"Experience had taught me to beware of buying a stock that refuses to follow the group-leader"

Peter also takes the same approach

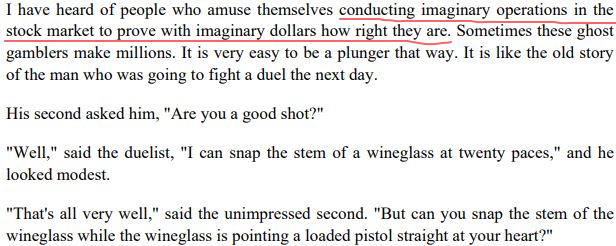

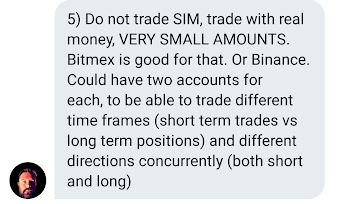

Just because you're profitable on a simulated account, doesn't mean you're going to be with the real thing.

@krugermacro agrees⬇️

If you made it this far it's safe to say you definitely need to read the whole thing

If you want a Part 2 let me know in the comments🤟 $crypto