Let's address the question everyone will be asking you this Thanksgiving:

"How will investors ever look at crypto again after FTX?"

Here's the answer without invoking any nonsense.

How to defend crypto with integrity this week:

↓

"How will investors ever look at crypto again after FTX?"

Here's the answer without invoking any nonsense.

How to defend crypto with integrity this week:

↓

First off, I think it’s very hard for the general public to separate "crypto," as in:

"Distributed ledger technology" and other terms that are complete gibberish to normal folk

from the massive edifice of grift that was built on top of it, as in:

"FTX and all the other scams."

"Distributed ledger technology" and other terms that are complete gibberish to normal folk

from the massive edifice of grift that was built on top of it, as in:

"FTX and all the other scams."

So a bad starting point would be:

"Well to understand distributed systems we need to talk about the Byzantine generals problem..."

and before long you're talking about Merkle Patricia Tries and hashing algorithms and self-custody and...

YAWN. HOW IS IT NOT A SCAM?

"Well to understand distributed systems we need to talk about the Byzantine generals problem..."

and before long you're talking about Merkle Patricia Tries and hashing algorithms and self-custody and...

YAWN. HOW IS IT NOT A SCAM?

Not everyone has been nerd-sniped by this industry.

So it's beyond reasonable to conflate crypto as technology with "all the shady garbage done in association with 'crypto.'"

So it's beyond reasonable to conflate crypto as technology with "all the shady garbage done in association with 'crypto.'"

And if we take them together, then yeah I don’t think “crypto” should ever recover.

We should hope not.

We should hope not.

But then how to justify "crypto's" existence?

Well the distinction between technology and scam becomes clear when we focus on FTX specifically:

FTX could have been an exchange for roughly ANY commodity.

Well the distinction between technology and scam becomes clear when we focus on FTX specifically:

FTX could have been an exchange for roughly ANY commodity.

To paraphrase SBF himself, it could've been an exchange for bananas!

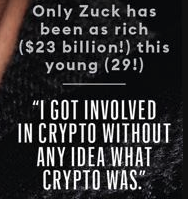

Sam didn't care about crypto-as-tech, only crypto-as-scam.

Here's his Forbes cover:

Sam didn't care about crypto-as-tech, only crypto-as-scam.

Here's his Forbes cover:

The real question is:

Did crypto ~uniquely~ enable the fraud that is FTX?

For the FTX scam to occur, was crypto necessary? Was it sufficient?

Did crypto ~uniquely~ enable the fraud that is FTX?

For the FTX scam to occur, was crypto necessary? Was it sufficient?

Because if FTX was fully and solely reliant on crypto, and regulators, investors, and users believe so--then we should put a bullet in "crypto's" head and call it a day.

But to me the answer is obviously: no, this wasn't uniquely a "crypto" scam.

Meaning "crypto" (and we'll have to define "crypto" at some point but bear with me) was responsible for ~10% of the grift.

Meaning "crypto" (and we'll have to define "crypto" at some point but bear with me) was responsible for ~10% of the grift.

"Crypto's" role was first and foremost being a speculative asset.

Which puts it in good company among other 2021 winners like:

- EV SPACs

- SaaS

- Cloud infra

- Teleconferencing

- Subscription stationary bicycle companies

That doesn't make crypto special.

Which puts it in good company among other 2021 winners like:

- EV SPACs

- SaaS

- Cloud infra

- Teleconferencing

- Subscription stationary bicycle companies

That doesn't make crypto special.

But it did:

1) Make smart Silicon Valley investors think that FTX's reported numbers were believable, since an exchange built on top of a speculative fervor looks like a promising money printer

and

2) Facilitate an accounting grift

Let's take each in turn:

1) Make smart Silicon Valley investors think that FTX's reported numbers were believable, since an exchange built on top of a speculative fervor looks like a promising money printer

and

2) Facilitate an accounting grift

Let's take each in turn:

First is the way "crypto" tricked investors into investing in a speculative mania.

But the things is, VCs and crossover investors weren't tricked by "crypto" any more than tech writ large.

Tiger lost $17 billion in the first months of 2022!

fortune.com/2022/05/10/tig…

But the things is, VCs and crossover investors weren't tricked by "crypto" any more than tech writ large.

Tiger lost $17 billion in the first months of 2022!

fortune.com/2022/05/10/tig…

They probably wrote something like this in their investment memos for FTX:

“'Crypto’ is an emerging asset class with an uncertain path to adoption, but boy are a lot of people trading it!

Today we're investing in one of the biggest picks-and-shovels businesses for trading.”

“'Crypto’ is an emerging asset class with an uncertain path to adoption, but boy are a lot of people trading it!

Today we're investing in one of the biggest picks-and-shovels businesses for trading.”

Which is kind of like, wild reasoning if you really think hard about it.

Because the value FTX's investors saw in crypto WAS the speculation:

Because the value FTX's investors saw in crypto WAS the speculation:

"Hey there are a bunch of people trading Pokemon cards.

We think Pokemon cards might be pretty dumb and worthless, and the people trading them are degenerates.

BUT we do think the infrastructure that facilitates the exchange of those cards could be a great business!"

We think Pokemon cards might be pretty dumb and worthless, and the people trading them are degenerates.

BUT we do think the infrastructure that facilitates the exchange of those cards could be a great business!"

But that's the *job* of risk capital.

Speculation (with some conviction) is the whole damn game.

FTX didn't go to -$1 trillion. It just went to 0.

I promise you Sand Hill Road isn't looking at this 0 and going, "Shit, guess the whole business of taking risk isn't working out."

Speculation (with some conviction) is the whole damn game.

FTX didn't go to -$1 trillion. It just went to 0.

