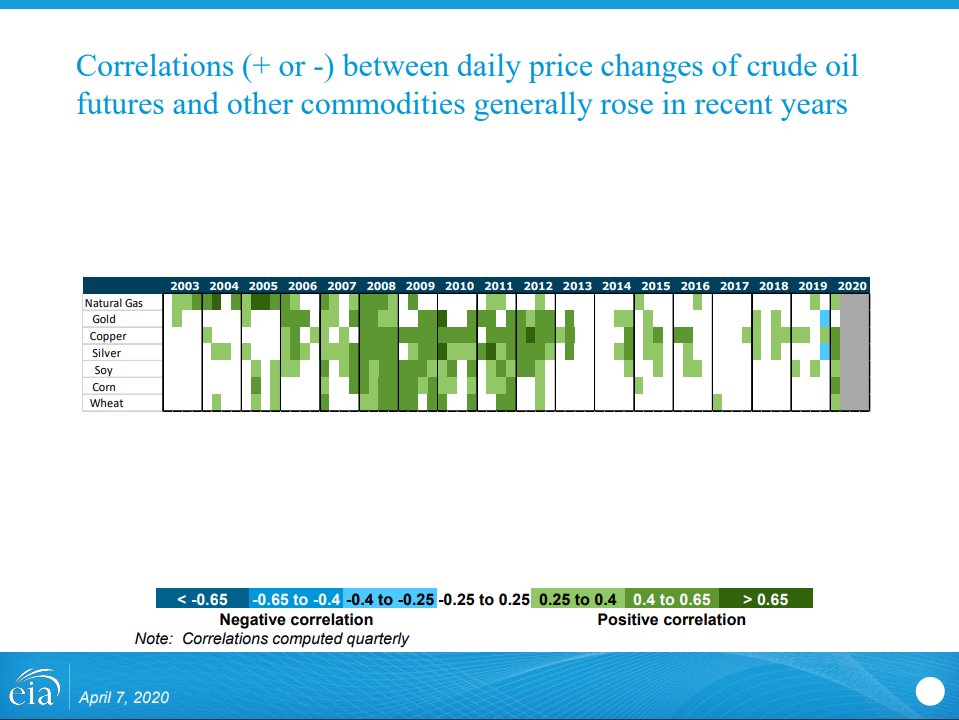

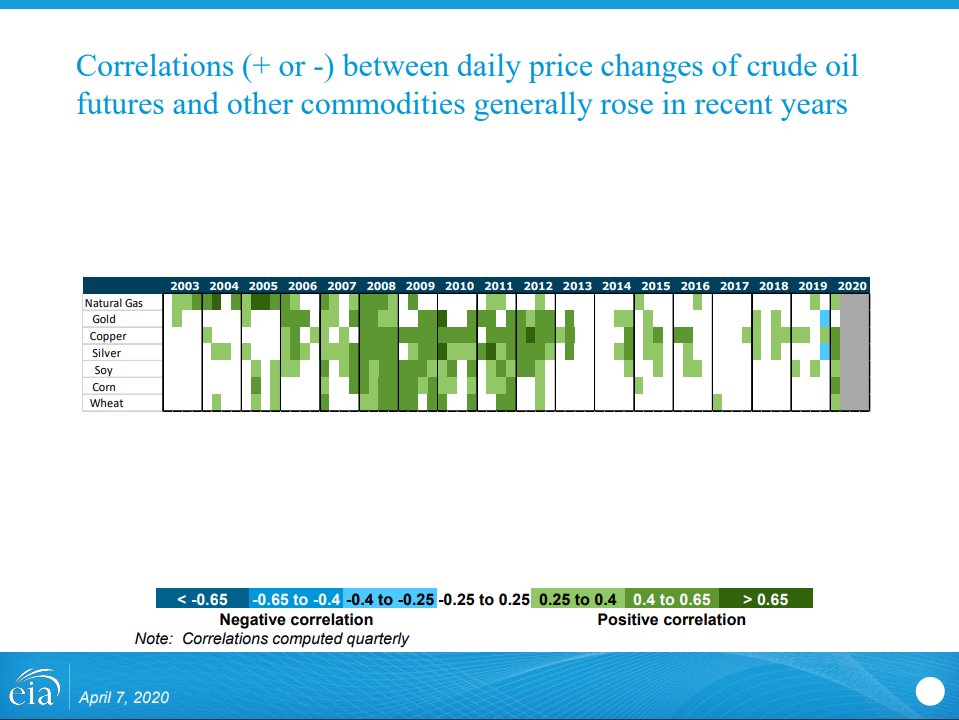

eia.gov/finance/market…

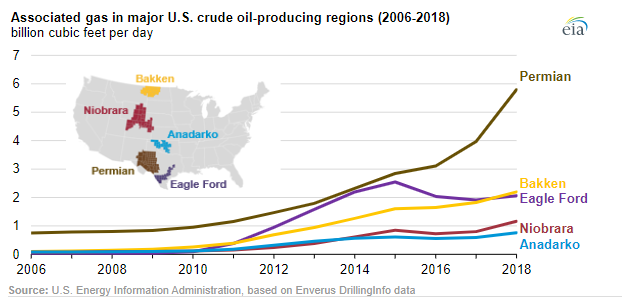

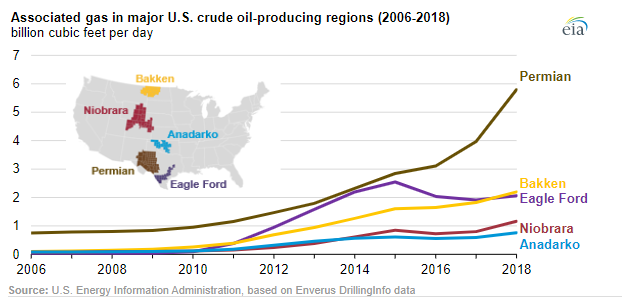

eia.gov/todayinenergy/…

reuters.com/article/us-usa…

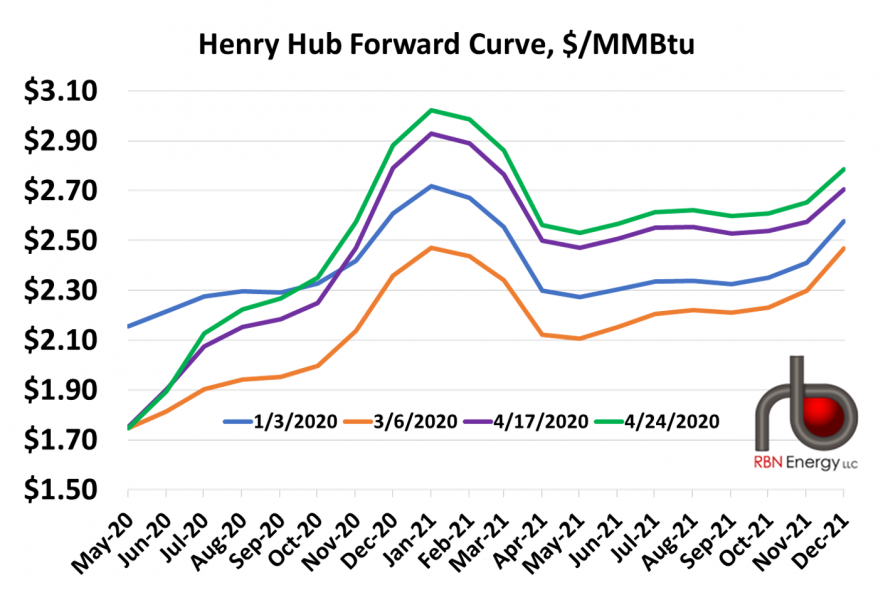

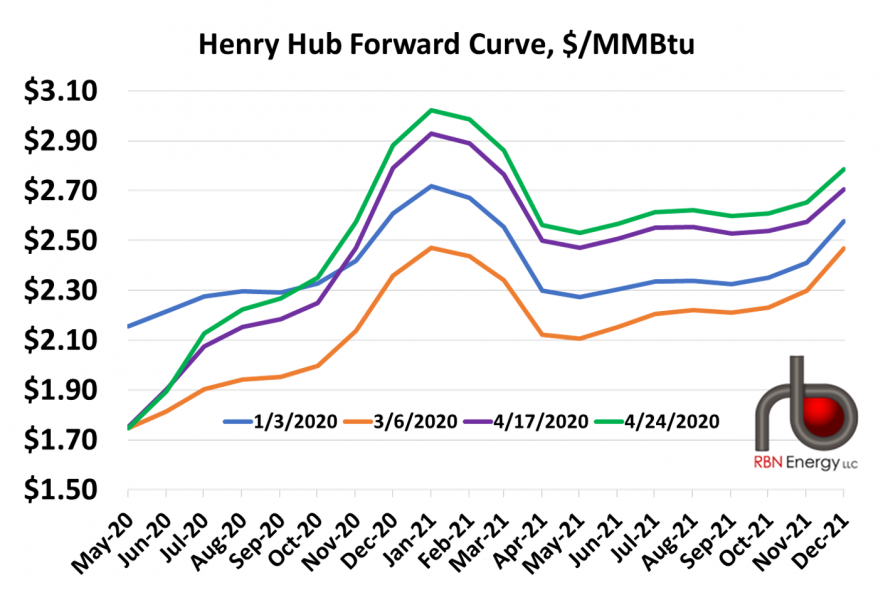

rbnenergy.com/hey-look-ma-i-…

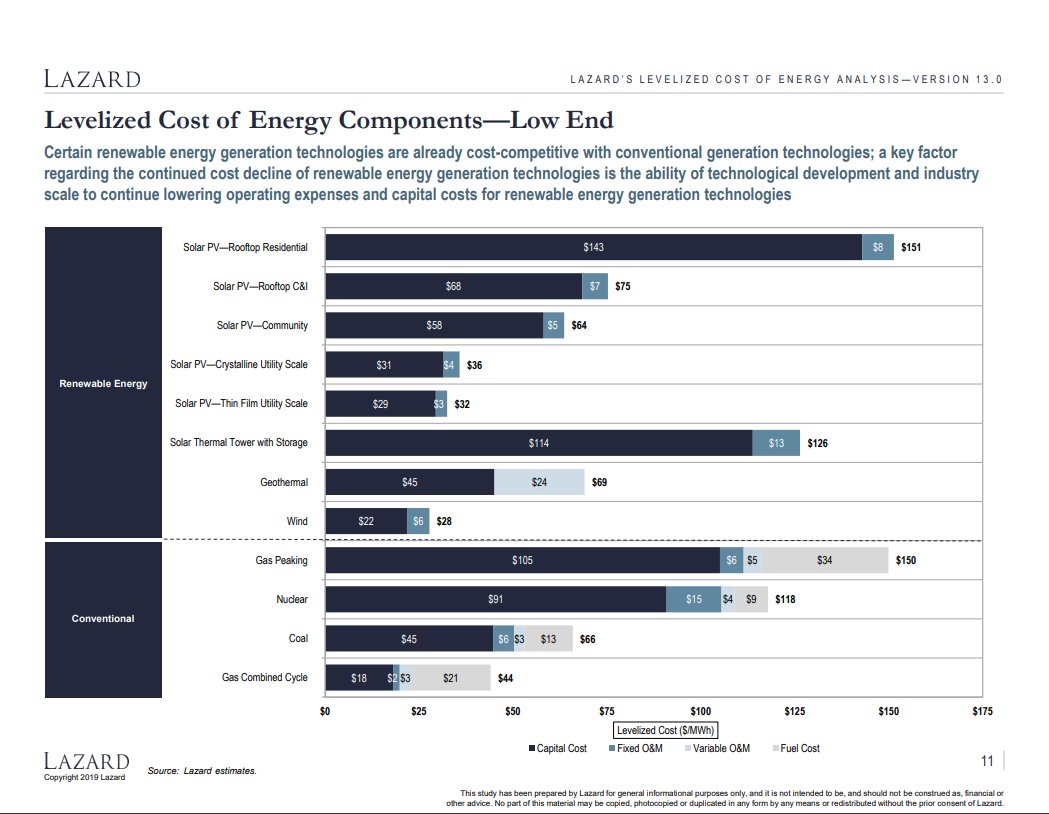

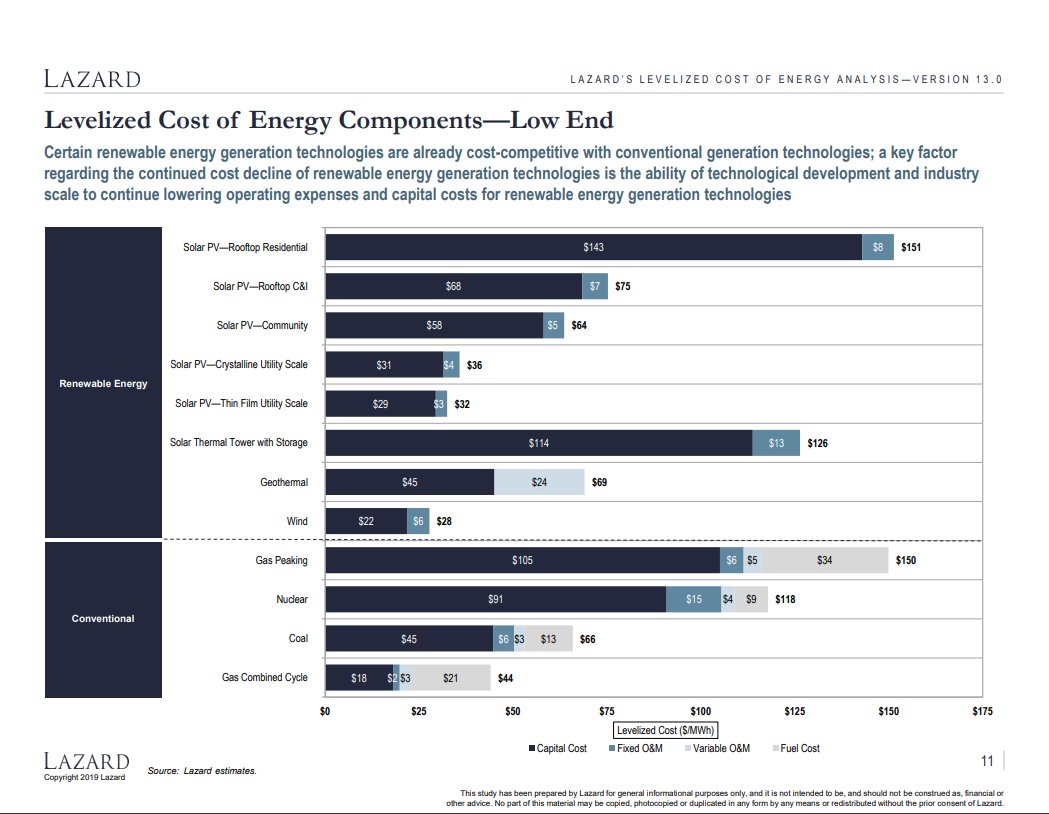

lazard.com/media/451086/l…

Keep Current with Tim Latimer

This Thread may be Removed Anytime!

Twitter may remove this content at anytime, convert it as a PDF, save and print for later use!

1) Follow Thread Reader App on Twitter so you can easily mention us!

2) Go to a Twitter thread (series of Tweets by the same owner) and mention us with a keyword "unroll"

@threadreaderapp unroll

You can practice here first or read more on our help page!