5 non-obvious lessons from Terra/Luna fallout: for future stablecoin investors, builders & regulators 👇

First I’m not gonna recount Terra/Luna de-peg saga here. If you need a rundown of what happened, check out @laurashin ’s excellent podcast episode last Friday.

@laurashin Let’s 1st get clear on what the stablecoin biz is abt.

The nature of stablecoin business:

Almost all stablecoins, regardless of design, involve you, the user, give a stablecoin issuer X amount of assets in exchange for Y amount of a token that’s priced at $1.

The nature of stablecoin business:

Almost all stablecoins, regardless of design, involve you, the user, give a stablecoin issuer X amount of assets in exchange for Y amount of a token that’s priced at $1.

@laurashin Exchange btw stablecoin issuer & you is an exchange of risk (or volatility).

@laurashin You the user, don’t like volatility. So you swap your variable-priced assets for a token that promises a fixed dollar price. The stablecoin issuer, on other hand, is a buyer of volatility. From this view she’s in the insurance business.

@laurashin Another way to look at it. The stablecoin issuer is in the banking business. You deposit variable-priced assets w/ the issuer, get a certificate (i.e. stablecoin token) back that offers 0% interest rate but promises to be always worth $1.

@laurashin Why can a stablecoin protocol make money?

Regardless of how profit is collected operationally, stablecoin issuer can potentially turn a profit (i.e. create value-added) in similar manner that insurance companies and/or banks can be profitable:

Regardless of how profit is collected operationally, stablecoin issuer can potentially turn a profit (i.e. create value-added) in similar manner that insurance companies and/or banks can be profitable:

@laurashin · A) from risk premium: issuer charging a fee for taking on asset price volatility risk

· B) from return arbitrage: issuer earning positive yield in dollar terms on deposited assets while paying 0% yield to you

· B) from return arbitrage: issuer earning positive yield in dollar terms on deposited assets while paying 0% yield to you

@laurashin B doesn’t necessarily require issuer to make risky investments w/ your deposits.

@laurashin USD money supply roughly expands at rate of nominal GDP growth (i.e. 4-5%). Assuming assets deposited into stablecoin protocol are of lower supply growth (e.g. BTC, ETH), their value should appreciate vs USD in long run, other things equal.

@laurashin That in itself allows protocol to turn a profit in long term while keeping the peg.

But obv it didn’t work out that way for Terra (or most other “algorithmic stablecoins” to date).

Why?

But obv it didn’t work out that way for Terra (or most other “algorithmic stablecoins” to date).

Why?

@laurashin 5 lessons to learn abt stablecoin operation from past failures:

1. Assets that “back” a stablecoin need to have uncorrelated demand

1. Assets that “back” a stablecoin need to have uncorrelated demand

@laurashin Terra/Luna eco is self-referencing w/ high degree of reflexivity built in. More minting of UST increases Luna token price—> higher Luna prices allows more UST to be minted.

@laurashin But reflexivity is huge on way down too. When UST is lower than $1, more Luna needs to be printed to shrink UST supply, dampening Luna price.

@laurashin Since there’s limited use case for Luna token aside from backing UST, If de-peg pressure is high enough, Luna price would be pushed to zero as there’s no other demand to help shore up price.

@laurashin In contrast, most fiat currencies have unspeculative demand tied to commerce & trade. Thus even when a currency is shorted heavily by speculators, it won’t go to zero barring major misstep in monetary policy.

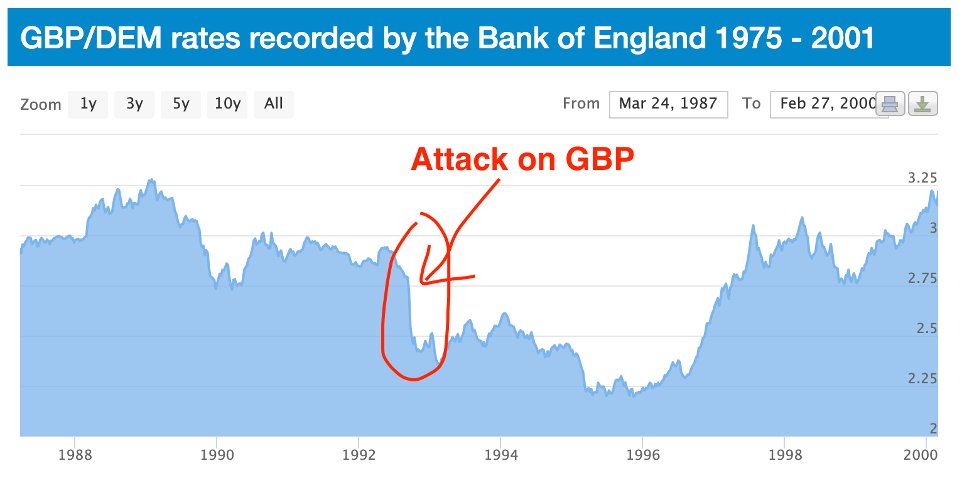

@laurashin Famous G. Soros attack on British pound in 1992 is similar in method to UST attack (i.e. if you believe there was indeed coordinated attack on UST/Luna). GBP ended up breaking its soft peg to Deutschmark, but only devalued 25% from peak to trough in 4 yrs.

@laurashin A major challenge in stablcoin design is thus to have on-chain reserve assets or backing assets that have use cases—hence value—uncorrelated w/ demand for said stablecoin.

@laurashin One obv choice is L1/L2 platform tokens, e.g. BTC, ETH, SOL, AVAX, etc. (This doesn’t include platform token specifically created to “collateralize” an algo stablecoin as in the case of Luna.)

@laurashin L1 tokens are created to secure their own blockchain & spent as txn fees on their own chain. Both can count as uncorrelated use cases that support demand for these tokens if the chain gains decent traction.

@laurashin 2. Fast expansion w/o actual network effect = ☠️

“Network effect” is holy grail concept in tech investment circles that’s frequently abused.

“Network effect” is holy grail concept in tech investment circles that’s frequently abused.

@laurashin In its name VCs touted blitzscaling expansion for products to gain mkt share at all cost as fast as possible. Motivation is usually a combination of gaining scale economy & monopoly advantage.

@laurashin Problem, esp regarding crypto, is it’s easy to confuse ponzi-nomics w/ real network adoption b/c of huge reflexivity.

@laurashin Soaring user/activity growth is not necessarily a sign of emerging network. In Terra’s case, Anchor, the bank that offered 20% deposit rate on UST, singlehandedly accounted for 80% Terra TVL at one point.

@laurashin Compared to other L1s, it was less of a network or ecosystem, more of a product.

https://twitter.com/TaschaLabs/status/1475194751213195265?s=20&t=Ng8Pnj7Q9kMTBn8Yk7P_vw

@laurashin Terra’s strategy of subsiding growth of a couple products to gain network adoption did “work” to an extent— it was starting to see more projects built on top— but not enough.

@laurashin The platform’s unsustainable rate of growth & amount of subsidies needed to keep it up far outstripped the pace of actual network effect growth.

@laurashin (BTW, like this so far? I help you get smarter about web3 & macro. Subscribe to my newsletter for updates 👉 taschalabs.com/newsletter .)

@laurashin 3. It’s network effect for the reserve asset, not for stablecoin itself, that matters

@laurashin Much of biz dev effort for newer stablecoins is focused on getting more adoption for the stablecoin itself— get it into more AMMs, used as DeFi collateral, deploy on multiple chains, etc. E.g. when UST was bridged to Avalanche eco it was seen as “bullish”.

@laurashin That’s the wrong focus imo.

Stablecoin is a utility product. There’s no real network effect for itself that guarantees sticky demand. No matter how big a mkt cap or user base your stablecoin has, if it de-pegs, game over.

Stablecoin is a utility product. There’s no real network effect for itself that guarantees sticky demand. No matter how big a mkt cap or user base your stablecoin has, if it de-pegs, game over.

@laurashin It’s the network effect for the reserve asset of the stablecoin that ultimately matters, as that creates uncorrelated demand for the reserve asset, which protects its value & in turn safety of the peg.

@laurashin ’Tis the part that stablecoin builders need to work hard on: how to get the token(s) that back the stablecoin to be adopted in as many use cases—ideally unrelated to DeFi—as possible. (@fraxfinance, looking at you!)

@laurashin @fraxfinance If that’s nailed, biz dev to get the stablecoin adopted is the easy part.

@laurashin @fraxfinance 4. Small(er) is beautiful

JPMorgan, largest US bank, is ~2% of global banking assets. Anchor, largest bank on Terra, was 8% of global DeFi TVL.

JPMorgan, largest US bank, is ~2% of global banking assets. Anchor, largest bank on Terra, was 8% of global DeFi TVL.

@laurashin @fraxfinance That is, large stablecoin protocols are way more “systemic” to crypto financial system than large banks to tradFi financial system. Plus the former don’t have any lender of last resort.

https://twitter.com/TaschaLabs/status/1525598539765764097?s=20&t=fXN6qFQA7mMCry0VHcW3IA

@laurashin @fraxfinance Too-big-to-fail risk in crypto isn’t limited to USD stablecoin. Lido the liquid staking service, e.g., holds over 90% (yes you read that right) of all liquid staked ETH in universe, w/ its stETH token (a ETH stablecoin) used as collaterals in multiple large DApps.

@laurashin @fraxfinance As investor you obv want whatever you invest in to be huge. But issue is bigger you are, harder it is to find outside capital to rescue you if things go south. Terra tried to find private bailout & failed.

@laurashin @fraxfinance DeFi would be more resilient w/ 15 medium-sized stablecoins backed by different reserve assets & pegging designs, than w/ 3 giga-sized ones.

@laurashin @fraxfinance And stablecoin protocols that limit mkt cap growth to below the pace of reserve asset network growth would be more likely to become long-term successes.

https://twitter.com/TaschaLabs/status/1525164092331372544?s=20&t=-djfZg8y1cPqBRcmUX4NGw

@laurashin @fraxfinance 5. Regulatory standards are a nuisance until they’re not

Financial assets held by firms, households & govs worldwide are ~$1000 trillion. Crypto is 0.15% of that rn— trivial in the grand scheme. But amount of interest, news & discourse it stirs go much beyond.

Financial assets held by firms, households & govs worldwide are ~$1000 trillion. Crypto is 0.15% of that rn— trivial in the grand scheme. But amount of interest, news & discourse it stirs go much beyond.

@laurashin @fraxfinance I have no doubt crypto financial sys will grow substantially in coming yrs. But like any child growing into adulthood, there’ll be adjustment & pain.

@laurashin @fraxfinance Being adult means realizing one needs to be responsible for own actions. You can’t do whatever the hell you want b/c your actions have impact on others.

@laurashin @fraxfinance Adults are obliged to follow laws. Industries are required to follow standards. Regulations are inconvenient, but protect society from destroying itself in long run.

@laurashin @fraxfinance E.g. if there’d been a minimal capital/liability ratio requirement in place for Terra, UST mkt cap wouldn’t have expanded as fast. Less investors would have ended in tears.

@laurashin @fraxfinance As systemic impact of stablecoin grows, it’ll be a necessity to have standards, if just to protect the industry’s own survival. To control the conversation, standards would better be self-enforced rather than waiting for regulators to impose them.

https://twitter.com/TaschaLabs/status/1525557229381902336?s=20&t=jcR7FizhOjFXOMrUxv-FUw

@laurashin @fraxfinance Until then, be thankful that deFi is not yet half of global financial system.

If you like this:

• Retweet the thread below

• Subscribe to my newsletter for more ideas to help you get smarter, richer, freer 👉 taschalabs.com/newsletter

Questions? Put in the comments & I’ll address interesting ones in future articles. Be civil.

• Retweet the thread below

• Subscribe to my newsletter for more ideas to help you get smarter, richer, freer 👉 taschalabs.com/newsletter

Questions? Put in the comments & I’ll address interesting ones in future articles. Be civil.

https://twitter.com/TaschaLabs/status/1526276308119932928?s=20&t=qCEihwvJ8gTlgt441DF-Ng

• • •

Missing some Tweet in this thread? You can try to

force a refresh