1/ The @fraxfinance team keeps shipping, its hard to keep track w/ each new product release

W/ inflation at record levels, we've been researching the sustainability of $FPI, $FRAXs inflation resistant stablecoin

Disclaimer: final docs have not been released

🧵 👇

W/ inflation at record levels, we've been researching the sustainability of $FPI, $FRAXs inflation resistant stablecoin

Disclaimer: final docs have not been released

🧵 👇

@fraxfinance 2/ First, some background. The Frax Price Index is a novel protocol in the $FRAX ecosystem centered around 2 tokens:

$FPI - the stablecoin pegged to the CPI rate

$FPIS - the governance token of the ecosystem

$FPI - the stablecoin pegged to the CPI rate

$FPIS - the governance token of the ecosystem

@fraxfinance 3/ The $FPI pricing system adjusts monthly according to an on-chain CPI oracle so that the value of $FPI will ↑ in accordance w/ the reported CPI ↑

The ↑ in $FPI's value will be supported by the yield earned on the underlying $FPI treasury assets

The ↑ in $FPI's value will be supported by the yield earned on the underlying $FPI treasury assets

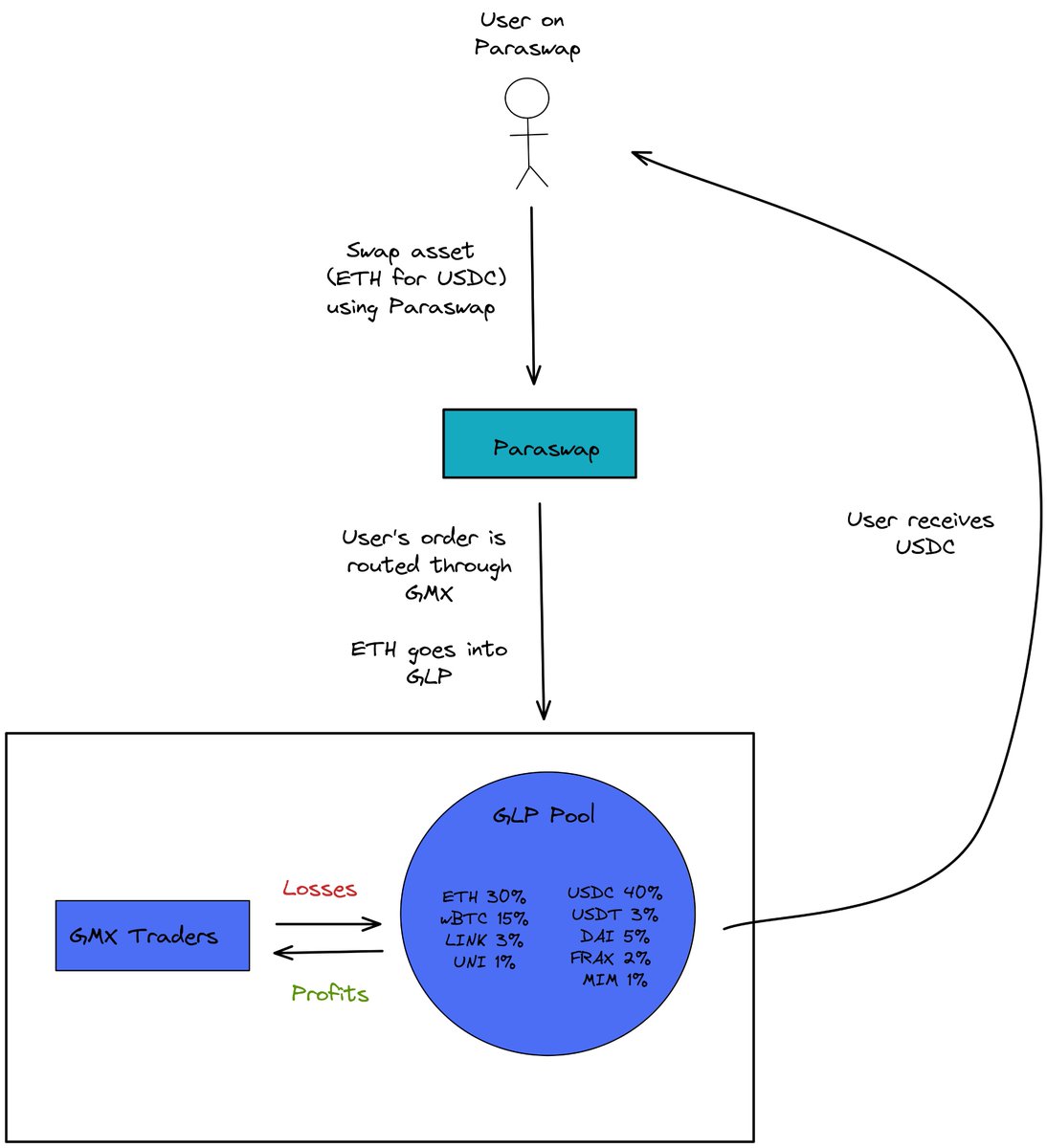

@fraxfinance 4/ $FPI treasury is 100% backed by $FRAX today

Eventually, the treasury will diversify into other crypto-native assets (ETH, wBTC, etc.) and other decentralized stablecoins

Eventually, the treasury will diversify into other crypto-native assets (ETH, wBTC, etc.) and other decentralized stablecoins

@fraxfinance 5/ Excess yield from $FPI treasury will be directed to $veFPIS stakers

If $FPI treasury yields < CPI, new $FPIS will be minted & sold w/ proceeds accruing to treasury value

If $FPI treasury yields < CPI, new $FPIS will be minted & sold w/ proceeds accruing to treasury value

@fraxfinance 6/ To analyze the sustainability of $FPI, let's imagine a future where $FPI is gaining traction with inflation running hot:

$FPI market cap is $5bn

Yearly CPI is 8%

Stablecoin / FRAX yields are 5%

$FPI market cap is $5bn

Yearly CPI is 8%

Stablecoin / FRAX yields are 5%

@fraxfinance 7/ With $FPI earning 5% on treasury assets and CPI at 8%, $150m worth of $FPIS would need to be minted/sold in the open mkt over the course of the year to subsidize the increase in $FPI price (8%-5%)*$5bn

