Migration towards Defi Exchanges- Like WFH, it was always going to happen, but this is the Covid accelerant moment.

At Selini Capital we have many HFT veterans amongst us, with an intricate understanding of market microstructure.

Lessons that are guiding us on evaluating DEXes:

At Selini Capital we have many HFT veterans amongst us, with an intricate understanding of market microstructure.

Lessons that are guiding us on evaluating DEXes:

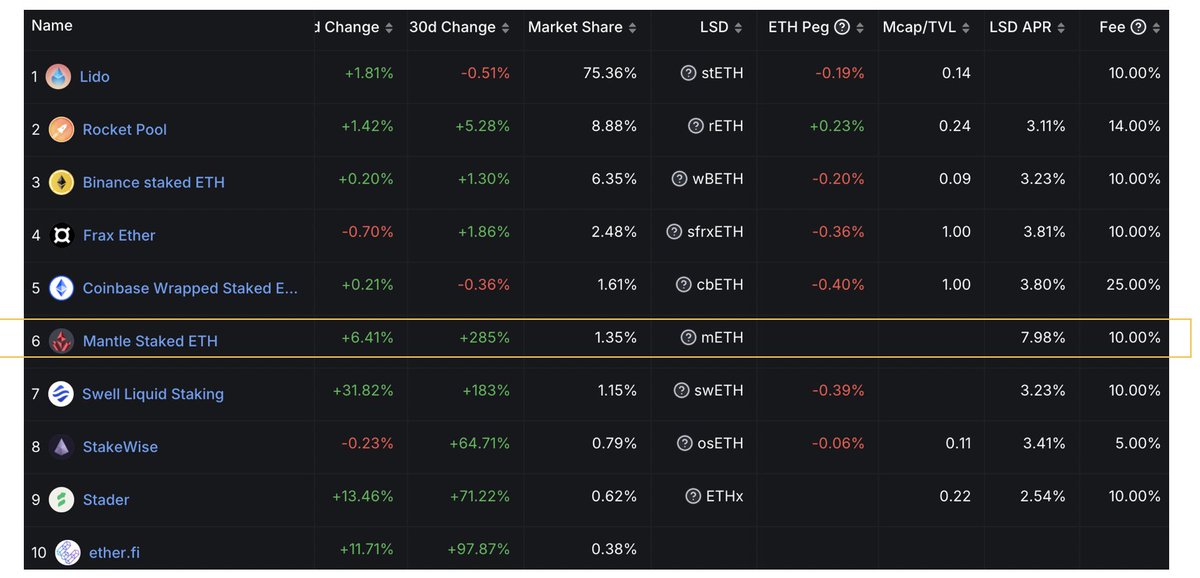

AMMs:

A cool but naive primitive.

Price discovery kills LPs with poorly named "impermanent" losses

Uni v2 very capital inefficient. Uni v3 killer for non-experts to MM, and worse than order book style

Not bad for stableswaps and long-tail Daos wanting to own their liquidity.

A cool but naive primitive.

Price discovery kills LPs with poorly named "impermanent" losses

Uni v2 very capital inefficient. Uni v3 killer for non-experts to MM, and worse than order book style

Not bad for stableswaps and long-tail Daos wanting to own their liquidity.

Oracle-Based exchanges:

There are no real MMs- this means no price discovery is happening there (unless its an exploit!).

They piggy back of centralized exchange market makers e.g. Binance etc.

Clever short but not scalable, and not part of the Defi Vision.

Sorry, just facts.

There are no real MMs- this means no price discovery is happening there (unless its an exploit!).

They piggy back of centralized exchange market makers e.g. Binance etc.

Clever short but not scalable, and not part of the Defi Vision.

Sorry, just facts.

CLOBs:

This is the only real long term solution for efficient price discovery to happen on-chain.

The issue is if you have the matching engine fully onchain it requires huge throughput that's not easily feasible yet.

And if you have it offchain you aren't fully decentralized.

This is the only real long term solution for efficient price discovery to happen on-chain.

The issue is if you have the matching engine fully onchain it requires huge throughput that's not easily feasible yet.

And if you have it offchain you aren't fully decentralized.

We are interested to see the innovation coming in the immediate months/years on this side.

dYdX is the leader rn, and we support their liquidity depth (disclaimer: we are not an investor, but hold some tokens and will stack more).

dYdX is the leader rn, and we support their liquidity depth (disclaimer: we are not an investor, but hold some tokens and will stack more).

Their matching engine is offchain at the moment (Starkware on top of Ethereum). They are trying to be more decentralized and move to their own app-chain on Cosmos, to hopefully have enough throughput to allow more decentralization.

Will they succeed?

Not sure, its a hard task.

Will they succeed?

Not sure, its a hard task.

But its what we have to move towards, and Selini will help support liquidity in serious projects moving in this direction and help figure out the warts and edge cases that will inevitably come up.

Hopefully in 5 years we look back at FTX model like we look at caveman tools..

Hopefully in 5 years we look back at FTX model like we look at caveman tools..

• • •

Missing some Tweet in this thread? You can try to

force a refresh