@Traders82 #Chapter3 : Price Action Trading Secrets

Disclaimer: I am going to share my experience in Price Action trading. Please note this is NOT at all a Holy Grail or even close so if you are looking for that, please stop reading here.

Disclaimer: I am going to share my experience in Price Action trading. Please note this is NOT at all a Holy Grail or even close so if you are looking for that, please stop reading here.

BUT if you want to learn about markets, supply & demand, how price moves & want to be on the right side most of the time, then continue reading. Once you read & understood these concepts, you need to spend 1000s of hours to screen various charts to practice what you have learnt.

ONLY this way you can learn price action trading so do I have your commitment on this?? I heard YES so get ready for the excitement.

1st Topic would be -

What is Price Action & why it is important?

1st Topic would be -

What is Price Action & why it is important?

1.What is Price Action & why it is important?

We all trade price every day. Knowingly or unknowingly but we all are associated with price. You buy a stock at 100 & I sell at 100, we traded price. So price is nothing but an agreement between 2 parties to trade something mutually

We all trade price every day. Knowingly or unknowingly but we all are associated with price. You buy a stock at 100 & I sell at 100, we traded price. So price is nothing but an agreement between 2 parties to trade something mutually

Bulls & bears often fight for a fair price which they think is right for them & they try to defend that price to keep their hold. Price action trading is the study of analyzing this tussle between them & helps you make trading decisions purely based on the price.

It does not use any technical indicators to derive the decision to buy or sell.

Price action is important to find the right balance between buying pressure & selling pressure which actually moves the price.

Price action is important to find the right balance between buying pressure & selling pressure which actually moves the price.

You analyze every single candle/bar in the price chart to understand who was in control in that specific time frame & who won the battle towards the close. It is very interesting study & keeps you on the right side always.

Hope this was helpful to understand what is price, what is price action and why it is important to make a trading decision.

Our next topic would be -

Understand structure, trends & market cycles

Our next topic would be -

Understand structure, trends & market cycles

2. Understand structure, trends & market cycles

What is the first thing you look when you see a new chart? Thinking???

Let me help. The first & foremost thing you should look for in any chart is “Structure” or “Trend”. It’s easy….right?

What is the first thing you look when you see a new chart? Thinking???

Let me help. The first & foremost thing you should look for in any chart is “Structure” or “Trend”. It’s easy….right?

But question is what a structure is & how it defines a trend?

Structure is nothing but the analysis of recent peaks & troughs (in other words pivots).

Structure is to spot the following 4 things on any given chart –

1.Higher high

2.Higher low

3.Lower high

4.Lower low

Structure is nothing but the analysis of recent peaks & troughs (in other words pivots).

Structure is to spot the following 4 things on any given chart –

1.Higher high

2.Higher low

3.Lower high

4.Lower low

But you may be thinking why should I look for the structure? What is the need & how it helps? The objective of looking for a structure is to know whether the stock is trending (consistently rising or falling) or in range (trading between a price range & not moving in 1 direction)

And why do we need to know this info? The reason is simple. Strategies are different for trending market or range bound market & one strategy doesn’t work in other type of market. Therefore, you need to first know the type of market you are in & only then define a strategy.

Note: If the chart you see doesn’t provide enough information to define the structure thus trend, zoom out so that you can see the structure for more time duration i.e. if currently you see just 1 month time chart, you should see 3 months or more to know clear picture.

Once you understand the structure, the next logical thing to know is which cycle this stock/index is operating in? There are mainly 4 stages/cycles for any stock & they are repetitive in nature i.e. they move in sequence & repeat again once all 4 are completed once.

These 4 cycles are –

a.Accumulation

b.Mark up

c.Distribution

d.Mark down

As Price Action trader you need to literally understand these concepts really well so that you can time your entries accordingly.

a.Accumulation

b.Mark up

c.Distribution

d.Mark down

As Price Action trader you need to literally understand these concepts really well so that you can time your entries accordingly.

Though they work on every time frame, my personal experience is that they work really well on larger time frames i.e. hourly, 4 hourly, daily, weekly, monthly.

