In these times, a thread that is more relevant than ever.

Read on (39 tweets)

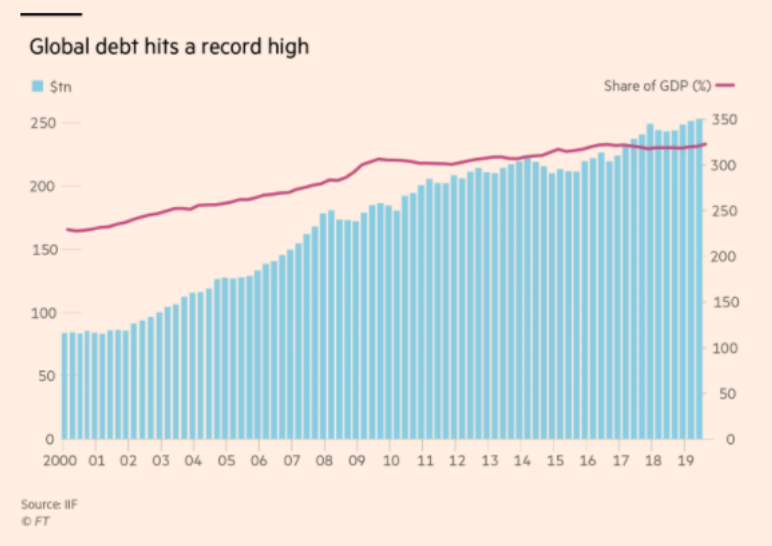

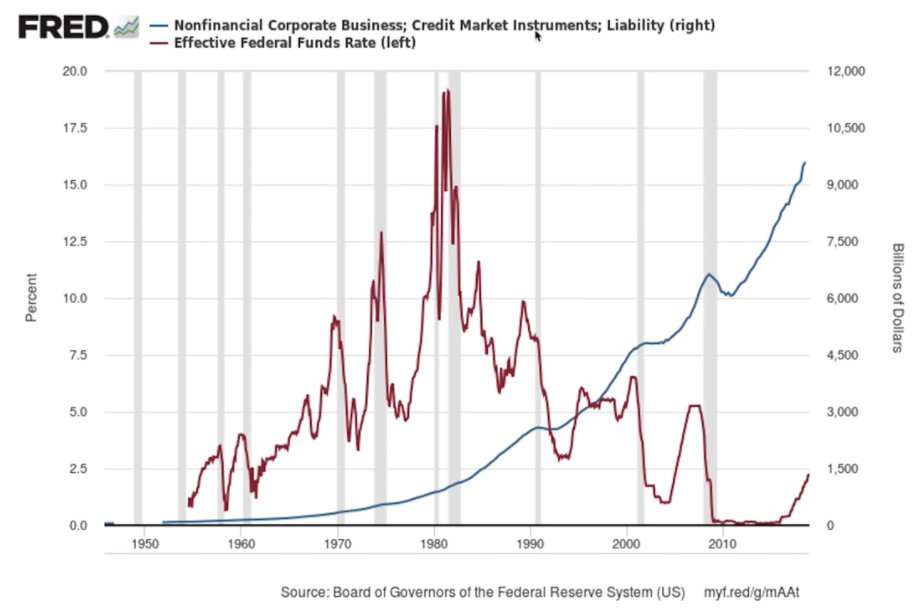

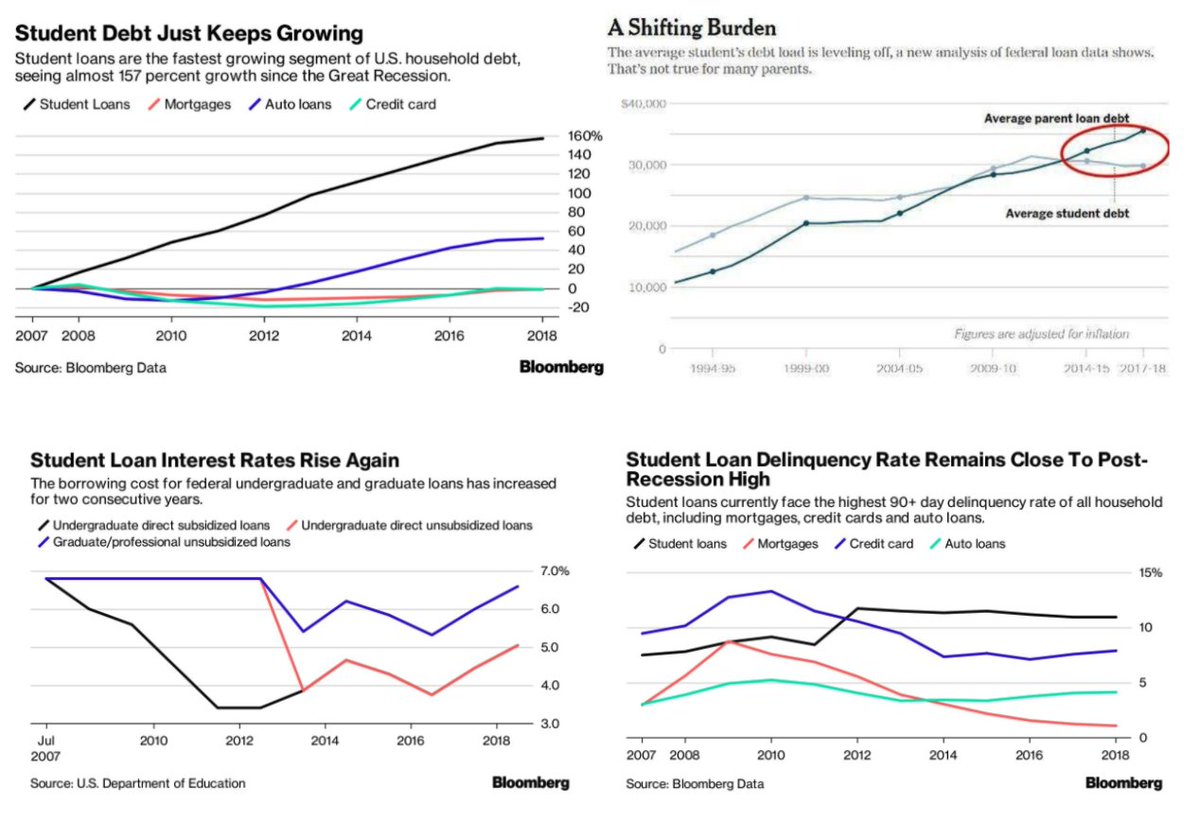

