The Definitive Thread on FTX

I met SBF before FTX started, and witnessed their rise and fall. I can't stand @nytimes's puff piece.

If anyone wants to know what happened, send them this.

I met SBF before FTX started, and witnessed their rise and fall. I can't stand @nytimes's puff piece.

If anyone wants to know what happened, send them this.

0/ The story of Alameda and FTX can best be summarized by @SBF_FTX's philosophy of betting big.

Every major decision they have made is related to acquiring more leverage - via deceptive fundraises, financial engineering, and ultimately, outright fraud, as we will see below.

Every major decision they have made is related to acquiring more leverage - via deceptive fundraises, financial engineering, and ultimately, outright fraud, as we will see below.

1/ In Nov 2018 - Jan 2019, a small hedge fund called Alameda Research was raising debt from investors, promising "HIGH RETURNS WITH NO RISK".

https://twitter.com/zhusu/status/1087622890592169989?s=20&t=9AKIj5uS7P1T3G7ZD5bmcQ

2/ Supposedly (and as far as I can recall), they had $5M in equity but trying to borrow $200M at 15% APY to finance their market making activities.

https://twitter.com/sumfattytuna/status/1591475020995624960?s=20&t=9AKIj5uS7P1T3G7ZD5bmcQ

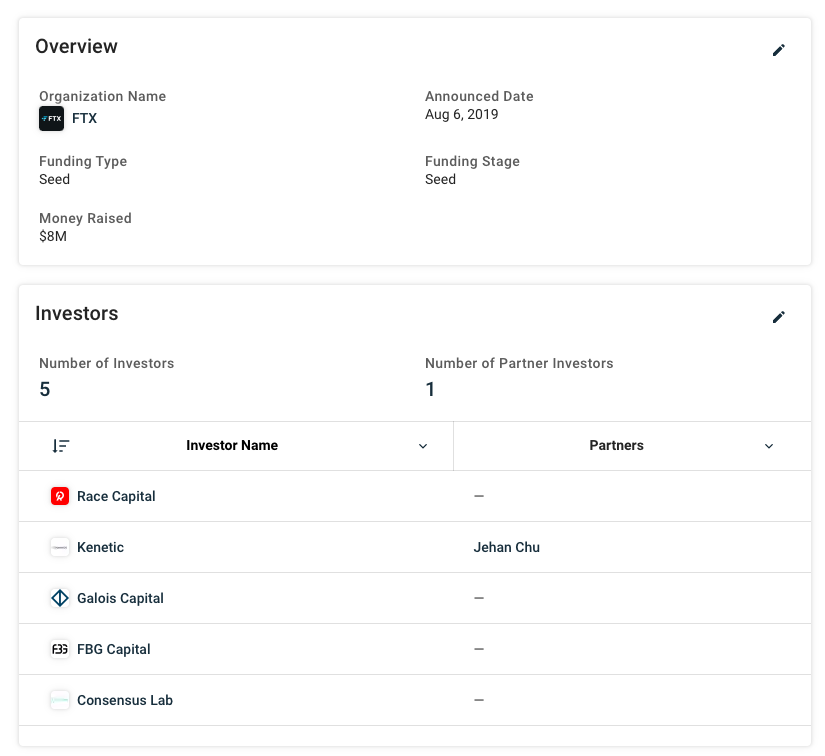

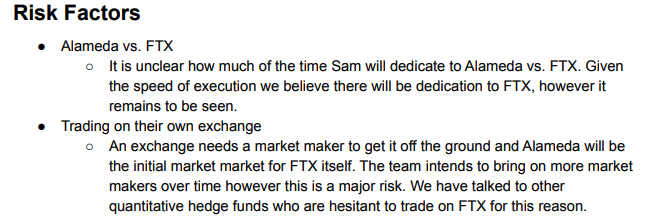

3/ Later that year, @FTX_Official planned a launch for July 2019 and closed a $8M seed from several funds, announced in August 2019.

In one investor's memo, "Alameda & FTX" is cited as a risk, as well as concerns around @SBF_FTX's personal split commitment between the two.

In one investor's memo, "Alameda & FTX" is cited as a risk, as well as concerns around @SBF_FTX's personal split commitment between the two.

4/ From my primary sources (who will remain undisclosed), @FTX_Official was allegedly started as an easy way to access capital by Alameda due to difficulties in raising for the latter.

This is unprovable short of leaking internal chats, so we'll leave that for the courts.

This is unprovable short of leaking internal chats, so we'll leave that for the courts.

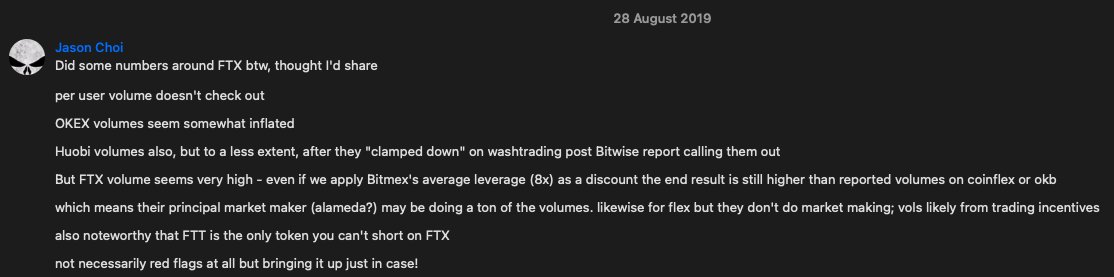

5/ In the early days, Alameda being a heavy portion of @FTX_Official's volumes was an open secret.

Employees told me Alameda has an exclusive API key that allows faster access than any user - offering a systematic way to profit off clients.

A message I sent to a FTX investor:

Employees told me Alameda has an exclusive API key that allows faster access than any user - offering a systematic way to profit off clients.

A message I sent to a FTX investor:

6/ Around September 2019, Alameda allegedly attempted to manipulate futures on @binance, which was thwarted by the latter.

However, this would likely mark the beginning of the bad blood between Binance and FTX that spelled the end for FTX.

However, this would likely mark the beginning of the bad blood between Binance and FTX that spelled the end for FTX.

https://twitter.com/cz_binance/status/1173418810918916096?s=20&t=WEb8V8eqTMBGQWAFLAG8uQ

7/ As FTX continued to grow, its appetite for capital seems insatiable.

In the midst of the so-called "DeFi Summer", FTX capitalized on the DeFi hype by creating @ProjectSerum, a decentralized exchange on @solana

In the midst of the so-called "DeFi Summer", FTX capitalized on the DeFi hype by creating @ProjectSerum, a decentralized exchange on @solana

8/ The raise was conducted in a way to encourage speed and not diligence - the faster investors committed, the lower the price.

Below is a screenshot of their fundraising tranches for @ProjectSerum, with some investors getting a 50% higher price for committing a few hours later

Below is a screenshot of their fundraising tranches for @ProjectSerum, with some investors getting a 50% higher price for committing a few hours later

9/ After, @FTX_Official became directly involved with multiple Serum / Solana ecosystem projects such as $FIDA, @Oxygen_protocol and $MAPS

All launched tokens in a short expanse of time.

Full thread from @SBF_FTX shilling all of these in Dec 2020

All launched tokens in a short expanse of time.

Full thread from @SBF_FTX shilling all of these in Dec 2020

https://twitter.com/SBF_FTX/status/1335531920952705026?s=20&t=So46p3_Mtpr-0-kliwA7yg

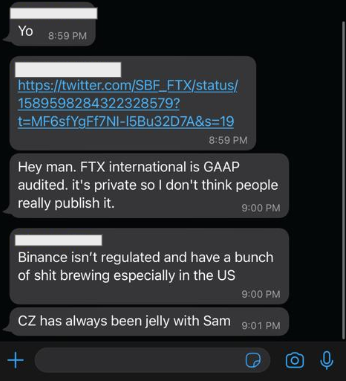

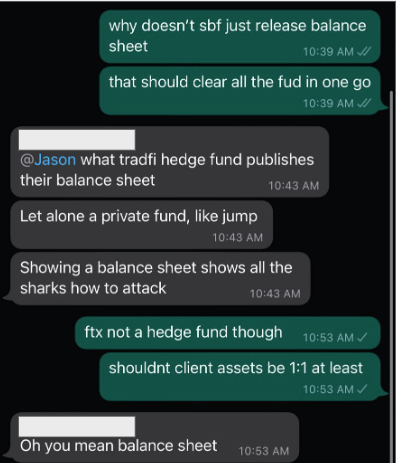

10/ According to my sources, much of Serum was operated by full-time @FTX_Official employees.

Some Serum ecosystem projects were made to seen as third party projects but were in fact internally incubated/ operated.

Some Serum ecosystem projects were made to seen as third party projects but were in fact internally incubated/ operated.

11/ Why did FTX do this?

First, some context.

Assuming Alameda and FTX were much closer than they represented, something changed internally with Alameda/FTX around that time (winter 2020).

First, some context.

Assuming Alameda and FTX were much closer than they represented, something changed internally with Alameda/FTX around that time (winter 2020).

https://twitter.com/AlamedaTrabucco/status/1385180941186789384?s=20&t=zsFrP_Q-gxFqbCxrNSOAPw

12/ Namely, Alameda moved AWAY from delta-neutral strategies as their edge eroded and began to assume massive directional risks in crypto.

They did so on massive amounts of leverage as well.

A detailed, subjective account here for you to bookmark:

milkyeggs.com/?p=175

They did so on massive amounts of leverage as well.

A detailed, subjective account here for you to bookmark:

milkyeggs.com/?p=175

13/ How did the Serum assets fit in?

They were likely used as collateral to enable the aforementioned leverage. All traded at thin circulations. It was easy to manipulate an artificial price for them and use them to pad balance sheet.

A primer on FDV:

They were likely used as collateral to enable the aforementioned leverage. All traded at thin circulations. It was easy to manipulate an artificial price for them and use them to pad balance sheet.