Let’s understand these cycles 1 by 1 –

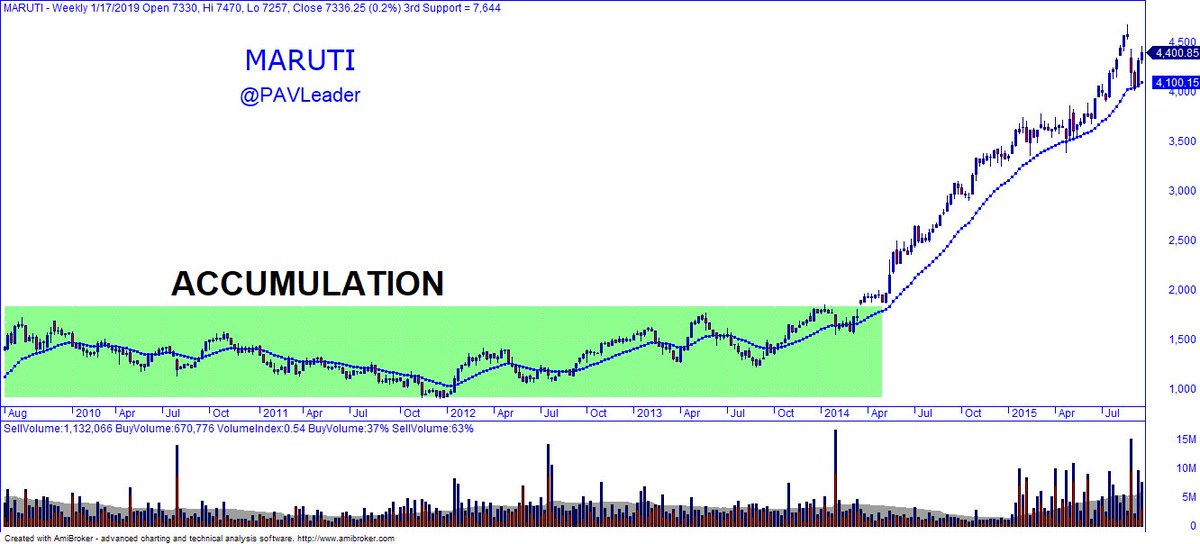

a. Accumulation: This cycle comes after the Mark down phase where the sell-off by Smart Money (FIIs, DIIs, big hedge funds etc.) happens to dump the stocks back to retail traders.

a. Accumulation: This cycle comes after the Mark down phase where the sell-off by Smart Money (FIIs, DIIs, big hedge funds etc.) happens to dump the stocks back to retail traders.

Once they dump their stock to retail & bring the price down from top to bottom, they start accumulating it again at lower prices (price which they think is fair for them). Therefore, this cycle runs really long & really test patience of long term buyers.

During the accumulation stage they try to take price up multiple times to check if any supply is present or not. This takes down the price a bit before they come back again and provide the required support to stop price fall further.

After this test, they take the price up again & this cycle repeats few times until all the floating supply is removed. Once they drain everyone & weak buyers they take the price up via breakout & never see those levels again.

To take the maximum advantage you need to learn to spot this cycle well so that you get early entry & ride along with the Smart Money.

Next section will be on Mark up phase.

Next section will be on Mark up phase.

b. Mark Up: Once they load their trucks full, the next stage is to take the price higher & higher (making higher highs & higher lows). This is the stage where price moves up at a very high speed because bulls are in control.

This happens till the point where either or both these things happens –

•Bulls feel that it’s time for profit booking or offloading the stock OR

•Bears start getting active to take control & price resist to move up

•Bulls feel that it’s time for profit booking or offloading the stock OR

•Bears start getting active to take control & price resist to move up

Its a game of muscles & endurance. If bulls win this then price continues to go up after facing a small resistance but if bears win then 2 things may happen –

•Either price falls sharply (highly unlikely in one shot) OR

•Price moves in range (beginning of distribution phase)

•Either price falls sharply (highly unlikely in one shot) OR

•Price moves in range (beginning of distribution phase)

The next phase comes for Distribution which is a very interesting phase.

c. Distribution: This phase is an interesting phase & price spends a lot of time here just like accumulation phase. Whatever stocks Smart Money has accumulated at lower prices, they need to now sell.

c. Distribution: This phase is an interesting phase & price spends a lot of time here just like accumulation phase. Whatever stocks Smart Money has accumulated at lower prices, they need to now sell.

In order to sell such huge number of stocks they need to make the market where they find buyers so they create that market. This is where price exhaustion, failed bullish breakouts, failed trend line breakouts occurs.

Price goes up fake & then comes back in the trading range giving retail buyers a feel that it’s a breakout so go for buy. This is where they trap most of the retail buyers & dump their stock inventory to them & get their investment with huge profits back.

They make price move in a specific range where on every rise (near resistance or little abv) they sell their stocks & when price falls a bit they buy a little to create a fake or temporary support & take the price back up where they sell again more than what they previously sold.

This happens few times at various price levels until they offload all their inventory fully which actually breaks the interim support they created & price never look back those levels again & falls like a knife only to head towards where the journey started.

Next phase-Mark Down

Next phase-Mark Down

d. Mark Down: Once the price breaks the final support level, it falls on its own weight. Retail traders have no clue why the hell price is falling because just now they had seen bullish breakouts.

So they try to average thinking that price will come back to their buying price and they will get out at cost. This little buying actually pulls the price little up but since there is no interest from heavy funds the price don’t go up much.

Since it doesn’t meet the average price of retail trader, they don’t sell in loss and hope that price will go up further. Some other retail traders sell their positions in fear and book losses.

On the other hand, those who missed the initial shorts at the top or at the break of support, now get a price closer to that level which is acting as a resistance, enter fresh shorts now because they don’t want to miss the opportunity this time.

Other retail traders who booked losses & sold in panic combined with fresh shorts accelerates the speed of this fall taking the price further down. Now this stock becomes sell on every rise and enters a perfect downtrend stock (making lower high, lower lows).

So this ends the topic 1 & 2 from Price Action trading secrets. Tomorrow I will share couple of more topics in continuation to what I shared today.

Hope you liked these fundamentals to understand how price moves.

You can comment & share your feedback now!

@chief_vk over to you

Hope you liked these fundamentals to understand how price moves.

You can comment & share your feedback now!

@chief_vk over to you

• • •

Missing some Tweet in this thread? You can try to

force a refresh