Well @binance and @FTX_Official are officially at war with each other.

What most people don't realize is that this conflict has been brewing since 2019.

Here's the complete history of how we got to this point and why you should care

MUST READ 🧵

What most people don't realize is that this conflict has been brewing since 2019.

Here's the complete history of how we got to this point and why you should care

MUST READ 🧵

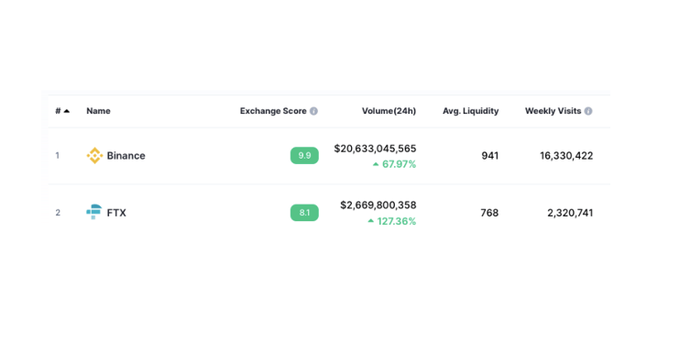

Back in 2017, @cz_binance founded @binance, and it quickly grew to be the largest centralized crypto exchange in the world.

Since it launched, many exchanges (Coinbase, BitMEX, Gemini, etc.) have unsuccessfully tried to take its crown.

Since it launched, many exchanges (Coinbase, BitMEX, Gemini, etc.) have unsuccessfully tried to take its crown.

In May of 2019, a new player entered the space when

@SBF_FTX founded @FTX_Official.

Immediately it was clear that these guys were on another level.

SBF had the smarts & the competitive drive to quickly rise to the top.

@SBF_FTX founded @FTX_Official.

Immediately it was clear that these guys were on another level.

SBF had the smarts & the competitive drive to quickly rise to the top.

CZ didn't build the largest crypto exchange by being lucky, he's an extremely smart person.

That is why he made the strategic decision to have Binance invest in FTX back in 2019.

It was also announced FTX would build institutional product offerings for the Binance ecosystem.

That is why he made the strategic decision to have Binance invest in FTX back in 2019.

It was also announced FTX would build institutional product offerings for the Binance ecosystem.

However, as FTX continued to rapidly grow during the last bull market, CZ sensed that they were becoming a threat.

That's why in 2021, Binance chose to divest from FTX during its $900 million funding round.

CZ called it a "normal investment cycle" but we now know it was more

That's why in 2021, Binance chose to divest from FTX during its $900 million funding round.

CZ called it a "normal investment cycle" but we now know it was more

Fast forward to 2022 and FTX is now the #2 exchange behind Binance.

While Binance still does 10x the volume of FTX, the rate of growth for FTX is surely alarming to CZ.

However, there's another reason CZ is worried...

While Binance still does 10x the volume of FTX, the rate of growth for FTX is surely alarming to CZ.

However, there's another reason CZ is worried...

It's no secret that SBF has grand ambitions, and he realizes the only way to maximize FTX's potential is by winning over regulators

That's why he is one of the biggest donors in not just crypto the industry, but in US politics overall

(He was the #2 donor to the Biden campaign)

That's why he is one of the biggest donors in not just crypto the industry, but in US politics overall

(He was the #2 donor to the Biden campaign)

SBF understands that in order to one day beat Binance, he needs to leverage US politics as a weapon.

And he also knows his angle. CZ was born in China & there are rumors of Chinese involvement with Binance.

As US<>China tensions rise, he has an angle to attack Binance.

And he also knows his angle. CZ was born in China & there are rumors of Chinese involvement with Binance.

As US<>China tensions rise, he has an angle to attack Binance.

However, CZ is not going down without a fight. And he recently got the opening he needed to strike back.

There were 2 events in particular that opened SBF/FTX up to an attack from CZ/Binance:

There were 2 events in particular that opened SBF/FTX up to an attack from CZ/Binance:

1. The first was after SBF published proposals on crypto regulation.

These proposals were met with SEVERE backlash from the crypto industry, with many claiming that SBF was trying to kill DeFi & push for regulatory capture.

SBF was suddenly an "enemy of crypto"

These proposals were met with SEVERE backlash from the crypto industry, with many claiming that SBF was trying to kill DeFi & push for regulatory capture.

SBF was suddenly an "enemy of crypto"

2. @CoinDesk published a story which stated that much of the $14.6 billion in assets on the Alameda (FTX's investing arm) balance sheet, was actually its $FTT token that the company prints itself.

This meant that if $FTT price dropped, FTX itself could be at risk.

This meant that if $FTT price dropped, FTX itself could be at risk.

Regardless of whether or not the financial risks from $FTT were real or not, CZ had the angle he needed to make his attack.

As part of the divestment from FTX back in 2021, Binance had received $2.1 billion worth of $FTT & $BUSD.

Then CZ went on the offensive...

As part of the divestment from FTX back in 2021, Binance had received $2.1 billion worth of $FTT & $BUSD.

Then CZ went on the offensive...

It first started with a tweet by CZ this weekend, where he highlighted the fact that Binance held large amounts of $FTT and would be liquidating all of it.

This was an effective attack on FTX for 2 main reasons:

This was an effective attack on FTX for 2 main reasons:

https://twitter.com/cz_binance/status/1589283421704290306

1. It helped fuel the FUD narratives around FTX insolvency & it further framed FTX as being against crypto.

2. It would allow Binance to make a material impact on the $FTT price by selling their tokens.

2. It would allow Binance to make a material impact on the $FTT price by selling their tokens.

The result of CZ's tweet was an immediate drop in the price of $FTT.

Recognizing the risk, @carolinecapital and @SBF_FTX were quick to speak up.

Caroline offered to buy the $FTT via OTC trade & SBF called for the exchanges to "make love (and blockchain) not war."

Recognizing the risk, @carolinecapital and @SBF_FTX were quick to speak up.

Caroline offered to buy the $FTT via OTC trade & SBF called for the exchanges to "make love (and blockchain) not war."

However, it was clear that CZ had no desire to make peace.

He further stoked the FUD flames by highlighting a

@whale_alert transfer of $584M worth of $FTT & then later comparing FTX to LUNA:

He further stoked the FUD flames by highlighting a

@whale_alert transfer of $584M worth of $FTT & then later comparing FTX to LUNA:

https://twitter.com/cz_binance/status/1589374530413215744

The strategic brilliance behind CZ's attack was that he realized the current state of the industry.

After months of large firms (that were previously considered safe) becoming insolvent, crypto participants are mentally rattled.

Nobody wants to take any chances.

After months of large firms (that were previously considered safe) becoming insolvent, crypto participants are mentally rattled.

Nobody wants to take any chances.

As @lawmaster pointed out in a tweet, the logical move for prudent crypto investors is to withdraw funds from FTX, even if there's an extremely low chance of FTX insolvency:

https://twitter.com/lawmaster/status/1589482357018734592

The irony is that these fears and rumors could very well trigger a bank run on FTX that could actually become self-fulfilling.

Even if FTX doesn't go insolvent, there's no doubt they are going to be damaged by this attack.

And who stands to gain? Competitors like Binance.

Even if FTX doesn't go insolvent, there's no doubt they are going to be damaged by this attack.

And who stands to gain? Competitors like Binance.

So what does all of this mean for crypto industry participants?

Well the obvious risk is that this exchange war leads to FTX insolvency.

At this point that would be near catastrophic for the crypto industry given the size of FTX.

Well the obvious risk is that this exchange war leads to FTX insolvency.

At this point that would be near catastrophic for the crypto industry given the size of FTX.

There's a very good chance that FTX is able to weather this storm.

However, it's clear that the gloves are off between Binance and FTX.

This will almost certainly not be the end of their battle, and I fear of collateral damage that could occur from it.

However, it's clear that the gloves are off between Binance and FTX.

This will almost certainly not be the end of their battle, and I fear of collateral damage that could occur from it.

Fans of the series Game of Thrones, will recognize the quote "Chaos is a ladder"

Both CZ & SBF know the game that they are playing, and will do ANYTHING they can do to climb.

We as a crypto community need to reject these sorts of players as they go against the ethos of crypto.

Both CZ & SBF know the game that they are playing, and will do ANYTHING they can do to climb.

We as a crypto community need to reject these sorts of players as they go against the ethos of crypto.

If you enjoyed this thread, you can read my complete breakdown in today's edition of the @web3pills daily newsletter:

web3pills.com/p/battle-crypt…

web3pills.com/p/battle-crypt…

For those keeping up with this evolving story. I just posted a new thread with today's developments 👇

https://twitter.com/alex_valaitis/status/1590117376200441857?s=20&t=vZl8XT3MPdE13yVXLMSeIQ

• • •

Missing some Tweet in this thread? You can try to

force a refresh