As MEV is becoming even more important in PoS Ethereum, Flashbots is about to release mev-boost, a neutral middleware that allows any builder to openly compete in making the best blocks. This is great for validators, staking pools, and Ethereum itself.

writings.flashbots.net/writings/why-r…

writings.flashbots.net/writings/why-r…

Block production consists of (1) building the best block from all available transactions, and (2) proposing this block to the network. The increasing difficulty of block building due to MEV is a centralizing force in Ethereum and the solution is to separate the two roles cleanly.

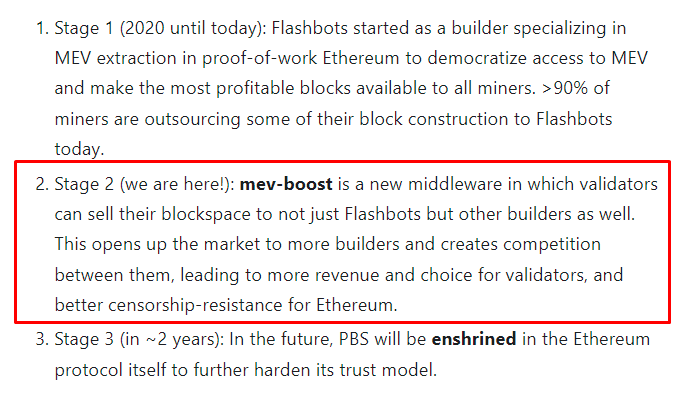

mev-boost, which can be seen as Stage 2 PBS, is good for many reasons.

An open market between builders maximizes revenue for validators.

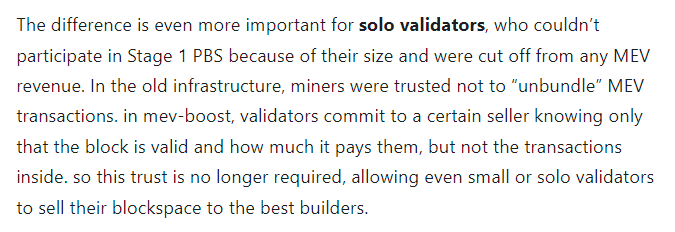

But mev-boost will especially help solo validators, who were too small to participate in Stage 1 PBS.

An open market between builders maximizes revenue for validators.

But mev-boost will especially help solo validators, who were too small to participate in Stage 1 PBS.

Going from a 1-to-many builder world can also increase Ethereum's censorship resistance.

Finally, we expect some builders to compete on features like account abstraction, privacy, paying MEV back to users, and more!

Finally, we expect some builders to compete on features like account abstraction, privacy, paying MEV back to users, and more!

But I think the most underrated aspect of mev-boost is that it is completely neutral infrastructure.

While not everyone was agreeing with Flashbots' mev-auction approach, builders in mev-boost can use any ordering approach they want, and we expect users to vote with their feet.

While not everyone was agreeing with Flashbots' mev-auction approach, builders in mev-boost can use any ordering approach they want, and we expect users to vote with their feet.

Unlike Stage 1 PBS where all participating miners had to run mev-geth, mev-boost will also work with any client. This supports Ethereum's goal of increased client diversity.

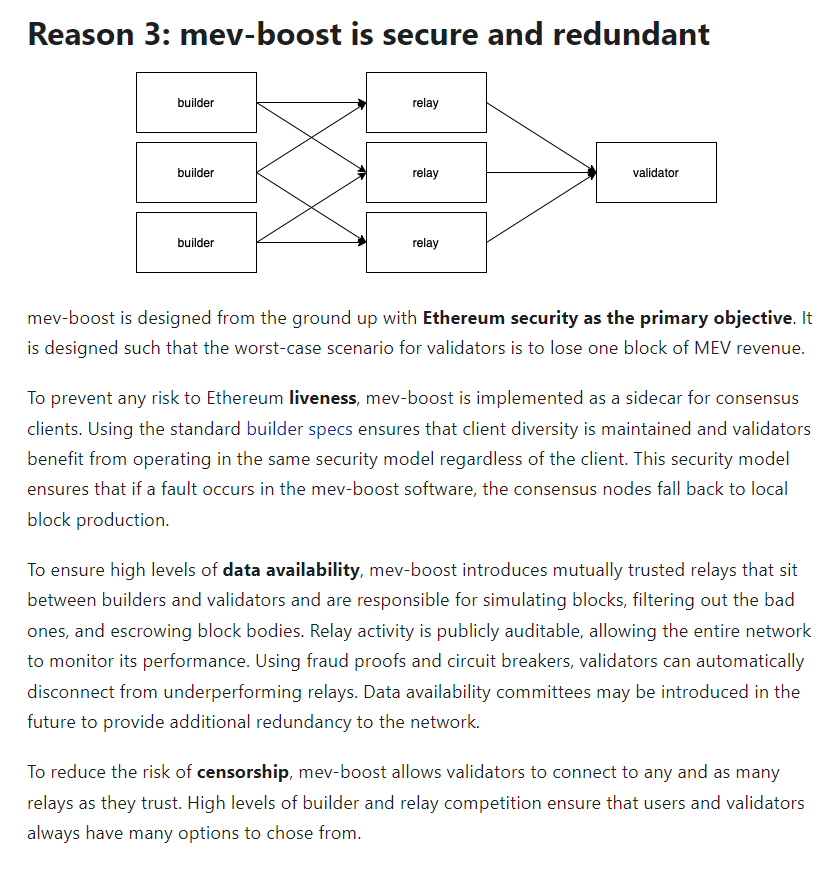

In terms of security, mev-boost is designed from the ground up for maximum security and redundancy. This matters to Ethereum but also to participating validators.

While the goal is to move to Stage 3 PBS, there are good reasons to move ahead with an out-of-protocol solution for now.

mev-boost is an important interim step that allows us to gather data and iterate toward the winning design before enshrining it in Ethereum itself.

mev-boost is an important interim step that allows us to gather data and iterate toward the winning design before enshrining it in Ethereum itself.

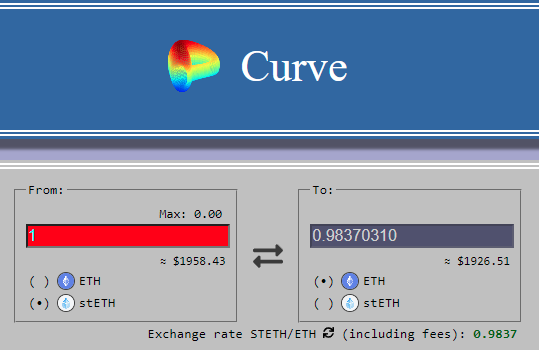

A final benefit is that mev-boost addresses a problem that all staking pools like Lido, Rocketpool, Alluvial, etc., have: their node operators are incentivized to hide the true value of blocks from the user!

mev-boost is an oracle for how much blocks are actually worth.

mev-boost is an oracle for how much blocks are actually worth.

Lastly, there are risks we need to stay vigilant of.

While Stage 3 PBS will solve the need for mutually trusted relays, builder centralization can be a bigger issue in the future. mev-boost is taking an important step by making competition between builders as easy as possible.

While Stage 3 PBS will solve the need for mutually trusted relays, builder centralization can be a bigger issue in the future. mev-boost is taking an important step by making competition between builders as easy as possible.

This article is written by me and @thegostep, my first for Flashbots. Expect more frequent writing going forward 🙂

Check out the full article: writings.flashbots.net/writings/why-r…

• • •

Missing some Tweet in this thread? You can try to

force a refresh