Next wave of crypto adoption will come from utility tokens of real-world companies.

Why & how:

Why & how:

Tokenization is big breakthrough of web 3. It creates huge possibilities for innovation but also opens many cans of worms.

The fact that anyone can create a token to represent anything of value, and trade it w/ any other asset on an open network under common standard is something unthinkable b/f creation of public blockchains. Amazing indeed!

But tokenization also allows many web 3 “products” to gain an appearance of traction in short term, even though they’re never sustainable biz on their own.

https://twitter.com/TaschaLabs/status/1537147991580020736?s=20

The ponzis eventually implode. But that doesn’t negate the fact that if applied in right context, tokenization is a powerful economic tool that will supercharge biz growth.

Real businesses are only waking up to the power of tokenization. Death of speculation in bear mkt gives breathing room for real innovations in tokenization to happen.

Companies w/ viable products that manage to integrate utility tokens into existing biz model *early* will be handsomely rewarded, while driving crypto adoption forward.

By “utility token”, I mean a token that has a clear usage within product life cycle, as opposed to “equity tokens” that give holders a share of company profit, which is akin to equities & likely run into regulatory headwind going forward.

How can a traditional biz benefit from utility tokens? Here’re 3 ways:

1. Loyalty programs w/ liquidity

Simplest utility token use case is as a reward program— users earn more tokens the more they use the product. Tokens can then be redeemed for more products in future.

1. Loyalty programs w/ liquidity

Simplest utility token use case is as a reward program— users earn more tokens the more they use the product. Tokens can then be redeemed for more products in future.

Loyalty programs are nothing new — think frequent flyers miles, Starbucks rewards, credit card points. The game changer part is to allow the “points” one earns to have liquidity in 2ndary mkts on public blockchains.

This completely turns biz model of traditional loyalty program on its head.

