One of the largest pieces of crypto legislation will be introduced this Tuesday (6/7).

It includes definitions of which coins are commodities, coins considered securities, stablecoins, CBDC framework, and NFT direction.

Let's dive into why you should be paying attention. 🧵

It includes definitions of which coins are commodities, coins considered securities, stablecoins, CBDC framework, and NFT direction.

Let's dive into why you should be paying attention. 🧵

Senator Cynthia Lummis (R) from Wyoming is introducing legislation on Tuesday to integrate cryptos into the financial system.

Sounds bullish, right?

Sounds bullish, right?

https://twitter.com/SenLummis/status/1532746920866762754?s=20&t=LQTdor3on8tSsh3nfAHibg

Recently @Heritage Foundation hosted a panel with everyone who worked on or influenced the legislation.

The biggest issue with regulation currently is US leaders don't understand crypto. This video with 6k views was the best time investment of my week.

The biggest issue with regulation currently is US leaders don't understand crypto. This video with 6k views was the best time investment of my week.

https://twitter.com/BitTowne/status/1531980364889178114?s=20&t=oQZMlO9sVVRqIOycJYqd9w

@Heritage It hits home nearly all of the largest outstanding questions across our industry.

The issue is, every person on this panel HEAVILY favors $BTC. It's legislation being written and introduced by a group of $BTC maxis. Horrendous for other L1's...

The issue is, every person on this panel HEAVILY favors $BTC. It's legislation being written and introduced by a group of $BTC maxis. Horrendous for other L1's...

https://twitter.com/BitTowne/status/1531980356966141956?s=20&t=oQZMlO9sVVRqIOycJYqd9w

@Heritage So let's dive into the panel...

Well, they choose everyone's favorite degen as the earliest set of eyes to help with direction. Michael "There is no second best" Saylor!

Need I say more?

Well, they choose everyone's favorite degen as the earliest set of eyes to help with direction. Michael "There is no second best" Saylor!

Need I say more?

https://twitter.com/BitTowne/status/1531980362368311296?s=20&t=oQZMlO9sVVRqIOycJYqd9w

@Heritage We also have @tedcruz (R) of Texas.

A quick history lesson, when China banned $BTC mining Texas welcomed the miners with open arms. Electricity is cheap due to operating on a separate power grid from the rest of the nation.

Miners flocked into the area over the past two years

A quick history lesson, when China banned $BTC mining Texas welcomed the miners with open arms. Electricity is cheap due to operating on a separate power grid from the rest of the nation.

Miners flocked into the area over the past two years

@Heritage @tedcruz Cruz now has massive crypto donors that operate a Proof of Work network in his state. Keeping BTC strong and alts weak directly benefits Texas... and some of his largest new donors.

He states he owns $BTC and everything else is outside his risk profile.

He states he owns $BTC and everything else is outside his risk profile.

https://twitter.com/cubeyxnft/status/1530727351281078272?s=20&t=oQZMlO9sVVRqIOycJYqd9w

@Heritage @tedcruz Moving on to @CaitlinLong_ is a blockchain consultant from Wyoming.

Caitlin is a 22-year wall street vet and now the CEO of Custodia Bank. She is hoping to work with the fed to create a Custodia over collateralized stable coin. Slowing DeFi momentum is in her best interest.

Caitlin is a 22-year wall street vet and now the CEO of Custodia Bank. She is hoping to work with the fed to create a Custodia over collateralized stable coin. Slowing DeFi momentum is in her best interest.

@Heritage @tedcruz @CaitlinLong_ Then we have Senator Lummis who has her own incentives to pump $BTC instead of any other L1's or altcoins.

At one point in the video discussing altcoins she states “Burn it all down. Bitcoin will be the Phoenix that rises”.

At one point in the video discussing altcoins she states “Burn it all down. Bitcoin will be the Phoenix that rises”.

https://twitter.com/congresstrading/status/1446171056310530049?s=20&t=RbRpeb2Elmt6rYDJlo2qJw

@Heritage @tedcruz @CaitlinLong_ The moral of the story here is anyone outside of $BTC holders is in big trouble in the coming weeks.

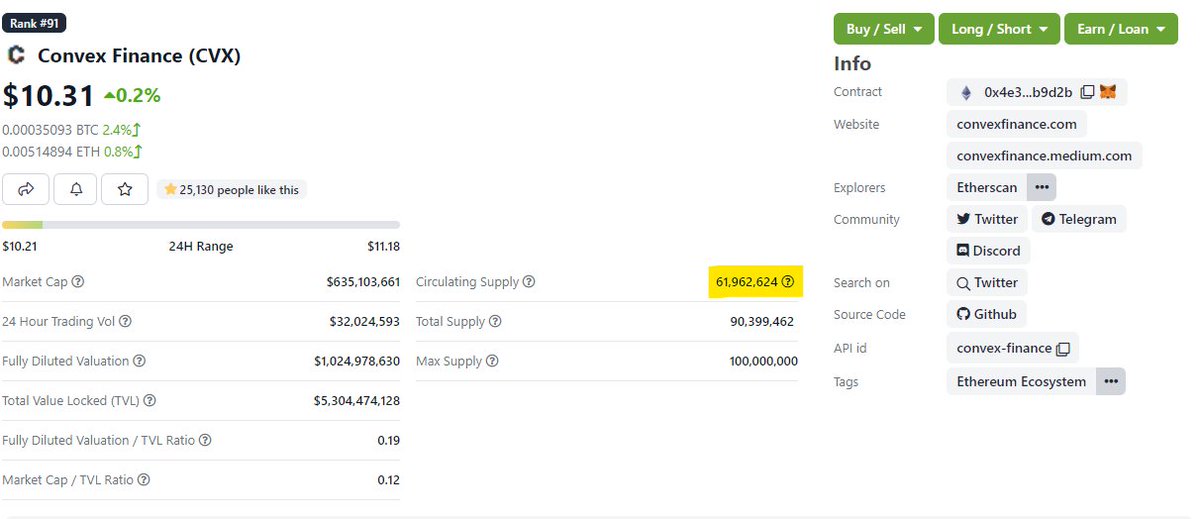

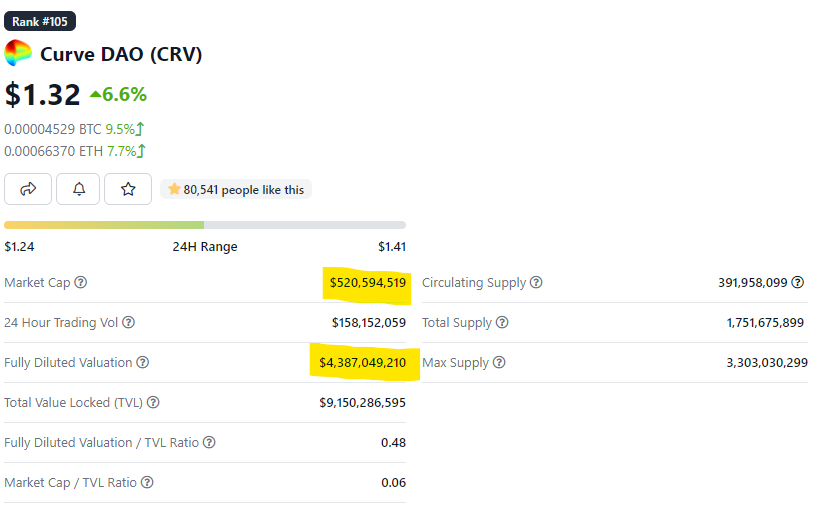

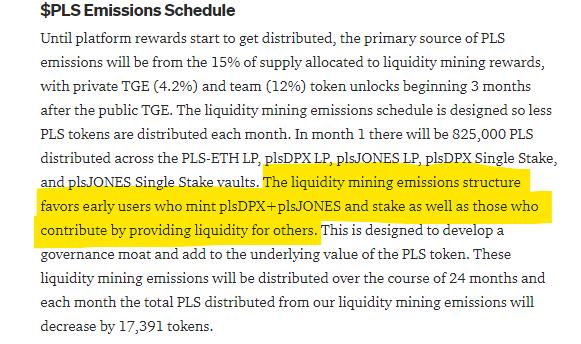

The first thing they call out as being decided by the legislation is commodities vs. securities. $ETH and L1s will fall under the blanket of securities.

The first thing they call out as being decided by the legislation is commodities vs. securities. $ETH and L1s will fall under the blanket of securities.

https://twitter.com/BitTowne/status/1531980356966141956?s=20&t=H64mDG_pgPj0safEcIU52w

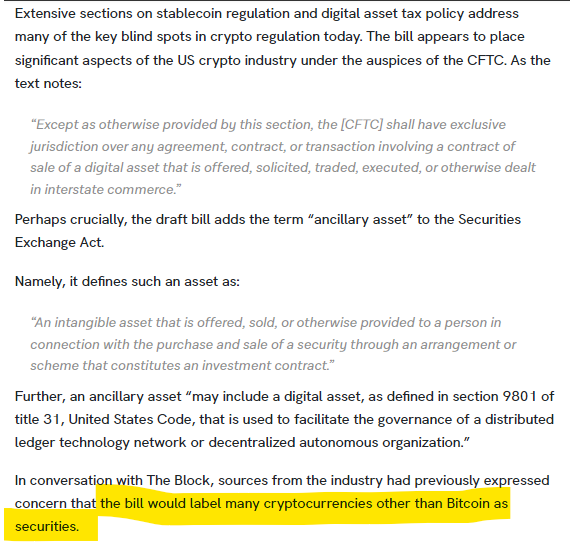

@Heritage @tedcruz @CaitlinLong_ If you'd like to get a headstart @TheBlock__ was able to obtain a copy of the Lummis legislation prior to next week's final copy.

By the outlined definition below, nearly every cryptocurrency including $ETH are securities.

theblockcrypto.com/post/149186/he… theblockcrypto.com/post/149186/he…

By the outlined definition below, nearly every cryptocurrency including $ETH are securities.

theblockcrypto.com/post/149186/he… theblockcrypto.com/post/149186/he…

@Heritage @tedcruz @CaitlinLong_ @TheBlock__ I've combed through the bill but haven't had time to cover all 70+ pages. This copy is dated March 1st so plenty of changes could have been made since shared.

There is bullish content that will help progress the space surrounding stablecoin regulation and the banning of CBDCs.

There is bullish content that will help progress the space surrounding stablecoin regulation and the banning of CBDCs.

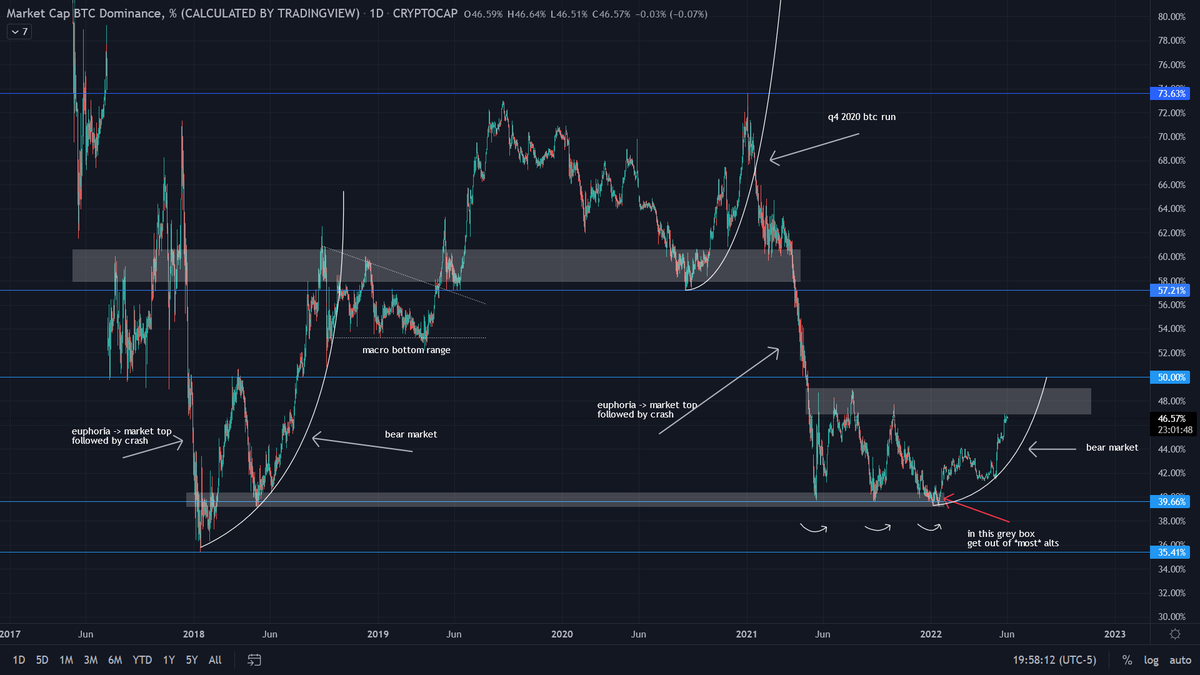

@Heritage @tedcruz @CaitlinLong_ @TheBlock__ Charts are backing up the evidence that we are in for a rude awakening. $BTC.D looking ready to explode upwards by 5-30% in the coming months. 60-73% dominance could be a real possibility

s/o @fewseethis

s/o @fewseethis

@Heritage @tedcruz @CaitlinLong_ @TheBlock__ @fewseethis Reached out to @bakeobits for his thoughts on $BTC dominance. I lean on him often for charting opinions and his chart paints a similar picture. $BTC 🆙 and Alts 📉

@Heritage @tedcruz @CaitlinLong_ @TheBlock__ @fewseethis @bakeobits $ETHBTC also has just lost a 1.5-year trend and is ready to get make way to the downside.

https://twitter.com/godbole17/status/1532686605059624961?s=20&t=mM-M9bqdFCPWD6rew_s4yA

@Heritage @tedcruz @CaitlinLong_ @TheBlock__ @fewseethis @bakeobits When the penguin speaks, you listen.

@Pentosh1 calling for a landing at either ~$750 or $1400 per $ETH.

@Pentosh1 calling for a landing at either ~$750 or $1400 per $ETH.

https://twitter.com/Pentosh1/status/1531809409726283776?s=20&t=QwNbB90Igo6EKQ7gKUF3JQ

@Heritage @tedcruz @CaitlinLong_ @TheBlock__ @fewseethis @bakeobits @Pentosh1 Charts seem to agree with the thesis that $ETH and other L1's will be classified as securities. Buckle up if you hold anything but $BTC or stables.

@Heritage @tedcruz @CaitlinLong_ @TheBlock__ @fewseethis @bakeobits @Pentosh1 This has some other very interesting implications for the CEX landscape. It could also be the reason behind some of the massive headlines that have dropped lately for some of the top exchanges.

Will they be forced to meet the regulations of all broker-dealers?

Will they be forced to meet the regulations of all broker-dealers?

@Heritage @tedcruz @CaitlinLong_ @TheBlock__ @fewseethis @bakeobits @Pentosh1 I found it extremely odd that @coinbase went from flaunting it's stack of cash to rescinding job offers in a matter of weeks. They could be getting forced to make a heavy pivot for their business in the coming months to meet regulations.

https://twitter.com/TeamBlind/status/1532769735393169410?s=20&t=QwNbB90Igo6EKQ7gKUF3JQ

@Heritage @tedcruz @CaitlinLong_ @TheBlock__ @fewseethis @bakeobits @Pentosh1 @coinbase @SBF_FTX also making headlines for being willing to spend $1B on the upcoming election.

Sending a message to both parties as they are working on this legislation possibly? The timing aligns and he isn't spending $1B for his personal political beliefs

Sending a message to both parties as they are working on this legislation possibly? The timing aligns and he isn't spending $1B for his personal political beliefs

https://twitter.com/fintechfrank/status/1529185967705292801?s=20&t=QwNbB90Igo6EKQ7gKUF3JQ

@Heritage @tedcruz @CaitlinLong_ @TheBlock__ @fewseethis @bakeobits @Pentosh1 @coinbase @SBF_FTX It'll be interesting to see which CEX or leaders step up to push back on legislation. Gemini/Coinbase and most likely the others already have issues regarding the SEC.

Who is going to step up and poke the bear? It's going to be needed and most likely worth it.

Who is going to step up and poke the bear? It's going to be needed and most likely worth it.

@Heritage @tedcruz @CaitlinLong_ @TheBlock__ @fewseethis @bakeobits @Pentosh1 @coinbase @SBF_FTX Another hidden narrative is that the Grayscale GBTC spot ETF application response is due back from the SEC on July 7th. They've previously denied spot ETF's due to things like stablecoin FUD that are cleared up in this bill. decrypt.co/101141/graysca…

@Heritage @tedcruz @CaitlinLong_ @TheBlock__ @fewseethis @bakeobits @Pentosh1 @coinbase @SBF_FTX I'd think this is highly unlikely to be approved until 2023 but if you are a hopeless bull looking for a path to $100k, $BTC being the only commodity and a spot ETF approval is it.

Grayscale GBTC trading at ~30% discount to NAV is worth keeping an eye on.

Grayscale GBTC trading at ~30% discount to NAV is worth keeping an eye on.

https://twitter.com/blockworksres/status/1532765214231306240?s=20&t=QwNbB90Igo6EKQ7gKUF3JQ

@Heritage @tedcruz @CaitlinLong_ @TheBlock__ @fewseethis @bakeobits @Pentosh1 @coinbase @SBF_FTX A fact I found interesting in my research is, that there have been massive inflows to the Canadian spot $BTC over the past few weeks.

https://twitter.com/WClementeIII/status/1532723918447968257?s=20&t=QwNbB90Igo6EKQ7gKUF3JQ

@Heritage @tedcruz @CaitlinLong_ @TheBlock__ @fewseethis @bakeobits @Pentosh1 @coinbase @SBF_FTX In my opinion, we are in a shakey spot in the market and I'll be keeping my funds on the sidelines until we have more clarity on the finalized legislation.

I'd assume based on all the info here, $ETH and other alts will see their final shakeouts in the next month or two. 📉

I'd assume based on all the info here, $ETH and other alts will see their final shakeouts in the next month or two. 📉

@Heritage @tedcruz @CaitlinLong_ @TheBlock__ @fewseethis @bakeobits @Pentosh1 @coinbase @SBF_FTX If you'd like to hear further discussion on the topic, @samkazemian the founder of @fraxfinance will be joining us for episode #2 of @MarketCapping!

Plenty for us to discuss with legislation dropping the same day and a packed FRAX roadmap. Tune in!

Plenty for us to discuss with legislation dropping the same day and a packed FRAX roadmap. Tune in!

https://twitter.com/MarketCapping/status/1532929636245684224?s=20&t=FAcJvidJWDH7a5Vu8g_Qmg

@Heritage @tedcruz @CaitlinLong_ @TheBlock__ @fewseethis @bakeobits @Pentosh1 @coinbase @SBF_FTX @samkazemian @fraxfinance @MarketCapping So my advice to you on how to play this..

I don't have any, because none of this is financial advice. Do your own research and correct anything I have wrong, I'm not a macro expert. . Maybe keeps comments civil? I decided to tag a bunch of senators.

Enjoy the weekend and GL! 👨🔬

I don't have any, because none of this is financial advice. Do your own research and correct anything I have wrong, I'm not a macro expert. . Maybe keeps comments civil? I decided to tag a bunch of senators.

Enjoy the weekend and GL! 👨🔬

@Heritage @tedcruz @CaitlinLong_ @TheBlock__ @fewseethis @bakeobits @Pentosh1 @coinbase @SBF_FTX @samkazemian @fraxfinance @MarketCapping You can read the unrolled version of this thread here: typefully.com/SmallCapScienc…

• • •

Missing some Tweet in this thread? You can try to

force a refresh