1) As @NathanTankus notes here (), the Fed is ultimately responsible for determining the distribution of long vs short-term govt liabilities in circulation, regardless of what Treasury issues in the first instance.

2) This also ignores the significant psychological and practical effects of transitioning from the current budget process to using overt monetary financing. Presently huge swaths of the public

3) It is also wrong to presume that the Fed paying positive interest on its liabilities (reserves or FedSecurities) will have the same impact in a consolidated govt sense as the Tsy paying

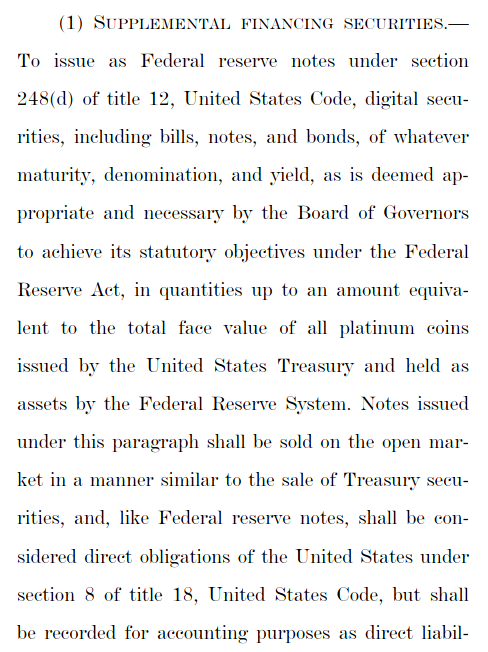

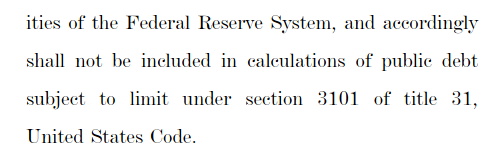

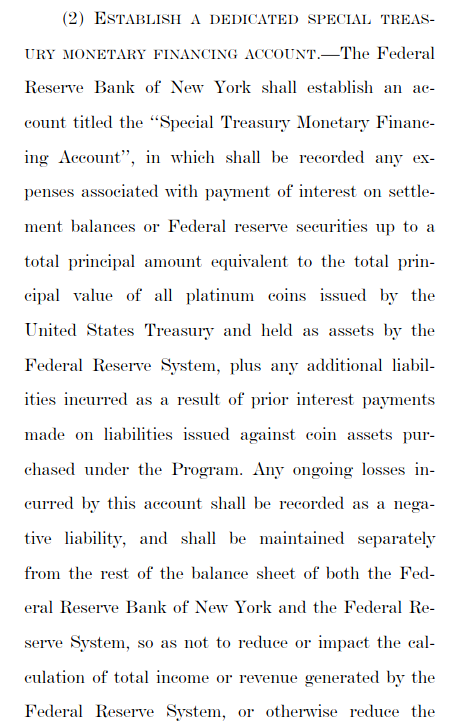

4) Alternatively, it’s entirely possible to change the existing accounting rules to make it so that any interest rate-related expenses are permanently absorbed solely on the Fed’s balance sheet, thereby avoiding any of the popular

5) Finally, this entire thread ignores the most basic fact, which is that interest rates paid on government liabilities – Treasury or Fed – are always and everywhere a policy choice,

Someone in Jason’s position should know better than to make misleading claims like this.

/fin