A primer on FDV:

https://twitter.com/mrjasonchoi/status/1294268757381062656?s=20&t=hm0cnbemhVWZnQ6LtnfXRQ

14/ To give an example -

Let's say Alameda funds a semi-incubated project at a $10M "fully diluted valuation" (price of token * total number of tokens ever to be issued) with $2M.

FTX then lists the token on its exchange, but only releases 1% of the total tokens to market

Let's say Alameda funds a semi-incubated project at a $10M "fully diluted valuation" (price of token * total number of tokens ever to be issued) with $2M.

FTX then lists the token on its exchange, but only releases 1% of the total tokens to market

15/ As markets are thin, Alameda can prop up prices using a few million dollars to create a "fake" fully diluted valuation of say $1B.

Suddenly, $2M is $200M on *paper*.

This is an open secret for what industry insiders call "Sam coins". Note the circulating supply across them:

Suddenly, $2M is $200M on *paper*.

This is an open secret for what industry insiders call "Sam coins". Note the circulating supply across them:

16/ By doing this, Alameda creates the illusion of a large + diversified balance sheet, which it could then borrow against to fund directional bets.

@FTX_Official also lists swaps contracts for "Sam coins", which means Alameda can short to lock in profits on unvested tokens.

@FTX_Official also lists swaps contracts for "Sam coins", which means Alameda can short to lock in profits on unvested tokens.

17/ Insiders who questioned the legitimacy of these schemes were personally bullied and threatened by @SBF_FTX into silence.

One of many accounts:

One of many accounts:

https://twitter.com/211lp/status/1592073286007271424

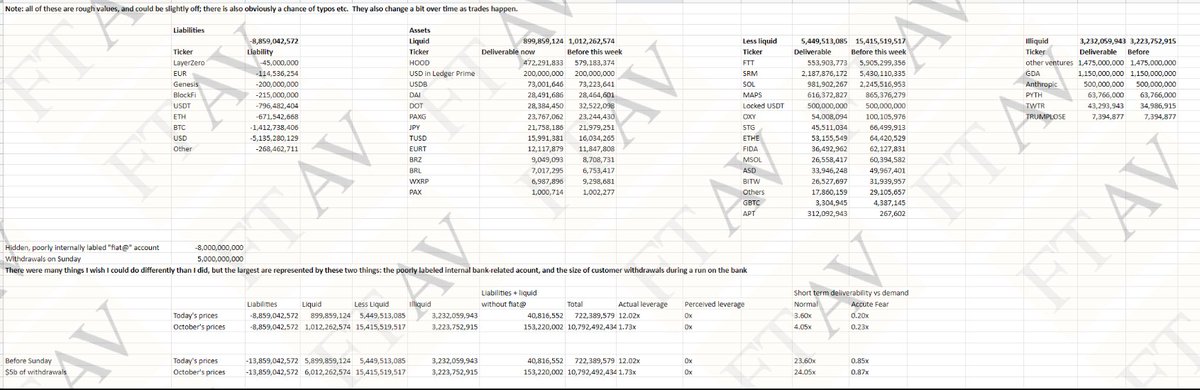

18/ All in all, this circus created hundreds of millions for Alameda/ @FTX_Official in equity value, based on a very illiquid market, as its leaked balance sheet showed.

Still, this was dwarfed by its $FTT holdings

Still, this was dwarfed by its $FTT holdings

https://twitter.com/TreehouseFi/status/1590002504900972544?s=20&t=QQVRlqytvOzpu5gsmIrTQw

19/ Some of the Serum coins and $FTT itself were pledged on @FTX_Official- the only exchange to allow such assets to be used - as collateral.

Some of it was likely used to borrow from credit desks.

help.ftx.com/hc/en-us/artic…

Some of it was likely used to borrow from credit desks.

help.ftx.com/hc/en-us/artic…

20/ This is likely how Alameda/FTX incurred the multi-billion dollar hole:

Alameda pledging illiquid collateral to borrow money to finance bets, which get margin called as markets went down this year, leading to theft of FTX user funds to put out fires.

Alameda pledging illiquid collateral to borrow money to finance bets, which get margin called as markets went down this year, leading to theft of FTX user funds to put out fires.

https://twitter.com/VentureCoinist/status/1592320588911366144?s=20&t=QQVRlqytvOzpu5gsmIrTQw

21/ This means liquid reserves on @FTX_Official were likely lower in amount than user deposits - but chances are this hole was manageable given enough time as more of FTX/Alameda's illiquid assets get vested over years.

That is, until @cz_binance's induced bank-run (more later).

That is, until @cz_binance's induced bank-run (more later).

22/ As all of this was brewing in the background, @SBF_FTX was aggressively pushing for mainstream legitimacy and establishing a regulatory moat...

Two things that would ensure the equity value of FTX and $FTT - which they used to finance leveraged bets - do not collapse.

Two things that would ensure the equity value of FTX and $FTT - which they used to finance leveraged bets - do not collapse.

23/ To do this, FTX increased their marketing.

The most dramatic examples: a $135M deal to rename the Miami Heats Stadium, being the second biggest donor to @JoeBiden, and a failed attempt to join @elonmusk's Twitter bid (happened post recent raise).

