1. $TMO acquires viral vector manufacturer Brammer Bio for $1.7b cash. Company on track for $250m in Revs in 2017 (6.8x). $0.10 EPS accretion implies ~$40m of Net Income (16% margins). Will grow 25% over the mid-term.

2. This implies ~$750m in Revenues in five years. Margins will expand within TMO. 25% Net Income margins in five years would generate $190m of Net Income. Good for an 11% ROIC.

3. Strategically this is an important acquisition for $TMO in response to the pending $GE/ $DHR deal. Viral vectors are the delivery vehicle for Regenerative Medicine. They enable therapy to target specific cells within the body.

4. $GE/ $DHR products are more centered around bioreactors, filtration, and cryo/thaw. This is the nuts and bolts of the manufacturing process. Will be interesting to see whether this leadership is more valuable than $TMO's position as a manufacturer.

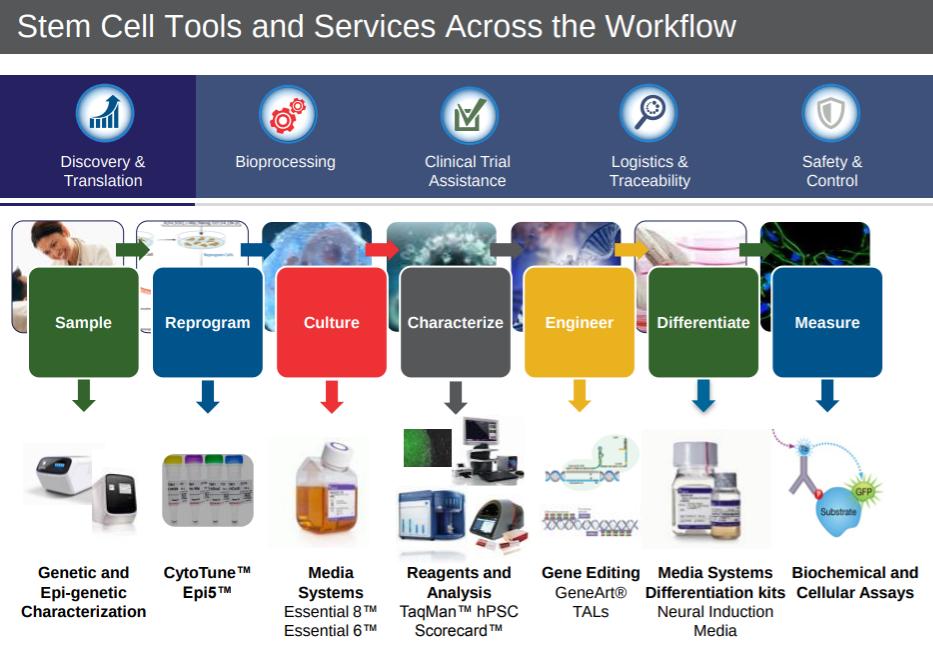

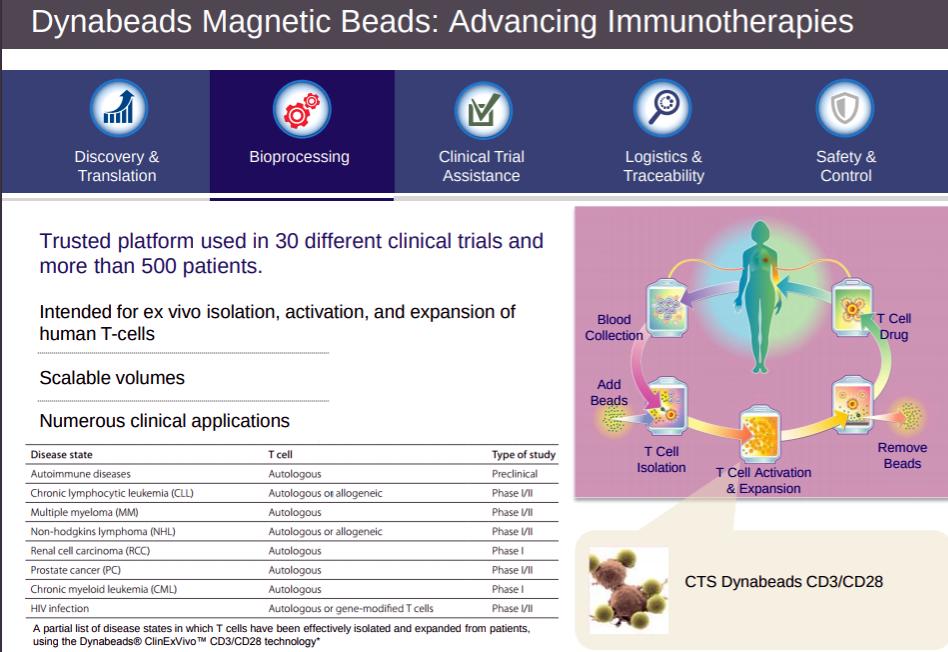

5. $TMO with a pitchbook about capabilities within Regen Med Space. Dynabeads are currently being used in 30 different trials.

tools.thermofisher.com/content/sfs/br…

tools.thermofisher.com/content/sfs/br…

6. Regen Med is clearly area of focus for LS Tools players and they are willing to pay for that exposure. Has to be viewed as a positive for $BRKS $BLFS $CYRX $LONN CH

• • •

Missing some Tweet in this thread? You can try to

force a refresh