Rocket Pool: the scaling thread.

tl;dr: @Rocket_Pool is quietly building at least 3 massive scaling solutions that will enable it to have ~1000x growth and easily compete at scale with Lido. 1/

tl;dr: @Rocket_Pool is quietly building at least 3 massive scaling solutions that will enable it to have ~1000x growth and easily compete at scale with Lido. 1/

Don’t sleep on it. The bear market is for buidlers and we can do better than what the incumbents offer. 🚀 2/

First, context. Rocket Pool is objectively the best liquid staking product on the market, by being purely decentralized, permissionless, non-rent seeking, and focused solely on Ethereum. Lido is 0/4 here and we desperately need competitive staking protocols like RP to step up. 3/

Here’s the landscape today. Not great. In fact it’s really terrible. Thankfully the path forward is with technology, and not marketing or cutting corners. 4/

Rocket Pool has a tech advantage, but has been growth-limited by capital inefficiency since each node operator currently has to carry 110-250% collateral on the underlying. Despite that they’ve grown to a 1.5% marketshare despite being late to market. 5/

Scaling concerns are about to go to 0. Here’s what’s in the works. IMO each of these 3 ideas is a ~10x in terms of scalability.

Imagine Rocket Pool not as it is today, but with 3 orders of magnitude in scaling. Enough to scale up to any size of self-imposed limit. 6/

Imagine Rocket Pool not as it is today, but with 3 orders of magnitude in scaling. Enough to scale up to any size of self-imposed limit. 6/

#1: Less ETH bonded minipools (LEBs)

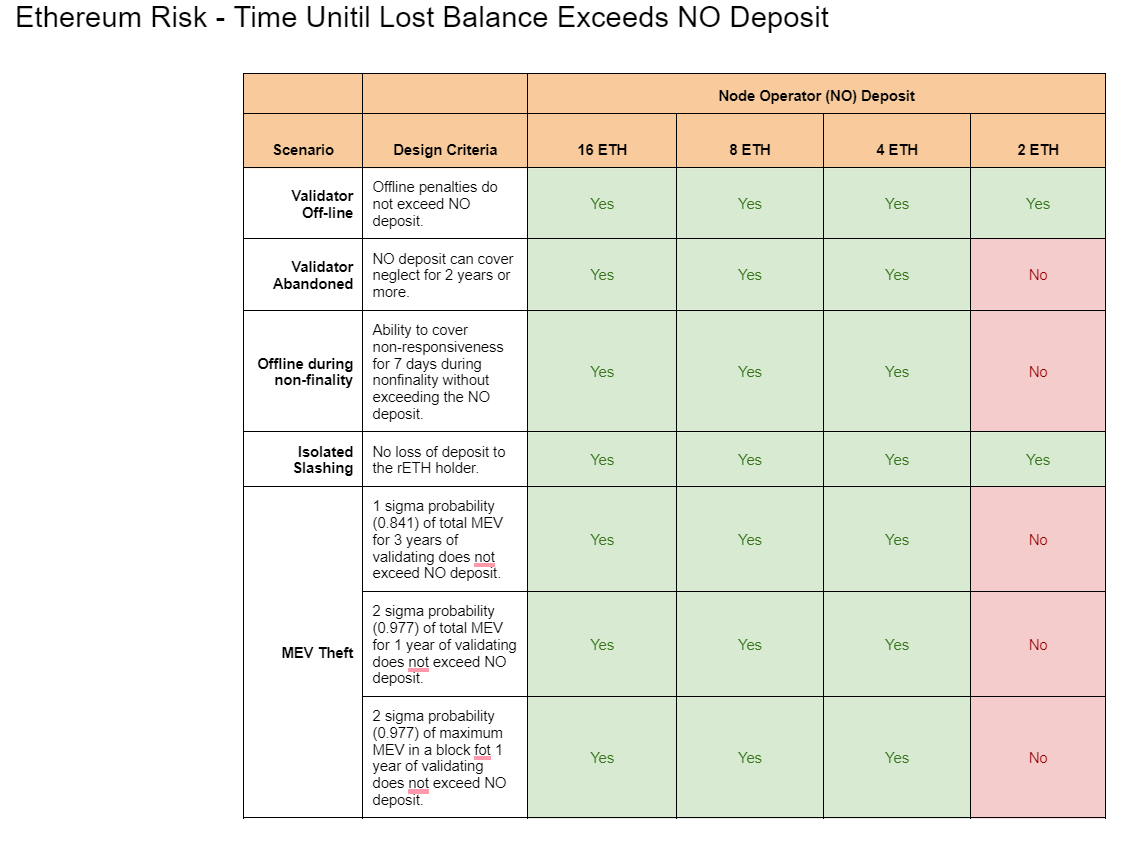

Research by @shtimseht has supported the idea of safely reducing the collateral requirement from 16 ETH down to as low as 4 ETH. The RP team is now refining the economic model and building this idea into a future contract iteration. 7/

Research by @shtimseht has supported the idea of safely reducing the collateral requirement from 16 ETH down to as low as 4 ETH. The RP team is now refining the economic model and building this idea into a future contract iteration. 7/

This would a) reduce collateral by 2-4x (enabling more participants), b) hugely increase node operator yield because they are able to charge commission on more rETH, and c) significantly increase the number of minted rETH per unit of TVL.

Simple and impactful. A Big Deal™. 8/

Simple and impactful. A Big Deal™. 8/

#2: Staking as a Service (SaaS)

SaaS will enable big fish to participate in staking in the most trust-minimized and yield-generative way currently available.

Credit to @langerstwit! 9/

SaaS will enable big fish to participate in staking in the most trust-minimized and yield-generative way currently available.

Credit to @langerstwit! 9/

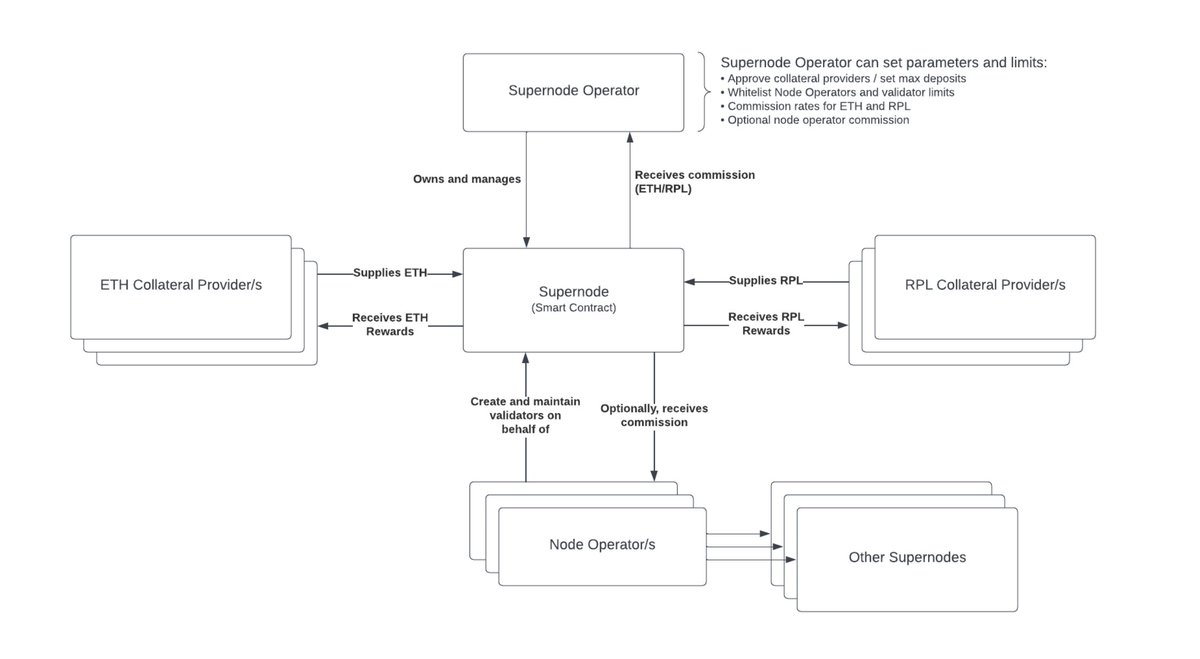

In particular, this caters to a new set of large scale operators including infrastructure companies, institutional custodians, high net worth individuals, financial services companies, enterprises, and treasuries. 10/

We already have companies on the sidelines ready to join as SaaS providers, including some big names you know… 👀 11/

In addition to supporting these big new market participants, it also unlocks novel new use cases. In particular it abstracts the node operation, ETH collateral, and RPL collateral into different layers. 12/

For example somebody could stake 100% ETH and split the commission with an RPL counterparty for the highest pure ETH yield in the market. 13/

This is a dream for the many ETH purists out there, who may not want to go long on the native protocol token (RPL).

It’s an evolution to the great whale marriage that I’ve worked on to support a few friends and their large-scale custody needs. 14/

It’s an evolution to the great whale marriage that I’ve worked on to support a few friends and their large-scale custody needs. 14/

#3: Integrated solo staker migration

As part of a credential update that’s expected in the Capella hard fork, Rocket Pool is able to offer a direct migration into their ecosystem, which would be higher yielding. 15/

github.com/ethereum/conse…

As part of a credential update that’s expected in the Capella hard fork, Rocket Pool is able to offer a direct migration into their ecosystem, which would be higher yielding. 15/

github.com/ethereum/conse…

Imagine large staking providers and individuals chasing yield and converting their existing validators en masse to Rocket Pool. 16/

The benefits to do so are actually really compelling: revenue smoothing (coming in ~2 months), higher yield, easier operation, enabling liquidity, etc. 17/

Perhaps just as importantly, it works synergistically with SaaS and provides an easy path for ETH to migrate to any number of large infra providers built on top of Rocket Pool. There’s an entire ecosystem that is going to be born out of this.

Credit to @jcrtp_eth. 👏 18/

Credit to @jcrtp_eth. 👏 18/

Here's some alpha for you.

All of these plans are hugely value-generative for RPL. In addition to backing the highest quality staking derivative, it also benefits from Merge tailwind effects, protocol growth, expected tech improvements, and improved tokenomics. 19/

All of these plans are hugely value-generative for RPL. In addition to backing the highest quality staking derivative, it also benefits from Merge tailwind effects, protocol growth, expected tech improvements, and improved tokenomics. 19/

It’s a form of leveraged ETH with strong downside protection from collateral requirements. I have entire essays written on how RPL is the pristine play for bear market conditions and post-Merge economics. 20/

If you believe me and want to take a speculative position or earn a higher ETH yield then you don’t own enough RPL.

But that’s a thread for another day. 21/

But that’s a thread for another day. 21/

Now let’s fast forward a year and imagine how things look. Withdrawals are enabled. 3 ~10x scaling solutions are live. Yields are way up. Staking is heavily de-risked. LSD pegs can be defended with arbitrage. 22/

And I haven’t even mentioned DVT, leveraged node staking, @NodeOperators, coming DeFi integrations, a higher ejection balance for more capital efficiency, @Bankless marketing campaign, future partnerships, etc.

Y'all haven't seen anything yet. 23/

Y'all haven't seen anything yet. 23/

*That’s* a rocket ship that you should take seriously. 🚀 24/Fin.

@Rocket_Pool @ryanberckmans, part of this thread was inspired by your talk on Unchained about limiting growth factors for RP.

Hopefully it's useful -- there's lots of ideas in the works. Capital inefficiency is very temporary, we just need to get the rETH flywheel moving.

Hopefully it's useful -- there's lots of ideas in the works. Capital inefficiency is very temporary, we just need to get the rETH flywheel moving.

• • •

Missing some Tweet in this thread? You can try to

force a refresh