1/ Alpha in the value factor is the result of a convergent process, where alpha itself is the market re-setting multiples upwards in anticipation of real future fundamental recovery. Momentum is a divergent process. Both explained here:

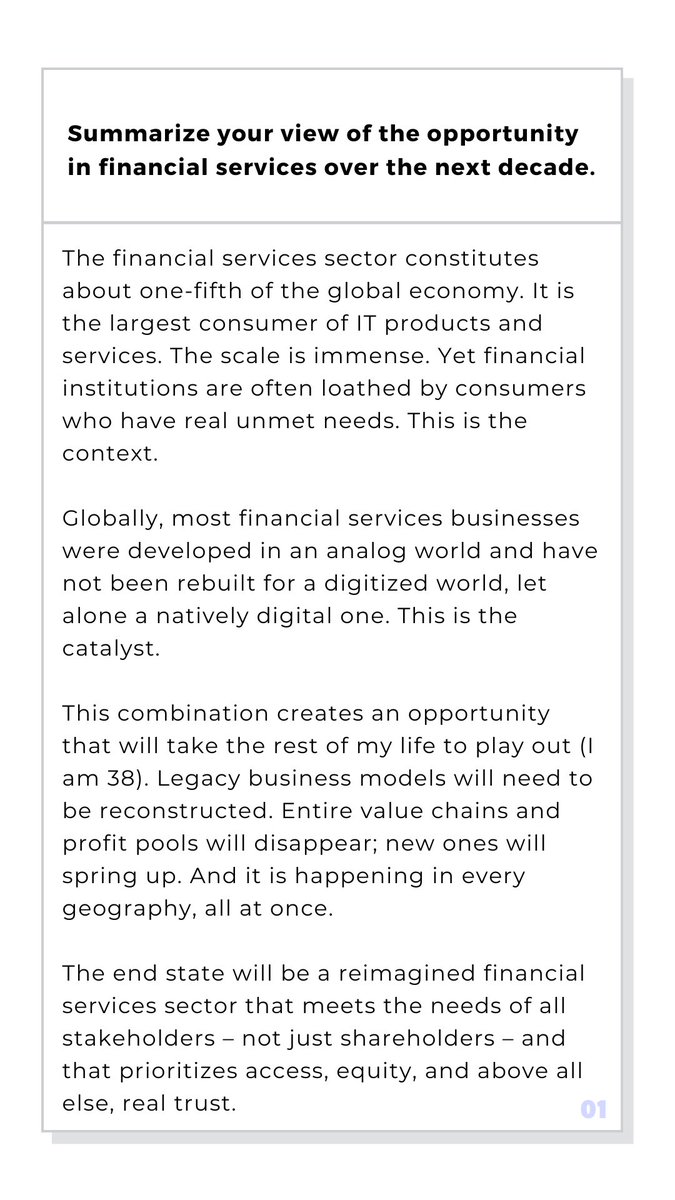

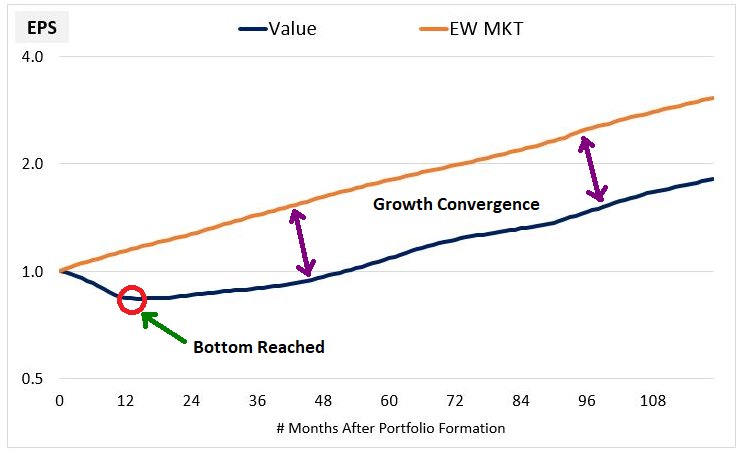

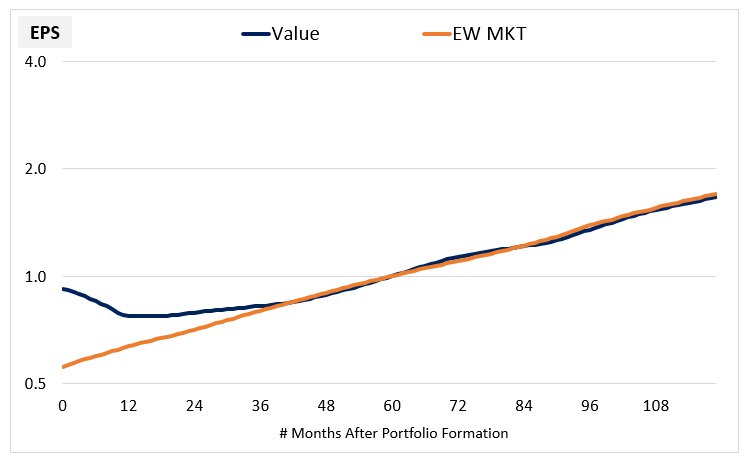

2/ If you build an index out of the value stocks, you can track trailing an FUTURE fundamentals. Here is *forward* 10-year EPS for value stocks.

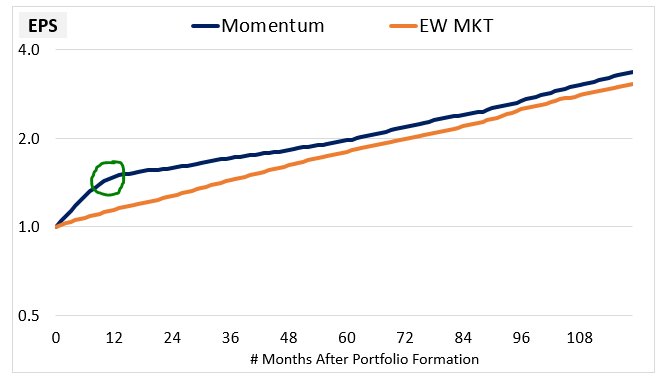