The most dramatic examples: a $135M deal to rename the Miami Heats Stadium, being the second biggest donor to @JoeBiden, and a failed attempt to join @elonmusk's Twitter bid (happened post recent raise).

https://twitter.com/elonmusk/status/1591224814597189633

24/ The subsequent rounds of fundraises that pushed FTX's valuation to $32B (Jan 2022), bringing in @paradigm, @sequioa, @TomBrady, @Temasek were widely documented.

Point is @FTX_Official was quickly capturing mainstream mindshare, bolstered by retail-facing ads as well.

Point is @FTX_Official was quickly capturing mainstream mindshare, bolstered by retail-facing ads as well.

25/ Amidst the growth in retail mindshare and aggressive capital raise, @SBF_FTX was making a push in policy too.

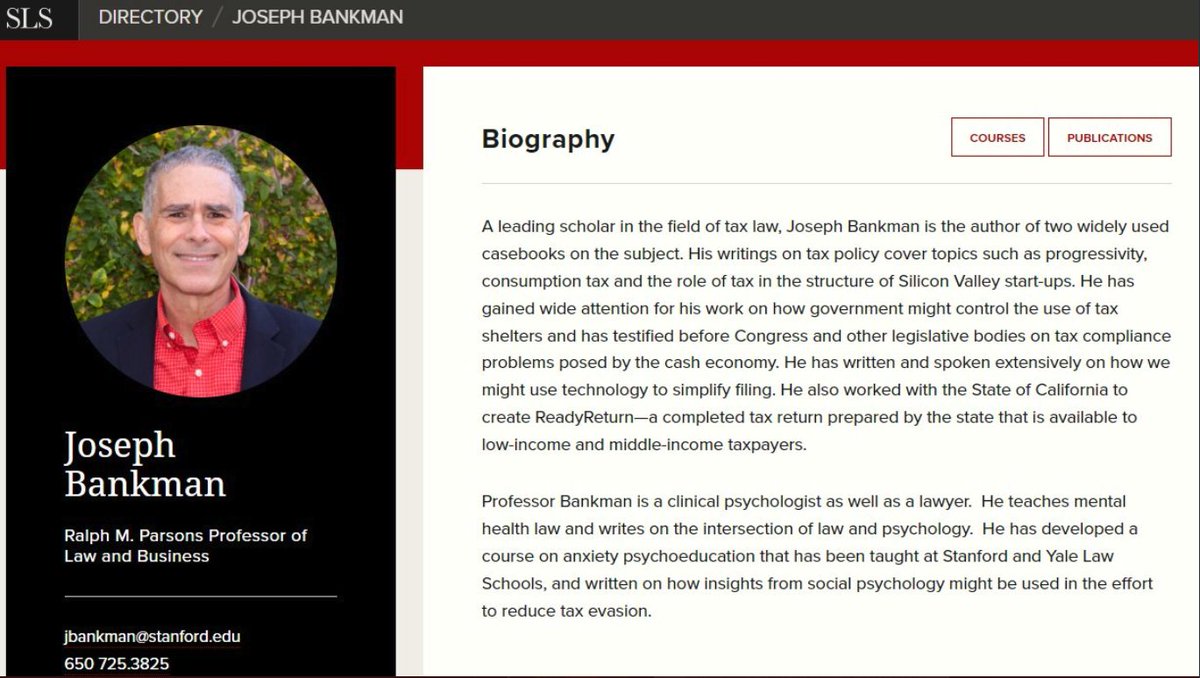

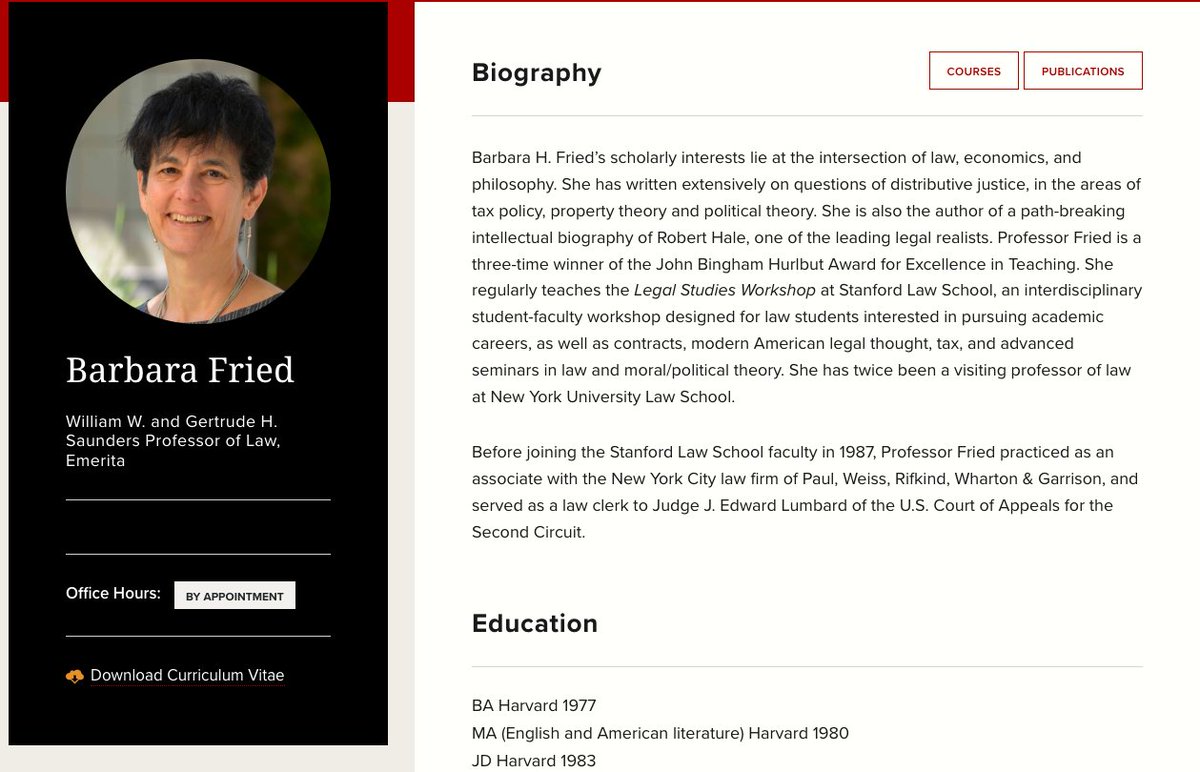

Important to note that SBF's parents - Joseph Bankman and Barbara Fried - are both professors at @StanfordLaw.

Important to note that SBF's parents - Joseph Bankman and Barbara Fried - are both professors at @StanfordLaw.

26/ The above is important as the family is known to have strong ties to the Democrats in the US.

A more detailed thread on SBF's familial relationships and *deep* political ties can be found here. You can bookmark this for later.

A more detailed thread on SBF's familial relationships and *deep* political ties can be found here. You can bookmark this for later.

https://twitter.com/JagoeCapital/status/1590840822916075520?s=20&t=0IuP9vxz-CrQ1UHa7nwfOw

27/ This is relevant as @SBF_FTX was exercising his considerable political muscles to establish a regulatory moat for @FTX_Official.

In Oct 2022, FTX proposes a standard for regulation that widely favored FTX over any DeFi competitors.

ftxpolicy.com/posts/possible…

In Oct 2022, FTX proposes a standard for regulation that widely favored FTX over any DeFi competitors.

ftxpolicy.com/posts/possible…

28/ Important to note that immediately prior to this, @AlamedaTrabucco, co-CEO of Alameda at the time, announces his stepping down from the firm in Aug 2022.

This did not raise much alarm at the time...but it should have.

fortune.com/crypto/2022/08…

This did not raise much alarm at the time...but it should have.

fortune.com/crypto/2022/08…

29/ A month later, @FTX_Official secured a $1.4B bid on Voyage Digital, a brokerage firm that went under due to the collapse of Three Arrows Capital earlier this year.

Court docs show >100K creditors and billions in liabilities

cointelegraph.com/news/ftx-s-1-4…

Court docs show >100K creditors and billions in liabilities

cointelegraph.com/news/ftx-s-1-4…

30/ Why would FTX bid for Voyager when it itself is in a cash crunch?

This is purely conjecture - but the likely explanation is that FTX was likely bailing out entities with large $FTT holdings to prevent forced selling, as much of its own leverage is backed against $FTT.

This is purely conjecture - but the likely explanation is that FTX was likely bailing out entities with large $FTT holdings to prevent forced selling, as much of its own leverage is backed against $FTT.

31/ Not long after, as @SBF_FTX seeks to establish legitimacy in Washington, his and @cz_binance commercial feud gives way to a Twitter spat.

Below is a deleted tweet from SBF.

Below is a deleted tweet from SBF.

32/ Shortly thereafter, @CoinDesk releases a concerning piece regarding Alameda's balance sheet, citing that a huge part of its $14.6B in assets are assets issued by the FTX team itself.

The sharks smell blood now.

coindesk.com/business/2022/…

The sharks smell blood now.

coindesk.com/business/2022/…

33/ On Nov 06 2022, @cz_binance states that in light of revelations regarding Alameda's balance sheet, Binance will liquidate the entirety of its whopping ~$584M in $FTT

https://twitter.com/cz_binance/status/1589283421704290306?s=20&t=YJb73LRUy8QOB5byLi7mUA

34/ In response, @carolinecapital , sole remaining CEO of Alameda, cites that ~$10B worth of assets are not reflected by the balance sheet reveal, which is echoed by @SBF_FTX

This added to fears that Alameda and FTX were more commingled than publicly perceived.

This added to fears that Alameda and FTX were more commingled than publicly perceived.

35/ @carolinecapital then makes a public offer to @cz_binance to purchase all $FTT at $22, leading to speculation that perhaps Alameda had loans that would be liquidated if $FTT trades under that price

https://twitter.com/carolinecapital/status/1589287457975304193?s=20&t=BZEme2DlZn7HK9Clgpw42A

36/ Markets react in panic.

As of Nov 07 2022, according to @nansen_alpha, ~$450M worth of stable coins left the exchange within 7 days.

A bank run is set in motion.

As of Nov 07 2022, according to @nansen_alpha, ~$450M worth of stable coins left the exchange within 7 days.

A bank run is set in motion.

https://twitter.com/mrjasonchoi/status/1589541601801801729?s=20&t=nRX48EAqRt6bJ4LY4Y3QbQ

37/ On Nov 08 2022, @SBF_FTX assured the public that FTX is "heavily regulated" and GAAP audited, with $1B in excess cash.

This tweet has since been deleted, but I got receipts.

This tweet has since been deleted, but I got receipts.

https://twitter.com/mrjasonchoi/status/1590167451245121537?s=20&t=nRX48EAqRt6bJ4LY4Y3QbQ

38/ At the time, FTX CEO @rsalame7926 calls @cz_binance "the worst" in a now-deleted tweet, as multiple junior to senior employees attempt to allay public fears and stop the bleeding.

39/ Based on internal chats shared with me, @SBF_FTX, who was fully aware of the situation at the time, seems to have kept his employees in the dark and asked them to publicly commit fraud.

40/ Shortly after, @SBF_FTX publicly claimed that FTX DOES NOT INVEST CLIENT ASSETS, EVEN IN TREASURIES, and that it has enough to cover all withdrawals.

This tweet has since been deleted.

This tweet has since been deleted.

https://twitter.com/mrjasonchoi/status/1590385230019690496?s=20&t=RkKcS5RljXFSS_YIE1O5fw

41/ Withdrawals from the exchange were soon frozen on Nov 08 2022, with no further communication from @FTX_Official.

On Nov 09, @SBF_FTX announced a potential deal with @binance, and made another fraudulent assurance that assets were 1:1 backed

On Nov 09, @SBF_FTX announced a potential deal with @binance, and made another fraudulent assurance that assets were 1:1 backed

https://twitter.com/SBF_FTX/status/1590012124864348160?s=20&t=RkKcS5RljXFSS_YIE1O5fw

42/ While withdrawals were frozen, Alameda was still able to siphon funds off of the exchange.

When asked why, @carolinecapital claimed this was the FTX US exchange, implying that only the FTX Intl entity was facing liquidity issues.

When asked why, @carolinecapital claimed this was the FTX US exchange, implying that only the FTX Intl entity was facing liquidity issues.

https://twitter.com/mrjasonchoi/status/1590291849939681280?s=20&t=RkKcS5RljXFSS_YIE1O5fw

43/ On Nov 10th, @cz_binance announced that chances for a potential bail out deal are off as suspicions arise that the hole was too big to fill.

