1/25 A REVIEW OF $ADT 's RUPICE: Its a good polymetallic exploration project v. likely to go into production, hence the interest. I built a "basic" model after the Co. provided me with some DDH survey info - Tx again @croninpd. All Other info came from bit.ly/33JthFl

2/25 I should add this is my desktop opinion. I am:

-Not being paid by ADT

-Not a S/H and may/may not be one at some point.

-Don't know the people.

-Have not discussed this with them.

-Have not visited the project

-Doing this because its what I do when I don't ride dirt bikes.

-Not being paid by ADT

-Not a S/H and may/may not be one at some point.

-Don't know the people.

-Have not discussed this with them.

-Have not visited the project

-Doing this because its what I do when I don't ride dirt bikes.

3/25. Some have said the biggest risk is the jurisdiction. It so HG that nothing could possibly go wrong! I don't know. I think the biggest risk could be wild optimism. The drilling results are great, but infectious & THAT bias could lead to some costly decisions. Besides-Murphy.

4/25 Its about 45km from Sarajevo as the crow flies. 77km by good road to the old Tiscovi (Veovaca) plant site (or 44km on a small, tight mountain rd). I would imagine a power line as-long would need to be constructed. Its in a very mountainous but historical mining area.

5/25 By all accounts the community is supportive. There is need for work. Permitting seems well managed, in order & not unduly onerous. ADT seems to have good people managing this. But where would the plant & TSF go? The mountains are big & rough.

6/25 Most of the drill assay data came from the prospectus & Co. news. What a mess to sort out. Columns in different orders, different significant figures used, inconsistent & incomplete info presented. Its worrying: Could they have been sloppy with the sample prep and ....

7/25 ...QA/QC? Its possible, one would hope not! Geological (litho) envelopes were not used in the creation of the block model, rather grade envelopes were used, 2 for each element, one for HG & another for LG. I don't like this but when creating my own pseudo solid of the...

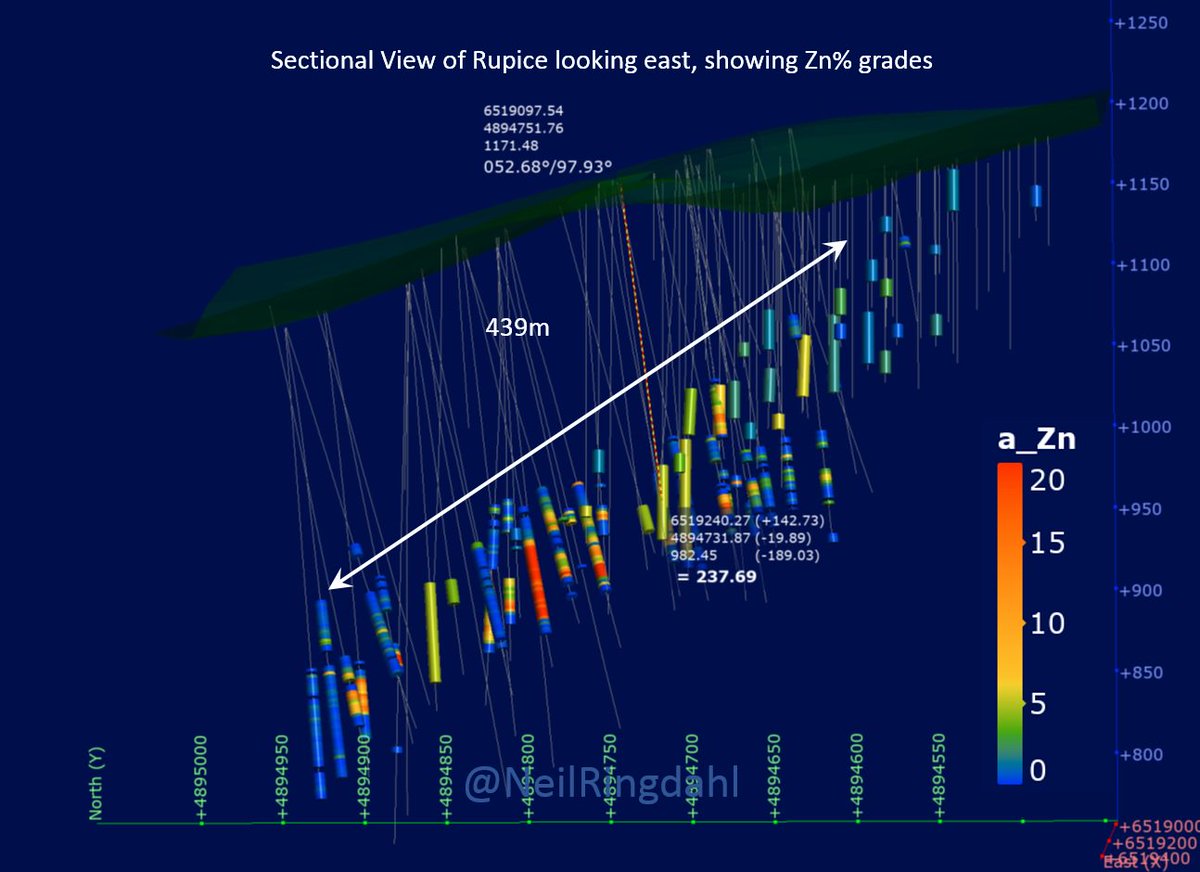

8/25 ore zone based on an AuEq cut-off I came up a similar volume to that reported in the Resource. Pleasing. The ore body appears highly faulted and experience & core loss in places would suggest the geotechnical conditions in & around the high grade areas could be very poor.

9/25 The ore body out crops at the top of the mountain and dips 37-50º in a sub-parallel direction to the North West, under the North-facing slope. This would be favorable for an open-pit scenario, but for the fact of the offset plunge increases the stripping ratio quickly.

10/25 OP mining this deposit has the disadvantage of starting in the outcrop at the top, where most of the Inf. material lies. It is also lower-grade than the rest below, maybe lower recovery also, so has a lower initial revenue/year. I did not have time to do a pit optimization.

11/25 However in OP mining ~80% of the resource, I estimated an approximate SR of ~1:15 using 45º slopes for 122Mt waste & 8Mt ore. It probably would be mined in 3 push backs (Cuts), but I spreadsheet-scheduled just 2. These No.'s are very rough & are order-of-magnitude only.

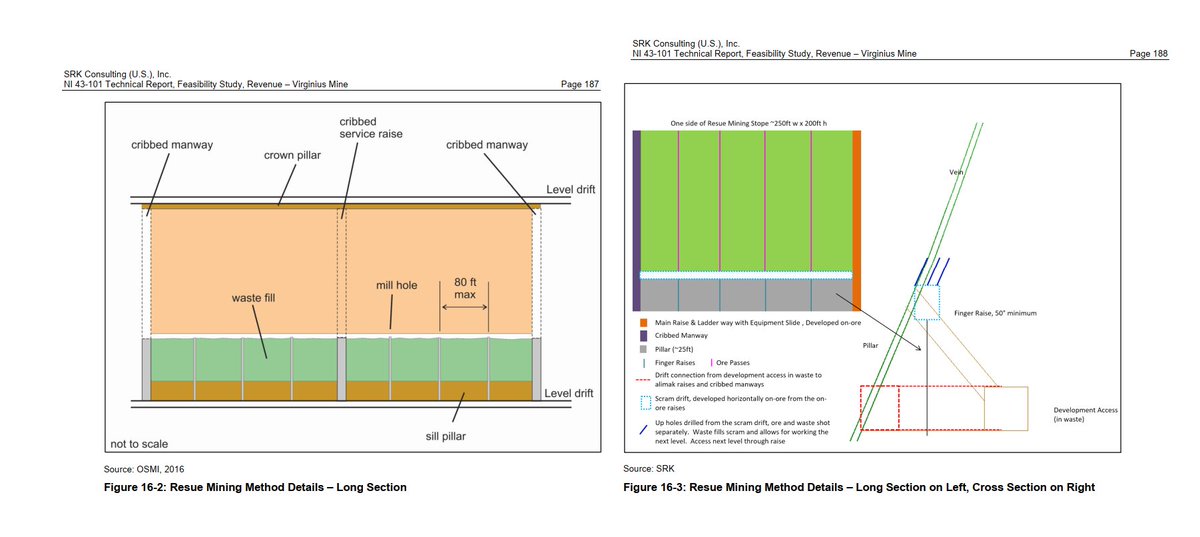

12/25 Spinning the thing around in 3D with a pseudo-estimated topography scaled off from GE, I came up with a more logical UG layout, adopting 3 main portals down the side of the mountain for a total of about 5,400m of primary waste development. The lowest portal comes out near

13/25 the base of the mountain and close to a road linking back to Veovaca, where the plant might be located. Why so far away? Simply b/c there was a plant there before, permitting would be easier & construction costs lower (flat ground). A study need to be done on plant location

14/25 Given there are around 7.5Mt in Indicated Resources, 1Mt/yr would be considered a reasonable production rate. A plant ought to be built with a 3,000 tpd line and a crushing circuit for double that volume if $ADT is bullish on the exploration upside, otherwise not.

