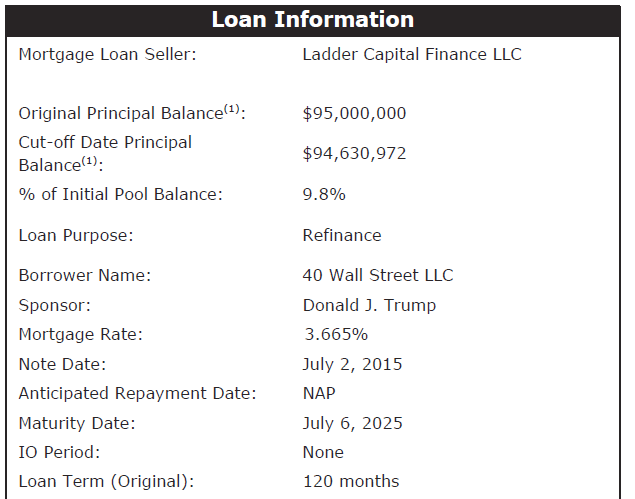

Well, a whistleblower contacted me a few months ago with a warning:He said commercial loans based on fraudulently inflated income data appeared to be on the brink of doing something similar.

Here’s how:

He knew lots of the loans made right before the crash would come due 10 years later.

Sometimes a property’s address, or name changed -- making it hard to find info on its earlier loan.

Properties’ net operating income appeared higher in the new loan docs than it had in the old.

Even though both loans were referring to historical financials for the exact same years.

It means an old loan reported a hotel made, say, $1 million in 2016... but a new loan said that the same hotel made $1.2 million in 2016.

Even that relatively small difference could qualify the property for a significantly larger loan.

-inflating historical cash flows

-“deceptively and inaccurately” describing loan representations

-other misbehavior.

A hotel in San Diego’s profit for 2013 was 21% higher in new loan docs, than old ones.

An L.A. trailer park’s profit grew 28% from one filing to another, for the very same year.

(Response in next tweet)

“It’s a higher cliff from which they are falling,” Flynn told us. “So the loss severity is going to be greater.”

propublica.org/article/whistl…