"Fat Protocol Thesis" is dead

"Fat App Thesis" is here to stay

A 🧵 on the biggest paradigm shift in how we will value crypto tokens going forward (x/16)

"Fat App Thesis" is here to stay

A 🧵 on the biggest paradigm shift in how we will value crypto tokens going forward (x/16)

1/ For those that don't know, the "Fat Protocol Thesis" was first coined by Joel Monegro in 2016 to highlight what he believed to be the differences in value accrual between the Internet and Blockchain applications.

usv.com/writing/2016/0…

usv.com/writing/2016/0…

2/ He argued that Web infrastructure allowed for applications to retain most of the value over the underlying protocols, whereas blockchains retained almost all the value at the base protocol not applications, hence the "Fat Protocol."

3/ The first argument for this was around the idea of a shared data layer.

The open and permissionless capabilities of blockchains lead to greater competition and reduced barriers of entry, pushing fees very close to zero as there is an optimization for user experience.

The open and permissionless capabilities of blockchains lead to greater competition and reduced barriers of entry, pushing fees very close to zero as there is an optimization for user experience.

4/ The second argument was the existence of a protocol token.

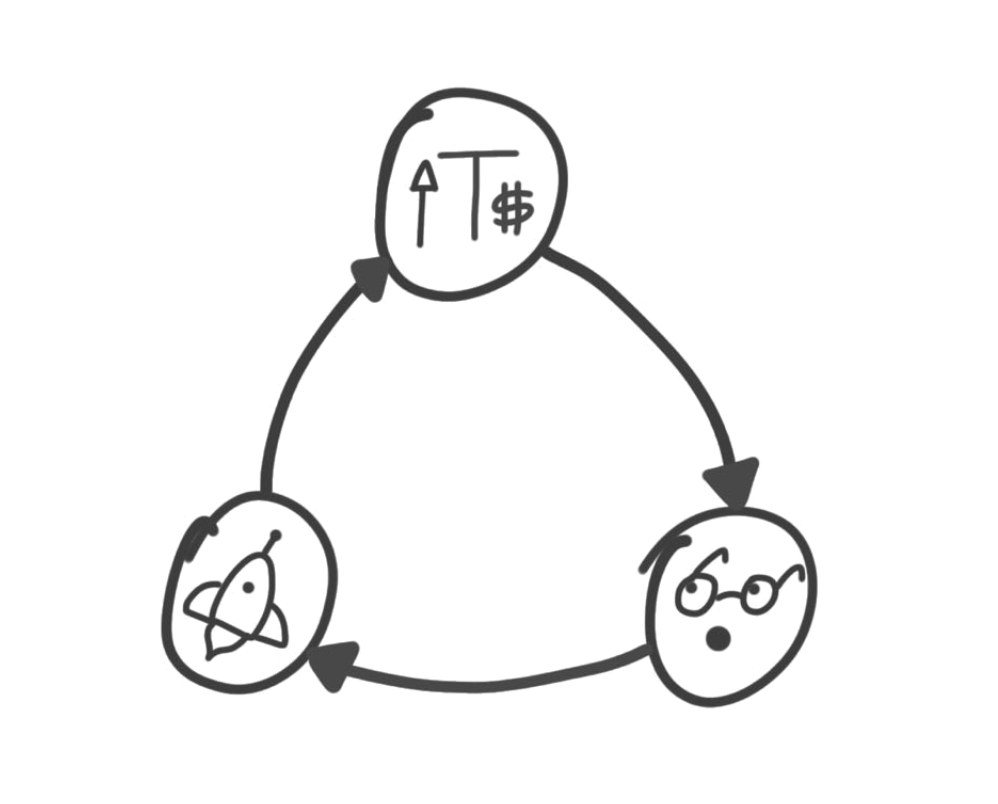

This allowed for a flywheel in which token price appreciation draws in more adopters of the network, and as more people adopt and build apps on the network the token increases in value, and the cycle continues.

This allowed for a flywheel in which token price appreciation draws in more adopters of the network, and as more people adopt and build apps on the network the token increases in value, and the cycle continues.

5/ Therefore, he argued that:

"... the market cap of the protocol always grows faster than the combined value of the applications built on top, since the success of the application layer drives further speculation at the protocol layer."

"... the market cap of the protocol always grows faster than the combined value of the applications built on top, since the success of the application layer drives further speculation at the protocol layer."

6/ While this has been true thus far, with $ETH and $BTC as the largest crypto assets and other base layer tokens such as $AVAX, $SOL, and $MATIC having incredible performances over the past cycle, this paradigm is very quickly changing.

7/ The base layers accrued all the value up to this point because, while people saw the immense potential of things like DeFi and NFTs, no individual application reached large enough product-market fit to compete at the level of Web 2 applications or fin-tech products

8/ Therefore, these base-layer tokens ( $ETH, $SOL, $AVAX ) became a way to bet on the future growth of a chain's economy while being uncertain of which individual applications actually come out as winners.

9/ We are finally reaching an inflection point in which applications are coming into their own.

Uniswap has rivaled volume from Coinbase, OpenSea is a household name, and Synthetix and GMX are constantly raking in more daily fees than the entire Bitcoin network.

Uniswap has rivaled volume from Coinbase, OpenSea is a household name, and Synthetix and GMX are constantly raking in more daily fees than the entire Bitcoin network.

10/ We are also seeing a shift to a world in which cash flow is king.

Fees and revenue generated have become the new scoreboard, as opposed to TVL which can be heavily manipulated (as seen through Ian Macalinao on Solana).

Fees and revenue generated have become the new scoreboard, as opposed to TVL which can be heavily manipulated (as seen through Ian Macalinao on Solana).

11/ Cash flow can also be an exact measure for where value accrues along the transaction pipeline.

For example: when a user trades $100,000 on an L2 DEX and pays $0.50 network transaction fees but $300 in exchange fees, it's clear which layer accrued more value.

For example: when a user trades $100,000 on an L2 DEX and pays $0.50 network transaction fees but $300 in exchange fees, it's clear which layer accrued more value.

12/ Beyond direct cash flow, most of the base protocol value accrual stems from MEV extraction. Applications have already begun to design methods to mitigate or absorb the value of this MEV.

Good examples of this currently include CowSwap's CoW, and Manifold Finance's OpenMEV.

Good examples of this currently include CowSwap's CoW, and Manifold Finance's OpenMEV.

13/ And while an open and permissionless network does allow for greater competition and better UX, this does not mean that applications can't build moats in liquidity and user retention.

Do you think someone could fork Uniswap or Aave right now and directly compete on Ethereum?

Do you think someone could fork Uniswap or Aave right now and directly compete on Ethereum?

14/ By reaching what is effectively an "unforkable state," these applications don't need to have their fees converge to zero, because users are willing to pay for the distinct value they provide.

15/ This is not to say that networks won't accrue value the more applications are built on them, there is simply a window for individual applications to accrue more.

This is especially true in an L2 environment or for L1s where network fees are extremely low.

This is especially true in an L2 environment or for L1s where network fees are extremely low.

16/ Therefore, as applications continue to grow their user base, create moats, increase revenue, and ultimately achieve product-market fit, we will start to see a world in which applications accrue more value than the networks themselves.

Thus, the "Fat App Thesis" is born.

Thus, the "Fat App Thesis" is born.

• • •

Missing some Tweet in this thread? You can try to

force a refresh