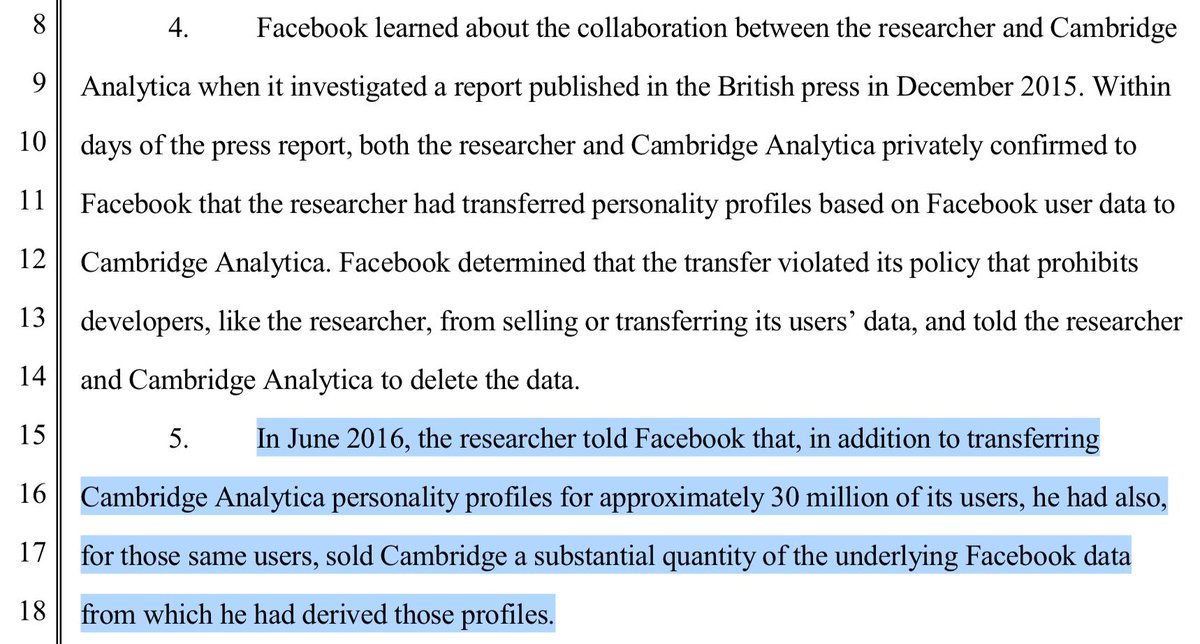

Finally. Here in SEC docs is what Facebook has painfully avoided public knowing and press has mostly missed documenting. Facebook data was ****SOLD**** to Cambridge Analytica. Can everyone please now say that Facebook personal data was sold rather than captured, transferred, etc?

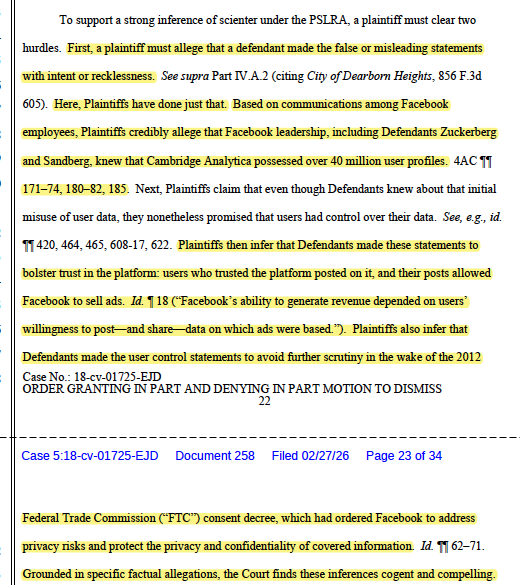

"Moreover, when asked by reporters in 2017 about its investigation into the Cambridge Analytica matter, Facebook falsely claimed the company found no evidence of wrongdoing, thereby reinforcing the misleading statements in its periodic filings."

"Facebook did not disclose..,.until March 16, 2018, when the company— for the first time—publicly acknowledged on its website that it had learned of the violation of its policy in 2015. The price of Facebook shares declined substantially following the company’s disclosure."

2 things here. I believe SEC report documents Zuckerberg's misleading testimony about how diligently they reacted upon press. This is one of Facebook's greatest deceptions in intentions with the cover-up. ps CA certification wasn't similar to Kogan's.