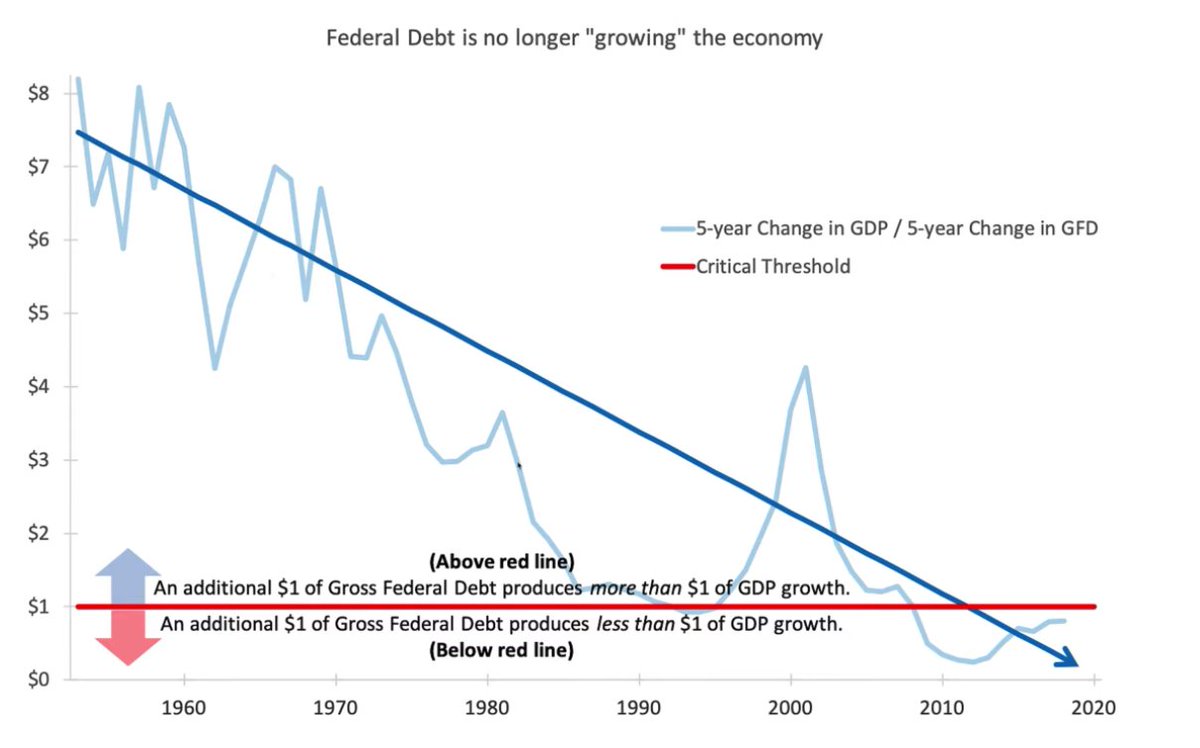

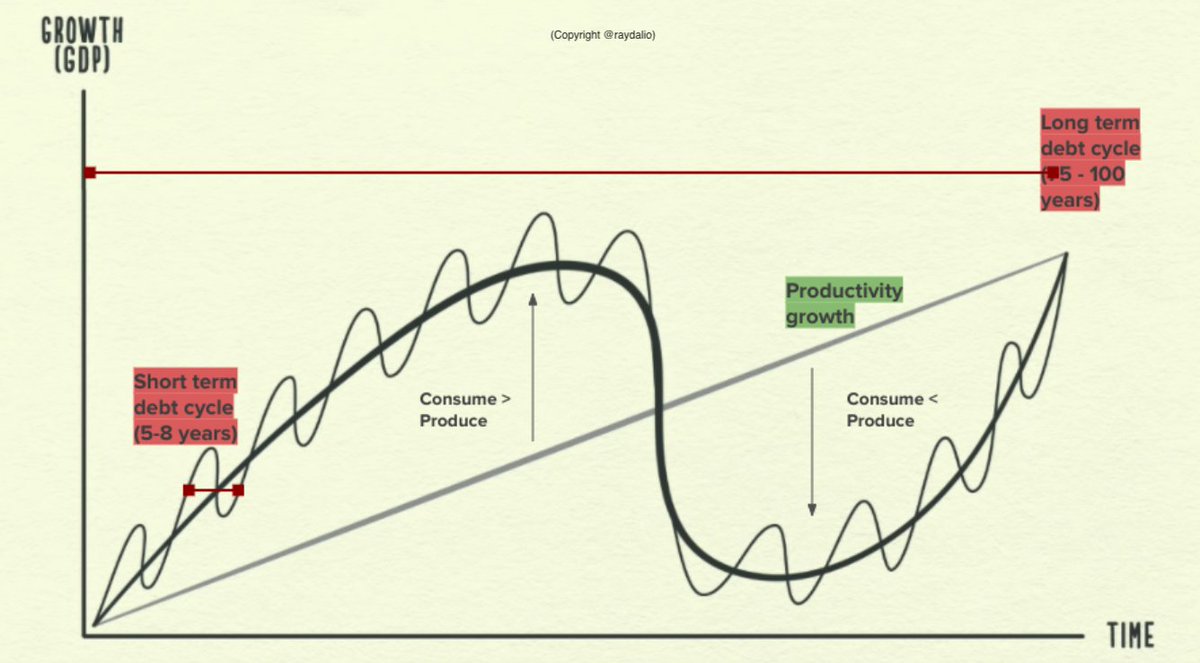

As debt grows so do debt repayments. Soon they both start growing much faster than income grows. When that happens we reach a tipping point where someone defaults

This spirals into a vicious cycle leading to a bubble bursting and a massive deflationary event where the economy starts to de-grows (Think Recession or worse a Depression)

