Apparently, DFA is being trashed on Facebook or some other social media platform for its performance or lack thereof. I'm not on these forums. Don't give a hoot.

But... for those asking, here's a thought..

Short answer.. doesn't matter! Well, shouldn't if you have a diversified portfolio in first place.

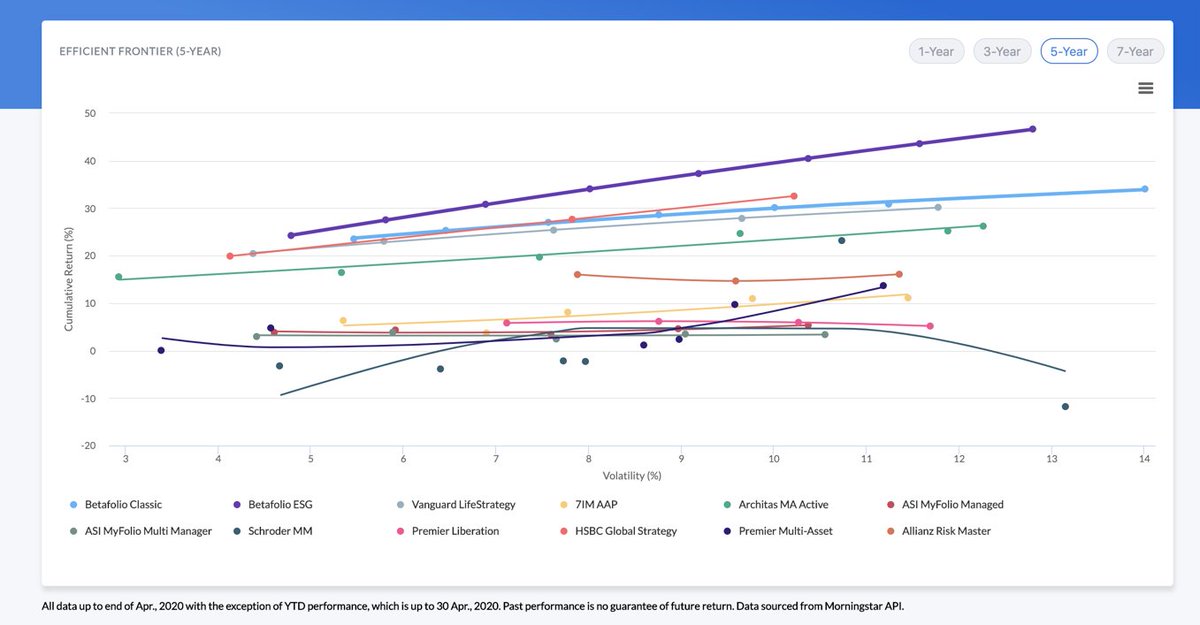

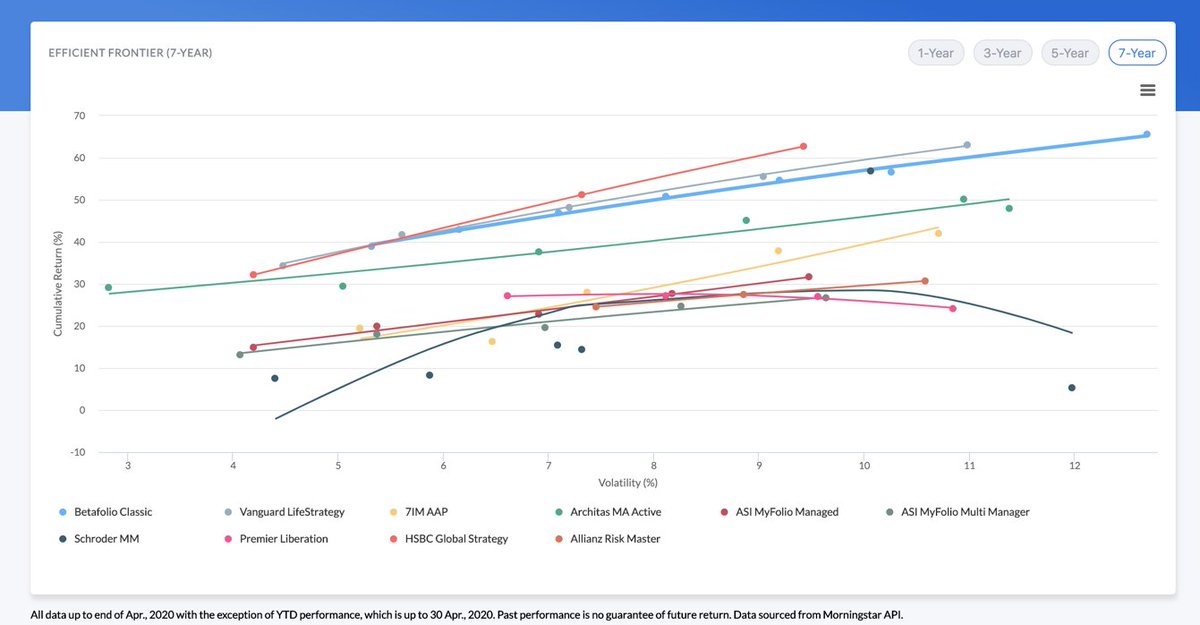

Regardless of DFA's perf, @betafolio models faired pretty well against popular multi-asset ranges

The very nature of value factor is that it can undergo prolonged period of underperformance. This is why it's called 'risk factors'.

Grandads of factors Fama/French: nope, all pretty normal. papers.ssrn.com/sol3/papers.cf…

Blitz @Robeco: may be, other factors better papers.ssrn.com/sol3/papers.cf…

PhDs @AQR: report of death greatly exaggerated

papers.ssrn.com/sol3/papers.cf…

Dimensional happens to 'specialise' in factors. So they're probably feeling the pain more. But on a like-for-like, little evidence that Vanguard factor funds fare better.

Worst possible time to abandon small/value.

Know what you own, why you own it. Diversification means ALWAYS having to 'apologise' for some part of your portfolio that's 'underperforming'.

Right now, we're 'apologising' for small value. That's diversification.

Rejoice. No pain, no premium!✌🏾