3/ The market is directionally right: value stocks do suck...at first. After point of purchase you can see the future decline in EPS, relative to the market. But the EPS of value stocks then begins to recover, eventually converging back on the market’s growth rate.

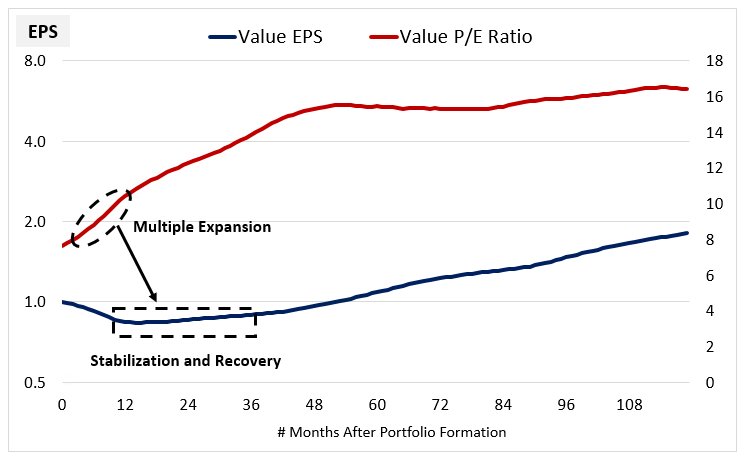

4/ Market’s look forward, and if EPS is set to recover, markets anticipate that and price it in: multiplies expand. You can see that here:

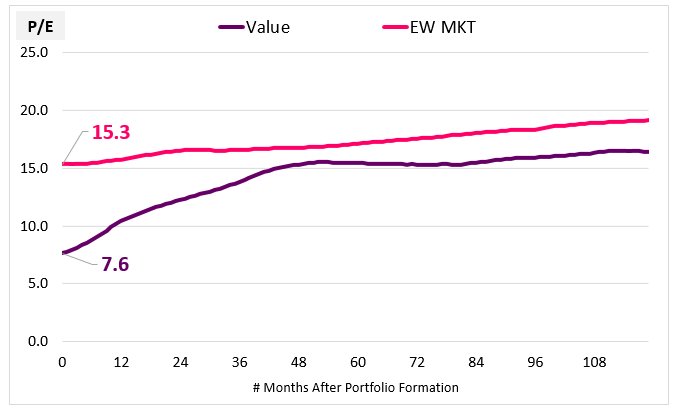

5/ Because the EPS growth rates of value stocks and the market converge, you can calculate the appropriate discount in starting P/E. If the market trades at 15.3x on average, value stocks SHOULD trade at 9.2x. But they trade at 7.6x!

6/ You can see this alpha advantage if you calculate the forward 10- year earnings yield (t+10 earnings) of value stocks vs. the market. They are priced TOO cheaply, and slowly converge, creating alpha.

7/ Value, therefore, is a convergent or corrective process: it succeeds because the companies themselves eventually recover. But quant value rebalances much more often than every ten years.

8/ So the alpha isn’t coming from fundamental growth itself—indeed in the common 1-year holding period for value, EPS growth stinks. Instead it comes from P/E multiple expansion happening in anticipation of future recovery.

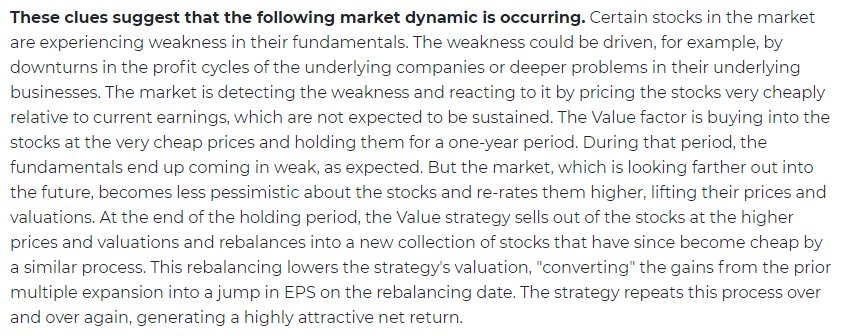

9/ Here is a full description.

Then on to momentum, which is very different…

Then on to momentum, which is very different…

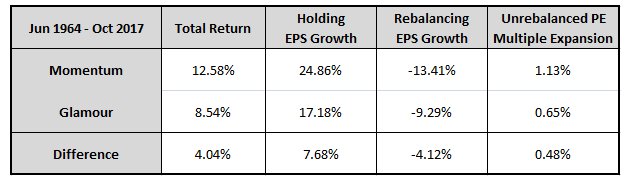

10/ Whereas value earned its returns via very strong P/E multiple expansion which more than makes up for poor holding period EPS growth, momentum identifies stocks with supernormal holdings growth. Momentum is better way to do growth growth investing.

11/ This table compares the sources of return between momentum and glamour. You can see that momentum stocks actually deliver MORE holding period EPS growth than portfolio just based on price (glamour).

12/ You can see this over a ten year period in the growth of EPS in a momentum “index.” Each dip down here is a rebalance, where you have to swap out less for more expensive names (thus reducing index EPS). Growth is so good it overwhelms multiple contraction.

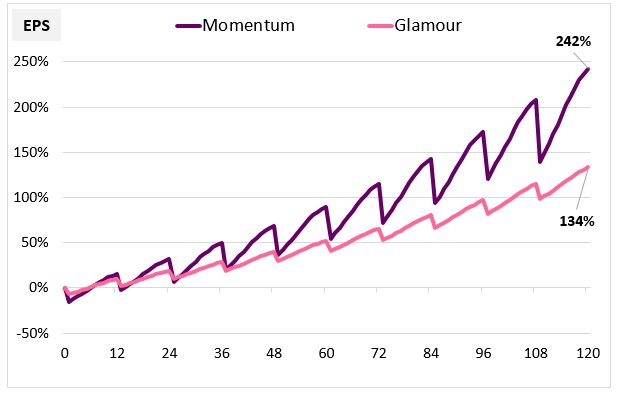

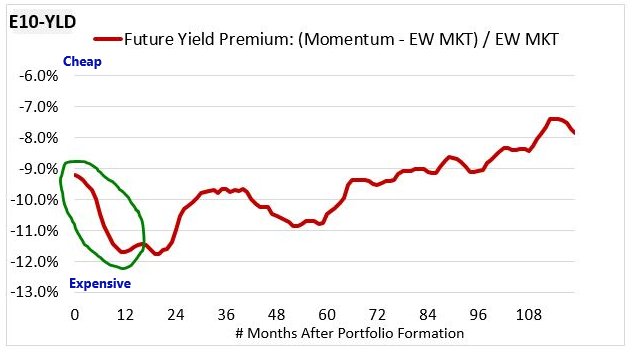

13/ But when compared against future 10-year EPS results like we did with value, we see the opposite thing happening: strong initial growth, then a fade.

14/ Whereas the future yield premium of value was much higher than the market, the future yield premium of momentum starts negative and gets *more* negative. This is the "divergent" process.

