28 principles for Web 3 founders.

Insights distilled from 100s of conversations & investments in crypto in the past 4 years.

Insights distilled from 100s of conversations & investments in crypto in the past 4 years.

1/ Ask not what you can build on a blockchain, but what use case you can improve 10x by building on one.

2/ Building a dapp doesn't absolve you of the need to think like a business owner.

3/ Shipping marginally improved versions of incumbents are not a product strategy.

4/ Skeumorphism is not a business strategy. <insert Web 2 idea>, but on a blockchain, is unlikely to be the basis for a scalable product.

5/ Run away from trends. If you’re building for DeFi or NFTs simply because they are in vogue, you will struggle eventually.

6/ Many otherwise smart founders focus too much on building products for 1,000 crypto native users.

7/ Tokens as rewards are a go-to-market strategy and a customer acquisition expenditure, not a business model.

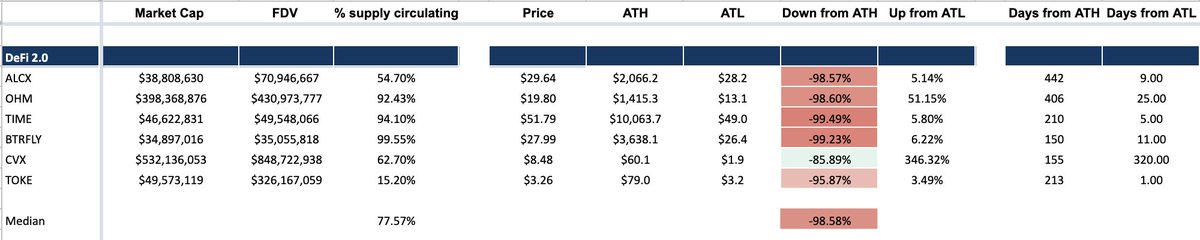

8/ Businesses that require continual growth in token price to work are ponzi schemes, not businesses.

9/ Credentialed founders often fall in the trap of scoffing at degens, only to wonder why no one uses their product.

10/ “Going multichain” is not a business strategy but lazy window dressing for retail investors.

11/ Crypto obsesses too much on ideas and not enough on processes. Good builders optimize products, great builders optimize processes.

12/ It you want to kill your growth, launch token governance before product maturity.

13/ Build to engage users, not to impress VCs. Half the founders in crypto forget this.

14/ Prefer 100 highly engaged users over 10,000 passive token holders.

15/ There are two communities: one that uses your product, and one that buys your token. Founders often mistakenly assume the two overlap more than they actually do.

16/ Only launch a token when you are ready to manage a public company.

17/ Founders tend to focus on refining token model when growth stalls. Optimizing for token models (ve- tokens / buy and burn) before you generate meaningful fees is time wasted.

18/ Token velocity seems like a myth in a bull market; it is often revealed to not be so in a bear market.

19/ Bad investors can’t kill your company, but good investors can help you go a long way (see thread on how NOT to raise funding)

https://twitter.com/mrjasonchoi/status/1449384111739523086?s=20&t=HKz0EyTzk3YAZzA6tOBlnQ

20/ Make +ve EV decisions. Funds raised are for growing your startup; the marginal 10-20% you make on farming with your treasury won't affect your success, but can bankrupt your company.

21/ If most of your users' activities are onchain, leverage that data to make educated business decisions. Too many teams neglect readily available user data.

22/ Because Crypto Twitter celebrates cults of personality, some founders assume they must build a prominent profile for their products to achieve success. This is false and reversed - popular products make prominent founders.

23/ It's not just about TVL.Have quantifiable metrics to aim for and constantly re-assess both the progress in reaching those metrics, and the suitability of said metrics as a proxy for growth.

24/ Be careful with confusing narratives with traction. The faster unearned value is accrued, the faster it will be destroyed.

25/ "Build it and they'll come" may work in a bull market but is never a scalable distribution strategy.

26/ Technical superiority alone almost NEVER wins.

27/ Do not underestimate the fickleness of retail consumers driven to your product for speculative reasons.

28/ Your early investors and users are the seeds of your community. Align your actions to attract the type of seeds you want.

29/ At @Tangent_xyz, we try to help our companies apply these daily. Those looking to build the next category-defining companies can come hear from founders and operators who have done it before:

tangent.ventures

tangent.ventures

• • •

Missing some Tweet in this thread? You can try to

force a refresh