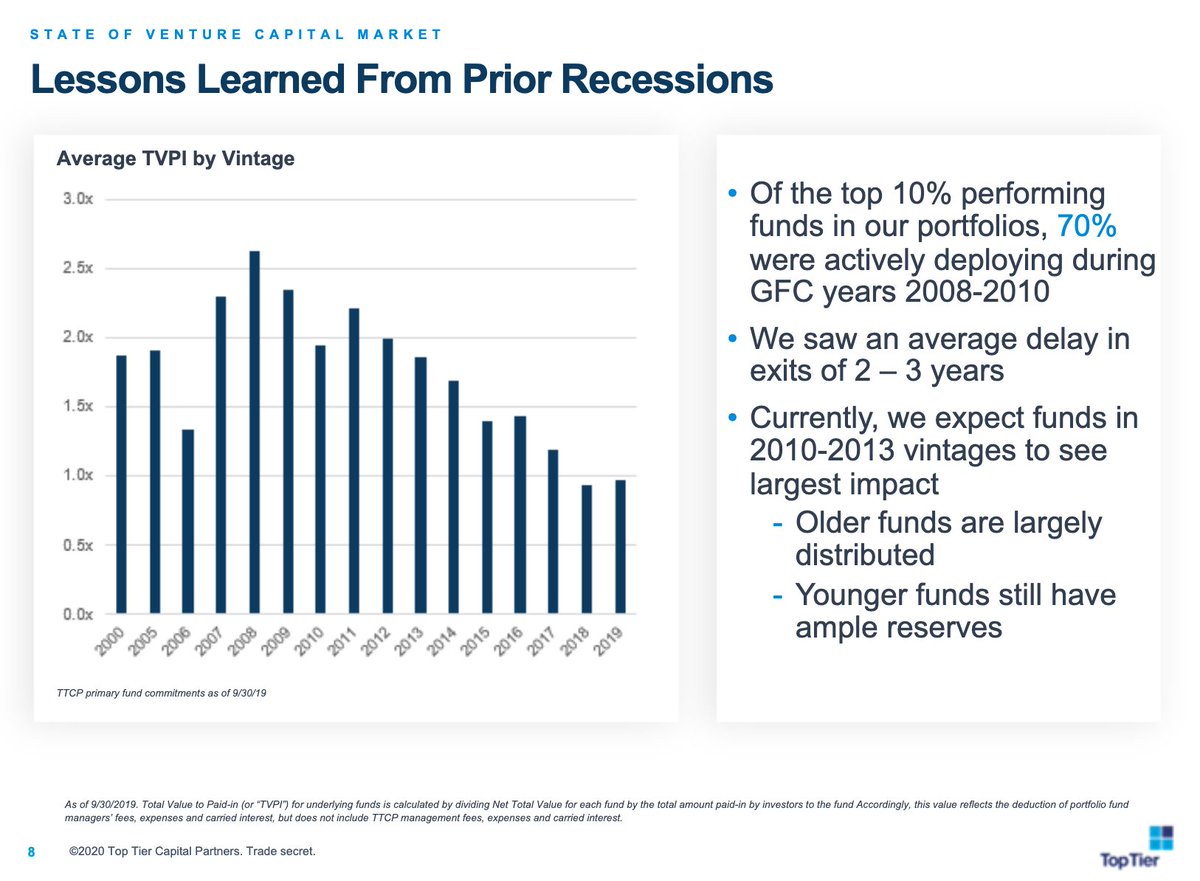

- VC funds investing through the GFC were some of the best for vintages 2000-2019 by TVPI, esp 2008 vintage

- M&As likely delayed by 2 years from now

- Valuation cuts by 30% sets pricing to 2017 levels

👇

How are GPs handling shares acquired through IPO exits? If you've hit your target public return, consider selling down to return to LPs. Helps them fund other commitments right now.