I promise you Sand Hill Road isn't looking at this 0 and going, "Shit, guess the whole business of taking risk isn't working out."

The second way "crypto" might have played a role is the way in which facilitated the accounting fraud.

Which has two components, and you have to decompose the seriousness of both:

Which has two components, and you have to decompose the seriousness of both:

1) Hiring Prager Metis, the “first metaverse accounting firm with an office in Decentraland” to audit your books.

Prager may have been a perfectly legitimate auditor just like BCG may have been a perfectly legit firm to conduct due diligence.

But legitimate != competent.

Prager may have been a perfectly legitimate auditor just like BCG may have been a perfectly legit firm to conduct due diligence.

But legitimate != competent.

2) Having hired them, convincing said firm that your completely fraudulent balance sheet full of illiquid fantasy coins is legitimate.

Note that (2) is contingent on (1), meaning it's a lot easier to convince a bad auditor of bad books than a good auditor of the same.

Note that (2) is contingent on (1), meaning it's a lot easier to convince a bad auditor of bad books than a good auditor of the same.

So if I had to rate the contributions of (1) picking bad auditors and (2) convincing them I haven't cooked the books, I'd say (1) does 90% of the work.

Hiring an at best clueless, at worst fraud-enabling auditor does most of the job here.

Hiring an at best clueless, at worst fraud-enabling auditor does most of the job here.

And believe me, I'm of the firm belief that SBF used all the illiquid circulating liquidity shitcoin "crypto" tricks in the book to fool the poor lads at Prager Metis and their own investors.

He is still the criminal.

He is still the criminal.

https://twitter.com/jonwu_/status/1590883261164638208

But ANY REASONABLE AUDITOR would still look at the supposed book value of digital assets and go “is this value realizable?"

They wouldn't just be like oh total assets > total liabilities, nothing to see here folks, let's move on.

They wouldn't just be like oh total assets > total liabilities, nothing to see here folks, let's move on.

Like let's say for instance you as a parent entity owned 90% of the equity of a related entity.

And you went to your auditors and said, “look I know we hold in treasury ~10x the circulating market cap of this other company, but it's worth exactly this amount, mark to market."

And you went to your auditors and said, “look I know we hold in treasury ~10x the circulating market cap of this other company, but it's worth exactly this amount, mark to market."

Would the auditors give you full value for the giant amount of illiquid shares you held?

Like, probably not, right?

Like, probably not, right?

They’d instead say something like:

"Hm, I’m not sure if you tried to sell 10x the circulating market cap of these tokens you’d get today’s value."

Any good auditor would do some analysis on what they think the price impact would be, and mark the value from there.

"Hm, I’m not sure if you tried to sell 10x the circulating market cap of these tokens you’d get today’s value."

Any good auditor would do some analysis on what they think the price impact would be, and mark the value from there.

They'd say "I’m not sure we can just take [market price] x [the amount you hold in treasury] and call it a day."

But Prager Metis, the first metaverse accounting firm may I remind you, might say such a thing!

But Prager Metis, the first metaverse accounting firm may I remind you, might say such a thing!

So with all that behind us, pretend it's now it's Thanksgiving.

You're gathered around the turkey and your dad or brother-in-law or whatever smart-ass in your family looks at you and smirks:

"So crypto is uninvestable now, right?"

You're gathered around the turkey and your dad or brother-in-law or whatever smart-ass in your family looks at you and smirks:

"So crypto is uninvestable now, right?"

And you say:

Well put on your big boy shoes and pretend you're a huge, hyper legitimate platinum-reputation institutional investor like IVP, Sequoia, NEA, Lightspeed, SoftBank, Tiger, Temasek, Ontario Teachers' etc.

Well put on your big boy shoes and pretend you're a huge, hyper legitimate platinum-reputation institutional investor like IVP, Sequoia, NEA, Lightspeed, SoftBank, Tiger, Temasek, Ontario Teachers' etc.

Do you actually look at what happened with FTX and go “Wow crypto is a fucking scam, stay away forever"?

Or if you're REMOTELY INTELLECTUALLY HONEST and good at your job, do you say:

“We got a little too high on the speculation narrative and funded a uniquely bad dude."

But I'm a huge asset manager and my fund is okay, and I learned a hard lesson.

Onwards!"

“We got a little too high on the speculation narrative and funded a uniquely bad dude."

But I'm a huge asset manager and my fund is okay, and I learned a hard lesson.

Onwards!"

Does FTX make you:

a) blame "crypto" as an asset class and render you somehow even more averse to crypto as tech?

or

b) blame this one specific ~generational~ psychopath and your own faulty diligence

a) blame "crypto" as an asset class and render you somehow even more averse to crypto as tech?

or

b) blame this one specific ~generational~ psychopath and your own faulty diligence

We can disagree about it, but I think you clearly blame Sam, this specific company thesis, and the specific circumstances enabling this fraud.

Investors will lick their wounds.

Venture has $290 BILLION of dry powder to deploy. A huge sum has been earmarked for crypto.

Once they explain to LP’s why this will Never, Ever Happen Again Or So I Swear To Carried Interest, they'll be back.

Crypto is far from dead.

Venture has $290 BILLION of dry powder to deploy. A huge sum has been earmarked for crypto.

Once they explain to LP’s why this will Never, Ever Happen Again Or So I Swear To Carried Interest, they'll be back.

Crypto is far from dead.

Shoot me a follow if this gave you something to bring to Thanksgiving other than soggy stuffing: @jonwu_

If you want to get more of my writing, sign up for my e-mail list at fortyiq.com

If you want to get more of my writing, sign up for my e-mail list at fortyiq.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh