hindenburgresearch.com/cmru/

www1.hkexnews.hk/listedco/listc…

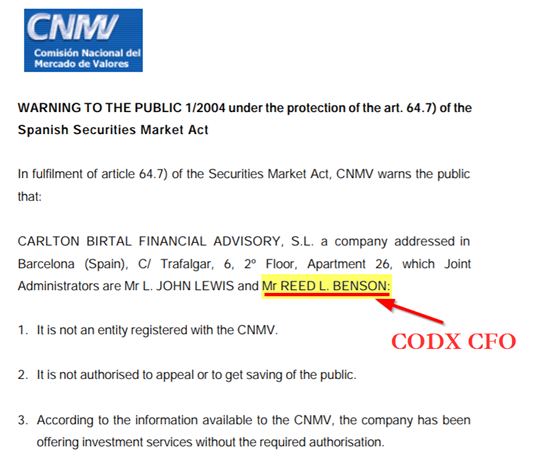

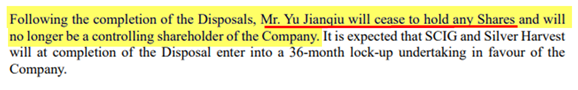

In several undisclosed and disclosed related party M&A transactions, there are clear links to CMRU’s Chairman/CEO’s family.

All told, we think it is an obvious near-term zero. $1636.HK

hindenburgresearch.com/cmru/