New York City is shutting down, a thread on #coronavirus

At 8pm all bars/restaurants are ordered to close for takeout only

Some bars, like East Village’s Crocodile Lounge are using that as an incentive to get drink now

ALL BEERS MUST GO! 1/n

At 8pm all bars/restaurants are ordered to close for takeout only

Some bars, like East Village’s Crocodile Lounge are using that as an incentive to get drink now

ALL BEERS MUST GO! 1/n

7-Eleven remains open in NYC, and it wants you to know it has hand sanitizer to battle #coronavirus

Unfortunately, it also has weenies rotating in the open air 2/n

Unfortunately, it also has weenies rotating in the open air 2/n

Famed concert venue Webster Hall has no names on the marquee with no shows planned due to gatherings of more than 50 people no longer being allowed 3/n

The IHOP on 14th Street specifically names Gov. Cuomo as the man with the plan.

Despite noting takeout is still available, it’s closed 4/n

Despite noting takeout is still available, it’s closed 4/n

The AMC in East Village is also shut, despite the fact that two people were somehow able to purchase tickets online

As you can imagine they were not pleased. One asked, “Man, they really shutting shit down, huh?”

Yeah, my man. Shit’s indeed gettin shut. Follow me on Twitter 5/n

As you can imagine they were not pleased. One asked, “Man, they really shutting shit down, huh?”

Yeah, my man. Shit’s indeed gettin shut. Follow me on Twitter 5/n

Famed chicken and rice powerhouse Halal Guys is chugging along because let’s be real, Halal Guys inflicts damage it does not take it

Coincidentally, this also explains why people were hoarding toilet paper

6/n

Coincidentally, this also explains why people were hoarding toilet paper

6/n

Famed pizza establishment Joe’s Pizza put up a sign telling customers they can no longer burn the roof of their mouth inside the restaurant

This is actually probably one of the few positives of the NYC #coronavirus lockdown

7/n

This is actually probably one of the few positives of the NYC #coronavirus lockdown

7/n

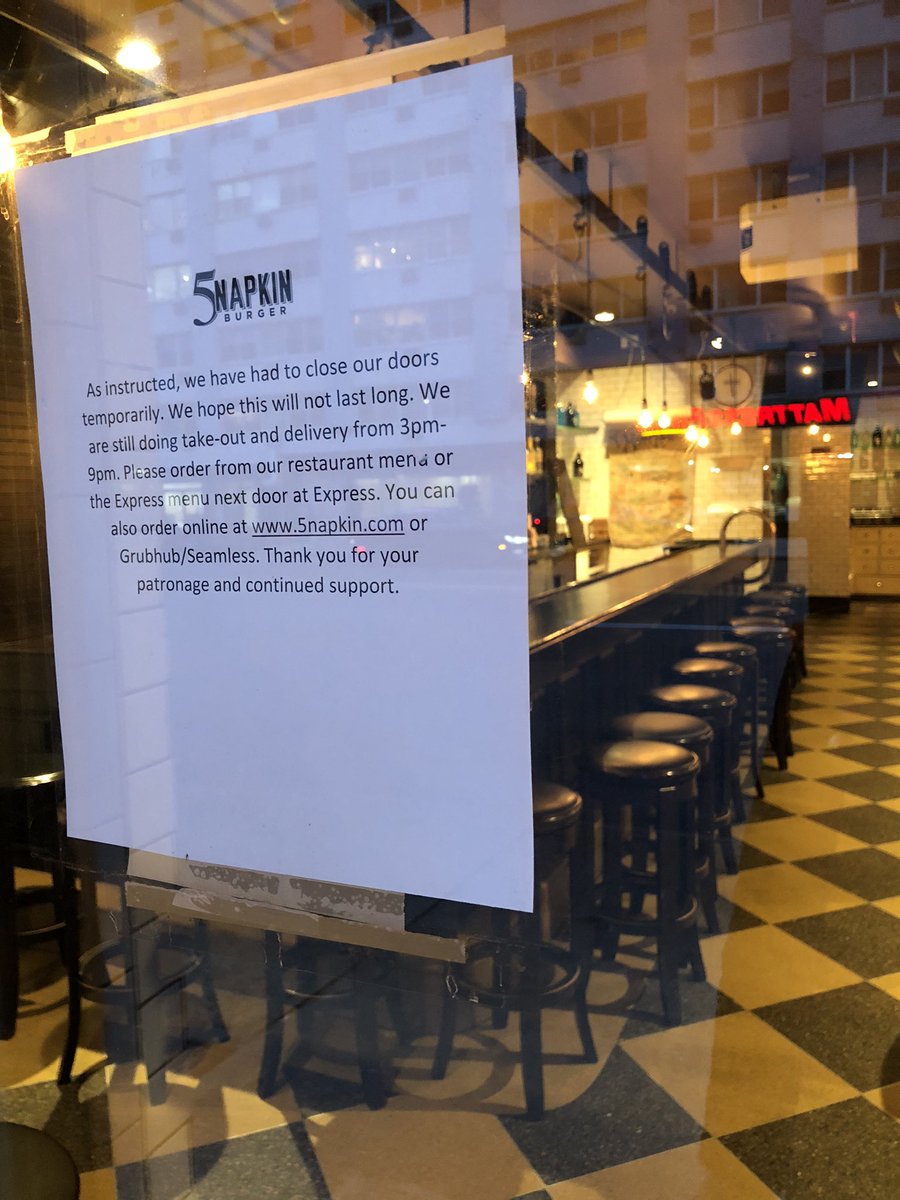

5Napkin Burger doesn’t mention #coronavirus at all in its notice that it’s closing, which doesn’t seem smart since customers might think they closed down for health code reasons ... or worse!

Maybe their burgers were only 4Napkin Burgers 8/n

Maybe their burgers were only 4Napkin Burgers 8/n

The 14th Street McDonald’s also noted it is only serving takeout orders due to #coronavirus

However, the sign did use a double negative that kinda left me confused

However, the sign did use a double negative that kinda left me confused

Fittingly, this thread will end with a very important reminder from your friends at the CDC:

Wash your hands. Flatten the curve. Maintain social distances. Refrain from groups of more than 10.

Stay safe. And God bless!

Wash your hands. Flatten the curve. Maintain social distances. Refrain from groups of more than 10.

Stay safe. And God bless!

• • •

Missing some Tweet in this thread? You can try to

force a refresh