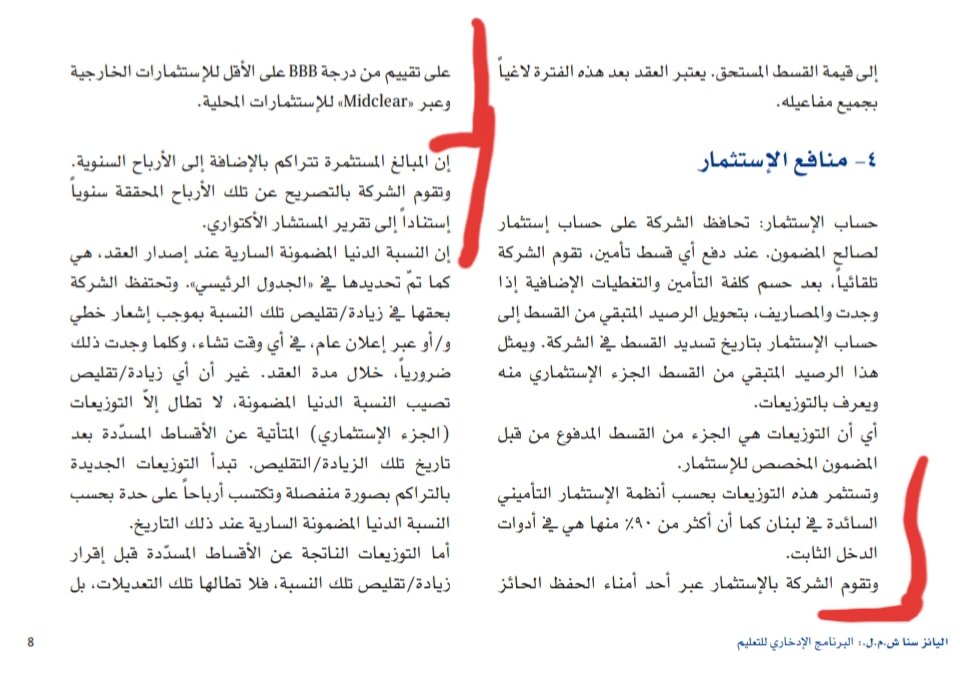

When asked on the phone the client was told the money was invested in Eurobonds and deposit with Lebanese banks

Can the nerds look into this?

@AzarsTweets @HuseinNourdin @Mohdfaour89 @lebfinance

So they are declaring a distribution without evidence. They are not transparent.

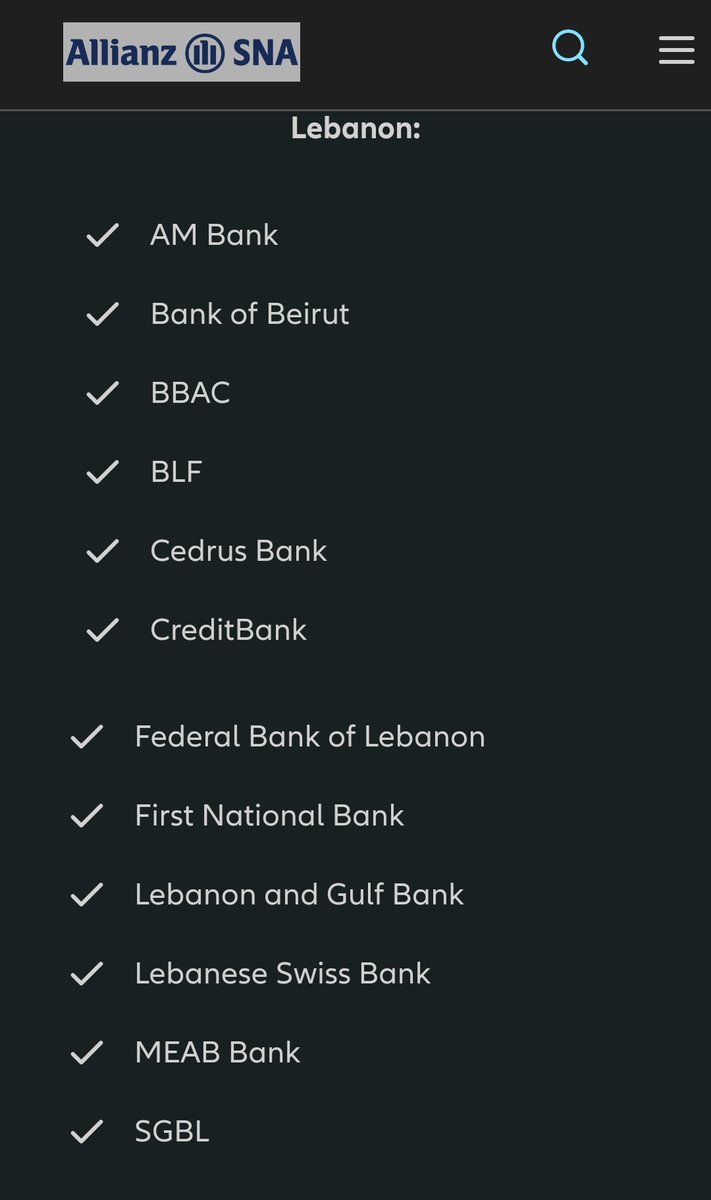

Banks who sold the policies

1- keep on paying premiums with fresh $

2- pay premiums with #lollars

4- pay in Lira (some insurance companies are accepting (hear desperation)