$FPI treasury yields need to outperform CPI or $FPIS dilution occurs

$FPI treasury yields need to outperform CPI or $FPIS dilution occurs

@fraxfinance 8/ The treasury management strategy is critical to $FPI / $FPIS success, particularly how it performs relative to inflation.

@fraxfinance 9/ The goal is for $FPI to eventually be a crypto-native unit of account that is pegged to a basket of goods & services.

$FPIS stakers will eventually govern the CPI index weights such that they can set $FPI = CPI +/(-) x% (as determined by governance)

$FPIS stakers will eventually govern the CPI index weights such that they can set $FPI = CPI +/(-) x% (as determined by governance)

@fraxfinance 10/ However perhaps $FPI shouldn't be tied to government-reported CPI, since it can understate "true inflation"

The govt is incentivized to manipulate calcs and underreport as some of the largest govt liabilities (social security, medicare, etc) are tied to CPI

The govt is incentivized to manipulate calcs and underreport as some of the largest govt liabilities (social security, medicare, etc) are tied to CPI

@fraxfinance 11/ There are alternatives to CPI that $FPIS governance could advocate using for $FPI

Truflation (indep econ data tracked real-time on-chain via $LINK)

Shadowstats (reports "alt" CPI figs that allegedly better track inflation)

Core CPI w/ Case Shiller (CPI incl true 🏘️ costs)

Truflation (indep econ data tracked real-time on-chain via $LINK)

Shadowstats (reports "alt" CPI figs that allegedly better track inflation)

Core CPI w/ Case Shiller (CPI incl true 🏘️ costs)

@fraxfinance 12/ $FPI represents one of the more fascinating experiments in DeFi. There may be challenges to fund $FPI growth, but if the treasury management team can long-term outperform inflation, the TAM is huge

@fraxfinance 13/ How huge? If $FPI proves to be secure and sustainable, and institutions eventually warm up to DeFi, $FPI will likely steal flows from treasury inflation-protected securities (TIPS) - a multi-trillion $ market

@fraxfinance 14/ Institutions view TIPS as a decent long-term inflation hedge, but not short-term. Just look at TIPS performance YTD. Inflation soaring and TIPS down -10%.