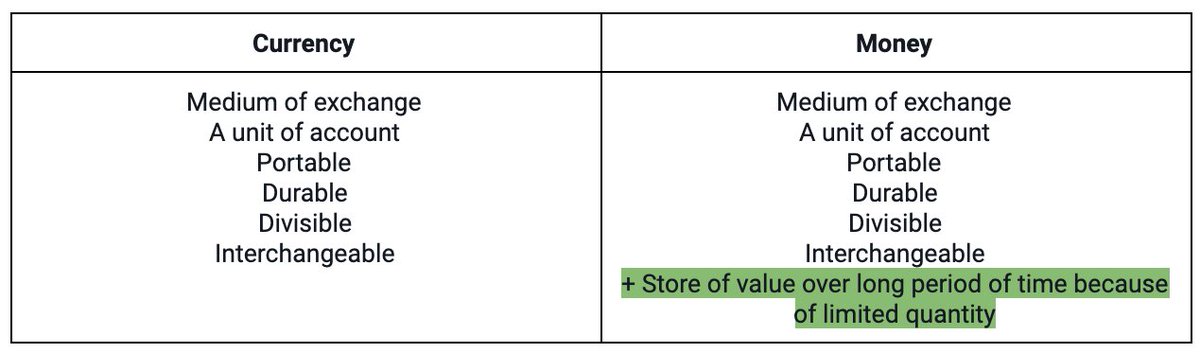

For that I first need to explain the difference between Currency & Money.

They're 2 very different things. 99% of the world's population is un-aware that we no longer use Money

If a bank's total deposits = $100 and if the Fractional Reserve Rate = 10%, they can lend $90 of that $100 to other customers.

In some countries FRR = 0% which means infinite Currency creation is possible 😑

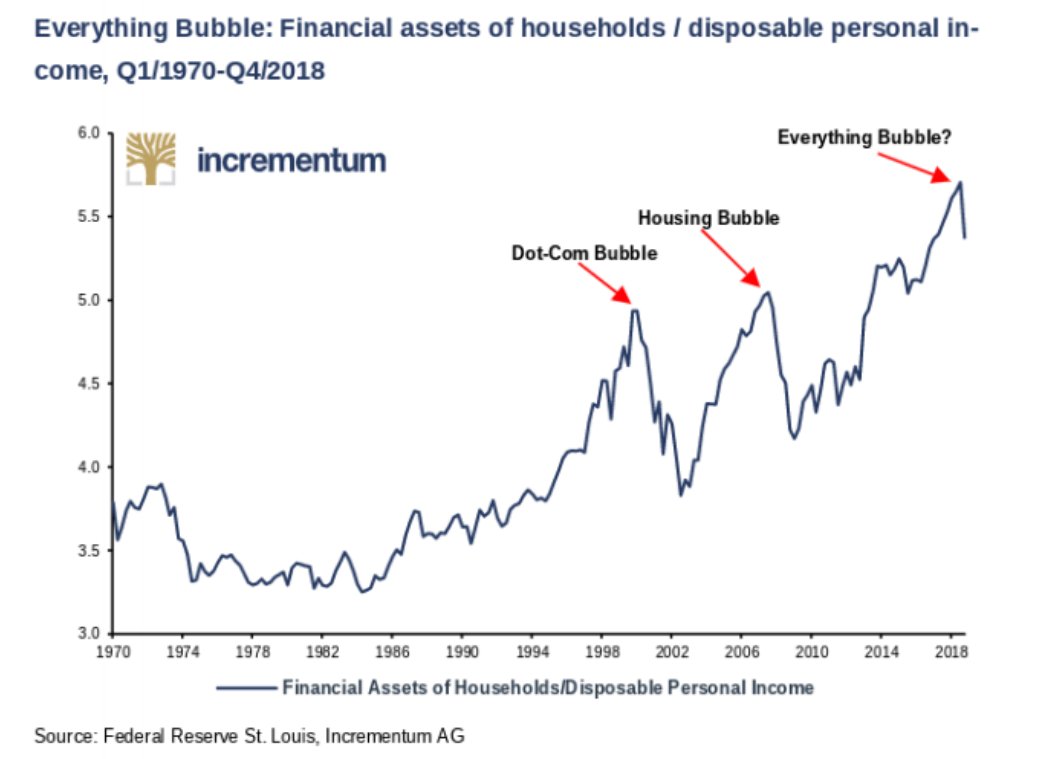

Borrowing creates cycles because what you borrow today has to be paid back tomorrow

1. Short term (5-8 yrs) &

2. Long term debt cycles (75-100yrs)

Must Watch "How the Economic Machine Works" by Ray Dalio -

That means we have no choice but to start paying back debt given debt growth >> income growth.