Drawdowns increased by 5%

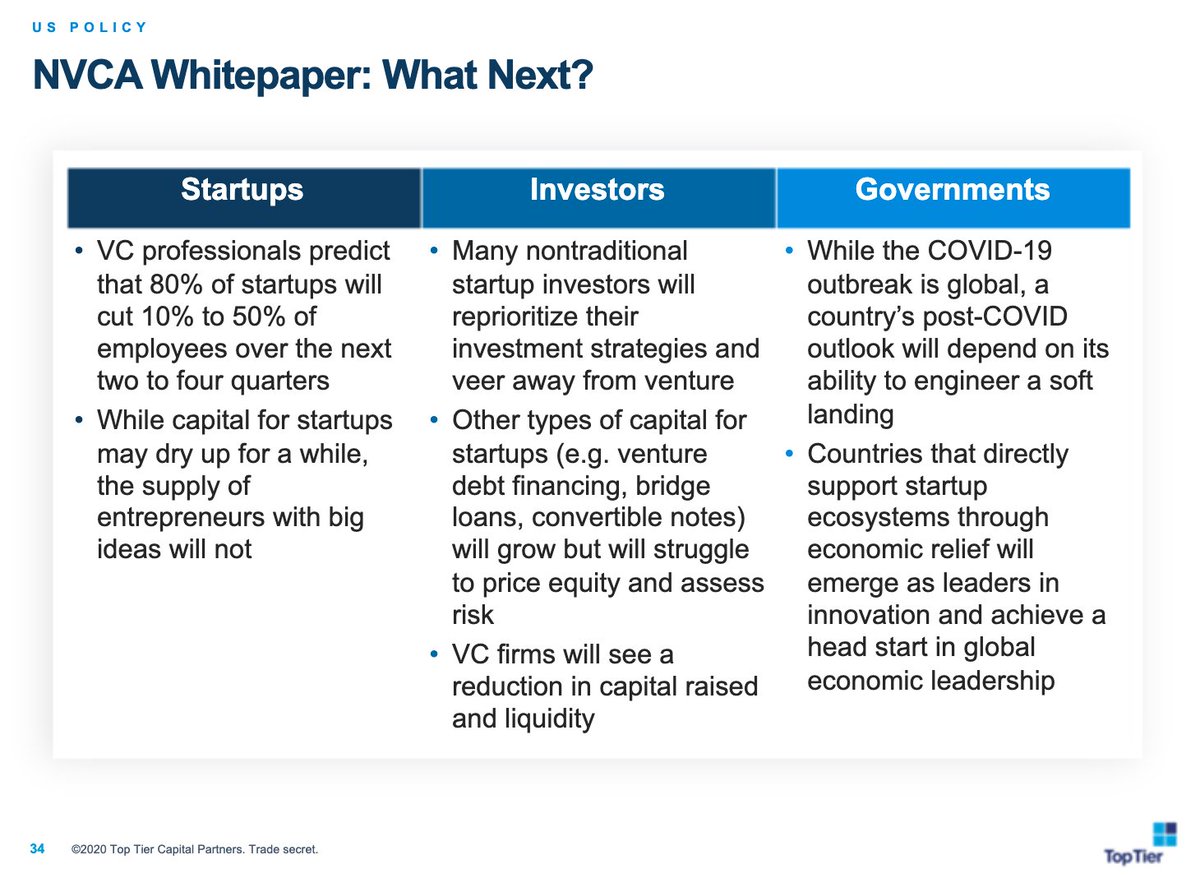

- Not too many problems for established managers who perform,

- Some established funds that were shooting for Fall fundraising have moved it up now, while others sticking to pre-COVID schedule

Progress can be made to convert LP relationships via video conference, but challenging.

May see more multi-closing situations vs. "one and done" for LPs

World is coming online at a different pace: Expect formation activity levels to correlate.

- Now is a great time to start building relationships: more open calendars and natural human icebreaker to ask how someone is doing :-)

- A lot of benefits to diligence over Zoom: everyone in same "room"

- Probs still need in-person once