m.economictimes.com/mf/mf-news/seb… (4/n)

Sanjay Sapre-

- Six funds voluntary wound down

- This was only way and the most difficult choice

- COVID has led to significant reduced liquidity in debt markets

- and also higher redemptions

(Courtesy @NagpalManoj)

(8/n)

- all other funds are safe

- margin safety is high

- equities are at cheap valuation

- people should continue investing in it (9/n)

- it is in best interest of customers

- financial market depends on economic conditions

- it all started with covid issues

- we have seen many bad cycles and came through

- current situation is bigger problem as we don't know when we will plan out of it.

(10/n)

- risk appetite has been degraded

- liquidity in system, increasing in buying are required, rbi has to help

- untill it comes back, we can not function normally

- RBI is taking measures but insufficient

- for success economy has to be improved (11/n)

- its tough to sell enough so we have to borrow

- but this will sustain only if know how many days it will continue

- otherwise it will continue increasing risk

- either we can wait or have to stop (12/n)

- or we have to sell maturity

- we shall keep selling the papers

- we don't want to sell in hurry

- we have taken this measure so that we can sell in orderly manner when market normalise (13/n)

- we are waiting for normalisation of market

- in short term funds, money will come faster due to short term maturity #franklintempleton

#MutualFundsSahiHai ? (14/n)

- Call is being recorded and will be made available shortly.

#FranklinMF #FranklinTempleton (15/n)

- Liquidity will arise after unlocking

- cont of fund was impacting investors due to cont. borrowing and sell on bad value

- We will return AS MUCH AS POSSIBLE

- this is outcome of protecting value for the investors who wanted to remain invested (16/n)

- We r committed to the business

- we have always generated huge values 4 investors

- we have long term good record

- purpose of winding up is generating maximum value for inv.

- several different investment teams are working independently #FranklinPaisaVapasDo

(17/n)

- We didn't have visibility about impact of COVID

- In this time frame, we were unable to deal with uncertainty

- moratorium was given to so many borrowers/landers

- many borrowers used #ForceMajeure clause

- this created mismatch (18/n)

- Equity schemes will be on consistent track

- High credit fund will also be on good track

- team is very experienced

- We recognize pain of investors (19/n)

#mutualfund #FranklinMF #FranklinTempleton #FranklinConference

- we shall deal with borrowings

- there will be monthly payments as when cash is realized

- we want to ignore stress selling of holdings

- we remain committed to business in India

CONCLUDES

(20/n)

#mutualfund #FranklinMF #FranklinTempleton #FranklinConference

#mutualfunds #FranklinTempleton #mutualfundsahihai ? (22/n)

#mutualfunds #FranklinTempleton (23/n)

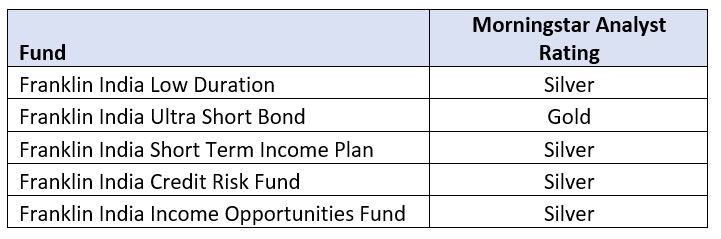

Morningstar suspends ratings of 4 Franklin mutual funds with immediate effect. 😂 #mutualfunds in