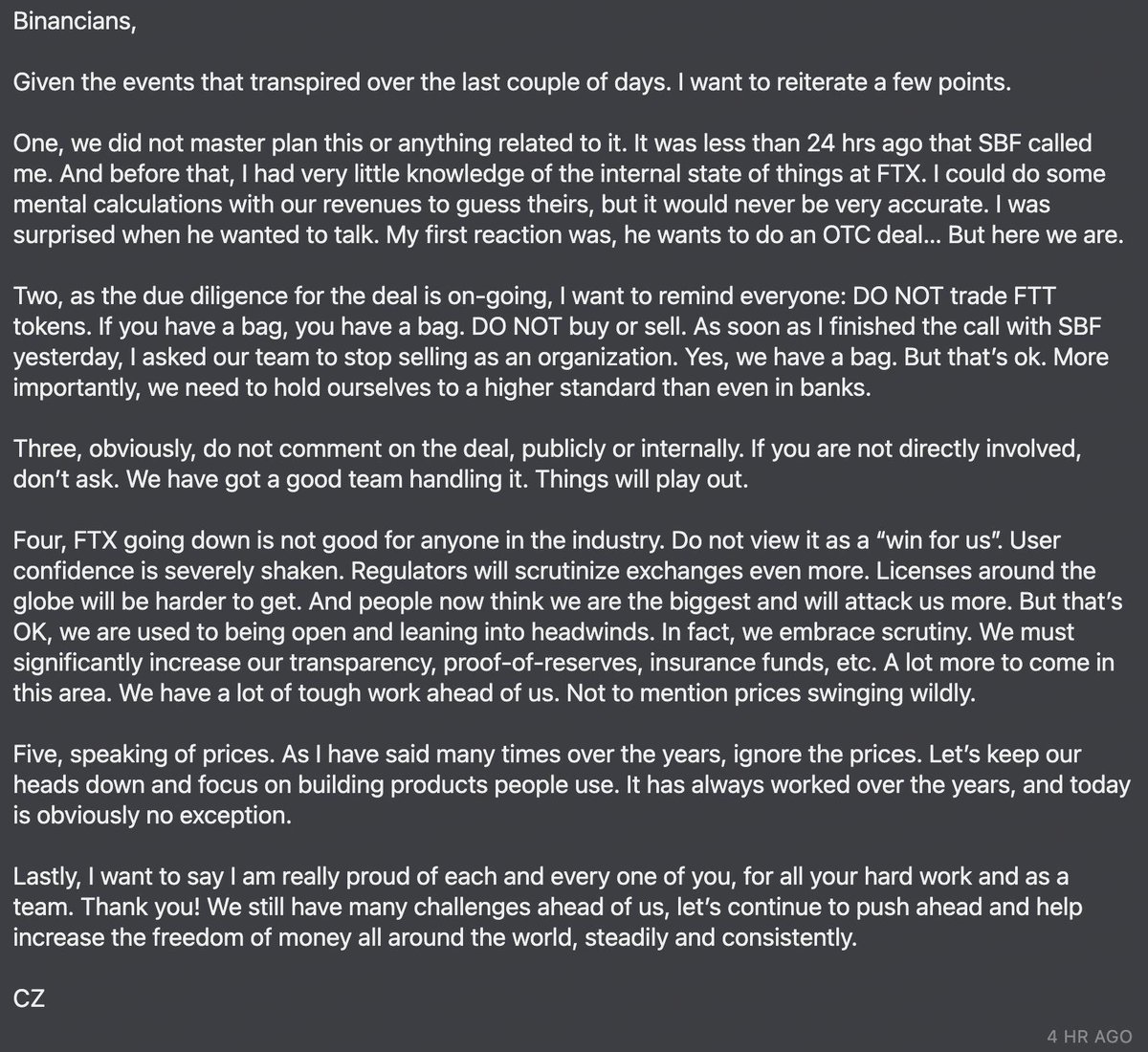

In an internal note on Nov 9th, @cz_binance stated that Binance did not "master plan this".

In an internal note on Nov 9th, @cz_binance stated that Binance did not "master plan this".

44/ Shortly after, withdrawals seemed to have resumed on FTX.

Later, @FTX_Official would claim that this is part of its compliance with regulations in Bahamas, where FTX's HQ is based.

Bahamian regulators would soon debunk this in an official statement.

Later, @FTX_Official would claim that this is part of its compliance with regulations in Bahamas, where FTX's HQ is based.

Bahamian regulators would soon debunk this in an official statement.

45/ Below is a DM leaked to me, where @SBF_FTX seemingly instructed one of his employees to once again commit fraud publicly.

But if not Bahamians locals, who was cashing out millions at a time?

But if not Bahamians locals, who was cashing out millions at a time?

46/ From a primary source I can confirm that at least one employee - who is neither Bahamian nor based in Bahamas - was able to successfully withdraw assets.

Speculation began to arise that insiders were cashing out, and commingling their withdrawals with actual Bahamaian users.

Speculation began to arise that insiders were cashing out, and commingling their withdrawals with actual Bahamaian users.

47/ Soon, users began to find ways to exploit the loophole, with at least one prominent trader @AlgodTrading supposedly purchasing Bahamian KYC'd accounts to launder assets out.

https://twitter.com/Crypto_Noddy/status/1590927542877552641?s=20&t=dhrsJlGvi4tcYCwG-Pf5cw

48/ On Nov 11 2022, @justinsuntron announced a credit facility to allow part of FTX's users to withdraw capital via assets associated with the @trondao network.

This led to a massive premium in $TRX price on FTX.

finance.yahoo.com/news/bankman-f…

This led to a massive premium in $TRX price on FTX.

finance.yahoo.com/news/bankman-f…

49/ For some inexplicable reason, @SBF_FTX never paused trading either for @FTX_Official - leading to alleged washtrading on multiple perp pairs, whereby a user would intentionally lose against an account that was able to withdraw in order to cash out.

50/ @FTX_Official + @SBF_FTX also never responded to questions regarding Bahamas withdrawals, and whether insiders cashed out.

But the comms blackout was conveniently timed right before a public announcement for FTX's bankruptcy on Nov 11, 2022

But the comms blackout was conveniently timed right before a public announcement for FTX's bankruptcy on Nov 11, 2022

https://twitter.com/SBF_FTX/status/1591089317300293636?s=20&t=DZN9fWpqf1VjcB0CWYVg7w

51/ After the bankruptcy announcement, withdrawals were finally paused; however, hundreds of millions began to be siphoned from FTX.

General Counsel @_Ryne_Miller claimed that FTX was moving its own assets to cold storage.

General Counsel @_Ryne_Miller claimed that FTX was moving its own assets to cold storage.

https://twitter.com/_Ryne_Miller/status/1591326796305530880?s=20&t=4nCRHRwKu3YNV_7jnrGQqQ

52/ However, this was likely not the entire truth as seasoned onchain sleuth @zachxbt revealed a potential hack has likely occurred.

https://twitter.com/zachxbt/status/1591475246250733568?s=20&t=chhUH4TQRY0IbB1FzTfB_w

53/ Miller responded with an official statement regarding cooperation with law enforcement to secure stolen assets.

https://twitter.com/_Ryne_Miller/status/1591495429338071042?s=20&t=1z7Swy8ivLs5U1rS-v5POw

54/ The fact that @SBF_FTX @rsalame7926 did not have tighter opsec and lock down + pause trading + withdrawals when multiple employees were claiming they were lied to and clearly disgruntled was a monumental failure in management.

https://twitter.com/mrjasonchoi/status/1591298118293000192?s=20&t=1z7Swy8ivLs5U1rS-v5POw

55/ After a brief period of silence, @SBF_FTX began to taunt the public by tweeting cryptic, one letter tweets on Nov 14, 2022.

https://twitter.com/SBF_FTX/status/1591989554881658880?s=20&t=DZN9fWpqf1VjcB0CWYVg7w

56/ Crypto investor @ercwl revealed that @SBF_FTX was likely using the tweets to fool bots that are designed to detect tweets being deleted.

