To get you ready for @CharlottesWWWeb live tweets, it is a great time to look at @EquitableGrowth's "The State of U.S. Federal Antitrust Enforcement" equitablegrowth.org/wp-content/upl…. Lots of graphs.

https://twitter.com/CharlottesWWWeb/status/1194649232453644288

New Criminal case, whether measured by cases, individuals charged, or corporations charged are at historically low levels.

Corporate fines for antitrust violations seem tell a different story. But, see Jon Connor's excellent piece on criminal enforcement. papers.ssrn.com/sol3/papers.cf…. Turns out the 2017 number is so high because DOJ reports based on when the fine is collected.

Turns out, 94% of the fines collected were for cases in which the case was resolved and the plea entered in 2014 or 2015. Take those cases out and DOJ collected just over $100 million in fines. For more information on criminal antitrust, check ou @AntitrustInst

As to merger enforcement, merger filings have nearly doubled since 2010, but enforcement actions have been flat.

As to appropriations, in real terms, the FTC's and DOJ Antitrust Division's budget are 18 percent lower than in 2010.

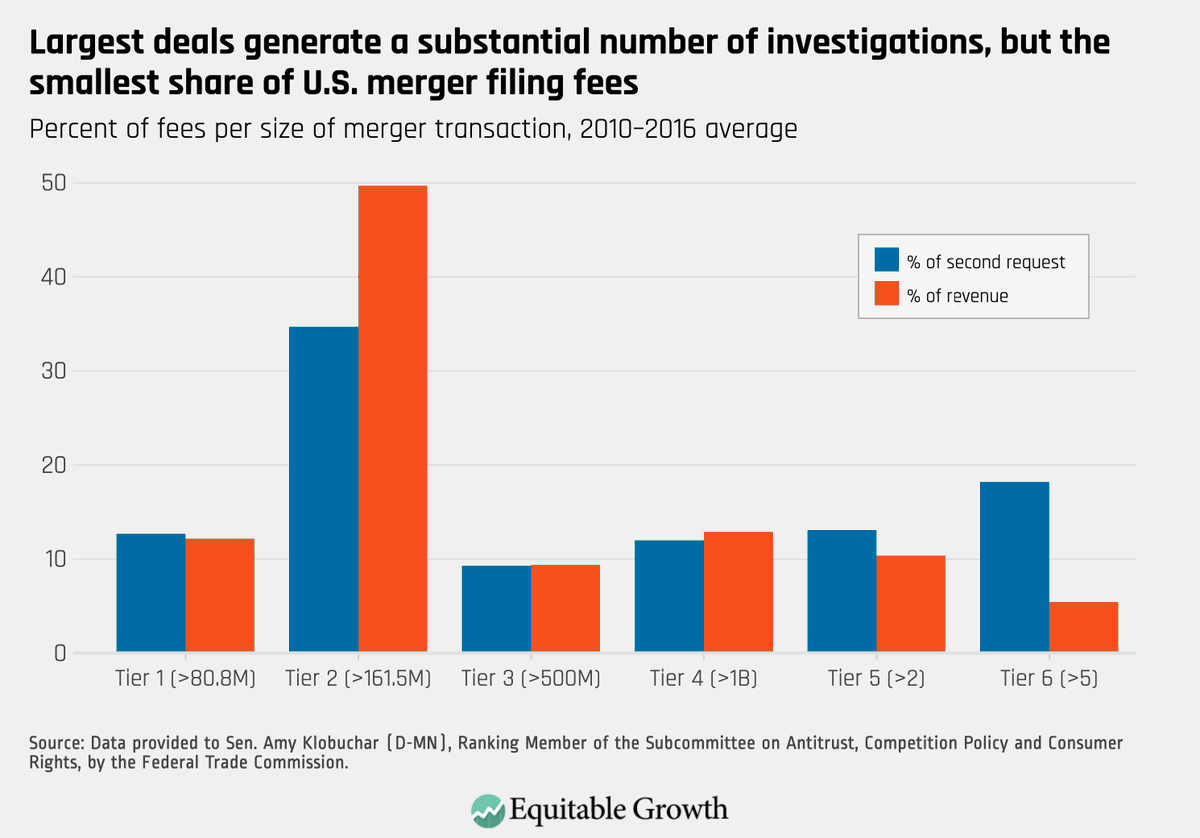

Although in the weeds a bit, the agencies collect fees for reportable mergers, with the fee based on the size of the deal with three tiers. The highest fee ($280000) applies to deals above $900 million.

Here's the odd thing, deals greater than five billion account for only 5 percent of the fees collected, but almost 1 out every five second requests . The report itself discusses potential reasons for these trends and, more importantly, questions they raise. /end

• • •

Missing some Tweet in this thread? You can try to

force a refresh