kkr.com/global-perspec…

Below are the quotes I clipped/saved.

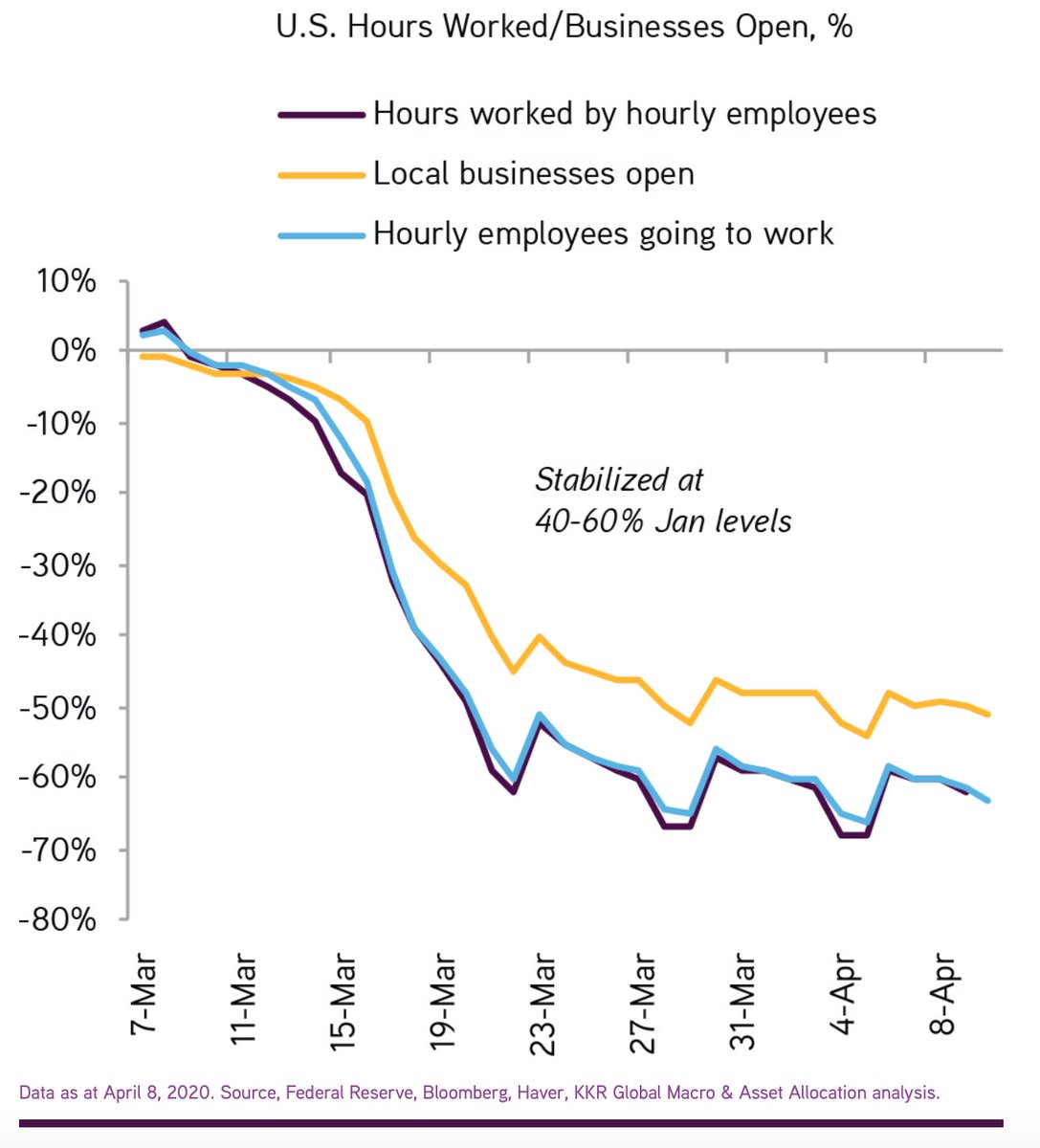

"We do not look for a traditionally sharp snapback in the second half of 2020.”

"De-leveraging will take years, not months, to work through.”

"Heavy debt loads will impede growth, we believe, at a time when demographics and re-regulation are likely to act as further headwinds.”

"We think that total monetary and fiscal stimulus in the United States could approach 35% (of GDP).”

“There will likely be a more elongated slowdown in luxury travel out of China that will have an impact on tourism from Tokyo to Paris to New York City.”

"We believe that Infrastructure as an asset class could be experiencing somewhat of a golden age.”

"Investors should expect that the coronavirus will advantage online over offline faster.”

"Globalization has peaked. We envision a more regionalized model, with the Americas coalescing around the US and Asia around China. Europe is likely to vacillate somewhere in the middle.”