@SenWhitehouse @SenBillNelson This begs the question what was the purpose of the 2012 FTC Consent Decree and the audits being done every other year by PWC??? 7 years and this is how this plays out?

@SenWhitehouse @SenBillNelson OMG, THERE IT IS. The FTC settlement is a distraction. The key report is the SEC report. Attempted whistleblowers knew prior to Guardian report, they were ignored and Facebook continued to take $ from "sketchy (to say the least) data modeling company” for political advertising.

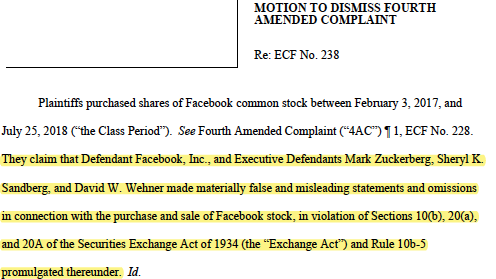

@SenWhitehouse @SenBillNelson I don't say this lightly. Compare this answer by CEO Zuckerberg to @USRepMikeDoyle to the relevant section of the SEC settlement. I would have examined the stock sales of every insider aware during this period including officers/directors.

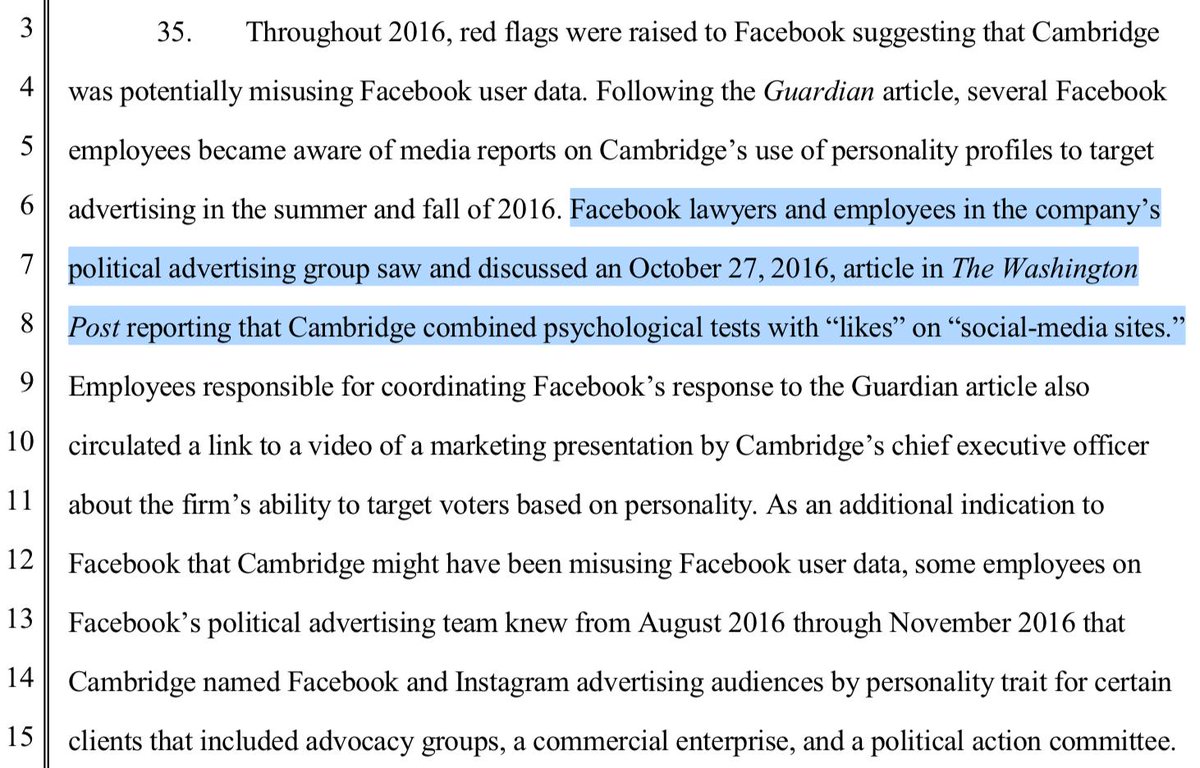

@SenWhitehouse @SenBillNelson @USRepMikeDoyle Woah this was 12 days before US elections. Facebook employees knew stuff was going on but their DC office appears to have frozen them. Consumers were deceived and harmed through their personal data likely in order to protect Facebook's reputation and share price.

@SenWhitehouse @SenBillNelson @USRepMikeDoyle "Although several employees in Facebook’s legal, policy, and communications groups who attended these meetings during the relevant period were aware of the researcher’s improper transfer of data to Cambridge, that incident was never discussed."

@SenWhitehouse @SenBillNelson @USRepMikeDoyle "Facebook knew, or should have known, that its Risk Factor disclosures in its annual reports on Form 10-K for the fiscal years ended December 31, 2015, 2016, and 2017, ...as incorporated into its Form S-8 registration statements, were materially misleading."

@SenWhitehouse @SenBillNelson @USRepMikeDoyle "During the relevant period, Facebook received approximately $29m in cash proceeds from the exercise of employee stock options. Facebook also granted restricted stock units to more than 17,000 new employees..."

@SenWhitehouse @SenBillNelson @USRepMikeDoyle Here is the part where Facebook (after covering up incident for nearly 2 1/2 years) burnt The New York Times and Guardian by preempting their reporting once they had dutifully come to Facebook for comment on their findings.

@SenWhitehouse @SenBillNelson @USRepMikeDoyle @AllMattNYT @carolecadwalla With everything above, it's completely reasonable to expect SEC to disclose what any officers and executives knew prior to Dec 9, 2015 (when the Guardian reporter was escalated to Menlo Park) considering reporter started investigating in Dec 2014. vox.com/2015/11/14/116…

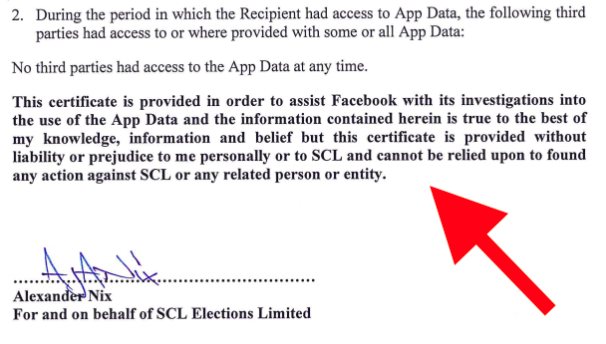

@SenWhitehouse @SenBillNelson @USRepMikeDoyle @AllMattNYT @carolecadwalla by the way, this is the "certification" between the CEO of Cambridge Analytica and Facebook. The red arrow is mine pointing to language which makes this agreement almost meaningless beyond the fact Facebook didn't sign it.

@SenWhitehouse @SenBillNelson @USRepMikeDoyle @AllMattNYT @carolecadwalla the cited Washington Post story. Having reviewed the SEC findings, this means Facebook read this report, knew Cambridge Analytica had improperly bought tens of millions of Facebook's personal data, was spending $ on Facebook and looked the other way. washingtonpost.com/politics/trump…

@SenWhitehouse @SenBillNelson @USRepMikeDoyle @AllMattNYT @carolecadwalla @PostKranish Reminder, this was Facebook testimony to UK Parliament on February 8, 2018. It was entirely misleading in light of the SEC report today. cc @CommonsCMS

Bam. Looks like DC Attorney General @AGKarlRacine agrees - Office just filed to unseal the internal Facebook emails referenced in the SEC settlement.

https://twitter.com/realdanstoller/status/1154434376438075392?s=21

@AGKarlRacine Time to bump a few important docs back up for a reality check. SEC complaint says Kogan told Facebook in June 2016 he had sold 30 million underlying records to a political operative. (1) seems obvious Facebook accelerated its cover-up at that point after 6+ months of deflection.

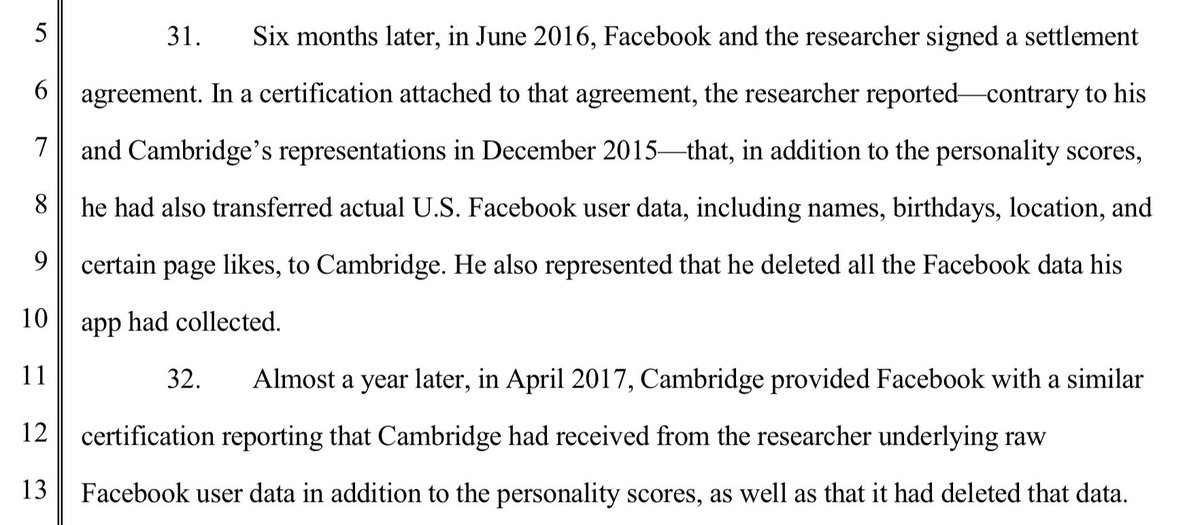

@AGKarlRacine Interesting timing as Kogan told FB this in June 2016 and he then signed an agreement with Facebook on June 24 which happened to be the result date of the Brexit Referendum. It was quite an agreement to review when it surfaced at @CommonsCMS. p19-33 parliament.uk/documents/comm…

@AGKarlRacine @CommonsCMS at minimum, this is why Facebook's top EU policy exec testifying in Feb 2018 CA didn't have FB data 1 month before global press attention was beyond ridiculous having been told in June 2016 30mm records had been sold to CA. @carolecadwalla is right, we prob should say he lied.

@AGKarlRacine @CommonsCMS @carolecadwalla side note, the May 2018 @CommonsCMS correspondence was a valuable written exchange. Source of many new details and some of their best obfuscations. It came during time of pressure for Zuckerberg to testify. He ultimately danced through Brussels instead. parliament.uk/documents/comm…

@AGKarlRacine @CommonsCMS @carolecadwalla aah, just pointed out I didn't link to the original SEC complaint. Here it is. sec.gov/litigation/com…

@AGKarlRacine @CommonsCMS @carolecadwalla and routing this thread back to another old one where I list a lot of the obfuscations... and probably connect to another thread of evidence. my timeline is a Facebook rabbit hole. So were their practices.

https://twitter.com/jason_kint/status/1064004507221311488?s=20

@AGKarlRacine @CommonsCMS @carolecadwalla Remember when Facebook famously went dark for five days after Cambridge Analytica scandal broke globally? I'm rewatching CEO Zuckerberg's first highly promoted CNN exclusive interview to compare to the SEC report yesterday. I've cued the spot for you.

@AGKarlRacine @CommonsCMS @carolecadwalla Put aside that Zuckerberg testified under oath and answers here that Facebook first learned from The Guardian report, I'm having trouble with "as far as we understood around the time of that episode there was no data out there." Yellow highlights are mine.

@AGKarlRacine @CommonsCMS @carolecadwalla Now reviewing Kogan's testimony where he testified to @SenJohnThune:

- Facebook visited Kogan in Sept 2015 and were told about his selling of data.

- His "equal partner" disclosed what they were doing during his job interview with Facebook (note: he was hired 11/9/15)

- Facebook visited Kogan in Sept 2015 and were told about his selling of data.

- His "equal partner" disclosed what they were doing during his job interview with Facebook (note: he was hired 11/9/15)

@AGKarlRacine @CommonsCMS @carolecadwalla @SenJohnThune just in, Facebook response to DC request, in light of SEC filing, to unseal internal emails showing FB had awareness of Cambridge Analytica problems earlier than Zuckerberg told Congress. When reports of emails surfaced, FB said they were about a different "scraping" incident.

+1 for lawmakers not willing to get rolled, misled or lied to by Facebook. Parliament asks for an explanation by Aug 12th why last week’s “SEC Complaint seemingly directly contradicts oral and written evidence”

https://twitter.com/commonscms/status/1156836968820563968?s=21

New update from Facebook v DC. They're still working incredibly hard to keep internal email chain sealed which reports to show prior knowledge of Cambridge Analytica. In worst case, it may also lead to perjury or securities issues for Facebook officer(s).

https://twitter.com/birnbaum_e/status/1157293028740161537?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh