Read this 🧵 to go from 0 to 100 on stablecoin designs and risk 👇

First, what are stablecoins?

A stablecoin is a crypto asset whose price is "pegged" to the reference price of a reserve asset. The most popular reserve asset for stablecoins is one US dollar.

A stablecoin is a crypto asset whose price is "pegged" to the reference price of a reserve asset. The most popular reserve asset for stablecoins is one US dollar.

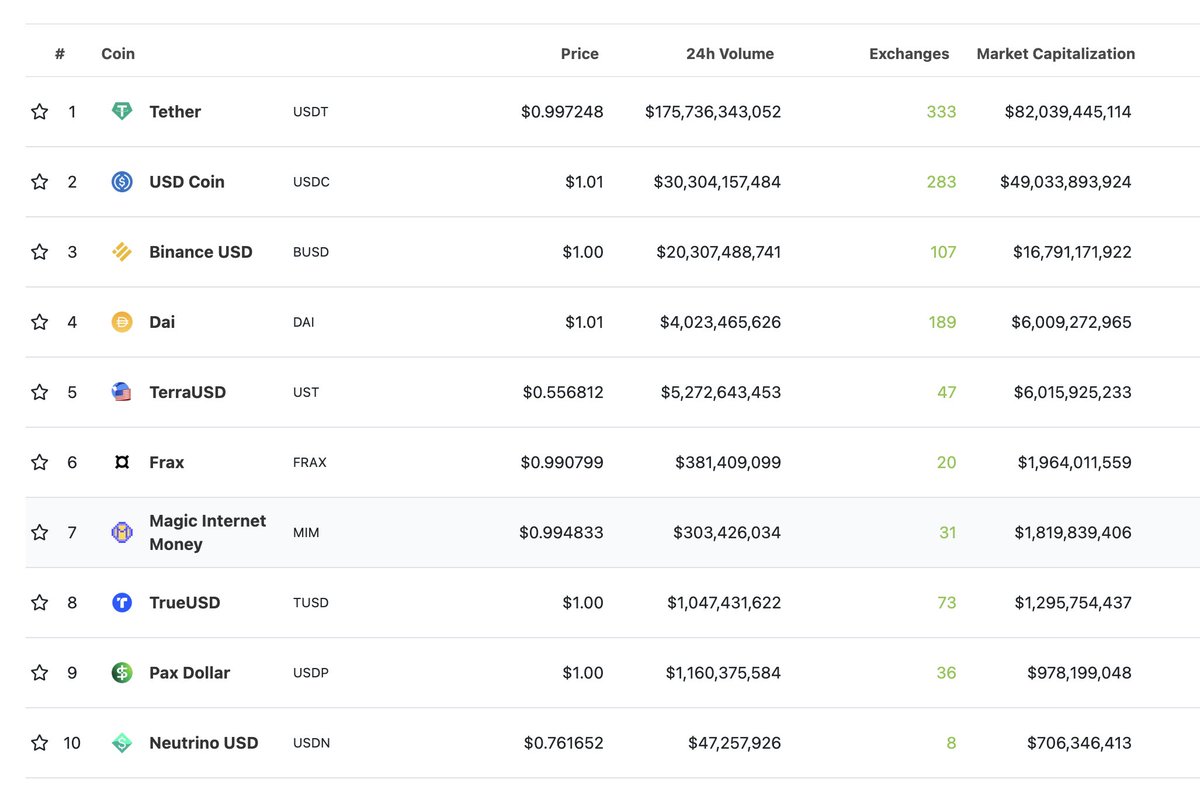

Stablecoins have a combined marketcap of more than $170B. A look at the market prices of the top 10 stablecoins on CoinGecko and we can see that not all of them are functioning properly. Why is that the case?

To understand why, we need to understand how stablecoins work. The best framework I've seen was published by @aklamunl and a team of DeFi researchers in 2020 (link below). I am going to break down the major concepts here so you don't have to read it.

papers.ssrn.com/sol3/papers.cf…

papers.ssrn.com/sol3/papers.cf…

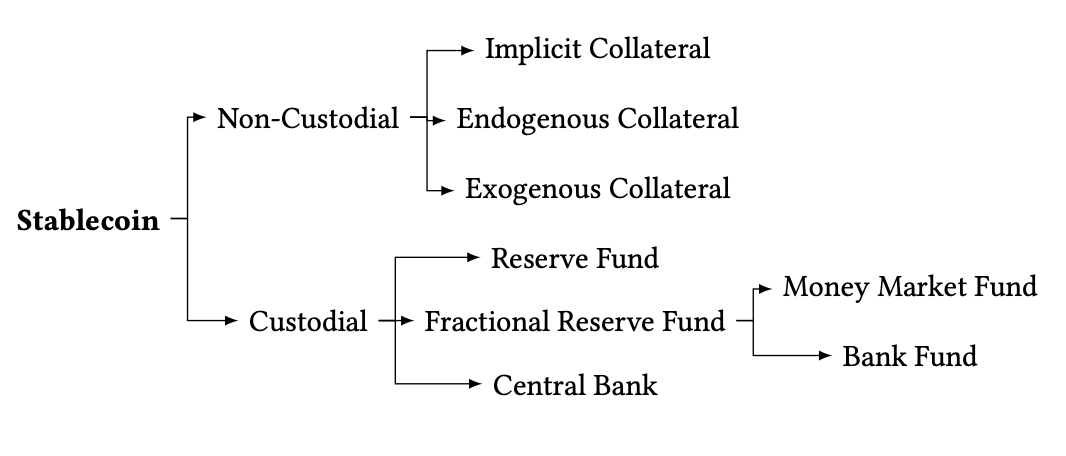

There are two major classes of stablecoins:

Custodial: entrusted by off-chain collateral assets like fiat dollars that sit in a bank. Requires trust in third party.

Non-custodial (aka decentralized): fully on-chain and backed by smart contracts & economics. No trusted parties.

Custodial: entrusted by off-chain collateral assets like fiat dollars that sit in a bank. Requires trust in third party.

Non-custodial (aka decentralized): fully on-chain and backed by smart contracts & economics. No trusted parties.

In custodial stablecoins, custodians hold a combination of assets (currencies, bonds, commodities, etc.) off-chain, allowing issuers (possibly the same entity) to offer digital tokens of an reserve asset. The top 2 custodial stablecoins today are USDT and USDC.

There are 3 types of custodial stablecoins.

#1 Reserve Fund: 100% reserve ratio. Each stablecoin is backed by a unit of the reserve asset held by the custodian.

#2 Fractional Reserve Fund: The stablecoin is backed by a mix of both reserve assets and other capital assets.

#1 Reserve Fund: 100% reserve ratio. Each stablecoin is backed by a unit of the reserve asset held by the custodian.

#2 Fractional Reserve Fund: The stablecoin is backed by a mix of both reserve assets and other capital assets.

And finally, #3 Central Bank Digital Currency (CBDC): A digital form of central bank money that is widely available to the general public. CBDCs are in their nascency as today only 9 countries/territories have launched them, many of them small.

Custodial stablecoins have three major risks:

- Counterparty Risk (fraud, theft, govt seizure, etc.)

- Censorship Risk (operations blocked by regulators, etc.)

- Economic Risk (off-chain assets go down in value)

Each can result in the stablecoin value going to zero.

- Counterparty Risk (fraud, theft, govt seizure, etc.)

- Censorship Risk (operations blocked by regulators, etc.)

- Economic Risk (off-chain assets go down in value)

Each can result in the stablecoin value going to zero.

Next, non-custodial stablecoins aim to operate without the societal institutions that custodial stablecoins rely on. They achieve this by creating an economic structure on blockchains enforced via smart contracts.

Tldr: economic strcuture + rational actors = price stablity

Tldr: economic strcuture + rational actors = price stablity

There are 3 types of non-custodial or decentralized stablecoins.

#1 Exogenous collateral: the stablecoin is backed by assets that has uses outside of the stablecoin system. The most prominent stablecoin in this category is DAI, which is backed by a # of crypto assets like ETH.

#1 Exogenous collateral: the stablecoin is backed by assets that has uses outside of the stablecoin system. The most prominent stablecoin in this category is DAI, which is backed by a # of crypto assets like ETH.

#2 Endogenous collateral: An asset created with the purpose of being collateral for the stablecoin. Examples include Synthetix, whose token SNX collateralizes its sUSD stablecoin.

#3: Implicit collateral (aka algorithmic): Stablecoins without explicit collateral that instead use market mechanisms to adjust supply to stabilize price.

UST is the most prominent algostable. Highly recommend reading this thread on its mechanics + blowup:

UST is the most prominent algostable. Highly recommend reading this thread on its mechanics + blowup:

https://twitter.com/jonwu_/status/1523793494761824258?s=20&t=frLavU_ab_59kZODyL20uw

Non-custodial stablecoins have 5 major risks:

- Collateral (value < issuance)

- Data Feed (system can't price itself)

- Governance (parameter failure)

- Base Layer (chain fails)

- Smart Contract (hack leads to insolvency)

Each can result in the stablecoin value going to zero.

- Collateral (value < issuance)

- Data Feed (system can't price itself)

- Governance (parameter failure)

- Base Layer (chain fails)

- Smart Contract (hack leads to insolvency)

Each can result in the stablecoin value going to zero.

Algo stables like UST are especially susceptible to collateral risk because they are not explicitly backed by collateral. When there is a crisis in confidence, such as the overall crypto markets going down, it can can lead to a bank run or "death spiral".

This is when an algostable's fractional liquid reserve is depleted by redemptions, causing its system to default and remaining liquid assets needing to be sold at a discount. This in turn depletes the system's overall equity, resulting in a spiral that is hard to overcome.

Algorithmic stablecoins are a brand new type of asset, and while most attempts to date have failed, not all of them have. It remains to be seen whether they are viable long-term at scale, however, many people in the crypto industry are optimistic.

Looking for more crypto fundamentals? Subscribe to my newsletter:

ournetwork.substack.com/subscribe?utm_…

ournetwork.substack.com/subscribe?utm_…

Follow me ( @spencernoon ) for more threads like this.

And please follow @aklamun who I accidentally typo’d earlier in this thread!

Like/Retweet the first tweet below if you can:

And please follow @aklamun who I accidentally typo’d earlier in this thread!

Like/Retweet the first tweet below if you can:

https://twitter.com/spencernoon/status/1524752048121466883?s=21&t=L8dtyTJehAkfIlAjP_Uz8Q

• • •

Missing some Tweet in this thread? You can try to

force a refresh