Tokenomics can make or break a crypto.

After using hundreds of DeFi projects over the past couple of years, I’ve noticed common patterns among tokens that underperform.

Here are the top 6 tokenomics mistakes to avoid as an investor or founder 🧵

After using hundreds of DeFi projects over the past couple of years, I’ve noticed common patterns among tokens that underperform.

Here are the top 6 tokenomics mistakes to avoid as an investor or founder 🧵

Fundamentally, tokenomics are the buy and sell pressure on a token. When buy pressure outweighs sell pressure, price goes up. And vice versa.

Simple as that.

Set up tokenomics so that buy pressure is greater than sell pressure, while incentivizing desirable behavior.

Simple as that.

Set up tokenomics so that buy pressure is greater than sell pressure, while incentivizing desirable behavior.

Now, for the most common mistakes:

1. No incentive to hold the token.

How often have you seen a great product but no value accrual for its token?

If the token is also inflationary, this results in the price asymptotically going to zero. Sell pressure > buy pressure.

1. No incentive to hold the token.

How often have you seen a great product but no value accrual for its token?

If the token is also inflationary, this results in the price asymptotically going to zero. Sell pressure > buy pressure.

A few ways to create an incentive to hold:

Utility - Give discounts to token holders or require tokens to use a dapp.

Staking - Pay rewards, either from inflation, fees, or bribes, to stakers.

Buybacks - Buy back tokens, creating an expectation of a future price increase.

Utility - Give discounts to token holders or require tokens to use a dapp.

Staking - Pay rewards, either from inflation, fees, or bribes, to stakers.

Buybacks - Buy back tokens, creating an expectation of a future price increase.

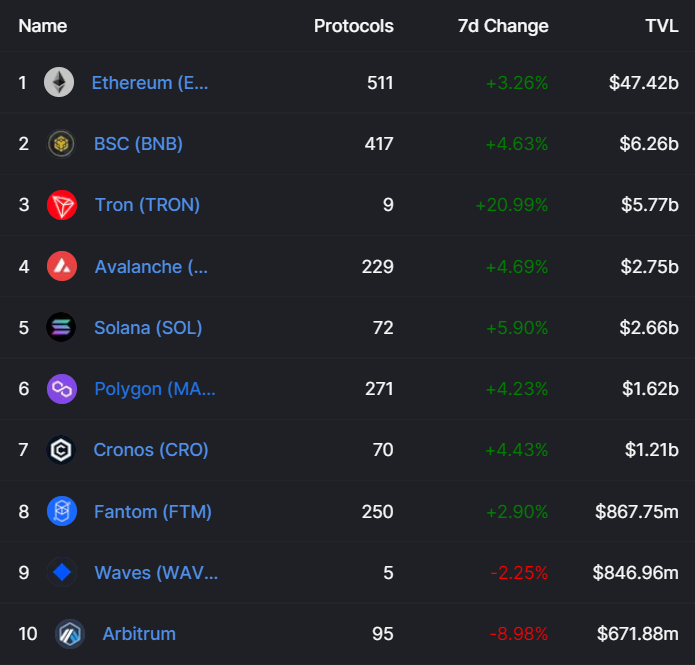

2. Low initial float.

Anyone who has spent a few months in crypto can think of tokens with less than 5% of their supply in circulation and an insane fully diluted value.

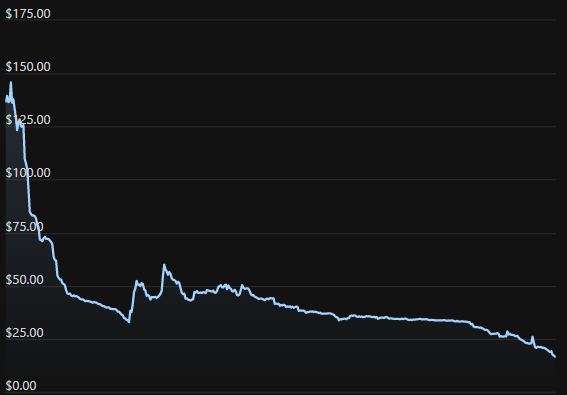

As tokens unlock, sell pressure quickly overwhelms buy pressure and the token chart looks like this.

Anyone who has spent a few months in crypto can think of tokens with less than 5% of their supply in circulation and an insane fully diluted value.

As tokens unlock, sell pressure quickly overwhelms buy pressure and the token chart looks like this.

This tends to result in serious damage to retail trust in that dapp, both for investors and users.

Solana DeFi projects became notorious for this last spring, although some newer ones have started to wise up.

Solana DeFi projects became notorious for this last spring, although some newer ones have started to wise up.

3. Linear unlocks

The twin brother of low initial float, linear unlocks create constant sell pressure.

Periods without unlocks allow a token to find an equilibrium, while revenue and community build. Anecdotally communities survive periodic unlocks better than constant dumping.

The twin brother of low initial float, linear unlocks create constant sell pressure.

Periods without unlocks allow a token to find an equilibrium, while revenue and community build. Anecdotally communities survive periodic unlocks better than constant dumping.

4. Mismatch between buy and sell flows.

Sometimes, you encounter tokens that are doing “everything right”, but price still trends down only. Usually this means that their sources of buy and sell pressure are severely mismatched.

Sometimes, you encounter tokens that are doing “everything right”, but price still trends down only. Usually this means that their sources of buy and sell pressure are severely mismatched.

Last year there was a yield aggregator that used fees to buy back tokens and emitted tokens to incentivize liquidity.

Quick math revealed that they would have needed billions of $ in TVL for buybacks to outweigh token emissions. A few calculations can save you a lot of money.

Quick math revealed that they would have needed billions of $ in TVL for buybacks to outweigh token emissions. A few calculations can save you a lot of money.

5. Pool 1 APR is higher than Pool 2 APR.

For those unaware, a pool 1 is a pool that doesn’t include a protocol’s native token and a pool 2 is a pool that does. For example, BNB-BUSD is a pool 1 on PancakeSwap and BNB-CAKE is a pool 2.

For those unaware, a pool 1 is a pool that doesn’t include a protocol’s native token and a pool 2 is a pool that does. For example, BNB-BUSD is a pool 1 on PancakeSwap and BNB-CAKE is a pool 2.

Since the pool 2 includes a highly inflationary token, it’s riskier than the pool 1. To incentivize liquidity providers to take on that risk, you must pay a higher APR.

Otherwise, anyone who receives your token incentives, immediately sells and puts the money into the pool 1.

Otherwise, anyone who receives your token incentives, immediately sells and puts the money into the pool 1.

This also applies to stablecoins. The APR on your reward token must be higher than the APR on your stablecoin.

Otherwise, liquidity providers have every incentive to extract maximum value from your token, dumping it immediately and keeping their money safely in stables.

Otherwise, liquidity providers have every incentive to extract maximum value from your token, dumping it immediately and keeping their money safely in stables.

6. Airdropping instead of incentivizing.

A protocol’s token is one of the most valuable pieces of leverage it has. Distributing that token for free (without warning) gives up this leverage.

A protocol’s token is one of the most valuable pieces of leverage it has. Distributing that token for free (without warning) gives up this leverage.

Imagine this scenario:

Protocol A has a popular product.

They do a one time airdrop to users. Receiving a sudden windfall, most of these users promptly dump the token. Even worse, some of them were using the dapp solely to get an airdrop. They now leave.

Protocol A has a popular product.

They do a one time airdrop to users. Receiving a sudden windfall, most of these users promptly dump the token. Even worse, some of them were using the dapp solely to get an airdrop. They now leave.

Now imagine this instead:

Protocol B also has a popular product.

Instead of a one-time airdrop, they announce they’ll do weekly airdrops to reimburse users for their fees. Moreover, users that restake these tokens for governance receive access to bonus product features.

Protocol B also has a popular product.

Instead of a one-time airdrop, they announce they’ll do weekly airdrops to reimburse users for their fees. Moreover, users that restake these tokens for governance receive access to bonus product features.

Airdrops can still work when paired with high utility or staking rewards.

But if it’s the primary method of token distribution, it forgoes a powerful tool that could otherwise be used to bootstrap needed user activity.

But if it’s the primary method of token distribution, it forgoes a powerful tool that could otherwise be used to bootstrap needed user activity.

Those are the 6 most common tokenomics mistakes I've seen that cause sell pressure to outweigh buy pressure.

And if your favorite project found a creative way to overcome one of these, I'd pass along the age-old saying, "If it doesn't apply to you, don't apply it to you."

And if your favorite project found a creative way to overcome one of these, I'd pass along the age-old saying, "If it doesn't apply to you, don't apply it to you."

If you found this thread helpful, you can:

1. Help other people see it by liking and retweeting

2. See more threads like this by following me @Dynamo_Patrick

If you’re a dev and are interested in discussing this in more detail, I offer tokenomics advising. DMs are open.

1. Help other people see it by liking and retweeting

2. See more threads like this by following me @Dynamo_Patrick

If you’re a dev and are interested in discussing this in more detail, I offer tokenomics advising. DMs are open.

https://twitter.com/1377775070156840960/status/1548372342694301699

• • •

Missing some Tweet in this thread? You can try to

force a refresh