15/25 The reason for this is that in the event the mine resource grows another line can be relatively inexpensively installed later on, giving 2Mt/yr capacity. Rather start smaller on lower Capex & lower expectations all round & grow on CF. Promoters don't like this. Go figure.

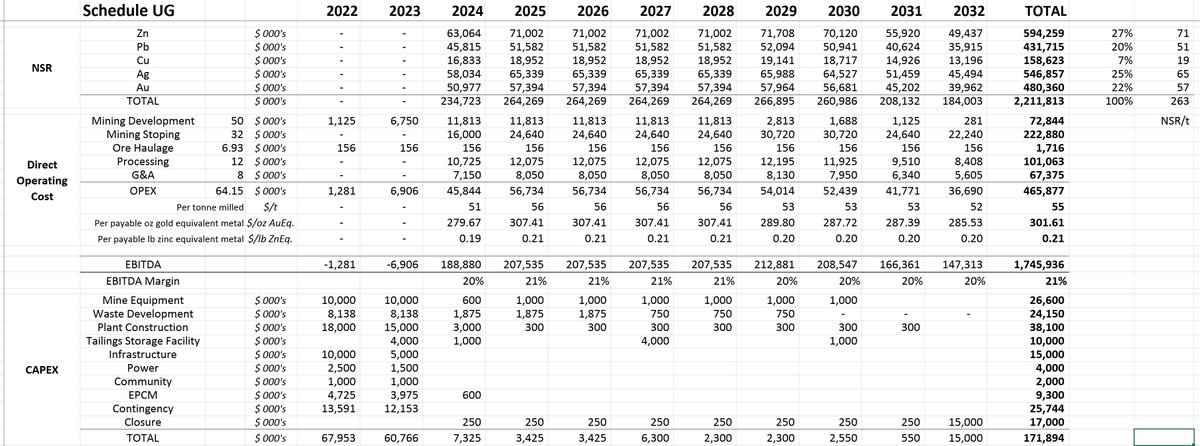

16/25 A simple schedule for the UG and OP scenarios would give us a glimpse of a possible project value. You may have already noted the lower recovery assumptions used for NSR. That's because it until the test work demonstrates otherwise, why be wildly optimistic!?

17/25 Then we have barite. ADT use $200/t. I have others telling me as low as $50/t. Its used mostly in oil drilling but I have my doubts there will be market for 270kt/yr !? Anyways if we cant get ALL the lead out of it will it even meet EU/intl. safety guidelines as a product?

18/25 BaSO4 is an industrial mineral that has its won idiosyncrasies and a niche market. So no, wild optimism; let's agree to set it aside as an opportunity to improve project economics at some point. Besides using ADT assumptions, it represents only about 14% of the NSR.

19/25 Using market-related payable metal & reasonably conservative TC/RC's, penalties, transport costs, my recoveries, spot prices, and a mining dilution of 15%, I came up with a diluted NSR of around $263/t on the Indicated resource. Not bad, actually pretty good!

20/25 So the mine plan assumes 7.5Mt diluted down to 8.5Mt with 15% reduced grade because I have assumed v. poor ground conditions in such good ore. UG site costs come in around $55/t over the LoM. Capex 128MM.

21/25 Here are the bottom line pre-tax, pre-royalty numbers (of which I have no idea).

NPV8% comes in at $907M which I know is lower than most other estimates, but why build unrealistic expectations? Projects seldom come in on time, on budget and do as well as we would like.

NPV8% comes in at $907M which I know is lower than most other estimates, but why build unrealistic expectations? Projects seldom come in on time, on budget and do as well as we would like.

22/25 Funding required is $136M including W/C but excludes permitting, exploration, test work & engineering.

Remember though, this is a very quick desktop estimate.

The OP scenario obviously comes in at a lower Opex ($20/t).

Remember though, this is a very quick desktop estimate.

The OP scenario obviously comes in at a lower Opex ($20/t).

23/25 The OP Scenario has ~$50M more in additional Capex. The LG Inferred material which has to be mined 1st (& was excluded from the UG model) has a big negative impact lowering NPV8% by ~$200M on this alone (using the same LoM throughput), even when considering the much lower

24/25 mining dilution for OP. The undiluted NSR of the Inferred material is almost 50% that of the Indicated, and then there are the additional terrain & environmental permitting challenges for OP as well. I would take the higher Opex UG mining any day.

25/25 In summary then $ADT does indeed look very attractive, 💯 even using conservative assumptions. I'll leave it up to the rest of you to decide what the SP should be. All the best to Paul, the team and Sandfire in this venture. I'll be watching with great interest. 👍

@croninpd @threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh