a16z published their state of crypto report last month.

It’s a 50+ slide presentation that outlines where we are in Crypto’s lifecycle and what the future holds.

The presentation is long, but I read through it so you don’t have to.

Here are my takeaways.

A thread 🧵

It’s a 50+ slide presentation that outlines where we are in Crypto’s lifecycle and what the future holds.

The presentation is long, but I read through it so you don’t have to.

Here are my takeaways.

A thread 🧵

1. NFTs are becoming mainstream and that’s great for creators.

NFTs were a huge narrative in 2021. We saw pictures of Apes selling for millions of dollars.

A lot of what went on in the NFT space is unsustainable. Most projects that exist now will inevitably go to 0.

NFTs were a huge narrative in 2021. We saw pictures of Apes selling for millions of dollars.

A lot of what went on in the NFT space is unsustainable. Most projects that exist now will inevitably go to 0.

But NFTs are more that just monkey pictures.

They have countless applications, and they’re going to play a key role in the creator economy.

They have countless applications, and they’re going to play a key role in the creator economy.

2. Crypto will have a huge impact on financial systems

1.7 billion people don’t have bank accounts.

Demand for decentralized finance or DeFi and digital dollars has increased dramatically.

DeFi has the potential to solve these issues.

1.7 billion people don’t have bank accounts.

Demand for decentralized finance or DeFi and digital dollars has increased dramatically.

DeFi has the potential to solve these issues.

There are a lot of potential use cases, but DeFi is still really early. Lending protocols and token exchanges are the most common use cases.

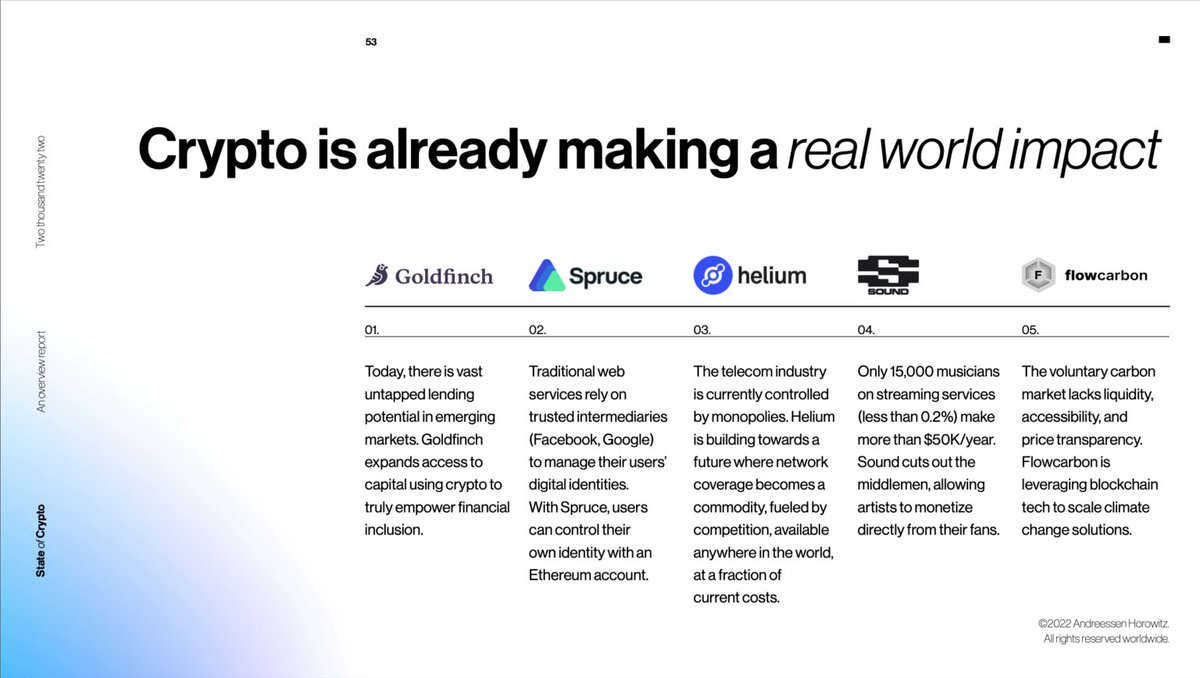

The use cases aren’t limited to the broken financial system. Web3 can do so much more.

Crypto is addressing other broken marketplaces, too.

Crypto is addressing other broken marketplaces, too.

3. Ethereum is the leading blockchain, but competition is catching up

Ethereum was the first to introduce smart contracts. Being early has allowed it to create a huge network affect.

Ethereum has far and away the most builders, but other platforms are starting to emerge.

Ethereum was the first to introduce smart contracts. Being early has allowed it to create a huge network affect.

Ethereum has far and away the most builders, but other platforms are starting to emerge.

Ethereum’s popularity is a double-edged sword. Ethereum prioritized decentralization over scaling.

This opened the door for other blockchains to swoop in and attract users with lower fees and better performance.

This opened the door for other blockchains to swoop in and attract users with lower fees and better performance.

4. The Future is Cross-chain

Bridges and cross-chain infrastructure is taking off. It's clear that one single chain cannot accomplish everything we want to be able to in Web3.

Bridges and cross-chain infrastructure is taking off. It's clear that one single chain cannot accomplish everything we want to be able to in Web3.

5. L2s could be the answer to Ethereum’s scaling issues

Rollups are growing in popularity. They’re cheaper and more efficient than writing directly to the blockchain.

@VitalikButerin is one person that believes that L2s are going to be key to the future of crypto.

Rollups are growing in popularity. They’re cheaper and more efficient than writing directly to the blockchain.

@VitalikButerin is one person that believes that L2s are going to be key to the future of crypto.

6. Web3 gaming could be huge

We haven’t seen many good Web3 games yet. Most of them have sucked.

That’s because it takes time to build a good game.

There was a lot of money being pumped into crypto, and teams were under pressure to put out products.

We haven’t seen many good Web3 games yet. Most of them have sucked.

That’s because it takes time to build a good game.

There was a lot of money being pumped into crypto, and teams were under pressure to put out products.

This led to underdeveloped games that were not thought out well

We’re going to see people invest more time and money into creating good Web3 games and that opens a treasure trove of opportunities.

We’re going to see people invest more time and money into creating good Web3 games and that opens a treasure trove of opportunities.

7. DAOs could be the biggest entities we see in the future

They give people the ability and freedom to create things make collective financial decisions

There are already some huge DAOs and some great stories. @Uniswap, @OlympusDAO, and @GnosisDAO to name a few.

They give people the ability and freedom to create things make collective financial decisions

There are already some huge DAOs and some great stories. @Uniswap, @OlympusDAO, and @GnosisDAO to name a few.

Remember Constitution DAO. We’re going to see a lot more similar stories over the next few years.

8. We’re in the middle of the fourth crypto market cycle

Crypto can be volatile and its cycles seem chaotic, but there appears to be some underlying logic.

Crypto can be volatile and its cycles seem chaotic, but there appears to be some underlying logic.

@cdixon and @eddylazzarin wrote a great article about the Crypto Price-Innovation Cycle:

a16z.com/2020/05/15/the…

a16z.com/2020/05/15/the…

Essentially, prices are a hook. As prices rise, crypto interest rises. This drives ideas and activity, leading to innovation.

Benjamin Graham once said “It’s best to pay no mind to “Mr. Market”, who frequently boomerangs from exuberance and euphoria to despair and depression.”

Don’t step away if you believe in Web3. You could miss out on the opportunity of a lifetime.

Don’t step away if you believe in Web3. You could miss out on the opportunity of a lifetime.

Imagine if people swore off the internet after the dotcom crash.

So much great technology has emerged since then. We wouldn’t have streaming, cloud services, or social media.

So much great technology has emerged since then. We wouldn’t have streaming, cloud services, or social media.

For some further context, Amazon shares traded below 10 dollars following the dotcom crash.

Even with the market down right now, that share would be worth over $2000 today.

Web3 could be a very similar story.

Even with the market down right now, that share would be worth over $2000 today.

Web3 could be a very similar story.

9. We’re Still Early

@a16z estimate there are somewhere between 7 million and 50 million active Ethereum, based on various on-chain metrics.

We’re around where the internet was in 1995, in terms of adoption.

@a16z estimate there are somewhere between 7 million and 50 million active Ethereum, based on various on-chain metrics.

We’re around where the internet was in 1995, in terms of adoption.

That is extremely early. We’re yet to hit mainstream adoption.

Most people have hear of crypto but don’t use it. Fewer make use of DeFi and dApps.

Most people have hear of crypto but don’t use it. Fewer make use of DeFi and dApps.

Web3 has so much potential. It could help creators, solve systematic issues in finance, and change the way we make decisions collectively.

Web3 has the potential to change the world. The technology is still extremely nascent, and we’re just beginning to scratch the surface.

Web3 has the potential to change the world. The technology is still extremely nascent, and we’re just beginning to scratch the surface.

And those were my takeaways. The report has a lot of useful insights, and I recommend taking a look at the full report:

a16zcrypto.com/wp-content/upl…

a16zcrypto.com/wp-content/upl…

I hope you found this useful. If you did please retweet and share the top tweet:

https://twitter.com/cryptoPothu/status/1537886820490301442

Also checkout my substack for more great content:

pothu.substack.com

pothu.substack.com

I realize this thread is almost as long as the deck 😅.

I got caught up in adding my insights.

I got caught up in adding my insights.

• • •

Missing some Tweet in this thread? You can try to

force a refresh