1/ lots of ppl asking me about @bitfinex and $USDT

i'm not a cheerleader of BFX nor USDT, but here's a thread looking at the facts

don't trust the FUD, verify - the market usually knows b4 any announcement

i'm no expert on any of this, just watching the same game ur watching

i'm not a cheerleader of BFX nor USDT, but here's a thread looking at the facts

don't trust the FUD, verify - the market usually knows b4 any announcement

i'm no expert on any of this, just watching the same game ur watching

2/ premium on BFX remains likely due to the time it takes wires to hit the exchange - 2-3 business days at least

wires were restored on Oct 16th, so as early as FRI or MON EST

bitfinex.com/posts/294

it will also take time for confidence/trust to be restored in BFX/USDT

wires were restored on Oct 16th, so as early as FRI or MON EST

bitfinex.com/posts/294

it will also take time for confidence/trust to be restored in BFX/USDT

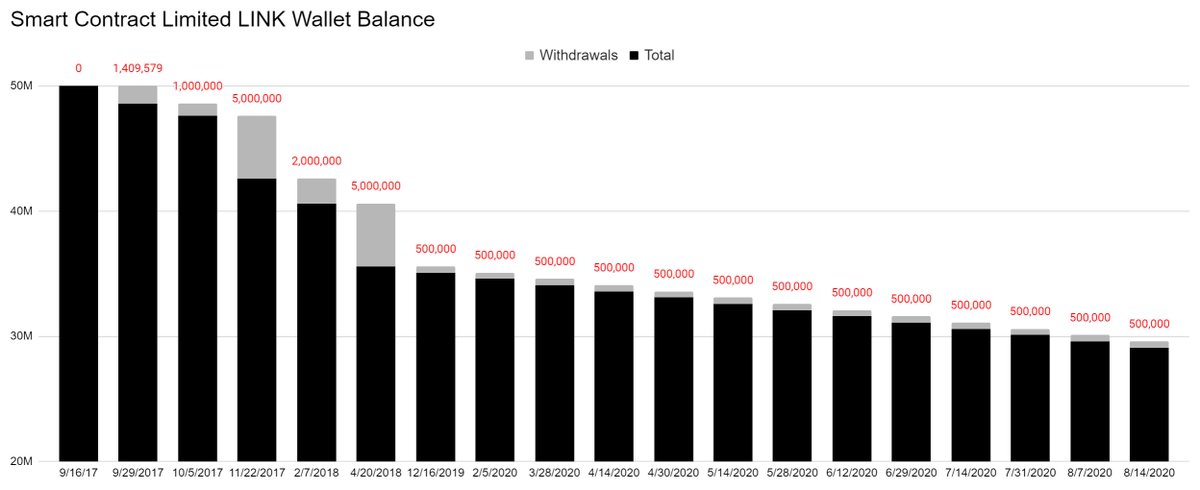

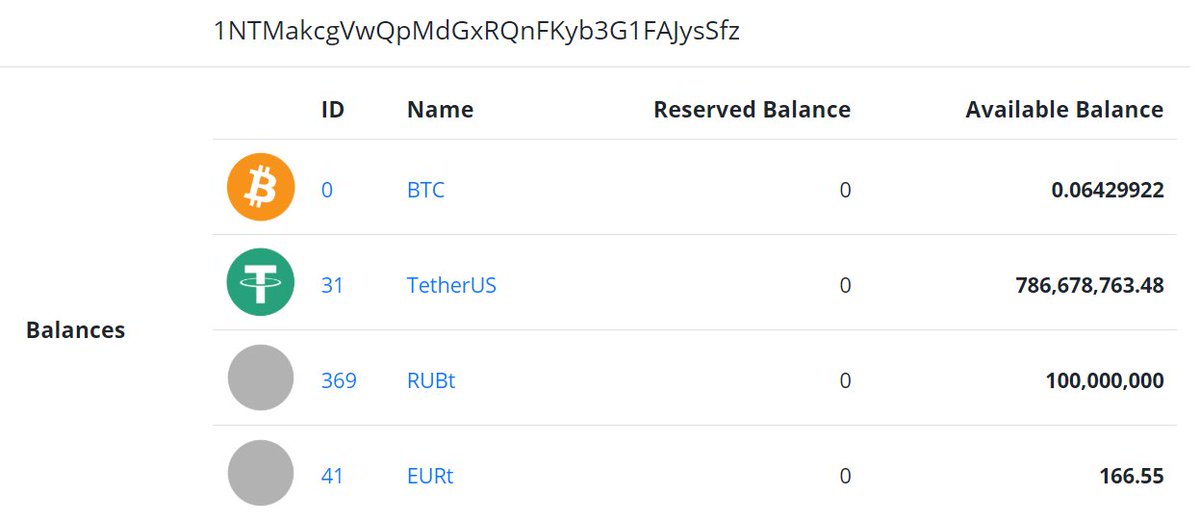

3/ i'm also keeping a close eye on the US$786MM sitting in the $USDT treasury address - flows in and out of this 1NT address will indicate if things are working properly

omniexplorer.info/address/1NTMak…

afaik, this unused $USDT eventually goes to a burn address? (i could be wrong)

omniexplorer.info/address/1NTMak…

afaik, this unused $USDT eventually goes to a burn address? (i could be wrong)

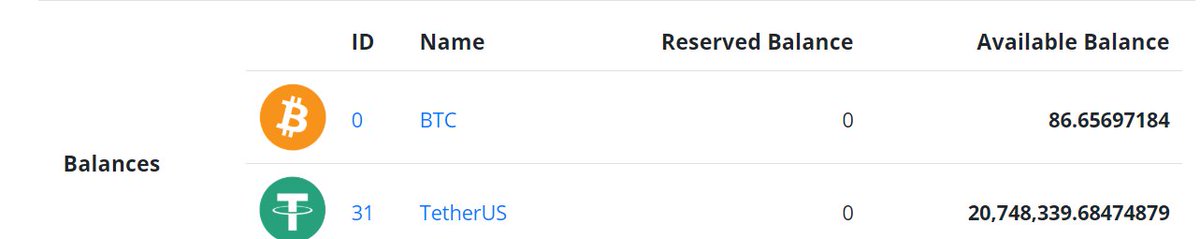

4/ there is also US$20MM sitting the BFX 1KY $USDT address - again, inflow/outflow here will show restored processing

omniexplorer.info/address/1KYiKJ…

total circulating supply of $USDT listed on CMC as US$2.2 billion

u can also check USDT addresses for other major exchanges/coins

omniexplorer.info/address/1KYiKJ…

total circulating supply of $USDT listed on CMC as US$2.2 billion

u can also check USDT addresses for other major exchanges/coins

5/ u can also watch the USDT/USD pair for the return to normalcy

as @IamNomad pointed out, this IS NOT the peg, this is the market rate

the peg refers to the ability to cash out 1 $USDT to $1 - based on the few i've spoken with, this process is working as intended

as @IamNomad pointed out, this IS NOT the peg, this is the market rate

the peg refers to the ability to cash out 1 $USDT to $1 - based on the few i've spoken with, this process is working as intended

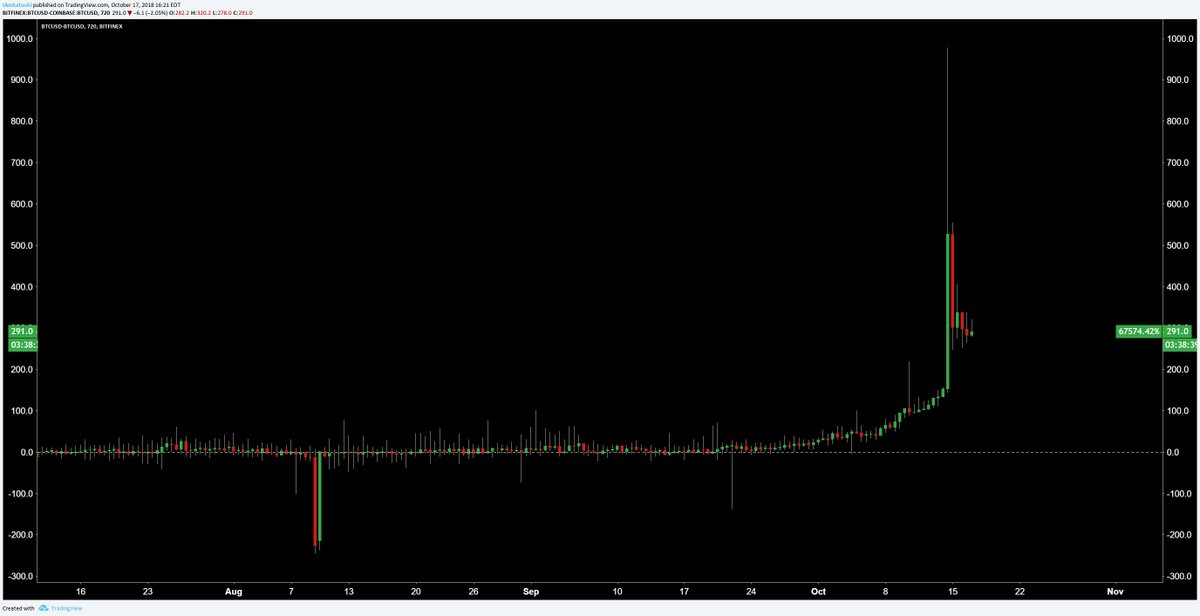

6/ the ultimate market confidence indication for BFX as an exchange will be a steady increase in cold wallet stores, which have been on a steady decline since early Sept

blockchain.com/charts/balance…

next time says BFX is insolvent, look here first - we have the blockchain, use it

blockchain.com/charts/balance…

next time says BFX is insolvent, look here first - we have the blockchain, use it

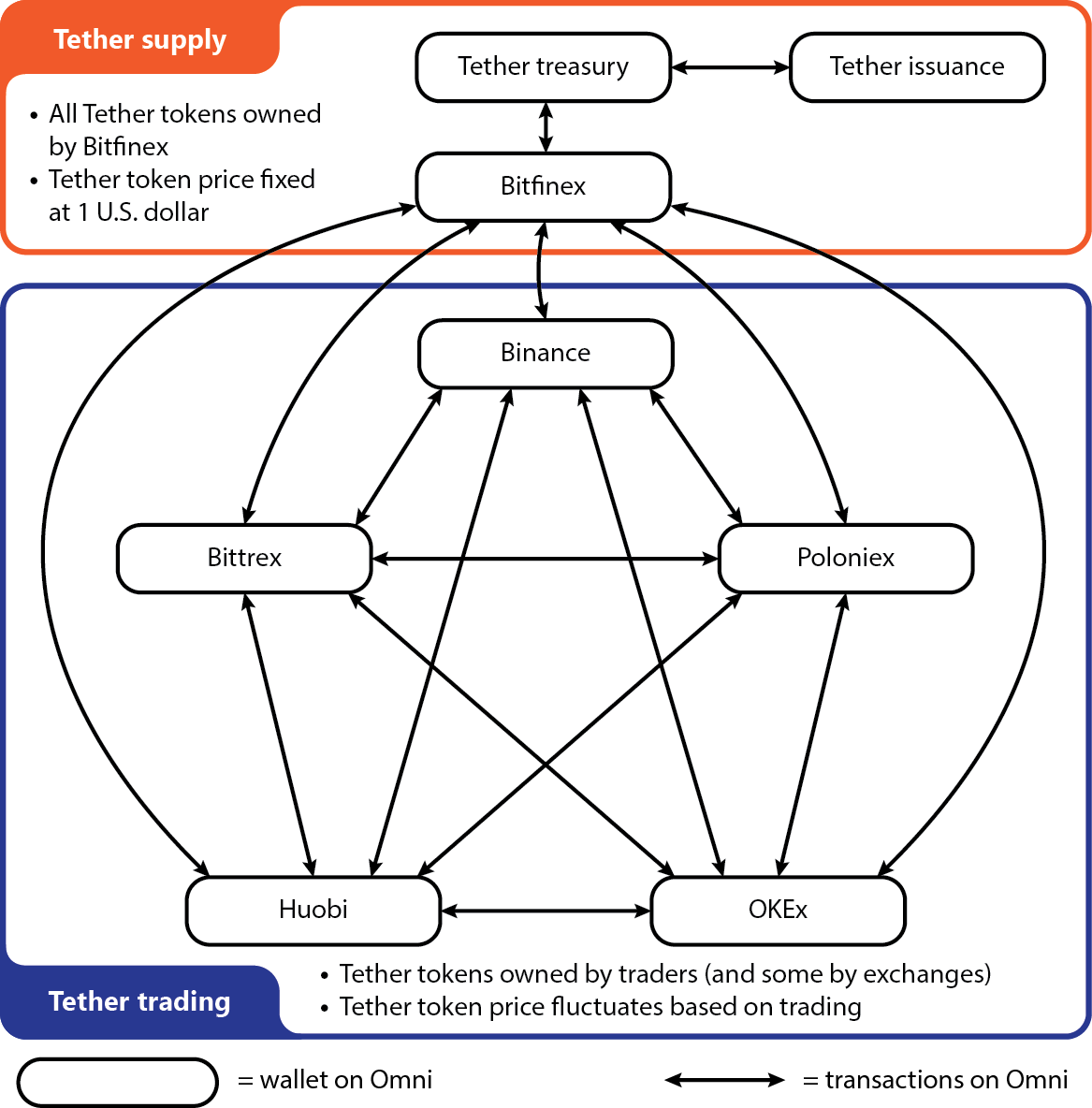

7/ when all is said and done, all $USDT pairs on all exchanges should see a decrease in price relative to the fiat pairs & the fiat pairs may also see a bump in price (arbitrage)

i disagree with the language used on this site, but the info is clean untether.space

i disagree with the language used on this site, but the info is clean untether.space

8/ so how can all this be prevented?

$USDT & BFX need much more transparent & offensive PR

they waited a month before saying anything - way too long for the announcement on wtf was going on

wires were delayed a month or more at that point for some ppl

blog.bitfinex.com/announcements/…

$USDT & BFX need much more transparent & offensive PR

they waited a month before saying anything - way too long for the announcement on wtf was going on

wires were delayed a month or more at that point for some ppl

blog.bitfinex.com/announcements/…

9/ $USDT also needs to remove the words "frequent" & "audit" from the website

a true audit will never happen, just ask Cameron Winklevoss

a true audit will never happen, just ask Cameron Winklevoss

https://twitter.com/winklevoss/status/1052580017799090176?s=19

10/ TL;DR

market still unsure of $USDT and BFX, as evident by: market price of $USDT, declining BFX $BTC cold storage, and unarbed $USDT pair premiums - this should/could return to normal by next week

market still unsure of $USDT and BFX, as evident by: market price of $USDT, declining BFX $BTC cold storage, and unarbed $USDT pair premiums - this should/could return to normal by next week

11/ competition for $USDT & BFX is great for consumers & crypto as a whole

use/reliance of $USDT by multiple/all exchanges is definitely a single point of failure

but, be cognizant that others seek to gain from the decline of both, don't fall victim to disinformation campaigns

use/reliance of $USDT by multiple/all exchanges is definitely a single point of failure

but, be cognizant that others seek to gain from the decline of both, don't fall victim to disinformation campaigns

12/ furthermore, i don't think the crypto market as a whole goes anywhere until all of the points discussed above are crystal clear

BFX & $USDT represent too much of the market to think otherwise

BFX & $USDT represent too much of the market to think otherwise

cc: @Tether_to

• • •

Missing some Tweet in this thread? You can try to

force a refresh