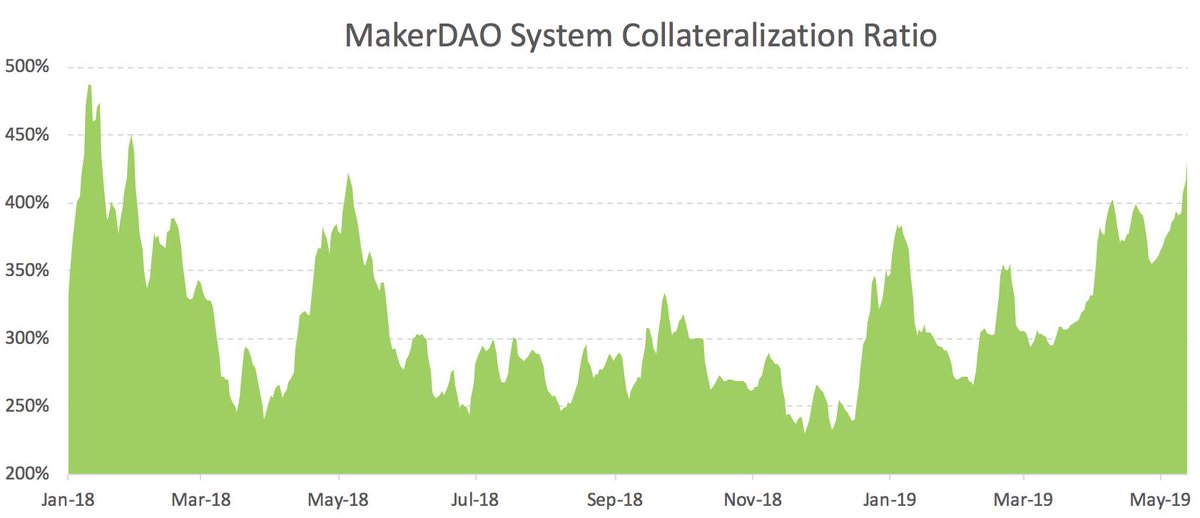

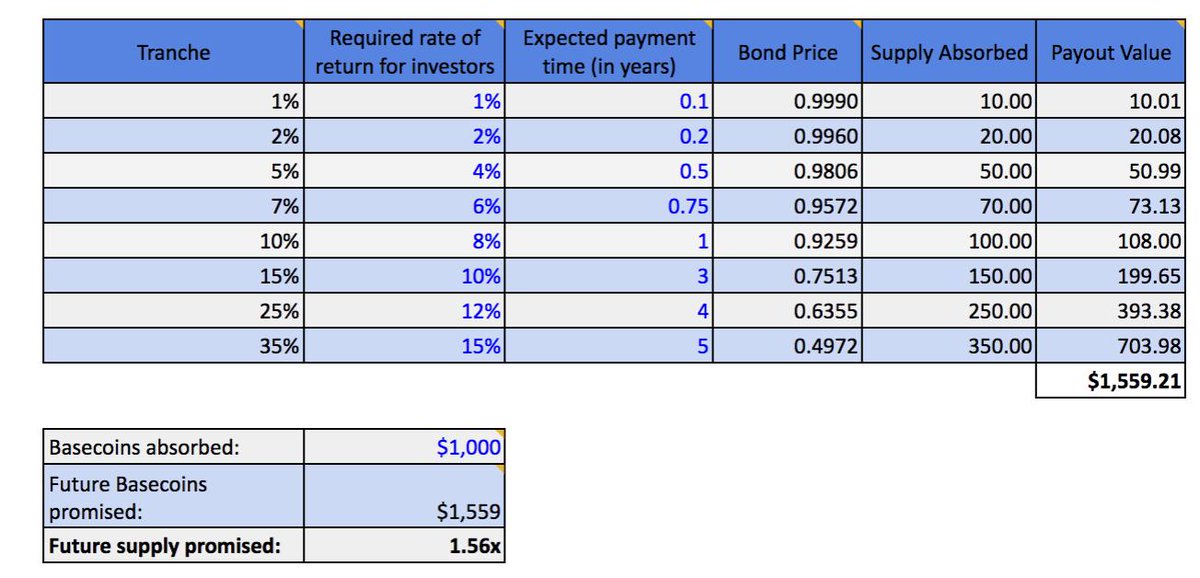

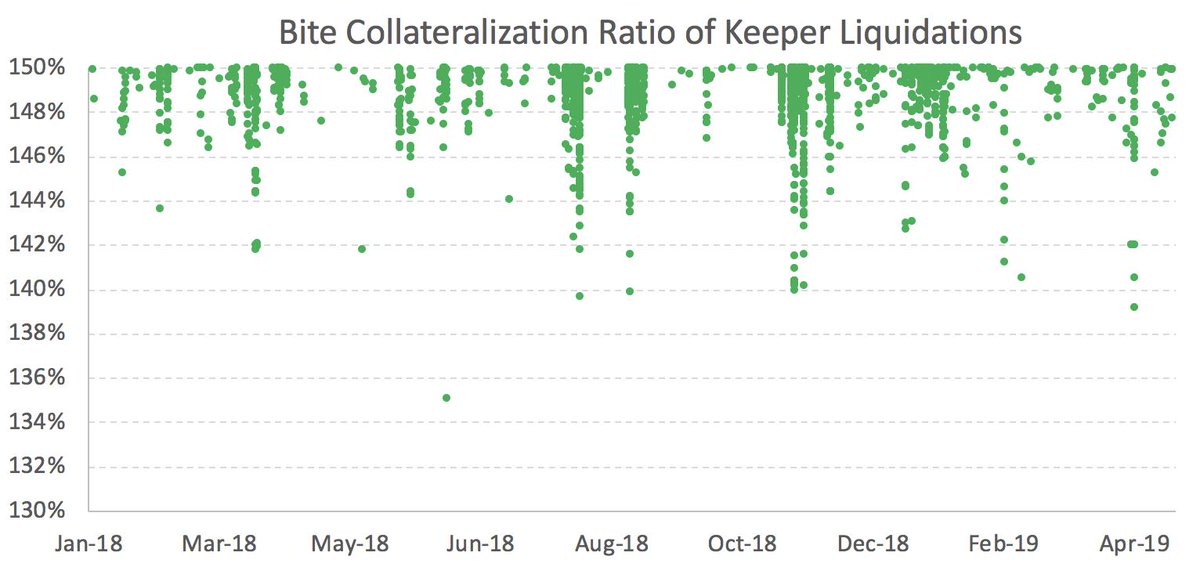

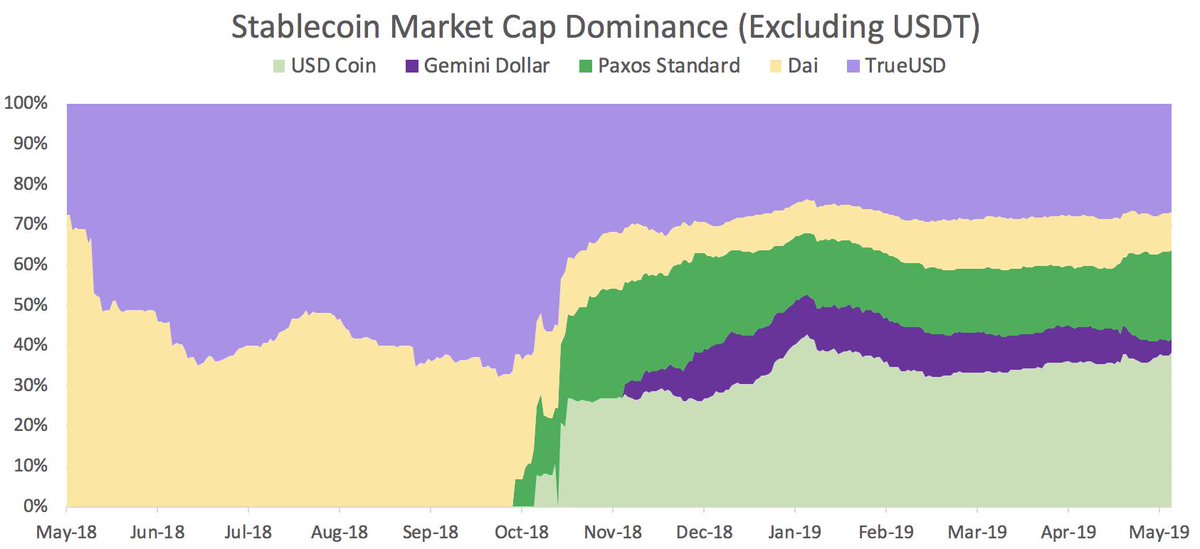

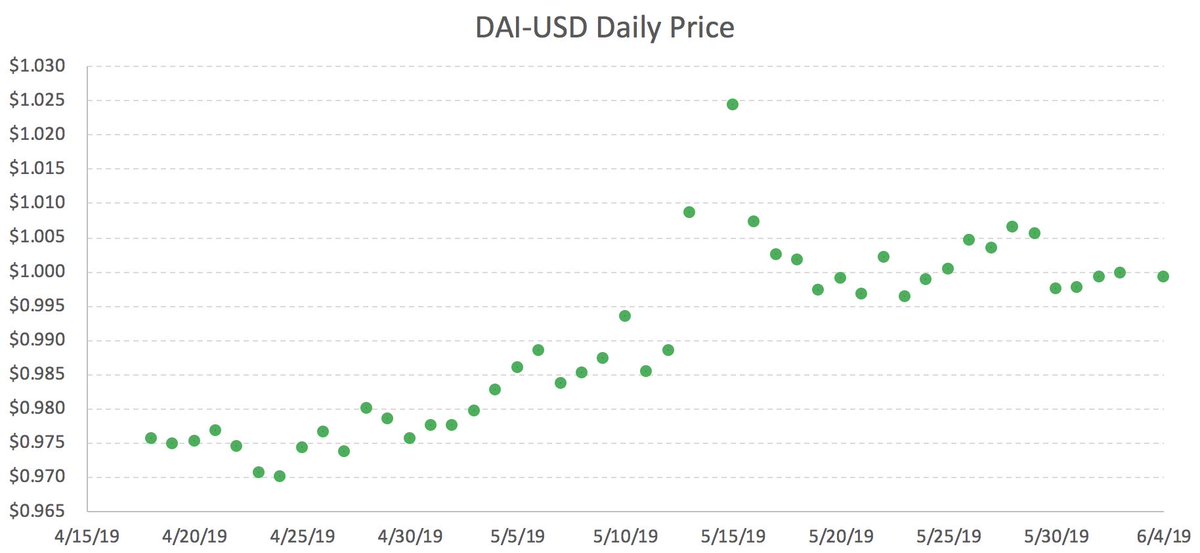

Anyways, the conclusion of the data set is amazing. Maker is growing at a staggering pace 💯

h/t @placeholdervc + @alexhevans Maker Network Overview for chart inspirations 😀