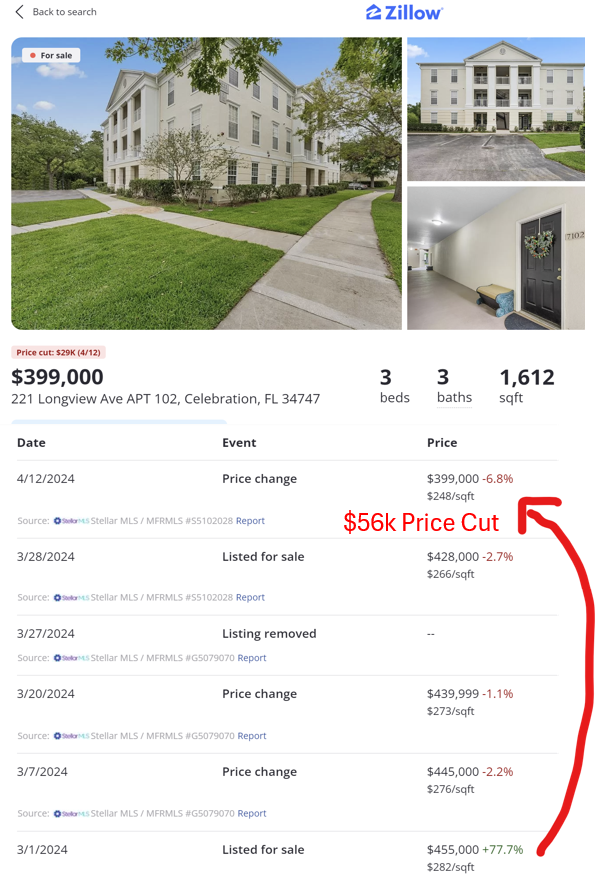

1) This Airbnb selloff next to Disney is leading to more and more big price cuts. Like on the listing below.

1) This Airbnb selloff next to Disney is leading to more and more big price cuts. Like on the listing below.

1) To analyze this data further: you can see that March 2024 purchase application index of 145 is massively below pre-pandemic norms.

1) To analyze this data further: you can see that March 2024 purchase application index of 145 is massively below pre-pandemic norms.

1) Here's a ranked list of the top 10 migration states.

1) Here's a ranked list of the top 10 migration states.

1) Now - many of these price cuts are small in nature. And overall price levels in Florida are still very high compared to pre-pandemic norms.

1) Now - many of these price cuts are small in nature. And overall price levels in Florida are still very high compared to pre-pandemic norms.

1) general trend: prices have dropped in the Mountain West, Northern California, Texas, and Louisana (areas in blue on the map below).

1) general trend: prices have dropped in the Mountain West, Northern California, Texas, and Louisana (areas in blue on the map below).

1) What's crazy is that builders have already cut prices by nearly 20% from peak.

1) What's crazy is that builders have already cut prices by nearly 20% from peak.

1) In the last downturn, new home prices from builders dropped 23% from 2007-2010.

1) In the last downturn, new home prices from builders dropped 23% from 2007-2010.

1) What's crazy about this is that most hardship withdrawals were $5,000 or less.

1) What's crazy about this is that most hardship withdrawals were $5,000 or less.

1) In the case of a market like Tampa, FL, you can see it just logged its highest price cut rate in six years.

1) In the case of a market like Tampa, FL, you can see it just logged its highest price cut rate in six years.

1) This data comes from the Mortgage Bankers Association.

1) This data comes from the Mortgage Bankers Association.

1) Despite this drop in prices, real estate in Austin is still fairly expensive.

1) Despite this drop in prices, real estate in Austin is still fairly expensive.

31 subscribed

31 subscribed