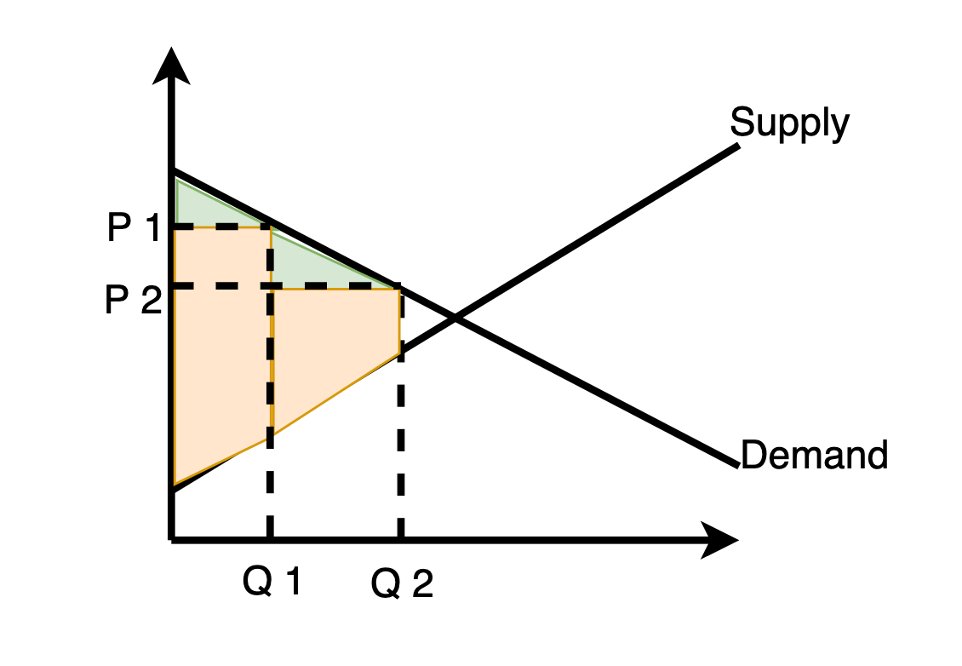

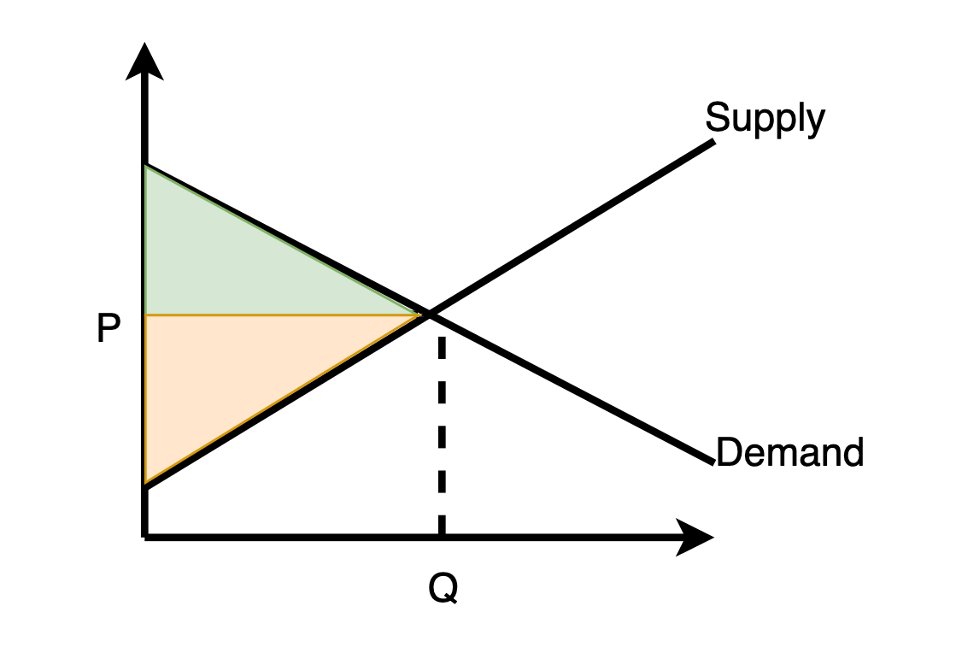

Traditional user rewards programs are essentially discriminated pricing. Charging users different prices by usage level allows firms to capture higher profits— or in economic jargon, higher producer surplus.

Example: Orange area in chart below is the producer surplus when all customers are charged same price (P):

The more fine-grained the price discrimination, the more producer surplus there is, as long as the firm makes sure customers on more expensive tiers cannot cheat to take advantages of lower prices on other tiers.

That’s why airlines don’t allow you to sell your frequent flyer miles. If “volume discount” can be transferred to other users, the biz model of loyalty program falls apart.

But that’s exactly what happens if you tokenize a loyalty program. If loyalty points are fungible tokens that can be traded on 2ndary mkt, you’re giving everyone the same discount that is = token price x amount of your product 1 token can redeem for.

Then why would any biz want to tokenize a loyalty program?

B/c although tokens made differentiated pricing impossible, it gives stronger incentive for users to earn rewards since monetary benefit can be immediately cashed out on 2ndary mkt. Liquidity makes tokenized rewards more attractive than loyalty points confined in walled gardens.

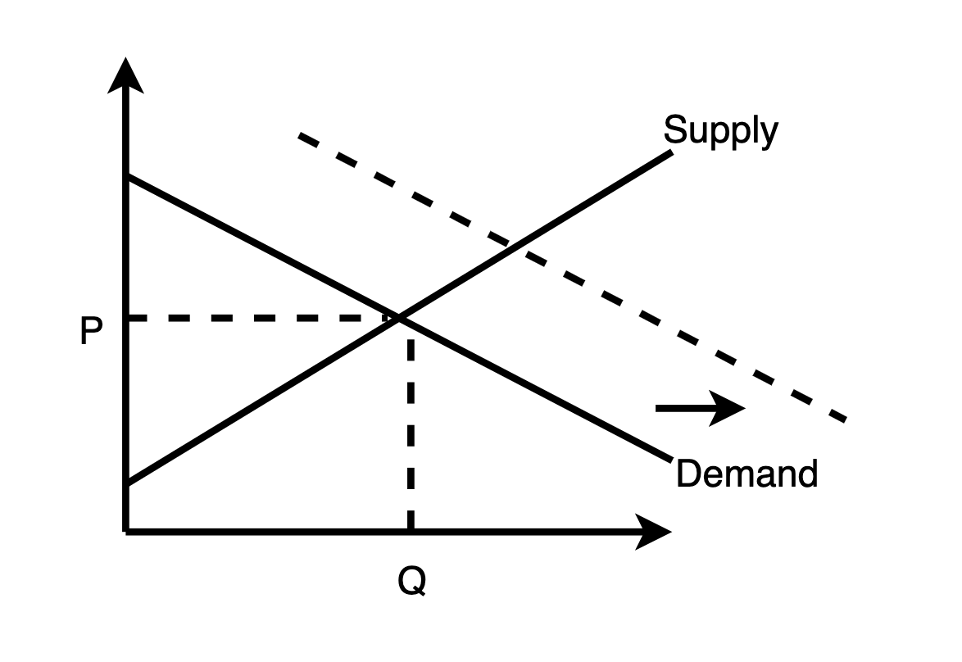

In economic terms, the extra incentive creates upward shift in demand curve equal to the amount of discount, which manifests as user growth & higher usage from existing users. Resulting equilibrium price, quantity & producer surplus are higher than in base case.

You say, but the firm now gives out a “subsidy” to ALL users in the form of loyalty tokens. Do benefits outweigh subsidy cost?

That brings us to benefit #2—

That brings us to benefit #2—

2. Funding growth marketing spend w/o affecting current cashflow

In 2000 PayPal paid tens of millions $$ in signup bonus to new users to bootstrap adoption. It was a great incentive, but was hard cash taken out of company coffer.

In 2000 PayPal paid tens of millions $$ in signup bonus to new users to bootstrap adoption. It was a great incentive, but was hard cash taken out of company coffer.

Unless you’re a VC backed startup w/ large runway, it’s hard for new firms to pull off growth marketing stunt like that.

But if signup bonus is in token form, it doesn’t impact company’s current cash position. Instead, tokens given out today subtract from tomorrow’s revenue as users redeem tokens for company’s products & services in future.

W/ help of 2ndary mkt to extend liquidity, you can use future (unrealized) revenues to fund growth today. ’Tis a much more flexible marketing spend possible for a wider range of companies.

Besides, you can adjust redemption ratio, i.e. X amount of tokens can be redeemed for Y amount of product, to change how much discount in $ terms you’re giving out at different time, depending on mkt prices of your product & your token.

This “monetary policy” is additional marketing lever at your disposal (it also helps set floor price for your token & support price stability).

Another benefit of tokens compared to traditional rewards program— it increases the number of direct & indirect stakeholders:

Another benefit of tokens compared to traditional rewards program— it increases the number of direct & indirect stakeholders:

3. Broadening stakeholder base

Many so-called web 3 “communities” are nothing more than echo chambers of speculators hoping token price would go up.

Many so-called web 3 “communities” are nothing more than echo chambers of speculators hoping token price would go up.

Community built on appreciation hopium is powerful in bull mkt, but also fragile & even destructive in long term. Not to mention regulatory hassle you may get into down the road if goal of holding your token is price going up.

Instead, like any good currency you’d want to build long-term trust in your utility token by aiming for relatively stable price. So user incentive is to earn more tokens, not expecting token to appreciate.

Even w/o speculative cult following, the fact that your token is circulated on 2ndary mkt means it interacts w/ many more people than your direct user base. And an asset of stable value can be incorporated into other financial instruments, further extending your reach.

What types of companies are good candidates for having user utility tokens?

A few basic criteria:

A. You already have product mkt fit w/ low churn rate

It’s unwise to issue a token on day one for unproven products that haven’t been tested in market.

A few basic criteria:

A. You already have product mkt fit w/ low churn rate

It’s unwise to issue a token on day one for unproven products that haven’t been tested in market.

Reflexivity of token price & opportunistic “users” will give you wrong signal abt product viability. When tide goes out (it will), you find yourself swimming naked.

https://twitter.com/TaschaLabs/status/1537147989122109440?s=20

If churn rate is high, having a token is not gonna fix that, despite appearance in short term. Make sure product is sticky enough to keep the users you attract first. Or it’d be a big round trip about nothing.

B. Your marginal cost is declining

Keep in mind token rewards are issued at expense of your future revenue. ’Tis less of an issue if your marginal cost declines w/ number of users, say, b/c of scale economy or network effect. E.g. AT&T, Facebook, any number of web 2 mkt places.

Keep in mind token rewards are issued at expense of your future revenue. ’Tis less of an issue if your marginal cost declines w/ number of users, say, b/c of scale economy or network effect. E.g. AT&T, Facebook, any number of web 2 mkt places.

In these cases it makes sense to get as many users as possible as it offsets your reward cost & tokenization will help you get there. But if your marginal cost is flat or—God forbid— increasing, the math of tokenization may not make sense.

(BTW, like this so far? I help you get smarter about web3 & macro. Subscribe to my newsletter for updates 👉 taschalabs.com/newsletter .)

C. You’re in large addressable market w/ winner-takes-all potential

This complements point B as winner-takes-all scenario often happens in industries w/ declining marginal cost.

This complements point B as winner-takes-all scenario often happens in industries w/ declining marginal cost.

Bottomline is there should be enough room in this mkt to meaningfully push demand curve upwards. If you run a small town restaurant that serves 2k local folks, tokens prob wouldn’t be right marketing tool for you.

D. Your biz model allows tokens to have clear utility

Example: Your product sells for X dollars / month. Users can pay in tokens up to Y%.

Example: Your product sells for X dollars / month. Users can pay in tokens up to Y%.

It can even work if usage & sales of your product come from different groups, e.g. content platforms relying on ad revenue. In this case, audience earn tokens by consuming content—> audience sell tokens on 2ndary mkt—> advertisers buy tokens & pay them to you.

Again tokenization is a powerful economic model to drive biz growth. But it won’t have any legs until integrated w/ products & services of viable value-added. I expect to see many innovations in this area coming out of bear mkt & becoming next frontier of crypto adoption.

• Like this, retweet this first tweet in thread 👇

• Subscribe to my newsletter for more ideas to help you get smarter, richer, freer 👉 taschalabs.com/newsletter

• Subscribe to my newsletter for more ideas to help you get smarter, richer, freer 👉 taschalabs.com/newsletter

https://twitter.com/TaschaLabs/status/1542583780409413633?s=20&t=YDZeAAsyJRjzNfBabxg9xg

Thanks @thebitsian of Juno.finance for our lively discussion that inspired this post!!!

• • •

Missing some Tweet in this thread? You can try to

force a refresh