But... we never do. Thus, a Bubble

1. Genoa Pact (1913 to 1943) ~30 years 🥇

2. Bretton Woods (1944 - 1971) ~26 years🥇 💵

3. Smithsonian Agreement (1971 till today) ~49 years 💸

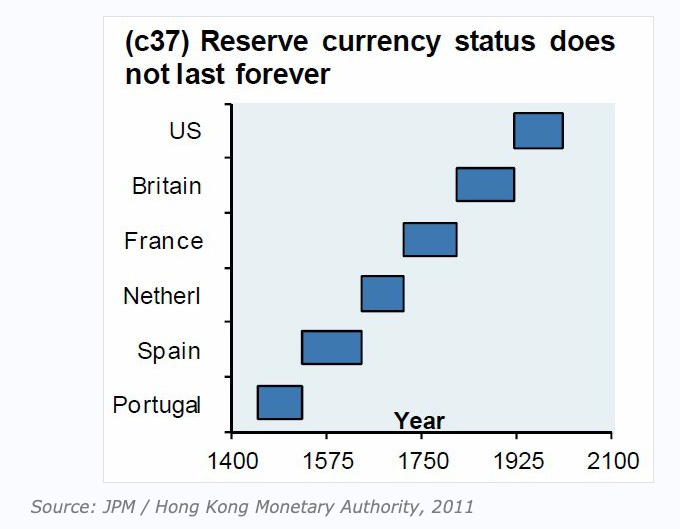

We're clearly overdue a reset.

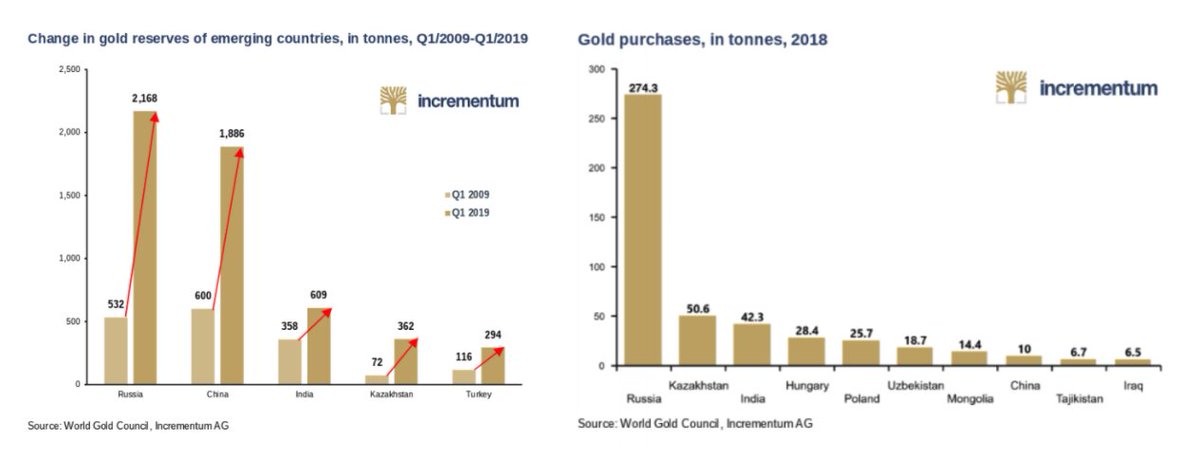

Is the world anticipating a $ collapse? It seems so and given the world pegs to the $, something big might be coming.

A 21st Century Gold-Backed Monetary System.

Wouldn't that be something.

Most people's first reaction would be🤨

It would be no surprise given our last 2 generations have been rigorously conditioned by professors and policy makers to believe that Gold is a commodity and has no role in the world's monetary system

