Has Curve V2 lost the great DEX battle to Uniswap V3? Many claim that Curve is a dead man walking, but what does the data say?

The answer will surprise you 🧵

The answer will surprise you 🧵

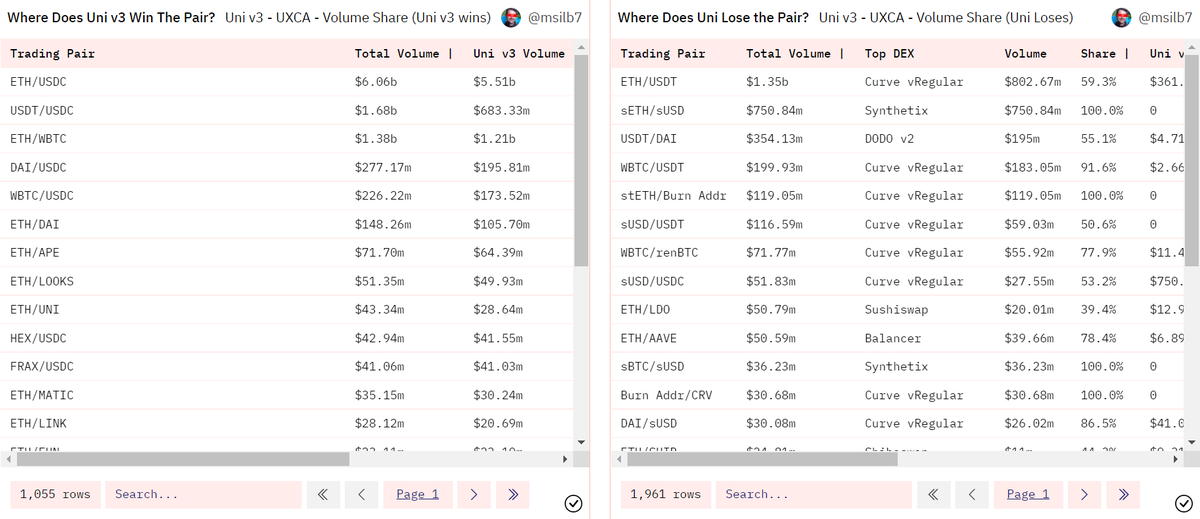

TL;DR: Curve and Uniswap are both winning, but in different markets. Uniswap is at a 50/50 standoff with Curve in the stables market, dominates the volatile pairs, and completely loses the synthetic market.

Now the market breakdown ↓

Now the market breakdown ↓

>> Stablecoins

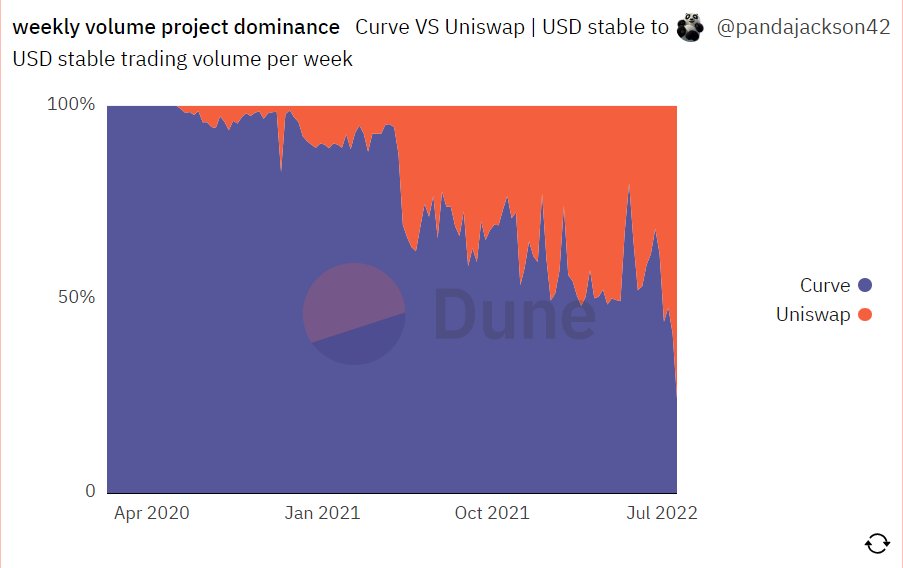

1/x Uniswap quadrupled its market share after the upgrade, but only after doing 1bps fee for stable swaps did it stabilize the gains. Curve grew back to 80% during the UST depeg, before Uniswap reclaimed its throne. The process was tumultuous to say the least.

1/x Uniswap quadrupled its market share after the upgrade, but only after doing 1bps fee for stable swaps did it stabilize the gains. Curve grew back to 80% during the UST depeg, before Uniswap reclaimed its throne. The process was tumultuous to say the least.

2/x Total Value Locked

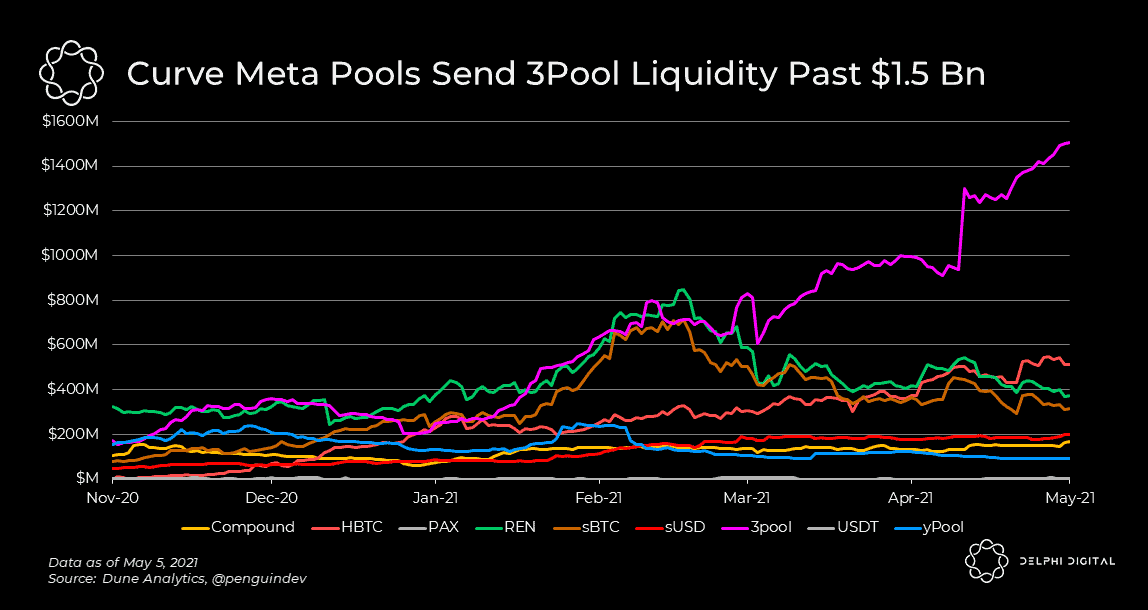

Curve pools tend to have greater TVL than Uniswap counterparts due to a) Curve's highly incentivized governance structure coordinating LP incentives (e.g. $CRV rewards) and b) the metapool's accumulation effect that grows liquidity in the 3pool.

Curve pools tend to have greater TVL than Uniswap counterparts due to a) Curve's highly incentivized governance structure coordinating LP incentives (e.g. $CRV rewards) and b) the metapool's accumulation effect that grows liquidity in the 3pool.