This is currently unproven and unlikely.

This is currently unproven and unlikely.

https://twitter.com/ercwl/status/1592334689335144448?s=20&t=DZN9fWpqf1VjcB0CWYVg7w

57/ Earlier on Nov 15, @yaffebellany, who has previously co-written a hit piece on rival exchange @krakenfx, published a piece on @SBF_FTX

This was widely considered to be a puff piece.

This was widely considered to be a puff piece.

https://twitter.com/TrungTPhan/status/1592349684471037955?s=20&t=1z7Swy8ivLs5U1rS-v5POw

58/ Most recently, news regarding loopholes in FTX's backend that allowed @SBF_FTX to launder user funds seem to have surfaced but currently unproven.

u.today/ftx-founder-se…

u.today/ftx-founder-se…

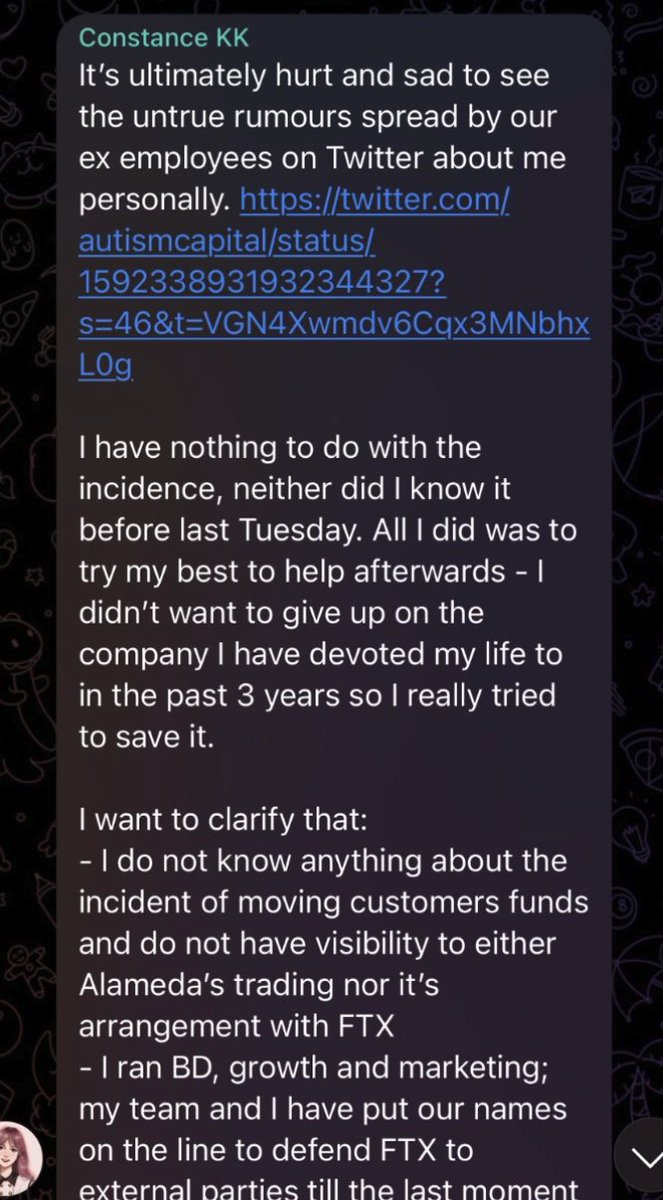

59/ According to primacy sources from FTX, only 4-5 senior executives knew the extent of FTX's woes until the very end.

Their names as shared with me are: SBF, Caroline Ellison, Gary Wang, Ramnik Arora, Constance Wang, Nishad Singh

Some have denied.

(Source: @AutismCapital)

Their names as shared with me are: SBF, Caroline Ellison, Gary Wang, Ramnik Arora, Constance Wang, Nishad Singh

Some have denied.

(Source: @AutismCapital)

60/ There are a lot more interesting facts - such as @carolinecapital's blog, @SBF_FTX's supposed stimulant addiction, alleged orgies in the FTX office - which I don't think are that relevant for those who seek to understand what happened.

I will leave the tabloids for @nytimes

I will leave the tabloids for @nytimes

61/ This will (hopefully) be the last development, short of prosecution and paying out of creditors, for the FTX saga.

I've also recorded an abridged, 20-min version of this on my podcast @theBlockcrunch, which you can find below

I've also recorded an abridged, 20-min version of this on my podcast @theBlockcrunch, which you can find below

https://twitter.com/mrjasonchoi/status/1592142223273250819?s=20&t=DZN9fWpqf1VjcB0CWYVg7w

• • •

Missing some Tweet in this thread? You can try to

force a refresh