Never has there been a financial instrument that can perfectly track inflation over the short and long term.

Never has there been a financial instrument that can perfectly track inflation over the short and long term.

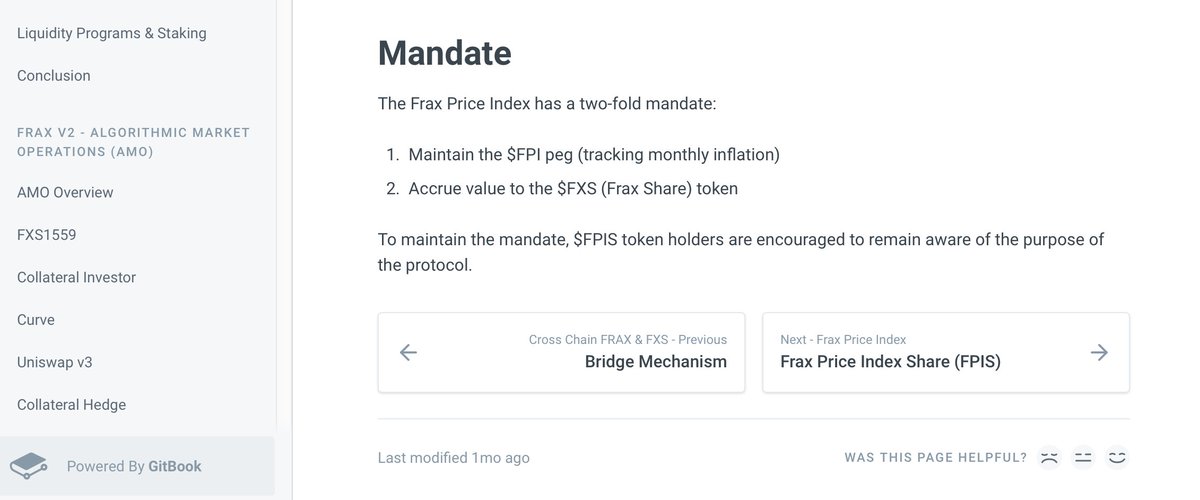

@fraxfinance 15/ So $FXS or $FPIS? Despite limited docs on $FPI, $FRAX docs mention $FPI has a very specific 2-part mandate:

1) Maintain $FPI peg

2) Accrue value to $FXS

....notice there's no mention of value accrual to $FPIS

1) Maintain $FPI peg

2) Accrue value to $FXS

....notice there's no mention of value accrual to $FPIS

@fraxfinance 16/ In other words, $FPIS appreciation is a likely by-product of $FPI adoption, however it's not an explicit mandate. Something to consider when weighing $FXS vs $FPIS

$FPIS seems like a call option on the success of $FPI - either goes to zero, or has massive asymmetric upside

$FPIS seems like a call option on the success of $FPI - either goes to zero, or has massive asymmetric upside

@fraxfinance 17/ Thanks @0x_d24 for helping us dig into $FPI

@fraxfinance @0x_d24 18/ Tagging chads in fxs community for visibility:

@fraxfinance

@samkazemian

@0x_d24

@Riley_gmi

@BarryFried1

@Kngmkrpod

@rektdiomedes

@flywheelpod

@fraxbull1

@DeFiDave22

@SalomonCrypto

@fraxfinance

@samkazemian

@0x_d24

@Riley_gmi

@BarryFried1

@Kngmkrpod

@rektdiomedes

@flywheelpod

@fraxbull1

@DeFiDave22

@SalomonCrypto

• • •

Missing some Tweet in this thread? You can try to

force a refresh