#Popculturetimemachine story time.

Once upon a time, one of the most iconic lifestyle brands was...McDonald's...

Once upon a time, one of the most iconic lifestyle brands was...McDonald's...

Fashion- absolutely! Whether your jeans were embellished with a Ronald McDonald patch, or you wore your fancy dress embroidered with the fry guys and burgers for school pictures, McDonald's couture had something for every occasion

What about leisure? McDonald's had you covered-- there was a different playset available depending on age and interest...

What about housewares? Well McDonald's had a variety of limited edition plates to adorn even the most elegant of tables....

Glassware you ask? Why yes, who wouldn't want to drink the beverage of their choice out of a glass featuring Grimace or Mayor McCheese?

When you went to the doctor, maybe he gave you a balloon...or, if your doctor was extra, he gave you a McDonald's hand puppet...

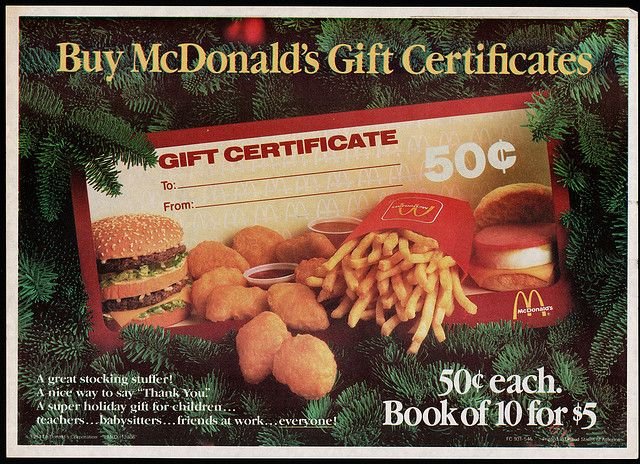

For the holidays, you could give someone you cared about a fabulous McDonald's gift certificate-- way before that was a thing. You could even get them from the "cool" houses for Halloween...

McDonald's...more than a burger and fries, it was a way of life. You didn't choose the McDonald's life-- it chose you.

• • •

Missing some Tweet in this thread? You can try to

force a refresh