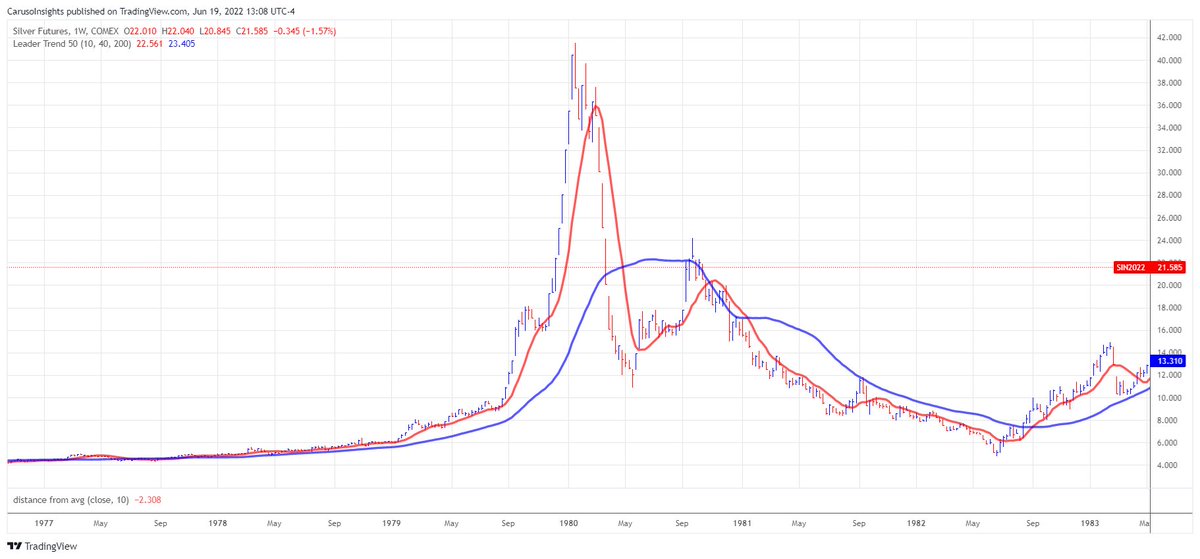

A thread on asset bubbles and $BTC. Asset bubbles are nothing new, and they don't just occur in assets that are 'scams.' The Dow Jones had one in 1929, Silver 1980, and Nasdaq 2000. I believe we had one in Crypto in 2020/2021. Here are my takeaways 1/n

There is usually a great catalyst that kicks off the bubble. A new technology, new monetary condition, or new geopolitical order. However, investors overdo it as human nature takes over and they overpay while also borrowing money to do so 2/n

Market forces take over and crashing prices trigger a cascading series of margin calls where investors are forced to sell as liquidity disappears and losses trigger selling. This results in changing the once unspoiled mindset of participants. Midas loses his touch. 3/n

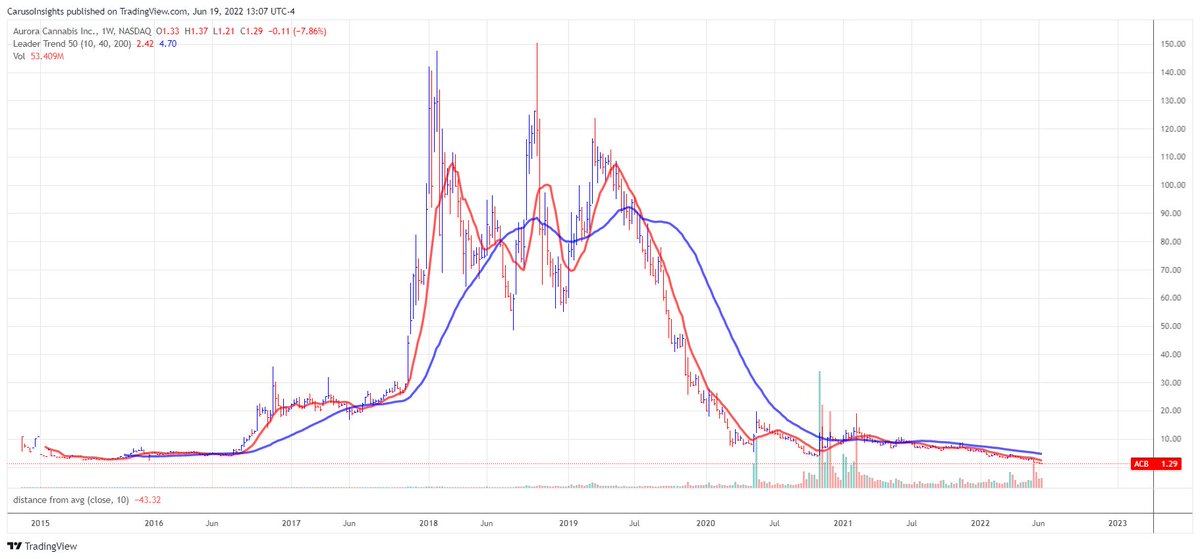

This produces two negative outcomes. 1) prices typically completely retrace the bubble phase as holders are forced to sell and the fear keeps new investors away resulting in no buyers even at what seems like reasonable prices 4/n

The second outcome is that it takes many many years to ever get back to new highs. This means investors are typically better off moving on to better opportunities rather than staying fixated on gains that were lost. 5/n

Each cycle had a very good reason. Similar to bitcoin, Silver & gold were alternate solutions to a failing world monetary order. Similar to 2000, the internet was a great new technology that would truly revolutionize the world. Crypto seems to have both 6/n

yet despite the reasoning and eventual truth behind past cycles, the blowing up of the asset bubble resulted in a long bear market trapping investors in losses and missing out on other great opportunities - sometimes in the very same space, ex: new tech companies post dot com 7/n

This cycle may very well be different, but so far it is following the script of past asset bubbles. Sometimes, the profits fail to ever materials as anticipated. This occurred in the Weed bubble and 3D printing bubbles. 8/n

It is important that you keep the big picture in perspective as even in a huge bear there can be massive rallies as silver had in 1980. What matters is your risk/portfolio management and clear-minded application of your investing strategy/philosophy. n/n

• • •

Missing some Tweet in this thread? You can try to

force a refresh