1/There’s this economist few remember, who wrote the 1st 2-sectors growth model, brought Pontryagin to econ, played rugby w/ Inada, argue over Marxism & Keynes w/ Solow & Kahn, rediscovered Veblen & ended up contributing to a papal encyclical.

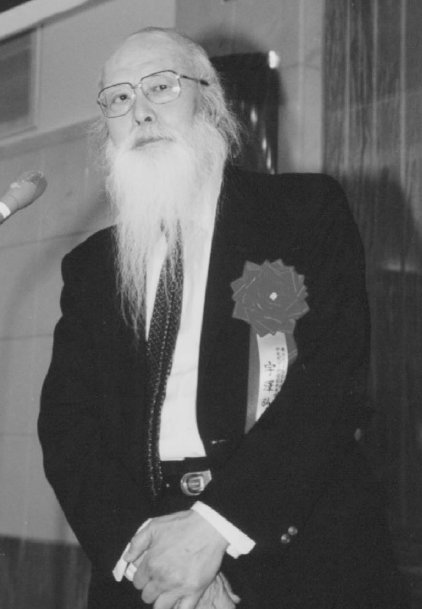

His name is Hiro Uzawa (宇沢弘文)

His name is Hiro Uzawa (宇沢弘文)

2/ A caveat: this is not a historical account, but a summary of Uzawa telling his own story in the wildest MD interview ever

(TBH I also enjoyed this interview because the reluctant interviewer I am can relate so much with things going out of control) https://t.co/ggLIdTMMkHcambridge.org/core/journals/…

(TBH I also enjoyed this interview because the reluctant interviewer I am can relate so much with things going out of control) https://t.co/ggLIdTMMkHcambridge.org/core/journals/…

3/ Uzawa was born in Japan in 1928, spent his spare time proving Newton’s theorem in middle school, graduated in math, struggled w/ depressed economy, shifted to econ.

Back then, in Japan, your typical econ textbook author was Stalin. Uzawa found it obscure, to say the least

Back then, in Japan, your typical econ textbook author was Stalin. Uzawa found it obscure, to say the least

4/ One summer, Stanford econ H. Houthakker came to give a course. He was doing what all Stanford econ did in 50s: applying math to study growth & allocation theory.

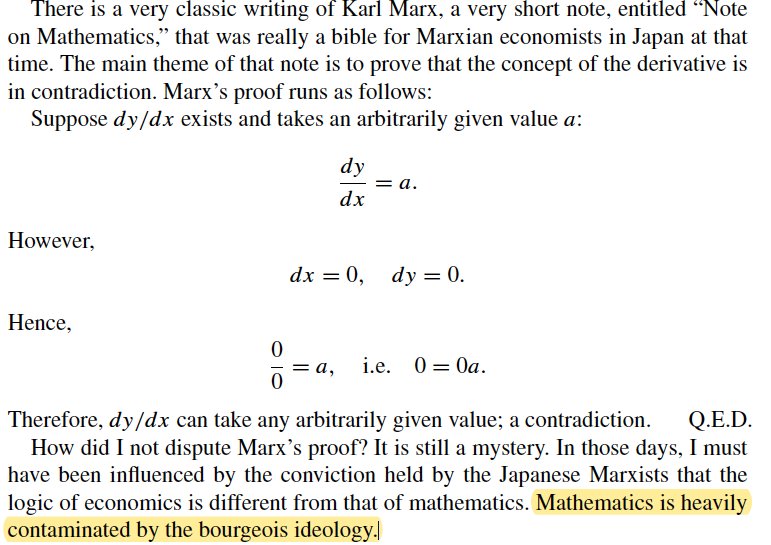

That’s how Uzawa discovered that though math is contaminated by bourgeois ideology, it can be useful to econ

That’s how Uzawa discovered that though math is contaminated by bourgeois ideology, it can be useful to econ

5/ Uzawa wrote to Arrow & Hurwicz that he had read their work “with ardor” (sic) and sent his homework (which happened to be the 1st clear distinction b/w global and local stability in programming). So Arrow invited him right away to Stanford

6/ Uzawa joined the Stanford growth seminar in 1956 and came up w/ a way put Das Kapital in equations: the 2 sectors growth model (w/ cool strictly concave production production frontier). But Solow didn’t seem to get that Uzawa was trying to bring classes in his growth model.

7/Since Ramsey, econ had borrowed calculus of variations from engineers to model growth path, but modeling agents as choosing set of actions over time under constraints was tricky: they didn’t know how to handle the time paths of their state & control variables.

Nor could they handle corner solutions (if you need a primer on the history of dynamic growth math, read Sent and Wulwick https://t.co/5wHUd0rc7x)read.dukeupress.edu/hope/article-a…

levyinstitute.org/pubs/wp38.pdf

levyinstitute.org/pubs/wp38.pdf

8/ But they were all working in the new OR dpt of Stanford engineering school, with mathematicians & engineers around. So Sam Karlin suggested that Uzawa check this fancy book by a blind Russian mathematician. Uzawa got it translated and gave it to Cass and Ryder, his students

9/ Uzawa got married, rented nice cottage. His landlady happened to be stepdaughter of a famous Stanford econ barred from getting tenured b/c of messy marriage : T. Veblen (). So Uzawa read tons of Veblen, liked his treatment of institutional constraints https://t.co/KuGnqo0gh5stanfordmag.org/contents/the-n…

10/ But Uzawa grew tired of Stanford’s peaceful world, and of feeling “so small” in front of Arrow, so he moved where his dear friend, the local “in house Keynesian” Lloyd Metzler said there was a war to wage: Chicago. Which got Koopmans to tell him “you are a traitor.”

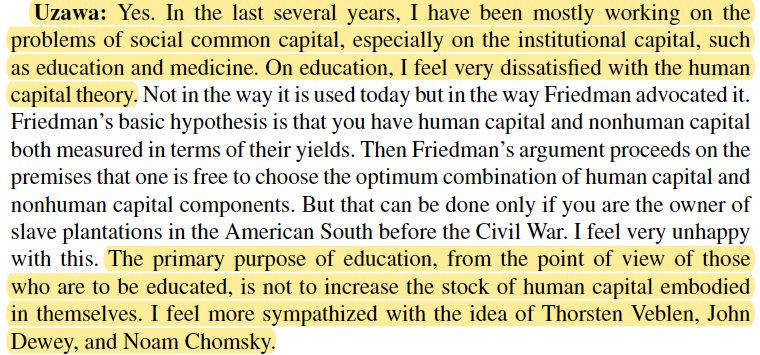

11/ He wrote the first human capital accumulation growth model (H is for Human capital, but also Hiro). Hardly gets a mention in interview. Bc at Chicago, there was Friedman. And there is so much to say abt Friedman Also, the Vietnam war has turned the US into a “chaotic mess,”

11/ Uzawa thought how about paying a visit to, you know, *real* Keynesians. So he flew to Cambridge, where he met Robinson, who was a kind of “Milton Friedman of the left” (except that “Friedman is logical” and Robinson “philosophical”)

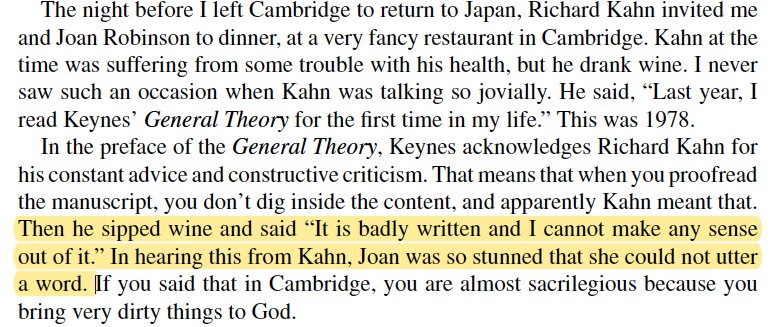

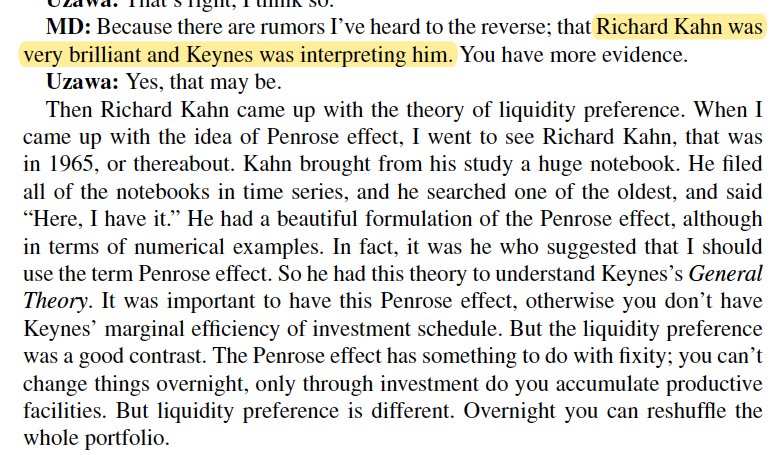

12/in fact, he spent most of his time hanging w/ Richard Kahn, (who was much clearer than Keynes), discussing how to model the fact that capital is an institutional entity that adjusts constantly in the production process (if I understood correctly). That was consistent w/ Veblen

13/ By that time, Uzawa had spent 20 years reflecting abt how all sorts of production factors accumulate, from human capital to public goods. He moved back to Japan, and focused on “social common capital”

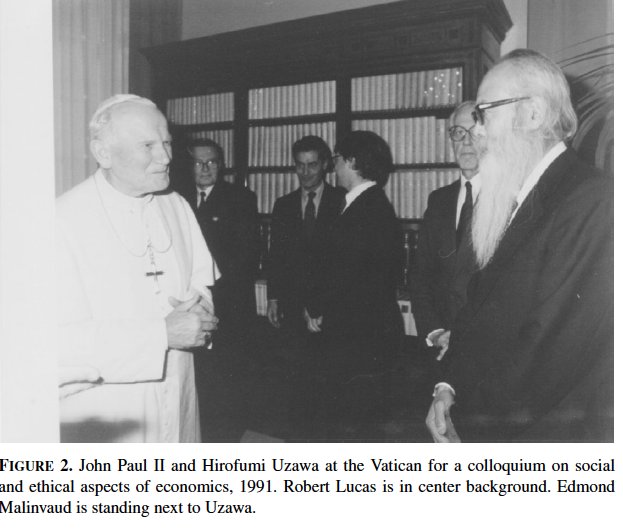

14/In late 1980s, Pope was working on new encyclical abt “the abuses of socialism & the illusions of capitalism” Question was how to transition from former to latter Uzawa saw opportunity to apply Solow meets Keynes meets Veblen, and offered advice. It became Rerum Novarum

/end/

/end/

@econoclaste ...de nouveaux facteurs et contraintes de prod, et qu'après avoir fait le malin avec Kuhn-Tucker et Pontryagin, il a passé le reste de sa vie à essayer de prendre en compte le capital social et les contraintes institutionnelles de production à la Veblen.

• • •

Missing some Tweet in this thread? You can try to

force a refresh