The Tale of Two Tariff Announcements

August 23, 2019: As expected, China announces a fairly modest** tariff retaliation. Trump then immediately escalates by announcing even more new tariffs.

My latest

1/

piie.com/blogs/trade-an…

August 23, 2019: As expected, China announces a fairly modest** tariff retaliation. Trump then immediately escalates by announcing even more new tariffs.

My latest

1/

piie.com/blogs/trade-an…

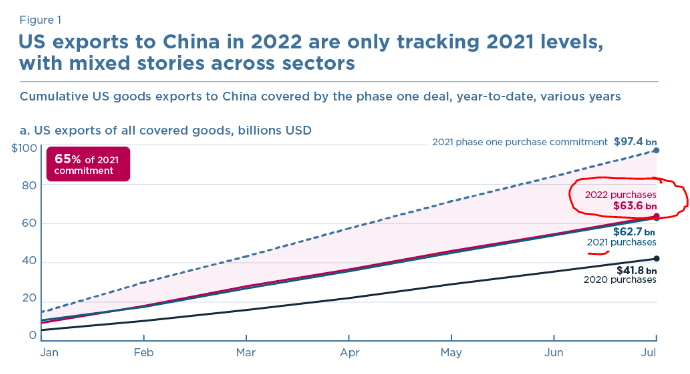

Overall, China’s average tariff applied to US exports during the trade war

• Jan 2018: 8.0%

• Today: 20.7%

• Sept 1, 2019: 21.8%

• Dec 15, 2019: 25.9%

2/

• Jan 2018: 8.0%

• Today: 20.7%

• Sept 1, 2019: 21.8%

• Dec 15, 2019: 25.9%

2/

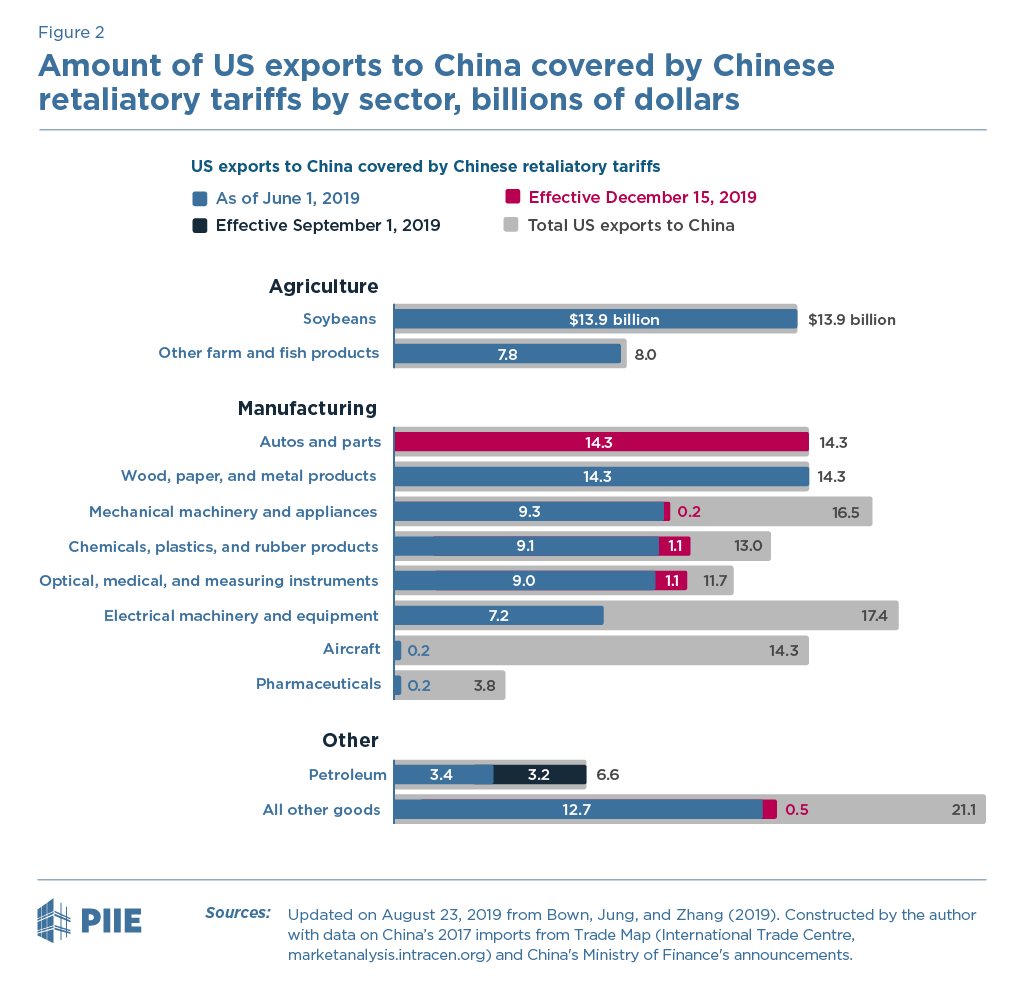

China’s next tariffs hit some new products, like autos and petroleum.

But aircraft, semiconductors, and pharmaceuticals remain mostly untouched.

The soybean tariff increase is hugely symbolic, but economically meaningless

(Tariffs so far had already stopped US exports)

3/

But aircraft, semiconductors, and pharmaceuticals remain mostly untouched.

The soybean tariff increase is hugely symbolic, but economically meaningless

(Tariffs so far had already stopped US exports)

3/

**Big news is China’s retaliatory tariffs on autos.

China suspended those as a sign of goodwill on Jan 1, 2019.

Despite Trump’s 2019 antics, China did not take the bait. Until now.

On Dec 15, Chinese tariffs hit $14 billion of US auto exports, some tariffs increase to 50%

4/

China suspended those as a sign of goodwill on Jan 1, 2019.

Despite Trump’s 2019 antics, China did not take the bait. Until now.

On Dec 15, Chinese tariffs hit $14 billion of US auto exports, some tariffs increase to 50%

4/

Trump's response to China's tariff increase?

More tariffs. Again.

Overall, Trump’s tariffs on China

• Jan 2018: 3.1%

• Today: 18.3%

• Sept 1, 2019: 21.2%

• Oct 1, 2019: 22.1%

• Dec 15, 2019: 24.3%

5/

More tariffs. Again.

Overall, Trump’s tariffs on China

• Jan 2018: 3.1%

• Today: 18.3%

• Sept 1, 2019: 21.2%

• Oct 1, 2019: 22.1%

• Dec 15, 2019: 24.3%

5/

Trump’s August 23 tariff announcement only increased the tariff RATES imposed on Sept 1, Oct 1, and Dec 15.

He did not add any new products.

By December 15, nearly all US imports from China will be covered by Trump’s tariffs.

6/

He did not add any new products.

By December 15, nearly all US imports from China will be covered by Trump’s tariffs.

6/

The purpose and next steps in Trump’s trade war remain unknown.

The economic significance of these NEXT tariffs in the offing are not.

ENDS /

piie.com/blogs/trade-an…

The economic significance of these NEXT tariffs in the offing are not.

ENDS /

piie.com/blogs/trade-an…

• • •

Missing some Tweet in this thread? You can try to

force a refresh