Yesterday, @AaveAave proposed GHO, a new stablecoin fueled by Aave's lending protocol.

Today, we take a closer look into the GHO proposal and try to explain what makes GHO special.

We will conclude with some open questions! 👇🧵

Today, we take a closer look into the GHO proposal and try to explain what makes GHO special.

We will conclude with some open questions! 👇🧵

@AaveAave Stablecoins are one of the strongest primitives in defi. New designs and approaches are actively researched and we may see the beginning of a Cambrian explosion of stablecoin models.

@AaveAave With the growing demand for decentralized stablecoins, interesting revenue opportunities open up for money markets such as @AaveAave. Surely, other projects will find the stablecoin opportunity very tempting as well.

@AaveAave GHO is a decentralized, over-collateralized, multi-collateral & USD-pegged stablecoin, at least initially integrated into Aave's lending protocol.

Aave users can mint GHO against their interest-bearing collateral provided to the protocol. The interest rate for borrowing ...

Aave users can mint GHO against their interest-bearing collateral provided to the protocol. The interest rate for borrowing ...

@AaveAave ... GHO will be set by the Aave's DAO. The earned fees will flow into the treasury of the DAO to create a constant revenue stream that can be used for further ecosystem development.

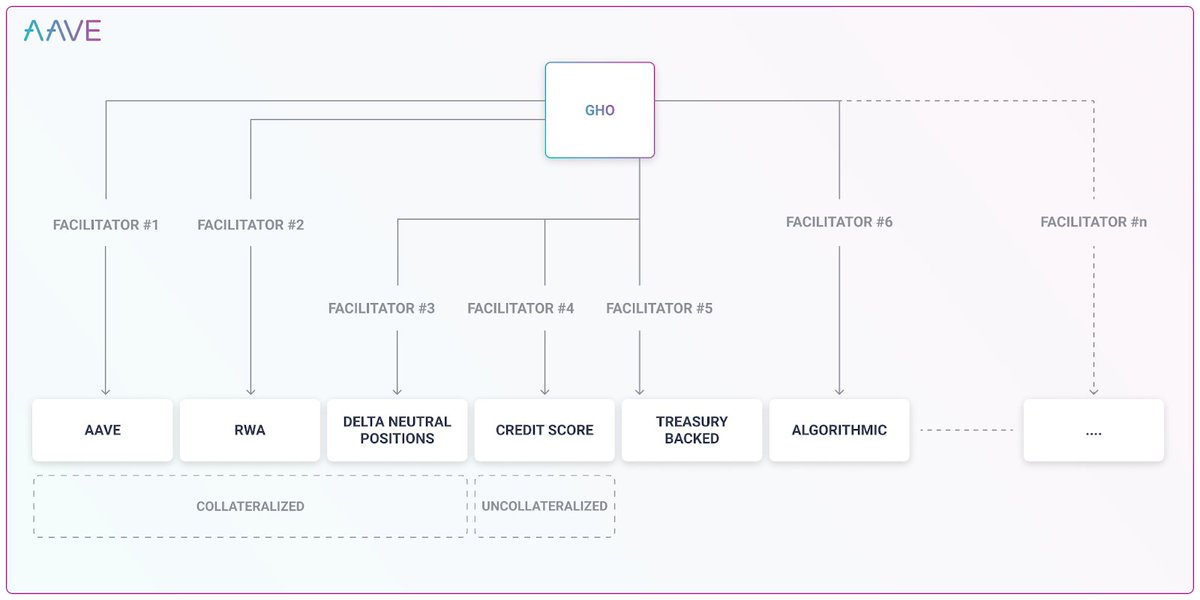

An important part of the strategy for GHO is the introduction of "facilitators" ...

An important part of the strategy for GHO is the introduction of "facilitators" ...

@AaveAave ... which can be any third-party protocol or entity with the mandate to mint & burn GHO based on the mechanism agreed on and accepted by the Aave DAO. This will enable & guarantee the availability and liquidity of GHO in different ecosystems beyond the Ethereum mainnet.

@AaveAave GHO also aims to increase the utility of AAVE tokens. The protocol will allow stkAAVE holders participating in the protocols safety module to borrow GHO at a discounted interest rate which is also set by the AaveDAO.

@AaveAave Further, Aave aims to rollout GHO across different L2 & alt L1 ecosystems leveraging their unique position as a lending market to profit from an improving UX enabling mainstream adoption on those chains.

@AaveAave Thereby, a success of GHO as a dominant stablecoin on other chains could lead AaveDAO to become like a (de)central bank steering money markets across defi ecosystems.

This might be an opportunity for AAVE holders but at the same time, could create additional systematic ...

This might be an opportunity for AAVE holders but at the same time, could create additional systematic ...

@AaveAave ... risks to the broader ecosystem. Also, the responsible and sustainable integration of external facilitators will constitute a challenge for the DAO.

Current market conditions will be an excellent opportunity to test the stability and resilience of GHO and it will be ...

Current market conditions will be an excellent opportunity to test the stability and resilience of GHO and it will be ...

@AaveAave ... interesting to see how successful the bootstrapping via the stkAAVE discount is in creating enough liquidity to be considered stable.

Of course, when GHO is live you’ll find all relevant information and market data on stablecoins.wtf 👀

Of course, when GHO is live you’ll find all relevant information and market data on stablecoins.wtf 👀

• • •

Missing some Tweet in this thread? You can try to

force a refresh