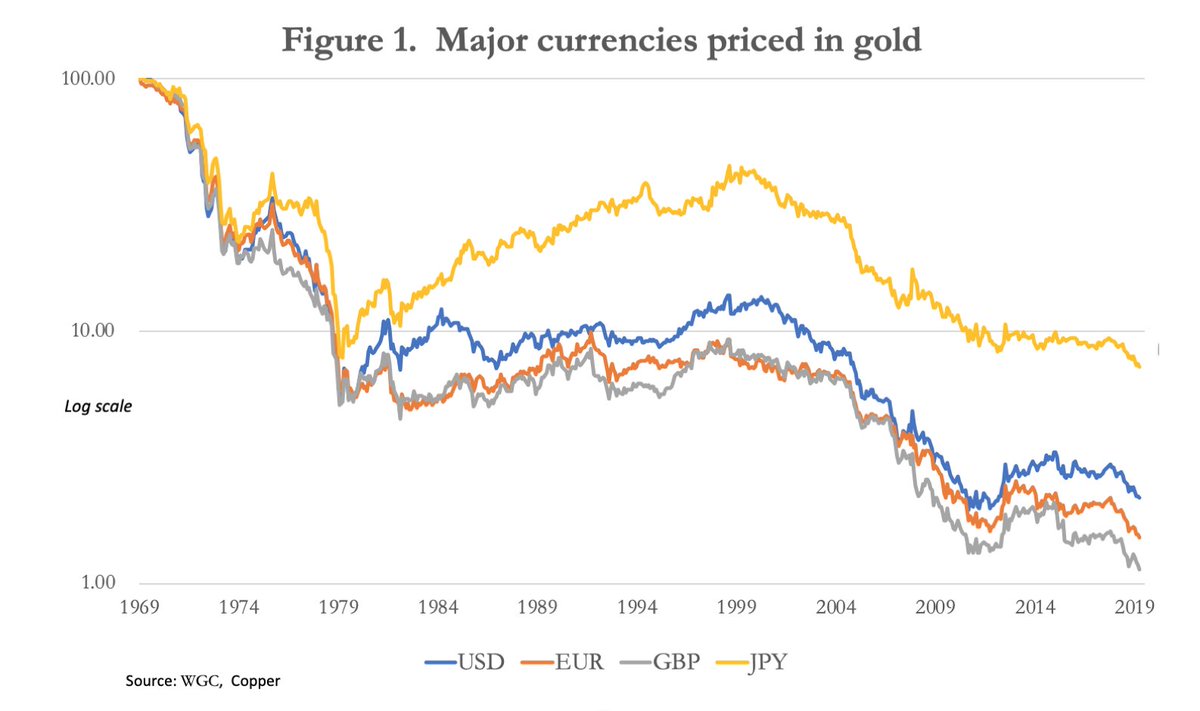

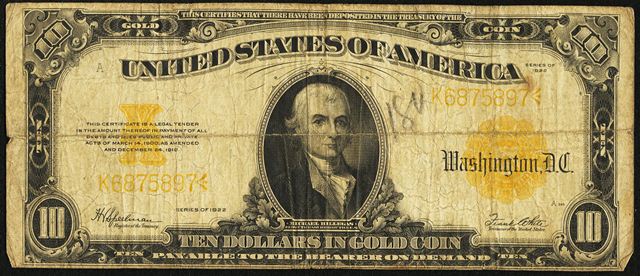

Until the 1971, it turns out that the entire world ran on a Gold Standard in some form.

That was just 50 years ago. Incredible isn't it

1. A new $ pegged to Gold & world remains pegged to $

2. Every country pegs to Gold directly

3. A crypto-based Gold solution

4. A global currency like the IMF SDR pegged to Gold

One can only speculate but my bet would be on #2

More ancient bills here - antiquemoney.com/value-of-1922-…

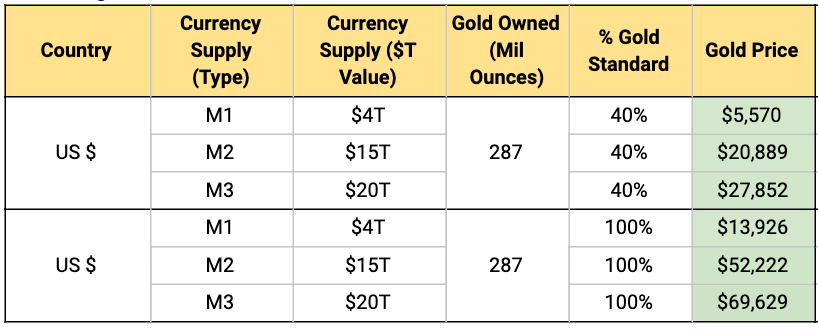

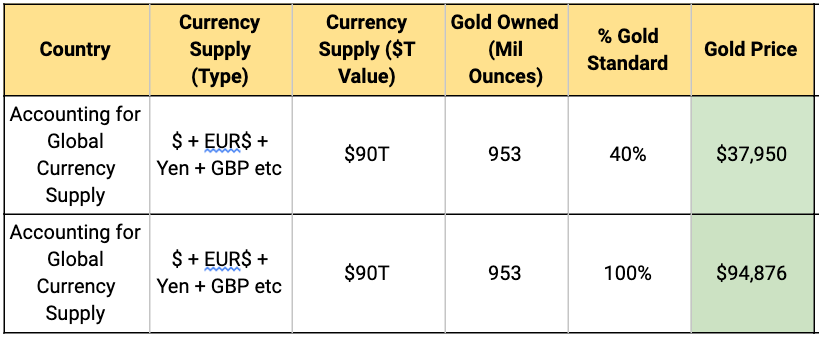

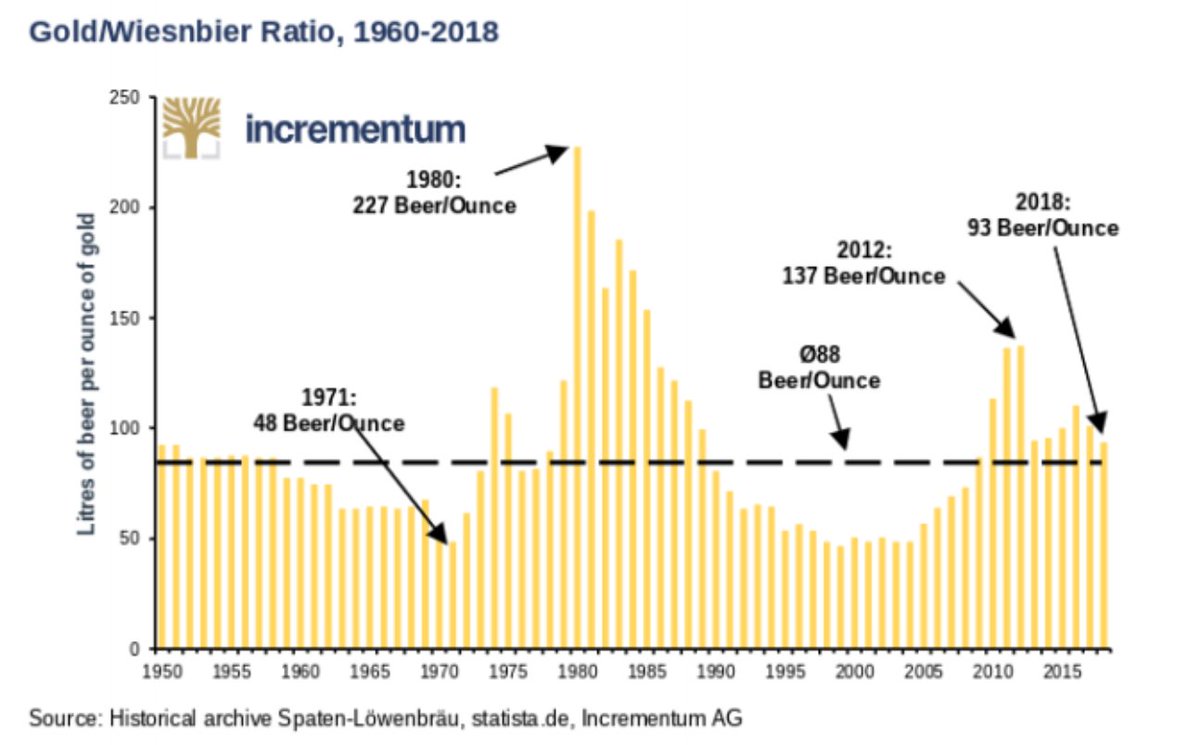

Well you just raise the value of Gold to match the global monetary supply. It's quite simple.

While history may not repeat itself but it can certainly inform the future.

1. 11 US States have already made Gold (& Silver) legal tenders - gsiexchange.com/states-gold-si…

2. In 2012 & 2016, Republicans passed a House bill to investigate viability of Gold

So clearly a big interest.

Her authored paper "Gold & Government" - - cato.org/sites/cato.org…

Looks like US and other countries are considering it but it would be kicking the can down the road and won't fix a broken system.

fool.com/millionacres/r…

It's increasingly likely that they won't exist in their current forms. Some say they may collapse - zerohedge.com/news/2019-08-2…

Did anyone notice the US Treasury practically took over the Federal Reserve?

washingtonpost.com/business/on-sm…

They began setting interest rates only in the 1920s, and became the guardians of inflation in the 1980s.

Thanks for tuning in!

There is only one chart to watch for Silver which is the Gold:Silver ratio.