3/x Efficiency & Slippage

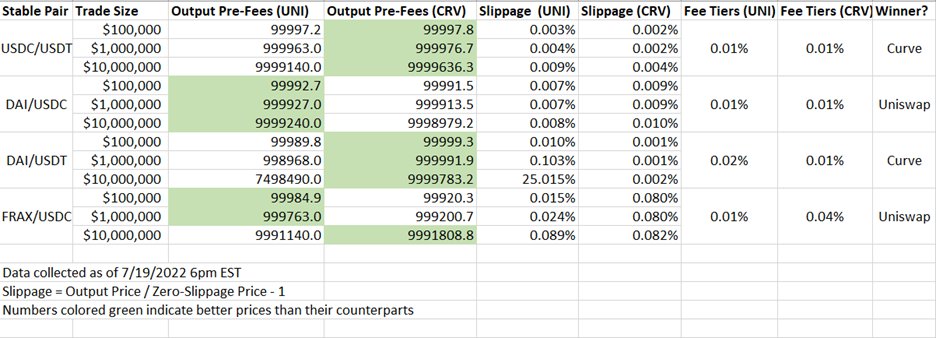

For the four most traded stable pairs, Curve tend to have better pool utilizations (24h VOL/TVL) for all except the USDC/USDT pair. In terms of slippages, Crv and Uni scored similar with Curve slightly outerpforming for larger trade sizes like $10M.

For the four most traded stable pairs, Curve tend to have better pool utilizations (24h VOL/TVL) for all except the USDC/USDT pair. In terms of slippages, Crv and Uni scored similar with Curve slightly outerpforming for larger trade sizes like $10M.

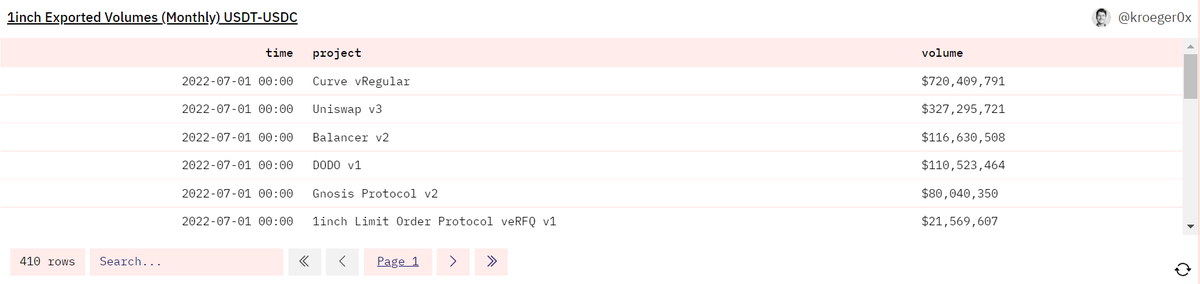

4/x Stables conclude: Curve held strong despite loss in market share. While Uniswap has lower fee tiers on average, Curve has higher TVL and comparable efficiency - reinforced by the fact that 1inch routes to Crv two times more than Uni on Uni's most traded pair USDC-USDT.

>> Volatile Pairs

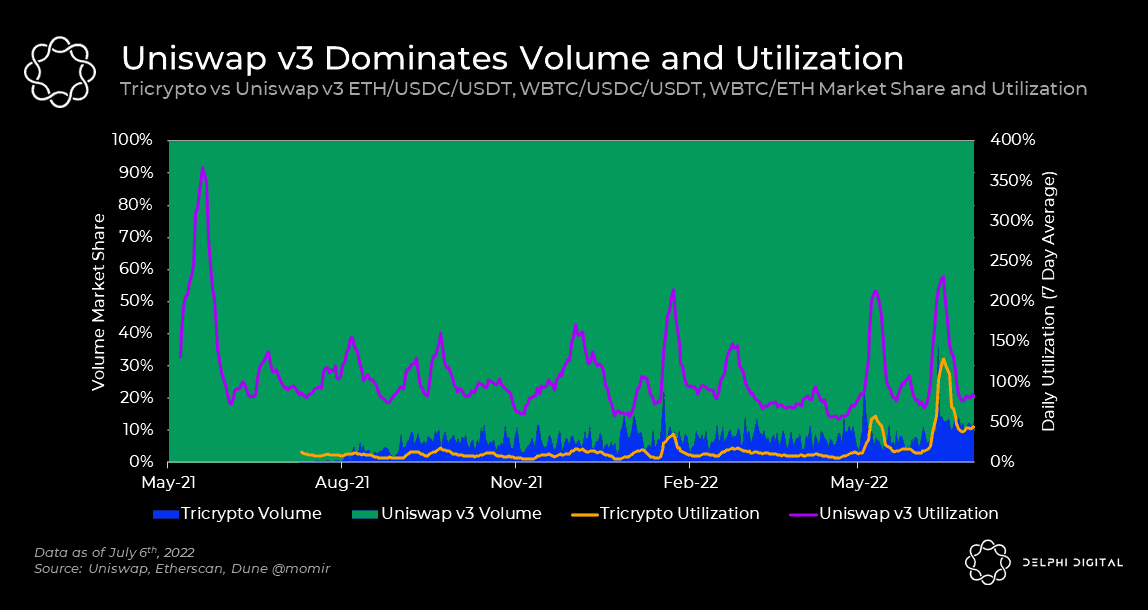

5/x However, stables are only 14% of UniV3’s volume in the psat year. For major volatile pairs like ETH/BTC/USD, Uniswap is an unequivocal hegemon, crashing the hard-fought gains of Curve's tricrypto pool in every aspect.

5/x However, stables are only 14% of UniV3’s volume in the psat year. For major volatile pairs like ETH/BTC/USD, Uniswap is an unequivocal hegemon, crashing the hard-fought gains of Curve's tricrypto pool in every aspect.

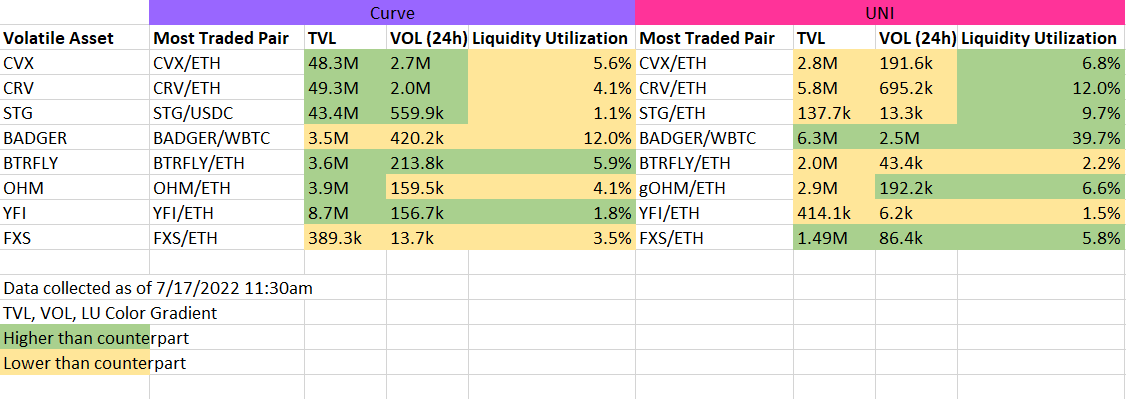

6/x So did Curve lose on the volatile pairs market? For long-tail assets like STG, BTRFLY, and YFI, Curve actually has better volume, but still lower efficency.

That is, although Curve accrues higher trading fees in total, for every dollar invested Curve renders a lower return.

That is, although Curve accrues higher trading fees in total, for every dollar invested Curve renders a lower return.

>> Synthetic pairs

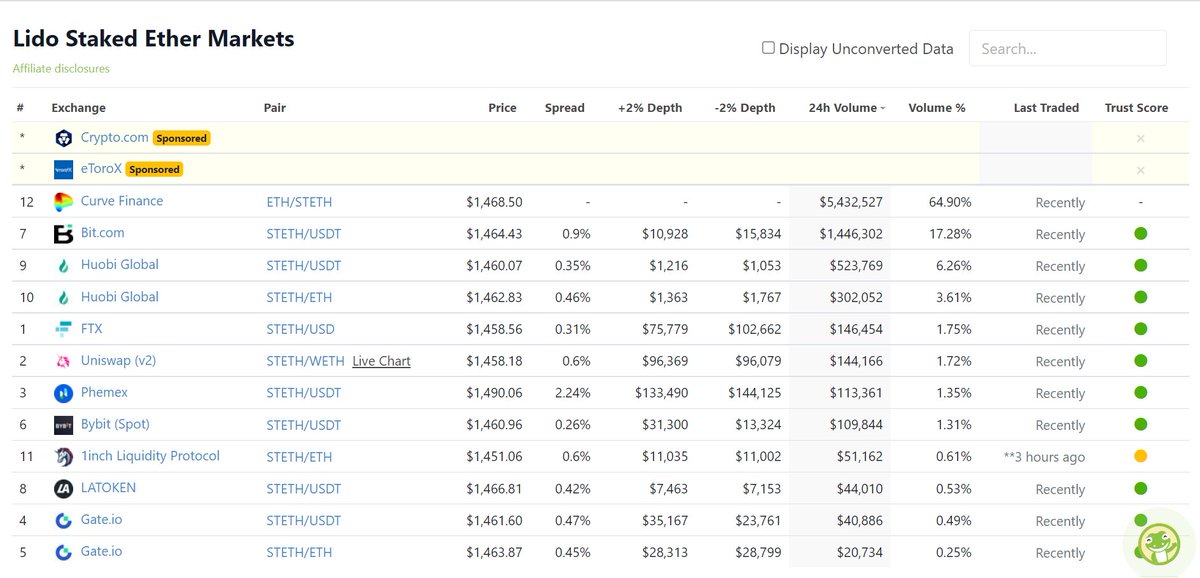

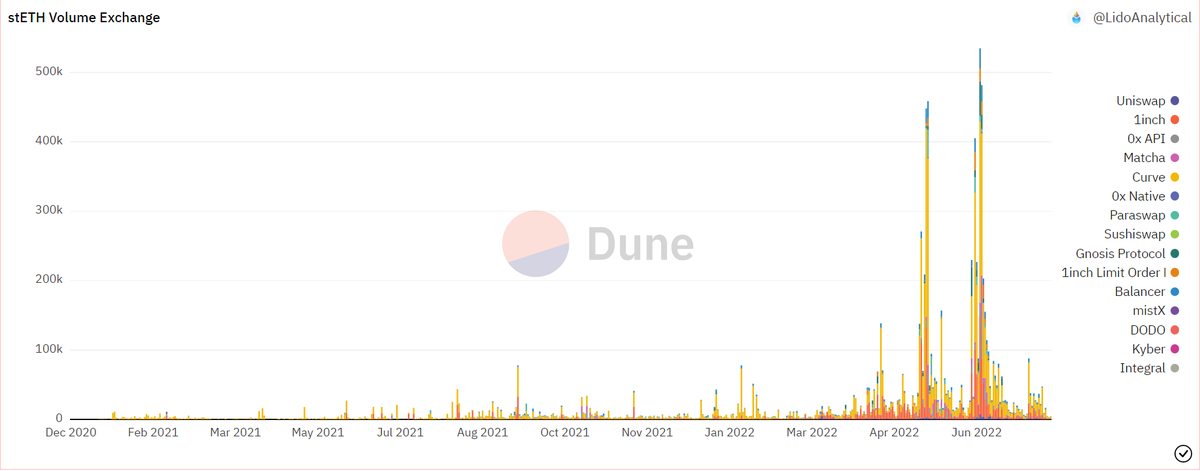

7/x Curve emerged as a clear winner of “ETH/BTC stables” including stETH, sETH, and renBTC. Curve took up 65% of the daily volume for stETH (vs 2% in Uniswap) and 84% for renBTC (vs 14% in Uniswap).

How did Curve win, and was this win big against Uniswap?

7/x Curve emerged as a clear winner of “ETH/BTC stables” including stETH, sETH, and renBTC. Curve took up 65% of the daily volume for stETH (vs 2% in Uniswap) and 84% for renBTC (vs 14% in Uniswap).

How did Curve win, and was this win big against Uniswap?

8/x Curve was winning the race from the beginning. Due to deep liquidity/LP incentives, Curve enjoyed Lido's support as the semi-official stETH pool. Similarly, Curve’s gains in sETH and renBTC derived from long-formed partnerships with synthetics issuers like Synthetix and Ren.

9/x How big was this win?

Synths' current daily volume on Curve (~20M) would rank 8th among Uni pools and represent 1.6% of Uni's volume (vs ~7.9% for Curve’s). The future growth of synths may benefit Curve, but the whole sector is miniscule compared to volatiles and stables.

Synths' current daily volume on Curve (~20M) would rank 8th among Uni pools and represent 1.6% of Uni's volume (vs ~7.9% for Curve’s). The future growth of synths may benefit Curve, but the whole sector is miniscule compared to volatiles and stables.

10/x The Future

Summary: For TVL and slippage, Crv performs similar/better to Uni for most long-tail* and pegged assets. For VOL, Curve loses mostly on ETH/BTC and stables while winning synths.

*For super long-tails like $CULT, Uni is better due to the ease of setting up a pool.

Summary: For TVL and slippage, Crv performs similar/better to Uni for most long-tail* and pegged assets. For VOL, Curve loses mostly on ETH/BTC and stables while winning synths.

*For super long-tails like $CULT, Uni is better due to the ease of setting up a pool.

11/x Why the disparity btw Crv's good execution and low volume?

a) Worse market positioning: Uni started with volatiles (~10x stables vol) and then grew specialized arms with V3 focusing on most traded pairs and V2 on tail-ends. However, Crv was largely confined to pegged pairs.

a) Worse market positioning: Uni started with volatiles (~10x stables vol) and then grew specialized arms with V3 focusing on most traded pairs and V2 on tail-ends. However, Crv was largely confined to pegged pairs.

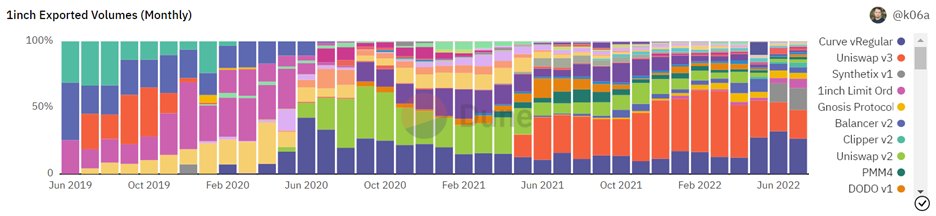

b) Curve has not won the heart of retail: Despite Curve only having ~24% of Uniswap’s volume, a higher percentage of 1inch dex aggregator’s volume routes through Curve, which is indicative of both Curve’s efficiency and its disproportionately fewer users.

12/x What may be the next inflection point for Crv?

a) Expand the user base beyond DeFi aficionados, by improving UI/UX, brand power, etc.

b) Capture the growing synths market: As the biggest market for stETH, Curve may benefit from the enhanced stETH liquidity after the Merge.

a) Expand the user base beyond DeFi aficionados, by improving UI/UX, brand power, etc.

b) Capture the growing synths market: As the biggest market for stETH, Curve may benefit from the enhanced stETH liquidity after the Merge.

c) Expand to other verticals (similar to how Uniswap acquired Genie): the rumor of Curve’s plan to issue stablecoins could signal its initial attempt to expand beyond AMM.

13/x However, all these could also mean greater centralization in CRV governance that may go against Curve's ethos as a decentralized and community-driven AMM. Then this will be the tradeoff that the community has to make for Curve to capture the next summer.

14/x Future research: this thread does not compare the avg LP profitability. The tuition is that neither protocol generates much LP alpha on top of market beta, given UniV3’s prev IL report arxiv.org/ftp/arxiv/pape… and that 32% Curve’s pools has <1% LP APY. curve.fi/combinedstats

15/x Thanks for topical guidance from @tomhschmidt, and the very helpful editorial opinions from @haseeb, @celiawan2, and @nicopei_eth.

I quoted extensively from dune wizards @PandaJackson42, @alex_kroeger, @MSilb7, @k06a. Thanks for the awesome data insights!

Curious to hear the thoughts from crv/uni gigabrains @BarryFried1 @CurveCap @bneiluj @danielesesta @0xHamz @mhonkasalo @danrobinson

• • •

Missing some Tweet in this thread? You can try to

force a refresh