Today on #CampaignCheck: The Liberal Democrats claim that they're now the party of "sound finance" with the toughest fiscal rules. bbc.co.uk/news/av/electi… This would be a big deal. Have they really taken the Tories' place as the party of fiscal discipline? To find out read on...

There are broadly speaking two kinds of fiscal rules. One which limits day-to-day spending/borrowing - CURRENT spending. The second kind puts limits on how much you can invest - CAPITAL spending. Before we get into the nitty-gritty, it's worth emphasising:

ALL major UK parties (Con, Lab, LD) are loosening fiscal rules this election. ALL their plans imply govt will carry on notching up deficits as far as the eye can see. Most of this new spending will be on INVESTMENT. Key differentiator for the LibDems is on current spending...

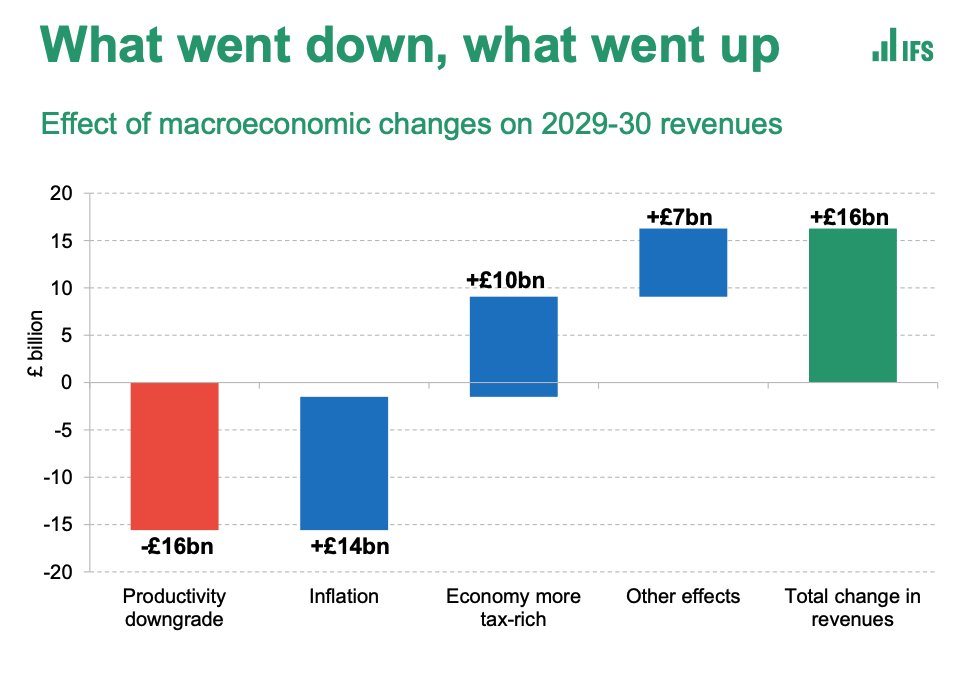

Tories & Labour both propose balancing the current budget over a 3yr & 5yr horizon respectively. Their rules give them some (not much) headroom to spend more or cut taxes. This chart shows you broadly how much (NB Tory prob have more headroom following today's C-tax cut u-turn)

LibDem rule is to target a 1% of GDP SURPLUS on the current budget. In other words, it looks a lot tougher than the others' rules (the yellow line here). That implies cuts/tax rises - tho they say there'll be a "remain dividend" that will bring in money to help meet the target

But here's the thing, that target, designed by the @resfoundation, has some important small print (see below). It's better described as a "range" rather than a simple number target. If the economy disappoints the rule will allow the LibDems to borrow, well, quite a lot

In other words, the LibDem fiscal rule is actually better depicted like this: a massive range which, esp in the event of a recession, could allow them to borrow even more than the major two parties.

The LibDem rule on the current budget is in some ways more sensible than the other parties', which look quite inflexible. If there is a recession there's a sig chance Lab/Con bust their rules overnight. BUT do the LibDems really have TOUGHER rules than the others? Not really.

Esp when u consider what they're spending on investment: basically smack bang between Tories and Labour. "Sound finance"? "the party of fiscal responsibility"? Hmm, not quite. Rules maybe slightly better-structured but it's not clear they're much tougher #campaigncheck

I'm told the LibDems are also adopting the @resfoundation rule on investment: "to deliver an improvement in public sector net worth". Basically the same rule as Labour. They'll ask the NAO or OBR to regulate it and ensure those investments are sensible...

This @resfoundation report has been used as the blueprint for new fiscal rules for:

Conservatives ✅

Labour✅

And now the LibDems✅

raising a question: has ANY single recent think tank report had as much influence on economic policy? resolutionfoundation.org/app/uploads/20…

Conservatives ✅

Labour✅

And now the LibDems✅

raising a question: has ANY single recent think tank report had as much influence on economic policy? resolutionfoundation.org/app/uploads/20…

• • •

Missing some Tweet in this thread? You can try to

force a refresh