15/ This means timing is critical. You have to rebalance momentum often to earn alpha. And if you keep holding, say past a year, the excess return in years 2-10 is terrible (value is different and continues to outperform)

16/ If you buy a value stock and sell it to someone else in a year, they can still expect to do well (there is “residual” alpha). But people who buy FROM momentum investors get screwed on average, and should expect to underperform.

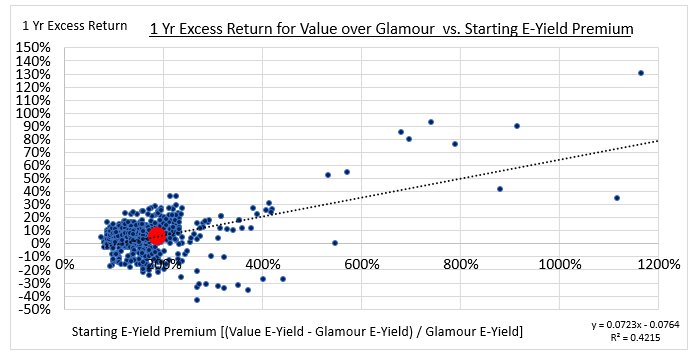

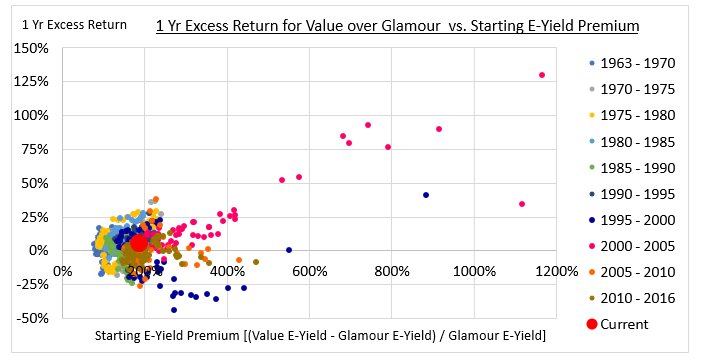

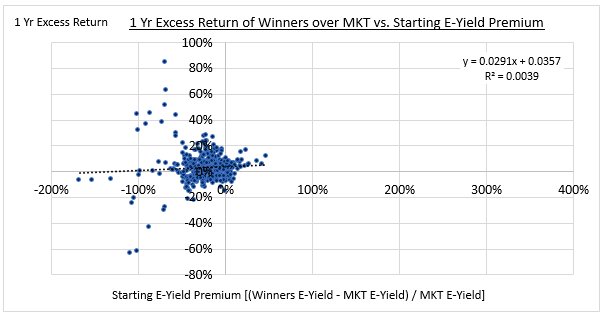

17/ Can you time factors using value? short answer: no. This compares the 1-year forward excess return of value over glamour relative to the starting valuation spread (the tool you might use to time value allocations). There is some relationship, but not actionable.

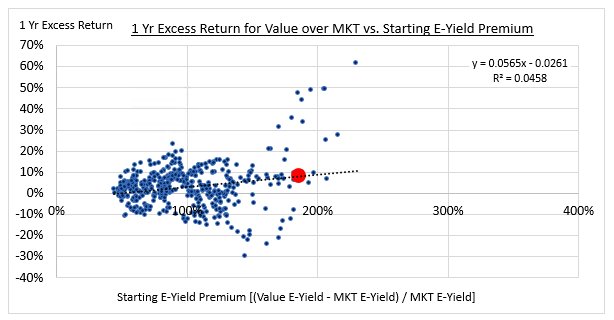

18/ Here is the same but vs. just the broader market. The relationship weakens.

19/ For momentum, there is no relationship between the “price” of the factor and future excess returns.

20/ Understanding how factors work helps investors 1) demonstrate return drivers and 2) knowing the levers, *improve* quantitative selection processes. These are all very simple one factor examples. Real implementation far better and more nuanced.

21/ I love quant because parsing/decomposition like this is possible. You can literally show repeatability and "source" alpha. I like some discretionary managers a lot, but underwriting repeatability is MUCH harder in that context.

22/ To earn the alpha you see here, first you need discipline, then you need to keep improving factor measurement, portfolio construction, and trading. Every aspect should get better over time as markets adapt.

23/ This will get harder and harder. No free lunches. You pay with pain and long stretches of underperformance.

We will keep parsing more factors soon. Full piece here:

osam.com/Commentary/fac…

We will keep parsing more factors soon. Full piece here:

osam.com/Commentary/fac…

• • •

Missing some Tweet in this thread? You can try to

force a refresh