1/ Calling all GHOsts 👻

We have created an ARC for a new decentralized, collateral-backed stablecoin, native to the Aave ecosystem, known as GHO.

Read more below and discuss your thoughts for the snapshot (coming soon)!👇

governance.aave.com/t/introducing-…

We have created an ARC for a new decentralized, collateral-backed stablecoin, native to the Aave ecosystem, known as GHO.

Read more below and discuss your thoughts for the snapshot (coming soon)!👇

governance.aave.com/t/introducing-…

2/ GHO will be:

🌍 Decentralized

💪 Over-collateralized by assets that continue to earn yield

✨ Backed by multiple types of collateral available on the Aave Protocol

⚖️ Governed by the Aave community

With community support, GHO can extend the capabilities of the Aave ecosystem!

🌍 Decentralized

💪 Over-collateralized by assets that continue to earn yield

✨ Backed by multiple types of collateral available on the Aave Protocol

⚖️ Governed by the Aave community

With community support, GHO can extend the capabilities of the Aave ecosystem!

3/ Users will be able to generate GHO after supplying collateral, and then burn GHO when reclaiming collateral 🔐

4/ Based on the proposal, all users with stkAAVE in the Safety Module will be eligible for a discount on GHO 👀

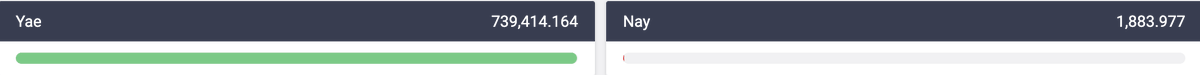

5/ This is yet another exciting leap forward for the Aave Protocol and we can’t wait to hear the community’s thoughts on it!

Ready, Set, GHO 🏃🏃♀️

Ready, Set, GHO 🏃🏃♀️

• • •

Missing some Tweet in this thread? You can try to

force a refresh